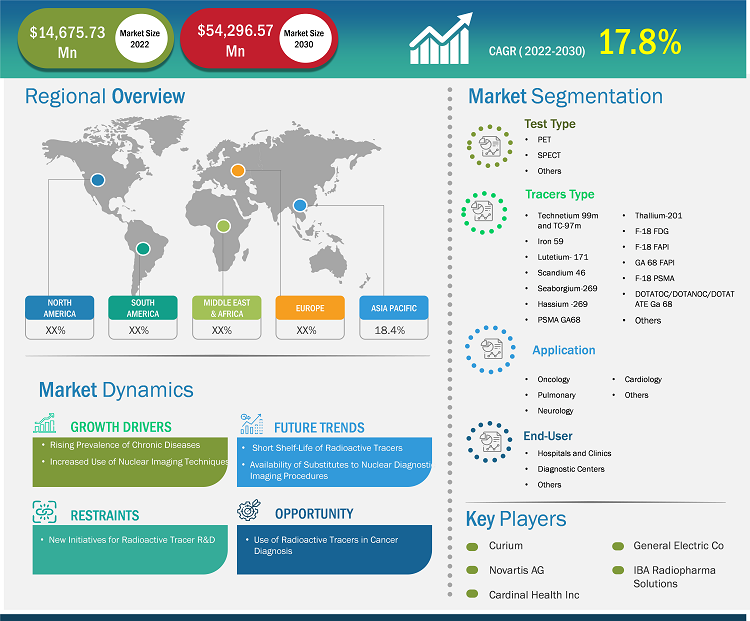

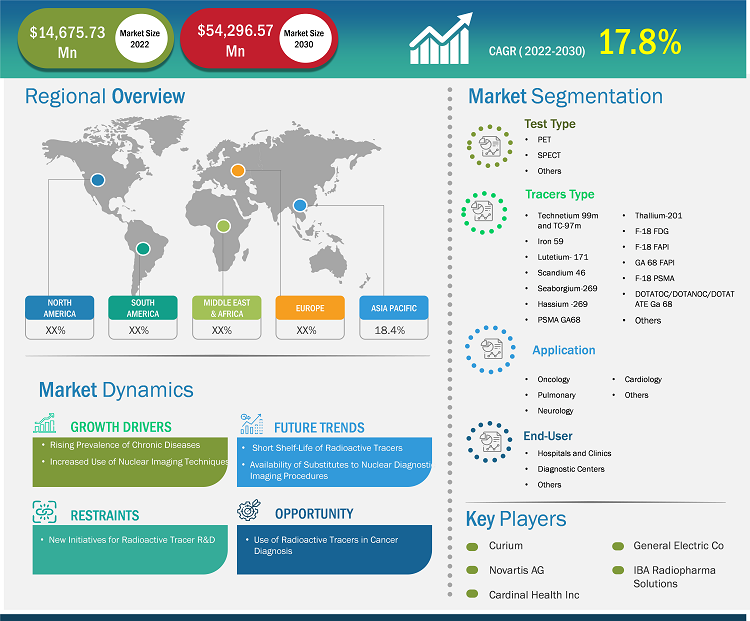

[Research Report] The radioactive tracer market is expected to grow from US$ 14,675.73 million in 2022 to US$ 54,296.57 million by 2030; it is expected to grow at a CAGR of 17.8% from 2022 to 2030.

Market Insights and Analyst View:

The rising prevalence of chronic diseases and increasing use of nuclear imaging techniques drive the radioactive tracer market growth. The rising focus on research and development in the field of diagnosis using radioactive tracer is also expected to boost the radioactive tracer market growth. A radioactive tracer is a chemical compound in which one or more atoms are replaced by a radioisotope. Radiotracer can be used to study chemical reactions based on the monitoring of their radioactive decay. They are also used to visualize flow in techniques such as single photon emission computed tomography (SPECT), positron emission tomography (PET), and computed radioactive particle tracking (CARPT).

The radioactive tracer market key players focus on strategic initiatives by collaborations to expand their geographic reach and enhance capacities to cater to a large customer base. In May 2022, Invicro opened a new global headquarters and laboratory in Needham, Massachusetts, to provide more resources to support pharmaceutical and biotechnology companies and their development of life-changing drugs.

Growth Drivers and Challenges:

Increasing aging population, changing social behavior, rising sedentary lifestyle, and accelerating urbanization are the key factors boosting the prevalence of obesity and other chronic diseases such as diabetes. Further, studies have long established that genes can cause chronic conditions such as cardiovascular disease (CVD), diabetes, obesity, Alzheimer's disease (AD), and depression.

According to the National Council on Aging, Inc., 80% of adults aged 65 and above suffer from at least one chronic condition, while 68% suffer from two or more. According to the Centers for Disease Control and Prevention (CDC), in 2020, ~6 in 10 people in the US suffer from at least one chronic disease, and 4 in 10 people suffer from two or more chronic conditions.

