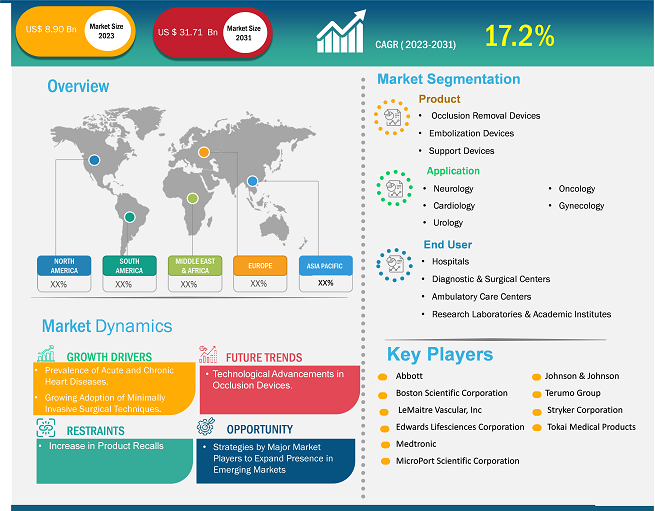

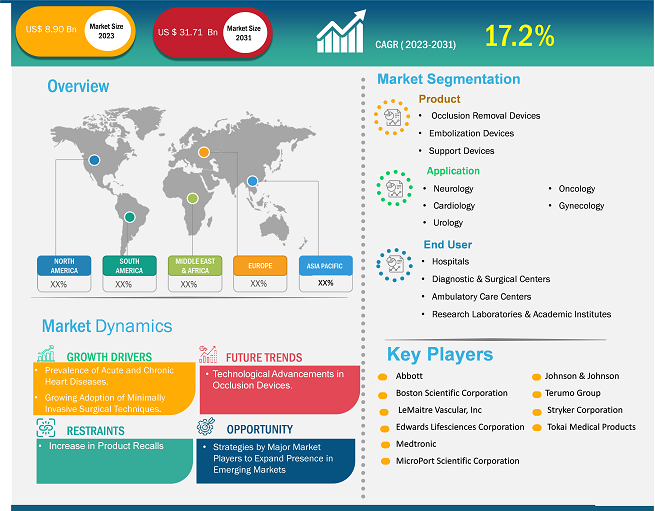

The occlusion devices market forecast can help stakeholders in this marketplace outline their growth strategies. The market is projected to grow from US$ 8.90 billion in 2023 to US$ 31.71 billion by 2031; it is estimated to record a CAGR of 17.2% during 2023–2031.

Occlusion devices are specialized tools or implants used to block abnormal blood vessels or structural defects in the heart. The occlusion device is designed with an expandable tubular body that consists of a frame with multiple interconnected parts. This frame expands inside a blood vessel and collpses for the delivery or retrieval of the device. In addition, the device features a hydrophilic polyurethane hydrogel layer attached to the interconnected components of the tubular expandable body. The polyurethane hydrogel layer expands when the device comes in contact with an aqueous environment. The report includes growth prospects owing to the current occlusion devices market trends and their foreseeable impact during the forecast period.

Growth Drivers:

A significant increase in the availability of a large number of cardiovascular diseases (CVDs) drives the growth of the occlusion devices market size. CVDs, including coronary artery disease

,

arrhythmia, and chronic total occlusion (CTO), can restrict the blood flow to the heart, causing a cardiac arrest or stroke. Based on angiographic evidence, a CTO is characterized by a complete blockage of a coronary artery for 3 or more months. According to the Centers for Disease Control and Prevention (CDC), in 2021, coronary heart disease was the most prevalent type of heart disease, affecting ~ 5% of adults aged 20 and above, and it resulted in the death of 375,476 people in the US. As per an article published in the Journal of the American College of Cardiology (JACC) in January 2022, 16–20% of patients with coronary artery disease undergoing coronary angiography are diagnosed with CTOs. Occlusion devices such as occlusion balloons, stent retrievers, and embolization devices are commonly used in interventional procedures, including angioplasty and thrombectomy, to remove blockages in blood vessels. The rising incidences of CTOs have led to an increase in the number of CTO percutaneous coronary interventions (PCIs) for the management of occlusion of arteries. Thus, the prevalence of acute and chronic heart diseases propels the occlusion devices market growth.Restraints:

The increasing number of product recalls in the occlusion devices market has raised concerns among healthcare providers and patients. These recalls can result due to factors such as design flaws, manufacturing defects, or inadequate safety standards. Consequently, trust in certain brands and products may diminish, leading to a potential decline in demand for aortic valve replacement devices. Patients and medical professionals may become more cautious while considering these devices, subsequently opting for alternatives or delaying procedures.

