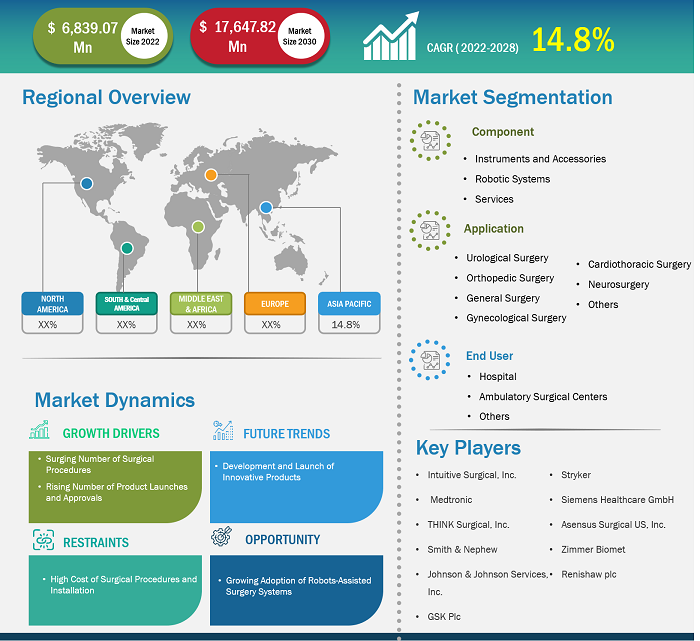

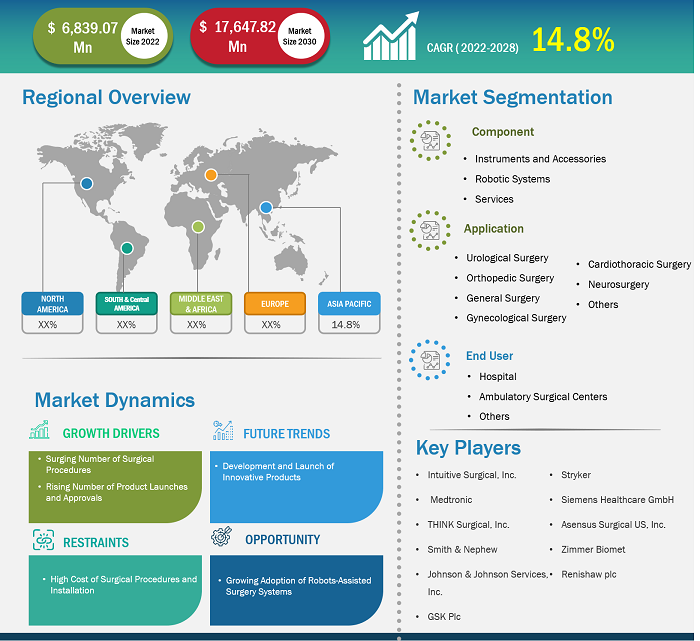

[Research Report] The surgical robots market size is projected to grow from the market is expected to reach US$ 17,647.82 million by 2028 from US$ 6,839.07 million in 2021. It is expected to grow at a CAGR of 14.8% during 2022–2028.

Market Insights and Analyst View:

Surgical robots are used in minimally invasive surgery, as they help manipulate surgical instruments in a small operation space. These are micromanipulators for minimally invasive neurosurgery. Surgical robots can be used in many surgeries, such as urological surgery, laparoscopic cholecystectomy, gall bladder excisions, etc. The scope of the surgical robots market includes components, applications, end users, and geography. The market for surgical robots is analyzed based on major countries such as North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South & Central America (SCAM).

Key driving factors such as the surging number of surgical procedures and new product launches and approvals define market growth. For Instance, in February 2023, Asensus Surgical uncovered its next-generation surgical robot platform, Luna. It is a next-generation surgical platform, instruments, and real-time intraoperative clinical intelligence. Its final component, a protected cloud platform, utilizes machine learning to deliver clinical insights. Luna enables Asensus’ vision of performance-guided surgery. Cutting-edge technology has released new realms of business with expanded therapeutics by tapping growth markets with great potential for the coming years.