CVDs, such as atherosclerosis, angina pectoris, and acute myocardial infarction, caused due to hectic lifestyles have become significant reasons for mortality worldwide. As per the data provided by the WHO, CVDs are the predominant cause of death worldwide, recording ~17.9 million deaths each year. Diabetes is a life-threatening chronic disease with no functional cure. Diabetes of all types can lead to various complications in different body parts and increase the overall risk of premature death. Heart attack, stroke, kidney failure, leg amputation, vision loss, and nerve damage are among the major complications associated with diabetes. According to the International Diabetes Federation (IDF), diabetic cases in North America are expected to reach 62 million by 2045 from 46 million in 2017. The data further reported that 425 million people had diabetes in 2017, and the count is expected to reach 629 million worldwide by 2045. The disease prevalence will likely increase by nearly 35% during the forecast period. Thus, an effective examination is a must for properly treating chronic diseases; therefore, nuclear substances are used for diagnosis and examination purposes. These nuclear substances are used in diagnostic tests such as positron emission tomography (PET) and single-photon emission computerized tomography (SPECT) to diagnose chronic diseases such as neurological, cardiovascular, chronic lung, and chronic kidney diseases. The availability of several radiotracer makes selection easy depending on the type of disease and its prognosis. Thus, the increasing incidences of chronic diseases are surging the demand for radioactive tracer , positively favoring market expansion.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Radioactive Tracer Market: Strategic Insights

Market Size Value in US$ 14,675.73 million in 2022 Market Size Value by US$ 54,296.57 million by 2030 Growth rate CAGR of 17.8% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Radioactive Tracer Market: Strategic Insights

| Market Size Value in | US$ 14,675.73 million in 2022 |

| Market Size Value by | US$ 54,296.57 million by 2030 |

| Growth rate | CAGR of 17.8% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Radioactive Tracer Market Segmentation and Scope:

The “Global Radioactive Tracer Market” is segmented based on tracer type, test type, application, end user, and geography. The radioactive tracer market, by tracer type, is segmented into Technetium-99m & Tc-97m, Iodine-131, Iron-59, Lutetium-171, Rubidium (Rb-82) Chloride & Ammonia (N-13), Scandium-46, Seaborgium-269, Hassium-269, Gallium Citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), Phosphorus-32 & Chromium-51, Thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and others. Based on test type, the radioactive tracer market is segmented into PET, SPECT, and others. By application, the radioactive tracer market is segmented into oncology, pulmonary, neurology, cardiology, and others. In terms of end user, the radioactive tracer market is segmented into hospitals & clinics, diagnostic centers, academic & research institutes, and others. Geographically, the radioactive tracer market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on tracer type, the radioactive tracer market is segmented into Technetium-99m & Tc-97m, Iodine-131, Iron-59, Lutetium-171, Rubidium (Rb-82) Chloride & Ammonia (N-13), Scandium-46, Seaborgium-269, Hassium-269, Gallium Citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), Phosphorus-32 & Chromium-51, Thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and others. The others segment held the largest market share in 2022, and Seaborgium-269 and PSMA GA68 is anticipated to register the highest CAGR of 28.4% from 2022 to 2030. As F-18 FDG is one of the most common radioactive tracer used to diagnose cancer in the human body using PET scan technique, the F-18 FDG segment held the second-largest share in the market in 2022. FDA has approved F-18 FDG PET for measuring regional glucose metabolism in the human brain to assist in diagnosing seizures. Under steady-state conditions, F-18 FDG is taken up by cells in competition with other sugars. Once inside cells, F-18 FDG is phosphorylated by hexokinase. This phosphorylation results in a polar entity that cannot diffuse from the cell. The entity can be dephosphorylated to F-18 FDG by glucose-6-phosphatase, but dephosphorylation occurs slowly. Therefore, the cellular concentration of F-18 FDG is closely representative of the accumulation of F-18 FDG and the glycolytic activity of exogenous glucose. The amount that accumulates in the tissue over a specific period allows for calculating the glucose uptake rate by that tissue. Accelerated glycolysis and decreased ability to make energy aerobically are features of malignant and epileptogenic brain cells. These features cause high rates of glucose uptake required to sustain the cells. The aforementioned factors drive the radioactive tracer market growth for the segment.

Regional Analysis:

Based on geography, the radioactive tracer market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2020, North America held the largest share of the global radioactive tracer market, and Asia Pacific is estimated to register the highest CAGR from 2022 to 2030.

North America is the largest market for radioactive tracer , with the US holding the largest market share, followed by Canada. The radioactive tracer market in the US is primarily driven by increasing demand for PET scanners in cancer diagnosis, rising demand for imaging modalities such as SPECT and PET, and a high adoption rate of radioactive tracer . Demand for SPECT and PET scanners in cancer diagnosis has increased remarkably over the past few years. The SPECT and PET offer a sophisticated diagnostic tool that can detect disease progression at each stage, helping in the early diagnosis of disease. Immuno-PET is a technique that uses radioactive tracer to target specific cancer cells. This technique aids in visualizing the distribution and accumulation of immunotherapy drugs in tumors, allowing for personalized treatment planning. Thus, owing to the wide range of benefits, there is a significant demand for radioactive tracer in the US.

