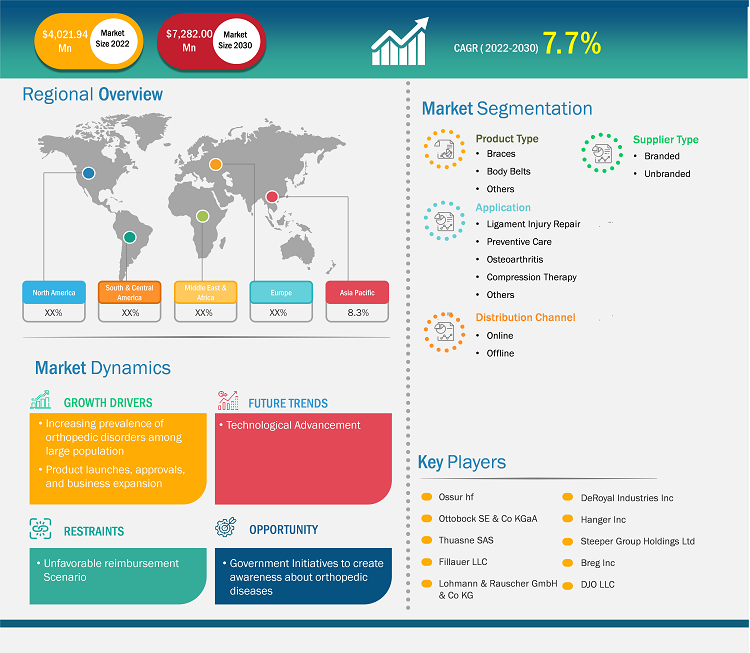

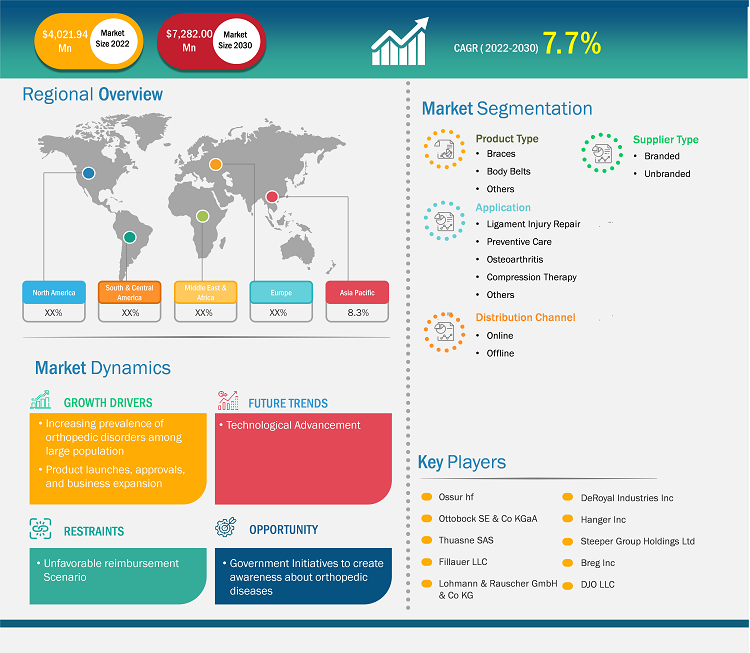

[Research Report] The orthotic aids market size is projected to grow from US$ 4,021.94 million in 2022 and is projected to reach US$ 7,282.00 million by 2030; the market is estimated to register a CAGR of 7.7% during 2022–2030.

Market Insights and Analyst View:

Orthotic aids are devices that are used to provide support and stability to the musculoskeletal system; prevent, correct, or align deformities; and improve the function of body parts. A few of the commonly used orthotic aids include foot orthotics, knee braces, back braces, wrist braces, and ankle braces. An upsurge in orthopedic conditions among large populations on the global level increases the demand for orthotic aids. Moreover, increasing product launches, technological advancements, and strategic collaborations by the orthotic market players are likely to amplify the orthotic aids market growth in the coming years.

Growth Drivers:

Orthopedic aids such as body belts and braces facilitate patients affected by cerebral palsy, brain injury, spinal cord injury, and other neurological/orthopedic conditions with mobility and support. According to the Centers for Disease Control and Prevention, the US reported approximately 214,110 traumatic brain injury (TBI)-related hospitalizations and 69,473 TBI-related deaths in 2020. Thus, the use of orthotic aids is increasing with the rising number of patients suffering from various orthopedic and neurological conditions.