However, the high cost of procedures and installation will likely hinder the market's growth during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Surgical Robots Market: Strategic Insights

Market Size Value in US$ 6,839.07 million in 2021 Market Size Value by US$ 17,647.82 million by 2028 Growth rate CAGR of 14.8% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Surgical Robots Market: Strategic Insights

| Market Size Value in | US$ 6,839.07 million in 2021 |

| Market Size Value by | US$ 17,647.82 million by 2028 |

| Growth rate | CAGR of 14.8% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Growth Drivers:

Surging Number of Surgical Procedures Propels Surgical Robots Market Growth

There is a rise in the number of surgeries performed across the world. In the last few years, lung cancer incidence has increased, leading to further treatment. For Instance, in the US, lung cancer is the second most common cancer in both men and women. As per the American Cancer Society, Inc., as of 2023, approximately 238,340 adults (117,550 men and 120,790 women) in the US have been diagnosed with lung cancer, and ~127,070 (67,160 in men and 59,910 in women) have succumbed to death due to the disease. Lung Cancer accounts for 1 in 5 of all cancer deaths, making it a leading cause of cancer death in the US. These include both small cell lung cancer and NSCLC. NSCLC is the most common type of lung cancer, account 81% of all lung cancer diagnoses. For all types of lung cancer in the US, the 5-year relative survival rate is 23%, and for NSCLC, the 5-year relative survival rate for men and women is 23% and 33%, respectively. In the US, screening for lung cancer is recommended with a test called a spiral computed tomography (CT or CAT) scan. Preventive Services Task Force (USPSTF) states that people aged 50–80 and with a history of smoking 20 pack years or more should undergo lung cancer screening with LDCT scans each year. Furthermore, robotic-assisted surgery for lung cancer offers advantages over open chest surgery, as it requires a shorter hospital stay and faster recovery time. Thus, the increasing number of lung cancer incidences has resulted in the surging demand for surgical robots.

Cancer and diabetes are leading causes of mortality across the world. In 2021, in the Netherlands, as per the Dutch Cancer Registry, approximately 123,672 new cancer cases were registered in that year. Breast cancer surgeries are among the most common procedures in plastic surgery. Furthermore, according to the International Diabetes Federation (IDF), the number of people having diabetes is expected to grow from ~537 million in 2021 to 783 million by 2045.

Moreover, robots are used for bariatric surgery as well. Therefore, many governments are taking initiatives to increase awareness. For Instance, in 2021, the UK government revised the policies to care for obese patients undergoing bariatric surgery. The policies include:

- Equipping the National Health Service (NHS) for the rapidly increasing obese population in England, instructing proper operational policies required for the planning, assessment, and management of the manual handling risks for the treatment of bariatric patients

- Designing buildings and vehicles to accommodate bariatric patients safely, comfortably, and with dignity.

Such government initiatives in the country make people feel comfortable and secure. Thus, with more people opting for this procedure, the bariatric surgery devices market will likely witness notable growth in the coming years.

Several market players are adopting organic strategies to stay competitive in the market. For Instance, in October 2022, Medtronic received a CE mark for the Hugo robotic-assisted surgery (RAS) system in Europe for general surgery procedures. The CE mark for general surgery spans several specialties, including bariatric, hernia, and colorectal. Thus, growing government initiatives to improve awareness of bariatric surgeries are driving the surgical robots market.

Report Segmentation and Scope:

The “Surgical Robots Market” is segmented based on components, applications, and end users. Based on components, the surgical robots market is divided into instruments & accessories, robotic systems, and services. The instruments & accessories segment dominated the market in 2022, and the same segment is expected to grow at its highest during the forecast period. The application segment of the global surgical robots market consists of general surgery, gynecology, urology, orthopedics, interventional cardiology, and neurology, among others. The urological segment acquired the highest market value in 2022. However, gynecological surgery is expected to grow at the highest CAGR from 2022 to 2030. The surgical robot market is divided into hospitals, ambulatory surgical centers, and Others based on the end-user. The hospital market dominated the market in 2022.