Nuclear medicine in the US has grown significantly owing to advancements in technology, such as hybrid imaging, the introduction of novel radiopharmaceuticals for diagnosis and treatment, and the development of molecular imaging based on the tracer principle.

Several market players are adopting organic strategies to stay competitive in the market. For instance, in March 2023, Telix Pharmaceuticals received FDA approval for a supplementary New Drug Application (sNDA) for Illuccix, a kit designed to prepare gallium Ga 68 gozetotide injection. The approval allows Illuccix to select patients with metastatic prostate cancer who could benefit from 177Lu 177 PSMA-directed therapy.

Industry Developments and Future Opportunities:

The European Union Committee has taken various initiatives to boost R&D activities in radioactive tracer and radioisotopes. The DOE Isotope Program (DOE IP) and its former organizations have been leading the development and production of radioactive and stable isotopes worldwide. Under the Atomic Energy Act of 1954, the DOE IP supplies isotope and related services to the US and has the exclusive authority within DOE to produce isotopes for distribution and sale. The mission of the DOE IP is to conduct R&D in order to develop transformative isotope production, separation, and enrichment technologies to allow academic, federal, and industrial innovation, research, and emerging technologies.

The Isotope Production and Distribution Program (IPDP) was established within the DOE's Office of Nuclear Energy to enhance the production and marketing of DOE-produced isotopes for research and commercial purposes. The IPDP was established on a condition that its operations were to be financially self-supporting.

PRISMAP is a European medical radionuclide program that was started to provide medical research access to novel radioisotopes of high purity grade. According to the data provided under this program, out of the ~3,000 different radioisotopes synthesized by scientists in laboratories under European Union, only a handful are used regularly for medical procedures, mostly for imaging. Many hospitals and research institutes focus on developing and using different radioactive tracer to diagnose chronic diseases. Massachusetts General Hospital (MGH) is focused on using a new PET tracer [18F]3F4AP to diagnose multiple sclerosis, Alzheimer's disease, mild cognitive impairment, and traumatic brain injury. According to the National Library of Medicine (ClinicalTrials.gov), [18F]3F4AP is used in Phase 1 clinical trial to diagnose multiple sclerosis, Alzheimer's disease, mild cognitive impairment, and traumatic brain injury. The ongoing research for discovering new radioactive tracer for diagnosing neurological disorders is anticipated to fuel the growth of the radioactive tracer market in the coming years.

COVID-19 Impact:

The COVID-19 pandemic has profoundly changed hospital activities, including nuclear medicine (N)M practice across the globe. A literature search on PubMed was performed covering COVID-19 studies published until January 2021. As per the findings, the pandemic strongly challenged NM departments, and a reduction in the workforce has been experienced in every center in Europe. NM departments introduced restriction measures to limit COVID-19 transmission, including rescheduling non-high-priority procedures. Also, some departments experienced a delay in the supply of radiopharmaceuticals or technical assistance due to the pandemic. As a result, the pandemic resulted in a significant reduction of diagnostic and therapeutic NM procedures and a reduced level of care for patients affected by diseases other than COVID-19. According to the British Nuclear Medicine Society (BNMS) COVID-19 survey results, ~97% of NM departments introduced procedures to limit SARS-CoV-2 transmission; at 68% of sites, standardized operating procedures were developed for running departments in pandemic situations. The pandemic influenced workflows in a substantial proportion of NM departments. As per the global survey by Freudenberg et al., nearly 15% of the respondent departments modified working hours for less than 20% of the staff and reported a mean decline of 54.4% in diagnostic procedures. PET/CT scans decreased by a mean of 36%; thyroid scans decreased by 67%; myocardial studies by 66%; bone scans by 60%; lung scans by 56%; and sentinel lymph node procedures by 45%. Nearly all (97%) participating centers in the survey from Germany, Austria, and Switzerland reported a decline in diagnostic NM procedures. In addition, nuclear cardiology was one of the most affected branches of NM during the COVID-19 pandemic in the region. All non-urgent examinations were postponed, and a decrease of 32% and 31% in activity was observed in NHS England PET/CT services in April and May 2020, respectively. However, European centers did not experience significant disruption in supplies of radioisotopes, generators, and kits. The BNMS survey reported that 81% of participants did not experience any problem with radiopharmaceutical supply, 13.9% had occasional issues, and 5.1% experienced disruptions to supply.

Apart from this, new findings supporting COVID-19 diagnosis are expected to accelerate the growth of radiopharmaceuticals in the region. For instance, as per the research study by Chentao Jin et al., published in the European Journal of Nuclear Medicine and Molecular Imaging in May 2021, PET is expected to offer pathophysiological alternations of COVID-19 and facilitate the clinical management of patients. With the role of PET during the COVID-19 pandemic, the research studies can also pave the way in combating other epidemics in the future.

Radioactive Tracer Market Report Scope

Competitive Landscape and Key Companies:

Some prominent players operating in the global radioactive tracer market are Rotem Industries Ltd, ABX advanced biochemical compounds GmbH, Invicro LLC, Cardinal Health Inc, Newcastle University, Novartis AG, Curium, Blue Earth Diagnostics Limited, General Electric Co, and IBA Radiopharma Solutions. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Tracer Type, Test Type, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Factors such as rising prevalence of chronic diseases and increased use of nuclear imaging techniques are the key driving the growth of the radioactive tracer market.