The modernization of healthcare facilities and improvements in healthcare services, which eventually boost people's life expectancy, lead to an increase in the global geriatric population. Elderlies are at a greater risk of falls, and minor accidents can also cause fractures or bone breakage due to the tendency of muscles and bones to wear off with age. Osteoporosis and other conditions that may affect older people may further raise the risk of bone breakage. Thus, an upsurge in the elderly population is correlated with the soaring number of orthopedic injuries and disorders, which creates the demand for orthotic aids. According to the Osteoarthritis (OA) Action Alliance, 88% of people with OA are at least 45 years old, and 43% are 65 or older in the US.

A child's musculoskeletal system may develop in ways that make movement and posture difficult due to orthopedic and neuromuscular conditions such as cerebral palsy, spina bifida, muscular dystrophy, and clubfoot. According to the Centers for Disease Control and Prevalence (CDC), clubfoot is one of the most common congenital disabilities in the US, and it affected ~6,643 babies in the country in 2022. Pediatric bracing involves the use of specialized orthotic devices or braces to support and align joints in children’s bodies, particularly those in the spine, hips, knees, ankles, and feet. These devices are prescribed following diagnosis and are typically manufactured to meet patients’ needs.

Thus, increasing the use of orthotic aids among people from various age groups drives the orthotic aids market growth.

Inconsistent insurance coverage or limited product coverage results in an increased cost burden on patients. The high cost of orthotic treatments and aids, along with unfavorable reimbursement policies, impedes the growth of the orthotic aids market. Elderly people suffering from chronic pain or injuries can benefit significantly from back braces. Durable arm, leg, neck, and back braces are covered by Medicare Part B, with some restrictions. The Medicare Braces Benefit covers knee orthoses. The orthosis must be a semi-rigid or rigid device that is used to support a weak or deformed body part or to limit or completely rule out motion in a diseased or injured part of the body to qualify for coverage under this benefit. The statutory definition of the Braces Benefit does not apply to items that are not sufficiently rigid to be able to immobilize or support the body part for which they are intended. Items that don't fit the description of a brace aren’t covered and don't qualify for benefits under this Medicare benefit.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Orthotic Aids Market: Strategic Insights

Market Size Value in US$ 4,021.94 million in 2022 Market Size Value by US$ 7,282.00 million by 2030 Growth rate CAGR of 7.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Orthotic Aids Market: Strategic Insights

| Market Size Value in | US$ 4,021.94 million in 2022 |

| Market Size Value by | US$ 7,282.00 million by 2030 |

| Growth rate | CAGR of 7.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The "Orthotic Aids Market" is segmented on the basis of product type, application, distribution channel, supplier type, and geography. Based on product type, the orthotic aids market has been segmented into braces, body belts, and others. In terms of application, the orthotic aids market has been segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. Based on distribution channel, the market is bifurcated into online and offline. The orthotic aids market, by supplier type, is bifurcated into branded and unbranded. Based on geography, the orthotic aids market is categorized into North America (US, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of MEA), and South & Central America (Brazil, Argentina, Rest of South & Central America).

Segmental Analysis:

The orthotic aids market, by product type, is categorized into braces, body belts, and others. The braces segment held the largest market share in 2022. The same segment is anticipated to register the highest CAGR during 2022–2030. Body belts such as back traction belts, elastic back braces, copper belts, back pain belts, and back braces are commonly used to treat joint sprain, muscle strain, and injuries. Most people are likely to experience back pain at some point in their lives. While injuries and illnesses are among several causes of back pain, a vast percentage of cases result from improper lifting of heavy objects and poor posture. Wearing a back brace is a common method of preventing back pain and improving posture. According to Cross River Therapy, 8 out of 10 Americans report having back issues at least once or more frequently in a year. As per the same source, 80 million workers, or 50% of all employed Americans, report back pain annually.

Based on application, the orthotic aids market is segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. The ligament injury repair segment held the largest market share in 2022 and is anticipated to register the highest CAGR 2022-2030. The medial collateral ligament (MCL), posterior cruciate ligament (PCL), anterior cruciate ligament (ACL), and lateral collateral ligament (LCL) are the four major ligaments in the knee. Ligaments are instrumental to keeping a person's knee moving, and moderately minor injuries can also cause much discomfort to persons. Knee braces can decrease the load on the knee. In case of a partial tear, a doctor may recommend repairing the ACL tear non-surgically by using an ACL brace and physical therapy for muscle strengthening. However, for patients undergoing surgery, doctors recommend wearing post-operative knee braces and crutches until they are adequately healed. The rehab procedure for an ACL tear is relatively lengthy, as it can take 6 months to 1 year for completion. After recovery, the patient may be advised to wear an ACL knee brace while playing sports.

