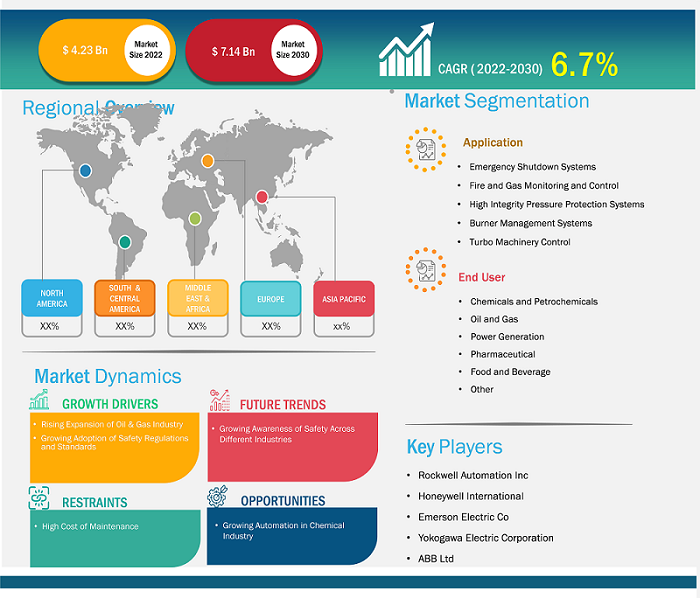

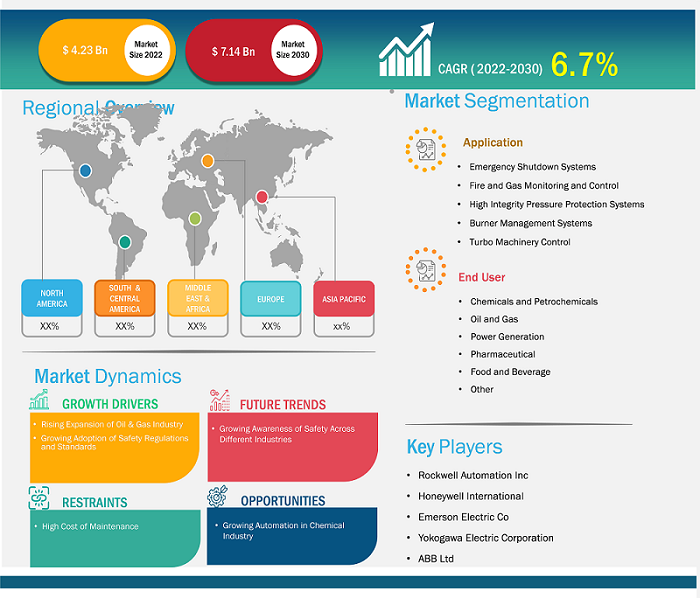

[Research Report] The safety instrumented system market is expected to grow from US$ 4.23 billion in 2022 to US$ 7.14 billion by 2030; it is estimated to record a CAGR of 6.7% from 2022 to 2030.

Analyst Perspective:

The construction of new oil & gas refineries and the growing mining activities worldwide are the major factors fueling the growth of the safety instrumented system market. Also, the growing adoption of safety regulations and standards is boosting the growth of the safety instrumented system market. Moreover, the growing industrial automation in the chemicals & petrochemicals industry to increase the efficiency and safety of employees is further creating opportunities for the growth of the safety instrumented system market. The growing awareness of safety across different industries further accelerates the safety instrumented system market expansion.

Market Overview:

A safety instrumented system (SIS) is used in many process plants as it helps to take automated action to keep a plant in a safe state when abnormal conditions arise. In case of any disturbance that can result in an unfortunate incident, the SIS will automatically bring the process to a safe state and help prevent loss of life, asset damage, and environmental damage. Several catastrophic events can occur at different operational sites in oil & gas, chemical, and other industries that deal with heavy machinery and chemicals. These can range from fires to leaks that could lead to explosions, and the need for high-end safety systems such as SIS is rising worldwide.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Safety Instrumented System Market: Strategic Insights