Answer: - Rotem Industries Ltd, Abx Advanced Biochemical Compounds Gmbh, Invicro Llc; Cardinal Health Inc; Newcastle University, Novartis Ag; Curium, Blue Earth Diagnostics Limited, General Electric Co, Iba Radiopharma Solutions among others are among the leading companies operating in the radioactive tracer market.

Based on tracer type, the others segment held the largest market share in 2022, and Seaborgium-269 and PSMA GA68 is anticipated to register the highest CAGR of 28.4% during the forecast period.

The hospitals & clinics segment held the largest share of the market in 2022 and academic & research institutes is anticipated to register the highest CAGR of 20.6% in the market during the forecast period.

A radioactive tracer is a chemical compound in which one or more atoms have been replaced by a radioisotope. Through monitoring its radioactive decay, a radiotracer can be used to study chemical reactions. Through different technologies, they are also used to visualize flow, including Single Photon Emission Computed Tomography (SPECT), Positron Emission Tomography (PET), and Computed Radioactive Particle Tracking (CARPT).

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Radioactive Tracer Market Landscape

4.1 Overview

4.2 PEST Analysis

5. Radioactive Tracer Market - Key Industry Dynamics

5.1 Key Market Drivers:

5.1.1 Rising Prevalence of Chronic Diseases

5.1.2 Increasing Use of Nuclear Imaging Techniques

5.2 Market Restraints

5.2.1 Short Shelf-Life of Radioactive Tracer

5.2.2 Availability of Substitutes to Nuclear Diagnostic Imaging Procedures

5.3 Market Opportunities

5.3.1 New Initiatives for Radioactive Tracer R&D

5.4 Future Trends

5.4.1 Use of Radioactive Tracer in Cancer Diagnosis

5.5 Impact Analysis:

6. Radioactive Tracer Market - Global Market Analysis

6.1 Radioactive Tracer Market Revenue (US$ Mn), 2022 – 2030

7. Global Radioactive Tracer Market – Revenue and Forecast to 2030 – by Tracer Types

7.1 Overview

7.2 Radioactive Tracer Market Revenue Share, by Tracer Types 2022 & 2030 (%)

7.3 Technetium 99m and TC-97m

7.3.1 Overview

7.3.2 Technetium 99m and TC-97m: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Iodine 131

7.4.1 Overview

7.4.2 Iodine 131: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Iron 59

7.5.1 Overview

7.5.2 Iron 59: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.6 Lutetium- 171

7.6.1 Overview

7.6.2 Lutetium- 171: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.7 RB82 and ammonia N-13

7.7.1 Overview

7.7.2 RB82 and ammonia N-13: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.8 Scandium 46

7.8.1 Overview

7.8.2 Scandium 46: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.9 Seaborgium-269

7.9.1 Overview

7.9.2 Seaborgium-269: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.10 Hassium -269

7.10.1 Overview

7.10.2 Hassium -269: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.11 Gallium Citrate GA 67

7.11.1 Overview

7.11.2 Gallium Citrate GA 67: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.12 PSMA GA68

7.12.1 Overview

7.12.2 PSMA GA68: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.13 FDDNP (F-18) and FDOPA (f-18)

7.13.1 Overview

7.13.2 FDDNP (F-18) and FDOPA (f-18): Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.14 Phosphorus 32 and Chromium -51