PCL tears are classified into four groups: Grade 1 tear, Grade 2 tear, Grade 3 tear, and Healthy PCL. If the tear is severe enough, the patient may have to have PCL surgery. After surgery, they are recommended to wear a PCL knee brace for post-surgical recovery. Brace Ability offers many braces and supports for preventing and treating PCL tears. The majority of MCL injuries can be treated at home with ice application, anti-inflammatory medication, and rest. A doctor may suggest a brace that helps protect the patient's knee and enables some movement. If the tear is significantly severe, patients may need surgery.

Based on the distribution channel, the orthotic aids market is bifurcated into online and offline. The offline segment held a larger market share in 2022. However, the online segment is anticipated to register a higher CAGR during 2022-2030. Online pharmacies allow customers to buy prescription medications, medical equipment, and electronic services without the need to visit actual stores, enabling them to receive their medications or services quickly and comfortably at home. Internet penetration, digitalization, government support, booming economy, etc., are the prominent factors contributing to the growth of the orthotic aids market through the online distribution channel. For instance, Walmart and Medical Department Store, Inc. are a few of the online distributors that offer braces, body belts, arm slings, etc.

Based on supplier type, the orthotic aids market is bifurcated into branded and unbranded. The branded segment held a larger share of the market in 2022; however, the unbranded segment is anticipated to register a higher CAGR during 2022-2030. Branded orthotic aids include products that are manufactured by well-known manufacturers with significant global presence; these products are made available through online and offline distribution channels. The US is the second-largest importer of knee braces in the world, sourcing the majority of its knee braces from China, Vietnam, and Belgium. The limited number of manufacturers in developing economies and increasing the purchasing power of consumers encourage manufacturers of branded goods to offer products meeting evolving consumer needs.

Regional Analysis:

The global orthotic aids market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is expected to hold a major market share owing to the increasing prevalence of orthopedic conditions among a large population, along with an upsurge in the geriatric population prone to such conditions. Moreover, product launches, geographic expansions, and technological advancements are expected to boost the orthotic aids market growth in the region in the future. The North American orthotic aids market is segmented into the US, Canada, and Mexico. The US accounts for a major market share. The Osteoarthritis Action Alliance (OAAA), states arthritis is a severe health crisis in the US. As per the Centers for Disease Control and Prevention (CDC) estimates, 53.2 million adults (i.e., ~25% or 1 in 4 persons) in the country were suffering from a form of arthritis during 2019–2021, and the number is anticipated to reach 78 million by 2040. There are more than 100 forms of arthritis and related diseases. Individuals with osteoarthritis (OA) experience more significant pain, disability, fatigue, and activity limitations than other people of their age. Chronic and episodic pain can result in functional disabilities and work limitations. Arthritis is characterized by the tenderness and swelling of one or more joints. Primary symptoms of arthritis include stiffness and joint pain, which generally worsen with age. Orthotic aids, such as knee braces, can help relieve pain and provide protection and support for joints or parts of the body without using drugs. The back braces strengthen the musculature and upper body, thereby reducing the risk of osteoporotic fractures.

The burgeoning incidence of spinal cord injuries in the US is fueling the orthotic aids market. According to the American Association of Neurological Surgeons, nearly 17,000 new spinal cord injuries occur in the US every year. The National Multiple Sclerosis Society states that ~1 million people were affected by multiple sclerosis in the US in 2020. Thus, disabilities caused by spinal cord injuries and multiple sclerosis consequently result in the need for orthotic aids to assist these patients in attaining mobility. The use of a brace is recommended by doctors among patients suffering from spinal cord injuries (SCIs). A brace externally appropriates the spine position, stabilizes the spine when soft issues (such as ligaments) cannot, applies corrective forces, and restricts movements.

Asia Pacific is expected to register a significant CAGR in the orthotic aids market during 2022–2030. The projected market growth is ascribed to the increasing geriatric population, which is prone to various orthopedic conditions. China has one of the largest geriatric populations. According to the Population Reference Bureau 2023, the Chinese geriatric population is expected to reach 366 million by 2050, i.e., substantially larger than the US. Moreover, collaborations among market players, technological advancements, and product launches would further drive the orthotic aids market growth in Asia Pacific. In January 2023, Breg, Inc. partnered with Coreal International, a medical device supplier, to bring its broad portfolio of bracing and cold therapy products to Chinese physicians and their patients.