Segmental Analysis:

By components, the market is divided into instruments & accessories, robotic systems, and services. The instruments & accessories segment dominated the market in 2022, and the same segment is expected to grow fastest during the forecast period. The major driving factors for the enzyme type segment's growth are the rising approvals, significance in efficacy studies, and easy availability. Additionally, rising healthcare expenditure in developing regions and increasing number of surgical methods are expected to drive market growth over the forthcoming years. Robotic surgical instruments help to enable precision during the surgical procedure. With a variety of modalities, the instruments can be used for a range of procedures. For Instance, Intuitive Surgical recently introduced a low-cost version of the DaVinci Xi in the market. It is positioned between the Si and the Xi models, and the DaVinci X maintains the thinner and more capable arms and instruments of the Xi version but with the moving part of the Si model. Though useful for abdominal surgery, The DaVinci X is also adaptable for other procedures. Da Vinci systems offer surgeons high-definition 3D vision, a magnified view, and robotic assistance. They use specialized instrumentation, including a miniaturized surgical camera and wristed instruments that help with precise dissection and reconstruction inside the body. Therefore, surgical instruments & accessories are increasingly adopted in emerging countries.

The market is segmented based on application into general surgery, gynecology, urology, orthopedics, interventional cardiology, and neurology. The urological segment acquired the highest market value in 2022. However, Gynecological surgery is expected to grow fastest from 2022-2030. This can be due to the increasing incidence rate of gynecological complications among women globally and continuous technological advancement in robotic systems. Technological advancements and demand for minimally invasive surgery further boost the surgical robot market.

The surgical robot market is divided into hospitals, ambulatory surgical centers, and Others based on the end-user. The hospital's segment accounted for the highest market share in 2022. Robots have become a vital element of many hospitals' workforces, performing different specialty surgeries such as using robots during COVID-19 to reduce exposure to pathogens. Hospital robots are transforming surgeries performed earlier and have meager chances of infections, high precision, and fewer complications. These are expected to generate demand and contribute to market growth over the forecast period. Various developed robots, such as The da Vinci Surgical Robot, are currently being implemented in hospitals to improve patient quality of care and their outcomes.

Regional Analysis - Surgical Robots Market:

Based on geography, the global bioanalytical testing services market is segmented into five regions: North America, Europe, Asia Pacific (APAC), South & Central America (SCAM), and the Middle East & Africa (MEA). In 2022, North America accounted for the most significant global surgical robots market share. Asia Pacific is expected to grow faster, with the highest CAGR from 2022–2030.

North America holds the largest share of the surgical robot market. The market in this region is split into the US, Canada, and Mexico. The market growth in the region is growing due to the rising number of surgical procedures associated with colorectal and urological conditions. The US is the most significant contributor to the surgical robots market in North America and the world.

Surgical Robots are frequently used in neonatal care units for the unique needs of tiny babies. As per the article published in Guardian News & Media Limited, in 2021, surgical robots are saving the lives of hundreds of premature babies. Telemedicine robots enable consultants to make bedside video calls used at Liverpool Women’s and Alder Hey Children’s hospitals in the UK to treat sick babies. According to the CDC, preterm birth has increased in the US, i.e., the birth rate increased from 10.1% in 2020 to 10.5% in 2021. In the US, preterm births are a severe health problem and one of the country's leading causes of infant mortality. Due to serious health problems, 17% of all infant deaths are accountable for causing more than US$25 billion per annum.