7.14.1 Overview

7.14.2 Phosphorus 32 and Chromium -51: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.15 Thallium-201

7.15.1 Overview

7.15.2 Thallium-201: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.16 F-18 FDG

7.16.1 Overview

7.16.2 F-18 FDG: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.17 F-18 FAPI

7.17.1 Overview

7.17.2 F-18 FAPI: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.18 GA 68 FAPI

7.18.1 Overview

7.18.2 GA 68 FAPI: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.19 F-18 PSMA

7.19.1 Overview

7.19.2 F-18 PSMA: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.20 DOTATOC/DOTANOC/DOTATATE Ga 68

7.20.1 Overview

7.20.2 DOTATOC/DOTANOC/DOTATATE Ga 68: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

7.21 Others

7.21.1 Overview

7.21.2 Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

8. Global Radioactive Tracer Market – Revenue and Forecast to 2030 – by Test Type

8.1 Overview

8.2 Radioactive Tracer Market Revenue Share, by Test Type 2022 & 2030 (%)

8.3 PET

8.3.1 Overview

8.3.2 PET: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

8.4 SPECT

8.4.1 Overview

8.4.2 SPECT: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Others

8.5.1 Overview

8.5.2 Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

9. Global Radioactive Tracer Market – Revenue and Forecast to 2030 – by Application

9.1 Overview

9.2 Radioactive Tracer Market Revenue Share, by Application 2022 & 2030 (%)

9.3 Oncology

9.3.1 Overview

9.3.2 Oncology: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Pulmonary

9.4.1 Overview

9.4.2 Pulmonary: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Neurology

9.5.1 Overview

9.5.2 Neurology: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

9.6 Cardiology

9.6.1 Overview

9.6.2 Cardiology: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

10. Global Radioactive Tracer Market – Revenue and Forecast to 2030 – by End User

10.1 Overview

10.2 Radioactive Tracer Market Revenue Share, by End User 2022 & 2030 (%)

10.3 Hospitals and Clinics

10.3.1 Overview

10.3.2 Hospitals and Clinics: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Diagnostic Centers

10.4.1 Overview

10.4.2 Diagnostic Centers: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

10.5 Academic and Research Institutes

10.5.1 Overview

10.5.2 Academic and Research Institutes: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

10.6 Others

10.6.1 Overview

10.6.2 Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

11. Radioactive Tracer Market - Geographical Analysis

11.1 North America Radioactive Tracer Market, Revenue And Forecast To 2030

11.1.1 Overview

11.1.2 North America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.1.3 North America Radioactive Tracer Market, by Tracer Types

11.1.4 North America Radioactive Tracer Market, by Test Type

11.1.5 North America Radioactive Tracer Market, by Application

11.1.6 North America Radioactive Tracer Market, by End-User

11.1.7 North America Radioactive Tracer Market, by Country

11.1.7.1 US

11.1.7.1.1 Overview

11.1.7.1.2 US Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.1.7.1.3 US Radioactive Tracer Market, by Tracer Types

11.1.7.1.4 US Radioactive Tracer Market, by Test Type

11.1.7.1.5 US Radioactive Tracer Market, by Application

11.1.7.1.6 US Radioactive Tracer Market, by End-User

11.1.7.2 Canada

11.1.7.2.1 Overview

11.1.7.2.2 Canada Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.1.7.2.3 Canada Radioactive Tracer Market, by Tracer Types

11.1.7.2.4 Canada Radioactive Tracer Market, by Test Type

11.1.7.2.5 Canada Radioactive Tracer Market, by Application

11.1.7.2.6 Canada Radioactive Tracer Market, by End-User

11.1.7.3 Mexico

11.1.7.3.1 Overview

11.1.7.3.2 Mexico Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.1.7.3.3 Mexico Radioactive Tracer Market, by Tracer Types

11.1.7.3.4 Mexico Radioactive Tracer Market, by Test Type

11.1.7.3.5 Mexico Radioactive Tracer Market, by Application

11.1.7.3.6 Mexico Radioactive Tracer Market, by End-User

11.2 Europe Radioactive Tracer Market, Revenue And Forecast to 2030

11.2.1 Overview

11.2.2 Europe Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.3 Europe Radioactive Tracer Market, by Tracer Types

11.2.4 Europe Radioactive Tracer Market, by Test Type

11.2.5 Europe Radioactive Tracer Market, by Application

11.2.6 Europe Radioactive Tracer Market, by End-User

11.2.7 Europe Radioactive Tracer Market by Country

11.2.7.1 Germany

11.2.7.1.1 Overview

11.2.7.1.2 Germany Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.7.1.3 Germany Radioactive Tracer Market, by Tracer Types

11.2.7.1.4 Germany Radioactive Tracer Market, by Test Type

11.2.7.1.5 Germany Radioactive Tracer Market, by Application

11.2.7.1.6 Germany Radioactive Tracer Market, by End-User

11.2.7.2 UK

11.2.7.2.1 Overview

11.2.7.2.2 UK Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.7.2.3 UK Radioactive Tracer Market, by Tracer Types

11.2.7.2.4 UK Radioactive Tracer Market, by Test Type

11.2.7.2.5 UK Radioactive Tracer Market, by Application

11.2.7.2.6 UK Radioactive Tracer Market, by End-User

11.2.7.3 France

11.2.7.3.1 Overview

11.2.7.3.2 France Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.7.3.3 France Radioactive Tracer Market, by Tracer Types

11.2.7.3.4 France Radioactive Tracer Market, by Test Type

11.2.7.3.5 France Radioactive Tracer Market, by Application

11.2.7.3.6 France Radioactive Tracer Market, by End-User

11.2.7.4 Italy

11.2.7.4.1 Overview

11.2.7.4.2 Italy Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.7.4.3 Italy Radioactive Tracer Market, by Tracer Types

11.2.7.4.4 Italy Radioactive Tracer Market, by Test Type

11.2.7.4.5 Italy Radioactive Tracer Market, by Application

11.2.7.4.6 Italy Radioactive Tracer Market, by End-User

11.2.7.5 Spain

11.2.7.5.1 Overview

11.2.7.5.2 Spain Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.7.5.3 Spain Radioactive Tracer Market, by Tracer Types

11.2.7.5.4 Spain Radioactive Tracer Market, by Test Type

11.2.7.5.5 Spain Radioactive Tracer Market, by Application

11.2.7.5.6 Spain Radioactive Tracer Market, by End-User

11.2.7.6 Rest of Europe

11.2.7.6.1 Overview

11.2.7.6.2 Rest of Europe Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.2.7.6.3 Rest of Europe Radioactive Tracer Market, by Tracer Types