Orthotic Aids Market Report Scope

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the orthotic aids market are listed below:

- In October 2023, OrthoPediatrics Corp. launched DF2 Brace as part of its expansion in the non-surgical business. The product is indicated for the treatment of kids with musculoskeletal injuries. The brace is intended to replace a spica cast in femur fracture fixation in pediatric patients of age ranging from 6 months to 5 years, enabling the immobilization of the femur, knee, and hip.

- In February 2021, Breg, Inc. launched two new lines of spinal orthoses: Pinnacle and Ascend. These two lines consist of 15 products in total, designed to elevate care for patients with spinal injuries.

Competitive Landscape and Key Companies:

Ossur hf, Ottobock SE & Co KGaA, Thuasne SAS, Fillauer LLC, Lohmann & Rauscher GmbH & Co KG, DeRoyal Industries Inc, Hanger Inc, Steeper Group Holdings Ltd, Breg Inc, and DJO LLC are among the prominent orthotic aids companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, Distribution Channel, Supplier Type, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The devices or supports known as orthotic aids are intended to enhance the sustainability and functionality of various body parts, usually the musculoskeletal system. These tools are frequently employed to address problems like pain, damage, or deformity. Common orthotic aids include orthotic insoles, ankle braces, knee braces, back braces, wrist braces, shoulder braces, neck braces, prosthetic limbs, spinal orthoses, etc. Orthotic devices have been shown to reduce pain and enhance people's quality of life significantly.

The global orthotic aids market is analyzed based on product type, application, type of supplier, and distribution channel. Based on product type, braces segment dominates the market growth during 2022-2030.

The growth of the global orthotic aids market is attributed to a few key factors, such as increasing prevalence of orthopedic conditions among people of different age groups. Additionally, the rising number of strategic collaborations and product launches by market players is expected to contribute to the orthotic aids market proliferation in the future.

The global orthotic aids market segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is expected to dominate the market in terms of market share however, Asia Pacific is expected to register the highest growth rate during 2022-2030.

The global orthotic aids market majorly consists of the players such as Ossur hf, Ottobock SE & Co KGaA, Thuasne SAS, Fillauer LLC, Lohmann & Rauscher GmbH & Co KG, DeRoyal Industries Inc, Hanger Inc, Steeper Group Holdings Ltd, Breg Inc, and DJO LLC.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Orthotic Aids Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Orthotic Aids Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Orthotic Aids Market - Global Market Analysis