Market Size Value in US$ 4.23 billion in 2022 Market Size Value by US$ 7.14 billion by 2030 Growth rate CAGR of 6.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Safety Instrumented System Market: Strategic Insights

| Market Size Value in | US$ 4.23 billion in 2022 |

| Market Size Value by | US$ 7.14 billion by 2030 |

| Growth rate | CAGR of 6.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Rising Expansion of Oil & Gas Industry Drive Safety Instrumented System Market Growth

The US is one of the largest natural gas producers in the world. According to the US Energy Information Administration (EIA), the country produced ~34,517,798 million cubic feet (MMcf) of natural gas and consumed 30,664,951 MMcf of natural gas in 2021. The country also exported 3,560,818 MMcf of liquefied natural gas (LNG). Various new oil and gas construction projects are also in progress worldwide. In Q2 2022, the construction work of the Centre of Excellence for Carbon Capture & Removal project started in Burnaby, British Columbia, Canada. It involved the construction of a CCS plant, which helps in capturing and storing up to 2,000 metric ton of CO2 per day. Similarly, the construction of the Vista Pacifico Liquified Natural Gas Plant project commenced in Q2 2022, with an investment of US$ 2,000 million. Under this project, an LNG export terminal will be constructed on 150 hectares in the Municipality of Ahome, Topolobampo, Sinaloa, Mexico. Thus, such oil and gas construction projects will propel the demand for safety instrumented systems.

Furthermore, According to the Statistics of the Swedish Mining Industry 2021 report, Swedish ore production reached 88.6 million metric ton in 2021, a rise of 22% since 2015. Also, as per the Australian Bureau of Statistics, mining production in Australia increased by 5.7% in the first quarter of 2023. Thus, the growing mining production worldwide is expected to surge the demand for security and monitoring to ensure the safety of employees, equipment, or materials. This increasing need for safety instrumented systems further boosts the growth of the safety instrumented system market.

Report Segmentation and Scope:

The safety instrumented system market is segmented on the basis of application, end user, and geography. Based on application, the safety instrumented system market is divided into emergency shutdown systems, fire and gas monitoring and control, high integrity pressure protection systems, burner management systems, and turbo machinery control. By end user, the safety instrumented system market is categorized into chemicals & petrochemicals, oil & gas, power generation, pharmaceutical, food & beverages, and others. Geographically, the safety instrumented system market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Segmental Analysis:

Based on application, the safety instrumented system market is divided into emergency shutdown systems, fire and gas monitoring and control, high integrity pressure protection systems, burner management systems, and turbo machinery control. The emergency shutdown systems segment held the largest safety instrumented system market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. The Emergency Shutdown (ESD) Systems are highly reliable control systems for high-risk industries such as oil & gas and nuclear power with explosion risk. The system helps in protecting personnel, plant, and the environment in case the process goes beyond the control margins.

Regional Analysis:

Asia Pacific held the largest safety instrumented system market share in 2022. The region is witnessing tremendous growth in the chemicals & pharmaceuticals industry. The market players in this region are continuously working on expanding their manufacturing facilities. For instance, in December 2022, Balaxi Pharmaceuticals announced that they had initiated the construction of a new drug manufacturing facility in Telangana, India. The company invested approximately US$ 10.29 million (INR 85 crore) in this project. The new production facility will help the company enter the European markets and enhance margins in current markets. Similarly, in September 2021, Hanwha Corp. announced its plan to build a nitric acid production plant by 2024. This plant will provide an annual capacity of 400,000 metric ton in Yeosu Industrial Complex, South Korea. For this, the company will be investing US$ 162 million (190 billion won).

Thus, the increasing number of new production facilities in the region will raise the demand for safety instrumented systems, as it helps prevent any accidents at the plant, propelling the safety instrumented system market growth.

Key Player Analysis:

ABB Ltd, Applied Control Engineering Inc, AVEVA Group plc, Emerson Electric Co, HIMA, Honeywell International, Rockwell Automation Inc, Schneider Electric, Siemens AG, and Yokogawa Electric Corporation are the key safety instrumented system market players profiled in the report.