11.2.7.6.4 Rest of Europe Radioactive Tracer Market, by Test Type

11.2.7.6.5 Rest of Europe Radioactive Tracer Market, by Application

11.2.7.6.6 Rest of Europe Radioactive Tracer Market, by End-User

11.3 Asia Pacific Radioactive Tracer Market, Revenue And Forecast to 2030

11.3.1 Overview

11.3.2 Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.3 Asia Pacific Radioactive Tracer Market, by Tracer Types

11.3.4 Asia Pacific Radioactive Tracer Market, by Test Type

11.3.5 Asia Pacific Radioactive Tracer Market, by Application

11.3.6 Asia Pacific Radioactive Tracer Market, by End-User

11.3.7 Asia Pacific Radioactive Tracer Market by Country

11.3.7.1 China

11.3.7.1.1 Overview

11.3.7.1.2 China Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.7.1.3 China Radioactive Tracer Market, by Tracer Types

11.3.7.1.4 China Radioactive Tracer Market, by Test Type

11.3.7.1.5 China Radioactive Tracer Market, by Application

11.3.7.1.6 China Radioactive Tracer Market, by End-User

11.3.7.2 Japan

11.3.7.2.1 Overview

11.3.7.2.2 Japan Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.7.2.3 Japan Radioactive Tracer Market, by Tracer Types

11.3.7.2.4 Japan Radioactive Tracer Market, by Test Type

11.3.7.2.5 Japan Radioactive Tracer Market, by Application

11.3.7.2.6 Japan Radioactive Tracer Market, by End-User

11.3.7.3 India

11.3.7.3.1 Overview

11.3.7.3.2 India Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.7.3.3 India Radioactive Tracer Market, by Tracer Types

11.3.7.3.4 India Radioactive Tracer Market, by Test Type

11.3.7.3.5 India Radioactive Tracer Market, by Application

11.3.7.3.6 India Radioactive Tracer Market, by End-User

11.3.7.4 Australia

11.3.7.4.1 Overview

11.3.7.4.2 Australia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.7.4.3 Australia Radioactive Tracer Market, by Tracer Types

11.3.7.4.4 Australia Radioactive Tracer Market, by Test Type

11.3.7.4.5 Australia Radioactive Tracer Market, by Application

11.3.7.4.6 Australia Radioactive Tracer Market, by End-User

11.3.7.5 South Korea

11.3.7.5.1 Overview

11.3.7.5.2 South Korea Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.7.5.3 South Korea Radioactive Tracer Market, by Tracer Type

11.3.7.5.4 South Korea Radioactive Tracer Market, by Test Type

11.3.7.5.5 South Korea Radioactive Tracer Market, by Application

11.3.7.5.6 South Korea Radioactive Tracer Market, by End-User

11.3.7.6 Rest of Asia Pacific

11.3.7.6.1 Overview

11.3.7.6.2 Rest of Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.3.7.6.3 Rest of Asia Pacific Radioactive Tracer Market, by Tracer Types

11.3.7.6.4 Rest of Asia Pacific Radioactive Tracer Market, by Test Type

11.3.7.6.5 Rest of Asia Pacific Radioactive Tracer Market, by Application

11.3.7.6.6 Rest of Asia Pacific Radioactive Tracer Market, by End-User

11.4 Middle East & Africa Radioactive Tracer Market, Revenue and Forecast to 2030

11.4.1 Overview

11.4.2 Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.4.3 Middle East & Africa Radioactive Tracer Market, by Tracer Types

11.4.4 Middle East & Africa Radioactive Tracer Market, by Test Type

11.4.5 Middle East & Africa Radioactive Tracer Market, by Application

11.4.6 Middle East & Africa Radioactive Tracer Market, by End-User

11.4.7 Middle East & Africa Radioactive Tracer Market by Country

11.4.7.1 Saudi Arabia

11.4.7.1.1 Overview

11.4.7.1.2 Saudi Arabia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.4.7.1.3 Saudi Arabia Radioactive Tracer Market, by Tracer Types

11.4.7.1.4 Saudi Arabia Radioactive Tracer Market, by Test Type

11.4.7.1.5 Saudi Arabia Radioactive Tracer Market, by Application

11.4.7.1.6 Saudi Arabia Radioactive Tracer Market, by End-User

11.4.7.2 UAE

11.4.7.2.1 Overview

11.4.7.2.2 UAE Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.4.7.2.3 UAE Radioactive Tracer Market, by Tracer Types

11.4.7.2.4 UAE Radioactive Tracer Market, by Test Type

11.4.7.2.5 UAE Radioactive Tracer Market, by Application

11.4.7.2.6 UAE Radioactive Tracer Market, by End-User

11.4.7.3 South Africa

11.4.7.3.1 Overview

11.4.7.3.2 South Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.4.7.3.3 South Africa Radioactive Tracer Market, by Tracer Types

11.4.7.3.4 South Africa Radioactive Tracer Market, by Test Type

11.4.7.3.5 South Africa Radioactive Tracer Market, by Application

11.4.7.3.6 South Africa Radioactive Tracer Market, by End-User

11.4.7.4 Rest of Middle East & Africa

11.4.7.4.1 Overview

11.4.7.4.2 Rest of Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.4.7.4.3 Rest of Middle East & Africa Radioactive Tracer Market, by Tracer Types