6.1 Orthotic Aids - Global Market Overview

6.2 Orthotic Aids - Global Market and Forecast to 2030

7. Orthotic Aids Market – Revenue Analysis (USD Million) – By Product Type, 2020-2030

7.1 Overview

7.2 Braces

7.2.1 Knee Braces

7.2.2 Foot Support and Braces

7.2.3 Elbow Support and Braces

7.2.4 Neck and Cervical Braces

7.2.5 Others

7.3 Body Belts

7.4 Others

7.4.1 Cast Covers

7.4.2 Pouch Arm Sling

7.4.3 Cast Shoes

8. Orthotic Aids Market – Revenue Analysis (USD Million) – By Application, 2020-2030

8.1 Overview

8.2 Ligament Injury Repair

8.3 Preventive Care

8.4 Osteoarthritis

8.5 Compression Therapy

8.6 Others

9. Orthotic Aids Market – Revenue Analysis (USD Million) – By Distribution Channel, 2020-2030

9.1 Overview

9.2 Online

9.3 Offline

10. Orthotic Aids Market – Revenue Analysis (USD Million) – By Supplier Type, 2020-2030

10.1 Overview

10.2 Branded

10.3 Unbranded

11. Orthotic Aids Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

11.1 North America

11.1.1 North America Orthotic Aids Market Overview

11.1.2 North America Orthotic Aids Market Revenue and Forecasts to 2030

11.1.3 North America Orthotic Aids Market Revenue and Forecasts and Analysis - By Product Type

11.1.4 North America Orthotic Aids Market Revenue and Forecasts and Analysis - By Application

11.1.5 North America Orthotic Aids Market Revenue and Forecasts and Analysis - By Distribution Channel

11.1.6 North America Orthotic Aids Market Revenue and Forecasts and Analysis - By Supplier Type

11.1.7 North America Orthotic Aids Market Revenue and Forecasts and Analysis - By Countries

11.1.7.1 United States Orthotic Aids Market

11.1.7.1.1 United States Orthotic Aids Market, by Product Type

11.1.7.1.2 United States Orthotic Aids Market, by Application

11.1.7.1.3 United States Orthotic Aids Market, by Distribution Channel

11.1.7.1.4 United States Orthotic Aids Market, by Supplier Type

11.1.7.2 Canada Orthotic Aids Market

11.1.7.2.1 Canada Orthotic Aids Market, by Product Type

11.1.7.2.2 Canada Orthotic Aids Market, by Application

11.1.7.2.3 Canada Orthotic Aids Market, by Distribution Channel

11.1.7.2.4 Canada Orthotic Aids Market, by Supplier Type

11.1.7.3 Mexico Orthotic Aids Market

11.1.7.3.1 Mexico Orthotic Aids Market, by Product Type

11.1.7.3.2 Mexico Orthotic Aids Market, by Application

11.1.7.3.3 Mexico Orthotic Aids Market, by Distribution Channel

11.1.7.3.4 Mexico Orthotic Aids Market, by Supplier Type

Note - Similar analysis would be provided for below mentioned regions/countries

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Rest of Europe

11.3 Asia-Pacific

11.3.1 Australia

11.3.2 China

11.3.3 India

11.3.4 Japan

11.3.5 South Korea

11.3.6 Rest of Asia-Pacific

11.4 Middle East and Africa

11.4.1 South Africa

11.4.2 Saudi Arabia

11.4.3 U.A.E

11.4.4 Rest of Middle East and Africa

11.5 South and Central America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South and Central America

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Orthotic Aids Market - Key Company Profiles

14.1 Ossur hf

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 Ottobock SE & KGaA

14.3 Thuasane SAS

14.4 Fillauer LLC

14.5 Lohmann & Rauscher GmbH & Co KG

14.6 DeRoyal Industries Inc

14.7 Hanger Inc

14.8 Steeper Group Holdings Ltd

14.9 Breg Inc

14.10 DJO LLC

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Jan 2026

Prenatal Testing Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Diagnostic Type (Noninvasive and Invasive), Disease (Aneuploidy, Microdeletions, Structural Chromosomal Abnormalities, and Others), End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2026

Joint Resurfacing Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Knee, Hip, Shoulder, Ankle, and Others), Material (Metal, Ceramic, and Others), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America)

Jan 2026

Embolization Plugs Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Neurology, Peripheral Vascular Disease, Oncology, Urology, and Others), End User (Hospital, Ambulatory Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2026

Carrier Testing Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Expanded Carrier Screening and Targeted Disease Carrier Screening), Medical Condition (Pulmonary Conditions, Hematological Conditions, Neurological Conditions, and Other Medical Conditions), End User (Hospital-Based Laboratories, Diagnostic Laboratories, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2026

Recombinant Albumin Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Human Recombinant Albumin, Bovine Recombinant Albumin, and Others), Application (Excipient in Biotherapeutics And Vaccines, Cell Culture, Drug Delivery, Diagnostics, and Others), and End User (Pharmaceutical and Biotechnology Companies, Research Institutes, Hospitals and Diagnostic Laboratories, and Others)

Jan 2026

Predictive Genetic Testing Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Predispositional Testing and Presymptomatic Testing), Disease (Cancer, Cardiovascular Diseases, Metabolic Diseases, and Other Diseases), End User (Hospital-Based Laboratories, Diagnostic Laboratories, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2026

Medical Contract Manufacturing Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Full-device Manufacturing, Sub-assembly and Components, and Materials-specific Services), Device Type (IVD Devices, Diagnostic Imaging Devices, Cardiovascular Devices, Drug Delivery Devices, Orthopedic Devices, Respiratory Care Devices, Ophthalmology Devices, Surgical Devices, Diabetes Care Devices, Dental Devices, Endoscopy and Laparoscopy Devices, Gynecology and Urology Devices, Neurology Devices, Patient Assistive Devices, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Jan 2026

Bulk Lyophilization Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Lyophilization Format (Bulk Tray Lyophilization, Drum Lyophilization, Shelf Freeze-Drying, Tunnel or Conveyer Based Freeze Drying, and Hybrid Methods), Scale (Small Scale or Lab Scale, Pilot Scale, and Commercial and Industrial Scale), Service Type (Custom Process Development and Optimization, Pilot Scale and R and D Lyophilization, and Full Scale Commercial Bulk Lyophilization), and End User (Pharmaceutical and Biotechnology Companies, Research and Academic Institutes, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For