Safety Instrumented System Market Report Scope

Recent Developments:

The safety instrumented system market players highly adopt inorganic and organic strategies. A few recent key market developments are listed below:

- In May 2022, Emerson introduced the TopWorxTM DX PST with HART 7. Units provide valuable valve data and diagnostic information, enabling the digital transformation of process applications. The new DX PST integrates seamlessly with existing valves and control systems, giving operators access to critical valve data, trends, and diagnostics that can be used to predict and schedule maintenance. Capable of Safety Integrity Level 3 (SIL 3), the DX PST is available with an integrated 2oo2 or 2oo3 solenoid valve redundancy when paired with ASCOTM Series Advanced Redundant Control System (ARCS) to further enhance safety and open terminals that allow an additional pressure transmitter along with two pressure switches.

- In March 2022, INTECH was awarded a contract to provide a high-integrity pressure protection system (HIPPS) for protecting infield oil gathering infrastructure at a major oil field in the Middle East. Under this contract, Middle Eastern oilfield companies sought INTECH’s expertise for manufacturing and installing IOPPS packages downstream of the manifolds for protecting trunklines and degassing stations from potential overpressure.

- In November 2020, ABB launched ABB Ability Safety Plus for hoists, a suite of mine hoist safety products that brings the highest level of personnel and equipment safety available to the mining industry. The products include safety plus hoist monitor (SPHM), safety plus hoist protector (SPHP), and safety plus brake system (SPBS), including safety brake hydraulics (SBH).

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US held the largest safety instrumented system market share in 2022.

The incremental growth expected to be recorded for the safety instrumented system market during the forecast period is US$ 2.90 billion.

Rising expansion in oil & gas industry and growing adoption of safety regulations and standards are the major factors that propel the safety instrumented system market.

The key players holding majority shares in the safety instrumented system market are Rockwell Automation Inc, Honeywell International, Emerson Electric Co, Yokogawa Electric Corporation, and ABB Ltd.

Asia Pacific is anticipated to grow with the highest CAGR over the forecast period.

The Safety instrumented system market is expected to reach US$ 7.14 billion by 2030.

Growing awareness of safety across different industries is anticipated to play a significant role in the safety instrumented system market in the coming years.

The safety instrumented system market was estimated to be US$ 4.23 billion in 2022 and is expected to grow at a CAGR of 6.7 % during the forecast period 2023 - 2030.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Safety Instrumented System Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Safety Instrumented System Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Safety Instrumented System Market - Global Market Analysis