A few product recalls by the key players in the occlusion devices market are mentioned below:

- In June 2023, Baxter Healthcare Corporation recalled the SIGMA Spectrum Infusion Pumps with Master Drug Library and Spectrum IQ Infusion Systems with Dose IQ Safety Software. The recall was due to repeat upstream occlusion false alarms, which can interrupt or delay therapy and contribute to clinician fatigue, causing serious adverse health consequences, especially for people receiving life-sustaining medications.

- In July 2021, W. L. Gore & Associates, Inc. initiated a voluntary product recall of GORE Molding and Occlusion Balloon Catheters intended for the temporary occlusion of aortic vessels or for assisting the expansion of endovascular prostheses. The company identified a change in manufacturing equipment as the source of the device failure.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Occlusion Devices Market: Strategic Insights

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Occlusion Devices Market: Strategic Insights

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global Occlusion Devices Market Analysis to 2031” is a specialized and in-depth study focusing on the global market dynamics to help identify the key driving factors, future trends, and lucrative opportunities in the market, which would, in turn, aid in identifying major revenue pockets. The report aims to provide an overview of the market with detailed market segmentation by product, application, and end user. The scope of the occlusion devices market report entails North America, Europe, Asia Pacific, Middle East & Africa, and South & Central.

By product, the market is segmented into occlusion removal devices, embolization devices, and support devices. The occlusion removal devices segment is further categorized into stent retrievers, coil retrievers, balloon occlusion devices, and suction and aspiration devices. The support devices segment is further bifurcated into microcatheters and guidewires. The occlusion removal devices segment held the largest occlusion devices market share in 2023. The support devices segment is anticipated to register the highest CAGR during the forecast period.

The market, by application, is categorized into neurology, cardiology, peripheral vascular diseases, urology, oncology, and gynecology. The cardiology segment held the largest share of the occlusion devices market in 2023. It is anticipated to register the highest CAGR during the forecast period.

The market, by end user, is categorized into hospitals, diagnostic centers and surgical centers, ambulatory care centers, and research laboratories and academic institutes. The hospitals segment held the largest share of the occlusion devices market in 2023, and it is anticipated to register the highest CAGR during the forecast period.

Regional Analysis:

In terms of revenue, North America held the largest occlusion devices market share in 2023. The surging prevalence and incidence of cardiovascular diseases is a major factor fueling the growth of the market. The growing preference for minimally invasive surgeries, availability of better healthcare infrastructure, and the rising number of new occlusion device approvals are the factors bolstering the overall growth of the market. In November 2020, Abbott Laboratories received FDA approval for its Amplatzer Piccolo Occluder, which is the world's first medical device that can be implanted in babies using a minimally invasive procedure to treat patent ductus arteriosus. Therefore, contributions and market initiatives of the key players such as Abbott, Johnson & Johnson, and MicroPort Scientific Corporation are positively influencing the occlusion devices market growth in North America.

Occlusion Devices Market Report Scope

Industry Developments and Future Opportunities:

A few of the strategic developments by leading players operating in the occlusion devices market, as per company press releases, are listed below:

- In February 2024, BIOTRONIK and Interventional Medical Device Solutions (IMDS) partnered to launch an innovative Micro Rx catheter. It is a rapid exchange microcatheter designed to enhance guidewire support during percutaneous coronary interventions (PCI). This advanced device is exclusively distributed by BIOTRONIK and manufactured by IMDS.

In September 2023, MicroPort Endovastec announced the successful implantation of the Reewarm PTX Drug Coated Balloon (DCB) Catheter by a team of doctors at Paulo Sacramento Hospital in Sao Paulo, Brazil. This shows the product’s continued proliferation in international markets. This device is intended to treat stenosis or occlusion in the femoral-popliteal artery for percutaneous transluminal angioplasty (PTA) in the peripheral vessels.

Competitive Landscape and Key Companies:

Abbott; Boston Scientific Corporation; LeMaitre Vascular, Inc; Edwards Lifesciences Corporation; Medtronic; MicroPort Scientific Corporation; Johnson & Johnson; Terumo Group; Stryker Corporation; and Tokai Medical Products are among the prominent companies profiled in the occlusion devices market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Key factors driving the occlusion devices market growth are increasing incidences of cardiovascular diseases (CVDs) and rising adoption of minimally invasive techniques in interventional procedures propel the occlusion devices market growth.