11.4.7.4.4 Rest of Middle East & Africa Radioactive Tracer Market, by Test Type

11.4.7.4.5 Rest of Middle East & Africa Radioactive Tracer Market, by Application

11.4.7.4.6 Rest of Middle East & Africa Radioactive Tracer Market, by End-User

11.5 South & Central America Radioactive Tracer Market, Revenue and Forecast to 2030

11.5.1 Overview

11.5.2 South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.5.3 South & Central America Radioactive Tracer Market, by Tracer Types

11.5.4 South & Central America Radioactive Tracer Market, by Test Type

11.5.5 South & Central America Radioactive Tracer Market, by Application

11.5.6 South & Central America Radioactive Tracer Market, by End-User

11.5.7 South & Central America Radioactive Tracer Market by Country

11.5.7.1 Brazil

11.5.7.1.1 Overview

11.5.7.1.2 Brazil Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.5.7.1.3 Brazil Radioactive Tracer Market, by Tracer Types

11.5.7.1.4 Brazil Radioactive Tracer Market, by Test Type

11.5.7.1.5 Brazil Radioactive Tracer Market, by Application

11.5.7.1.6 Brazil Radioactive Tracer Market, by End-User

11.5.7.2 Argentina

11.5.7.2.1 Overview

11.5.7.2.2 Argentina Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.5.7.2.3 Argentina Radioactive Tracer Market, by Tracer Types

11.5.7.2.4 Argentina Radioactive Tracer Market, by Test Type

11.5.7.2.5 Argentina Radioactive Tracer Market, by Application

11.5.7.2.6 Argentina Radioactive Tracer Market, by End-User

11.5.7.3 Rest of South & Central America

11.5.7.3.1 Overview

11.5.7.3.2 Rest of South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

11.5.7.3.3 Rest of South & Central America Radioactive Tracer Market, by Tracer Types

11.5.7.3.4 Rest of South & Central America Radioactive Tracer Market, by Test Type

11.5.7.3.5 Rest of South & Central America Radioactive Tracer Market, by Application

11.5.7.3.6 Rest of South & Central America Radioactive Tracer Market, by End-User

12. Pre & Post Covid-19 Impact

12.1 Pre & Post Covid-19 Impact

13. Radioactive Tracer Market Industry Landscape

13.1 Overview

13.2 Organic Developments

13.2.1 Overview

13.3 Inorganic Developments

13.3.1 Overview

14. Radioactive Tracer Market, Key Company Profiles

14.1 Rotem Industries Ltd

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 ABX advanced biochemical compounds GmbH

14.2.1 Business Description

14.2.2 Products and Services

14.2.3 Financial Overview

14.2.4 SWOT Analysis

14.2.5 Key Developments

14.3 Invicro LLC

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Cardinal Health Inc

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Newcastle University

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Novartis AG

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Curium

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Blue Earth Diagnostics Limited

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 General Electric Co

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 IBA Radiopharma Solutions

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About Us

15.2 Glossary of Terms

List of Tables

Table 1. Radioactive Tracer Market Segmentation

Table 2. Principal Radionuclides Used in Radioactive Tracer

Table 3. North America Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 4. North America Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – Test Type

Table 5. North America Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – Application

Table 6. North America Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – End-User

Table 7. US Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 8. US Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 9. US Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 10. US Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 11. Canada Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 12. Canada Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 13. Canada Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 14. Canada Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 15. Mexico Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 16. Mexico Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 17. Mexico Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 18. Mexico Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 19. Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 20. Europe Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – Test Type

Table 21. Europe Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – Application

Table 22. Europe Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – End-User

Table 23. Germany Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 24. Germany Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 25. Germany Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 26. Germany Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 27. UK Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 28. UK Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 29. UK Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 30. UK Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 31. France Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 32. France Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 33. France Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 34. France Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 35. Italy Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 36. Italy Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 37. Italy Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 38. Italy Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 39. Spain Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 40. Spain Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 41. Spain Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 42. Spain Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 43. Rest of Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 44. Rest of Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 45. Rest of Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 46. Rest of Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 47. Asia Pacific Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 48. Asia Pacific Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – Test Type

Table 49. Asia Pacific Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – Application

Table 50. Asia Pacific Radioactive Tracer Market Revenue And Forecast To 2030 (US$ Mn) – End-User

Table 51. China Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 52. China Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 53. China Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 54. China Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 55. Japan Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 56. Japan Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 57. Japan Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 58. Japan Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 59. India Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 60. India Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 61. India Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 62. India Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 63. Australia Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Tracer Types

Table 64. Australia Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 65. Australia Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Application

Table 66. Australia Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – End-User

Table 67. South Korea Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Type

Table 68. South Korea Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn) – Test Type

Table 69. South Korea Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 70. South Korea Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 71. Rest of Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 72. Rest of Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 73. Rest of Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 74. Rest of Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 75. Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 76. Middle East & Africa Radioactive Tracer Market Revenue and Forecast To 2030 (US$ Mn) – Test Type

Table 77. Middle East & Africa Radioactive Tracer Market Revenue and Forecast To 2030 (US$ Mn) – Application