6.1 Safety Instrumented System - Global Market Overview

6.2 Safety Instrumented System - Global Market and Forecast to 2030

7. Safety Instrumented System Market – Revenue Analysis (USD Million) – By Application, 2020-2030

7.1 Overview

7.2 Emergency Shutdown Systems

7.3 Fire and Gas Monitoring and Control

7.4 High Integrity Pressure Protection Systems

7.5 Burner Management Systems

7.6 Turbo Machinery Control

8. Safety Instrumented System Market – Revenue Analysis (USD Million) – By End-user, 2020-2030

8.1 Overview

8.2 Chemicals and Petrochemicals

8.3 Power Generation

8.4 Pharmaceutical

8.5 Food and Beverage

8.6 Oil and Gas

8.7 Others

9. Safety Instrumented System Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

9.1 North America

9.1.1 North America Safety Instrumented System Market Overview

9.1.2 North America Safety Instrumented System Market Revenue and Forecasts to 2030

9.1.3 North America Safety Instrumented System Market Revenue and Forecasts and Analysis - By Application

9.1.4 North America Safety Instrumented System Market Revenue and Forecasts and Analysis - By End-user

9.1.5 North America Safety Instrumented System Market Revenue and Forecasts and Analysis - By Countries

9.1.5.1 United States Safety Instrumented System Market

9.1.5.1.1 United States Safety Instrumented System Market, by Application

9.1.5.1.2 United States Safety Instrumented System Market, by End-user

9.1.5.2 Canada Safety Instrumented System Market

9.1.5.2.1 Canada Safety Instrumented System Market, by Application

9.1.5.2.2 Canada Safety Instrumented System Market, by End-user

9.1.5.3 Mexico Safety Instrumented System Market

9.1.5.3.1 Mexico Safety Instrumented System Market, by Application

9.1.5.3.2 Mexico Safety Instrumented System Market, by End-user

Note - Similar analysis would be provided for below mentioned regions/countries

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.5 Russia

9.2.6 Rest of Europe

9.3 Asia-Pacific

9.3.1 Australia

9.3.2 China

9.3.3 India

9.3.4 Japan

9.3.5 South Korea

9.3.6 Rest of Asia-Pacific

9.4 Middle East and Africa

9.4.1 South Africa

9.4.2 Saudi Arabia

9.4.3 U.A.E

9.4.4 Rest of Middle East and Africa

9.5 South and Central America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South and Central America

10. Pre and Post Covid-19 Impact

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. Safety Instrumented System Market - Key Company Profiles

13.1 ABB Ltd

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 Applied Control Engineering, Inc.

13.3 AVEVA Group plc

13.4 Emerson Electric Co.

13.5 HIMA

13.6 Honeywell International

13.7 Rockwell Automation, Inc.

13.8 Schneider Electric

13.9 Siemens AG

13.10 Yokogawa Electric Corporation

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - Safety Instrumented System Market

- ABB Ltd

- Applied Control Engineering Inc

- AVEVA Group plc

- Emerson Electric Co

- HIMA, Honeywell International

- Rockwell Automation Inc

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Safety Instrumented System Market

Dec 2023

Remote Access Solution Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Secure Remote Access-VPN, Identity and Access Management (IAM) Solutions, Multi-Factor Authentication, Single Sign-On (SSO), Endpoint Security, and Others], Mode of Deployment (Cloud and On-Premise), End-Use Industry (IT and Telecommunications, BFSI, Healthcare, Government, Manufacturing, and Others), and Geography

Dec 2023

Hall Effect Teslameter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Analog Hall Effect Teslameters and Digital Hall Effect Teslameters), End Users (Automotive, Industrial, Healthcare, Aerospace, Laboratory, and Others), and Geography

Dec 2023

Automotive Board to Board Connector Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pin Headers, Sockets, Floating Connector, and Card Edge Connector), Pin Headers (Stacked Headers and Shrouded Headers), Application (Powertrain Control Systems, Infotainment and Navigation Systems, Advanced Driver Assistance Systems (ADAS), Electric Vehicles (EV) and Hybrid Vehicle Systems, Lighting Control Systems, Autonomous Vehicles, and Others), Pitch (Less Than 1 mm, 1–2 mm, and More Than 2 mm), Number of Pin (2–12 Pin, 13–30 Pin, 31–50 Pin, 51–100 Pin, and 100+ Pin), and Geography

Dec 2023

Radiation Hardened Motor Controller and Motor Drive Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Motor Controller and Motor Drive), Motor Drive (AC Drive, DC Drive, and BLDC), Application (Space Exploration, Military and Defense, Nuclear Power Plants, and Others), and Geography

Dec 2023

Pluggable Optics for Data Center Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Switches, Routers, and Servers), Data Rate (100–400 Gb/s, 400–800 Gb/s, and 800 Gb/s and above), and Geography

Dec 2023

Doors and Windows Automation Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pedestrian Doors, Industrial Doors, and Windows), Component (Sensors and Detectors, Access Control Systems, Control Panels, Motors and Actuators, and Others), Industry Vertical (Commercial, Industrial, and Residential), Control System (Fully Automatic, Semi-Automatic, and Power Assist), and Geography

Dec 2023

Substrate-Like PCB Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Line/Space (25/25 and 30/30 µm and Less than 25/25 µm), Fabrication Process (MSAP and UV LDI), Application (Consumer Electronics, Automotive, Industrial, Medical, and Others), and Geography

Dec 2023

LED Flashlight Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rechargeable LED Flashlight and Non-Rechargeable LED Flashlight), Product (Everyday Carry Flashlights, Tactical Flashlights, and Safety Flashlights), Application (Residential, Commercial, and Military and Law Enforcement), and Geography

Get Free Sample For

Get Free Sample For