The occlusion devices market majorly consists of the players, including Abbott; Boston Scientific Corporation; LeMaitre Vascular, Inc; Edwards Lifesciences Corporation; Medtronic; MicroPort Scientific Corporation; Johnson & Johnson; Terumo Group; Stryker Corporation; Tokai Medical Products.

The occlusion devices such as stent retrievers, coil retrievers, balloon occlusion devices, and embolization devices are specialized tools or implants used to block abnormal blood vessels or structural defects of the heart. This frame expands inside a blood vessel and collapses for the delivery or retrieval of the device. In addition, the device features a hydrophilic polyurethane hydrogel layer attached to the interconnected components of the tubular expandable body. The polyurethane hydrogel layer expands when the device comes in contact with an aqueous environment.

The occlusion devices market was valued at US$ 8.90 billion in 2023.

The occlusion devices market is expected to be valued at US$ 31.71 billion in 2031.

The occlusion devices market, by product, is segmented into occlusion removal devices, embolization devices, and support devices. The occlusion removal devices segment held the largest market share in 2023.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Occlusion Devices Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Occlusion Devices Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Occlusion Devices Market - Global Market Analysis

6.1 Occlusion Devices - Global Market Overview

6.2 Occlusion Devices - Global Market and Forecast to 2031

7. Occlusion Devices Market – Revenue Analysis (USD Million) – By Product, 2021-2031

7.1 Overview

7.2 Occlusion Removal Devices

7.3 Embolization Devices

7.4 Support Devices

8. Occlusion Devices Market – Revenue Analysis (USD Million) – By Application, 2021-2031

8.1 Overview

8.2 Neurology

8.3 Cardiology

8.4 Peripheral Vascular Disease

8.5 Urology

8.6 Oncology

8.7 Gynecology

9. Occlusion Devices Market – Revenue Analysis (USD Million) – By End User, 2021-2031

9.1 Overview

9.2 Hospitals

9.3 Diagnostic Centers and Surgical Centers

9.4 Ambulatory Care Centers

9.5 Research Laboratories and Academic Institutes

10. Occlusion Devices Market - Revenue Analysis (USD Million), 2021-2031 – Geographical Analysis

10.1 North America

10.1.1 North America Occlusion Devices Market Overview

10.1.2 North America Occlusion Devices Market Revenue and Forecasts to 2031

10.1.3 North America Occlusion Devices Market Revenue and Forecasts and Analysis - By Product

10.1.4 North America Occlusion Devices Market Revenue and Forecasts and Analysis - By Application

10.1.5 North America Occlusion Devices Market Revenue and Forecasts and Analysis - By End User

10.1.6 North America Occlusion Devices Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Occlusion Devices Market

10.1.6.1.1 United States Occlusion Devices Market, by Product

10.1.6.1.2 United States Occlusion Devices Market, by Application

10.1.6.1.3 United States Occlusion Devices Market, by End User

10.1.6.2 Canada Occlusion Devices Market

10.1.6.2.1 Canada Occlusion Devices Market, by Product

10.1.6.2.2 Canada Occlusion Devices Market, by Application

10.1.6.2.3 Canada Occlusion Devices Market, by End User

10.1.6.3 Mexico Occlusion Devices Market

10.1.6.3.1 Mexico Occlusion Devices Market, by Product

10.1.6.3.2 Mexico Occlusion Devices Market, by Application

10.1.6.3.3 Mexico Occlusion Devices Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 U.A.E

10.4.4 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. Occlusion Devices Market - Key Company Profiles

13.1 Abbott

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 Boston Scientific Corporation

13.3 LeMaitre Vascular, Inc

13.4 Edwards Lifesciences Corporation

13.5 Medtronic

13.6 MicroPort Scientific Corporation

13.7 Johnson & Johnson

13.8 Terumo Group

13.9 Stryker Corporation

13.10 Tokai Medical Products

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies for Occlusion Devices Market

- Abbott

- Boston Scientific Corporation

- LeMaitre Vascular, Inc

- Edwards Lifesciences Corporation

- Medtronic

- MicroPort Scientific Corporation

- Johnson & Johnson

- Terumo Group

- Stryker Corporation

- Tokai Medical Products

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Occlusion Devices Market

May 2024

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

May 2024

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

May 2024

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

May 2024

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

May 2024

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

May 2024

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

May 2024

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

May 2024

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For