Table 78. Middle East & Africa Radioactive Tracer Market Revenue and Forecast To 2030 (US$ Mn) – End-User

Table 79. Saudi Arabia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 80. Saudi Arabia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 81. Saudi Arabia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 82. Saudi Arabia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 83. UAE Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 84. UAE Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 85. UAE Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 86. UAE Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 87. South Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 88. South Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 89. South Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 90. South Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 91. Rest of Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 92. Rest of Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 93. Rest of Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 94. Rest of Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 95. South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 96. South & Central America Radioactive Tracer Market Revenue and Forecast To 2030 (US$ Mn) – Test Type

Table 97. South & Central America Radioactive Tracer Market Revenue and Forecast To 2030 (US$ Mn) – Application

Table 98. South & Central America Radioactive Tracer Market Revenue and Forecast To 2030 (US$ Mn) – End-User

Table 99. Brazil Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 100. Brazil Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 101. Brazil Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 102. Brazil Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 103. Argentina Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 104. Argentina Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 105. Argentina Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 106. Argentina Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 107. Rest of South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Tracer Types

Table 108. Rest of South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Test Type

Table 109. Rest of South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 110. Rest of South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn) – End-User

Table 111. Organic Developments Done by Companies

Table 112. Inorganic Developments Done by Companies

Table 113. Glossary of Terms, Radioactive Tracer Market

List of Figures

Figure 1. Radioactive Tracer Market Segmentation, By Geography

Figure 2. North America - PEST Analysis

Figure 3. Radioactive Tracer Market - Key Industry Dynamics

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. Radioactive Tracer Market Revenue (US$ Mn), 2022 – 2030

Figure 6. Radioactive Tracer Market Revenue Share, by Tracer Types 2022 & 2030 (%)

Figure 7. Technetium 99m and TC-97m: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Iodine 131: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Iron 59: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Lutetium- 171: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. RB82 and ammonia N-13: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Scandium 46: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Seaborgium-269: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Hassium -269: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Gallium Citrate GA 67: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. PSMA GA68: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. FDDNP (F-18) and FDOPA (f-18): Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Phosphorus 32 and Chromium -51: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Thallium-201: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. F-18 FDG: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. F-18 FAPI: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. GA 68 FAPI: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. F-18 PSMA: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. DOTATOC/DOTANOC/DOTATATE Ga 68: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. DOTATOC/DOTANOC/DOTATATE Ga 68: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Radioactive Tracer Market Revenue Share, by Test Type 2022 & 2030 (%)

Figure 27. PET: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. SPECT: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. Radioactive Tracer Market Revenue Share, by Application 2022 & 2030 (%)

Figure 31. Oncology: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 32. Pulmonary: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 33. Neurology: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 34. Cardiology: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 35. Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 36. Radioactive Tracer Market Revenue Share, by End User 2022 & 2030 (%)

Figure 37. Hospitals and Clinics: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 38. Diagnostic Centers: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 39. Academic and Research Institutes: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 40. Others: Radioactive Tracer Market – Revenue and Forecast to 2030 (US$ Million)

Figure 41. Radioactive Tracer Market, 2022 ($Mn)

Figure 42. North America Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 43. North America Radioactive Tracer Market, By Key Countries, 2022 And 2030 (%)

Figure 44. US Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 45. Canada Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 46. Mexico Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 47. Europe Radioactive Tracer Market, By Geography, 2022 ($Mn)

Figure 48. Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 49. Europe Radioactive Tracer Market, By Key Countries, 2022 And 2030 (%)

Figure 50. Germany Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 51. UK Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 52. France Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 53. Italy Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 54. Spain Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 55. Rest of Europe Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 56. Radioactive Tracer Market, By Geography, 2022 ($Mn)

Figure 57. Asia Pacific Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 58. Asia Pacific Radioactive Tracer Market, By Key Countries, 2022 And 2030 (%)

Figure 59. China Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 60. Japan Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 61. India Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 62. Australia Radioactive Tracer Market Revenue And Forecast to 2030 (US$ Mn)

Figure 63. South Korea Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 64. Rest of Asia Pacific Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 65. Radioactive Tracer Market, By Geography, 2022 And 2030 ($Mn)

Figure 66. Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 67. Middle East & Africa Radioactive Tracer Market, By Key Countries, 2022 And 2030 (%)

Figure 68. Saudi Arabia Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 69. UAE Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 70. South Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 71. Rest of Middle East & Africa Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 72. Radioactive Tracer Market, By Geography, 2022 ($Mn)

Figure 73. South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 74. South & Central America Radioactive Tracer Market, By Key Countries, 2022 and 2030 (%)

Figure 75. Brazil Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 76. Argentina Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 77. Rest of South & Central America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Mn)

Figure 78. Pre & Post Covid-19 Impact

The List of Companies - Radioactive Tracer Market

- Rotem Industries Ltd

- Abx Advanced Biochemical Compounds Gmbh

- Invicro Llc

- Cardinal Health Inc

- Newcastle University

- Novartis AG

- Curium

- Blue Earth Diagnostics Limited

- General Electric Co

- IBA Radiopharma Solutions

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Radioactive Tracer Market

Aug 2023

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Aug 2023

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Aug 2023

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Aug 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Aug 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Aug 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For