Furthermore, factors such as increasing maternal age, poor prenatal care, obesity, induced fertility, and others are responsible for the alarming rate. One of the most significant risk factors for preterm birth is maternal age in the US. For Instance, as per the March of Dimes Foundation, during 2010-2020, in the US, preterm birth rates among women 40 and older (14.5%) were highest, followed by women under age 20 (10.4%). Furthermore, the survival of infants becomes critical as thermal supports are provided for survival.

Additionally, the surgical robots market in the US is expected to grow owing to the rising demand for advanced products as they ensure newborns' better delivery during birth. Also, due to rising healthcare expenditure, the FDA has increased the number of newborn care device approvals and provides well-equipped NICU to hospitals and centers. For Instance, in May 2021, Medtronic launched the SonarMed airway monitoring system. The device constantly checks for Endotracheal Tube Obstruction and Position for Neonates and Infants, providing immediate, actionable intelligence for Clinicians.

Surgical Robots Market Report Scope

Industry Developments and Future Opportunities - Surgical Robots Market:

Various initiatives taken by leading players operating in the surgical robots market are listed below:

- In June 2022, Stryker will open the Advanced Global Technology Center in India.

- In February 2022, Smith+Nephew, the global medical technology business, announced the commercial launch of its next-generation handheld Robotics platform, the CORI Surgical System, in Japan.

- In November 2021, Smith+Nephew announced the launch of CORI handheld Robotics, an advanced system for total and partial knee arthroplasties.

- In August 2022, THINK Surgical, Inc., an innovator in orthopedic surgical Robots, agreed to the development and distribution with Curexo, Inc., a South Korean medical Robotics company. THINK and Curexo have a strong relationship based on a historic development collaboration, and Curexo distributes THINK's TSolution One platform in Korea and Vietnam

Competitive Landscape and Key Companies - Surgical Robots Market:

Intuitive Surgical, Inc.; Medtronic; THINK Surgical, Inc.; Smith & Nephew; Johnson & Johnson Services, Inc.; Stryker; Siemens Healthcare GmbH; Asensus Surgical US, Inc.; Zimmer Biomet; Renishaw plc are the prominent surgical robots market companies. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The surgical robots market is expected to be valued at US$ 17,647.82 million in 2028.

Surgical Robots are robotic systems operated by surgeons consisting of miniaturized surgical instruments mounted on robotic arms. These are controlled by the surgeons on a computer console that offers HD and a magnified 3-D view of the surgical site. Surgical robots help in performing discrete complicated surgical procedures with more flexibility, exactness, and control than normal surgical procedures.

The Surgical Robots market majorly consists of the players, such as Intuitive Surgical; Stryker; Zimmer Biomet; Smith+Nephew; Johnson & Johnson Services, Inc.; Siemens Healthineers AR; Renishaw plc; Asensus Surgical, Inc.; THINK Surgical and Medtronic.

Instruments and Accessories has the largest share of the market in the global surgical robots market contributing a market share of US$ 3,584.57 million in 2021.

The Surgical Robots market is anticipated to grow in the forecast period owing to driving factors such as an increase in surgical procedures, the accuracy of the surgical robots, increasing popularity of minimally invasive surgeries, and increasing regulatory approval by the government.

The CAGR value of the surgical robots market during the forecasted period of 2022-2028 is 14.8%.

The surgical robots market is estimated to be valued at US$ 6,839.07 million in 2021.

The Asia Pacific is expected to be the fastest-growing region in the surgical robots market over the forecast period due to growing investments from international players in China and India, increasing disposable income, and lifestyle diseases in these regions will show promising growth in the surgical robots market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Surgical Robots Market– By Component

1.3.2 Global Surgical Robots Market– By Application

1.3.3 Global Surgical Robots Market– By End User

1.3.4 Global Surgical Robots Market – By Geography

2. Global Surgical Robots Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Surgical Robots Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America – PEST Analysis

4.2.2 Europe – PEST Analysis

4.2.3 Asia Pacific – PEST Analysis

4.2.4 South & Central America – PEST Analysis

4.2.5 Middle East & Africa – PEST Analysis

4.3 Expert Opinion

5. Global Surgical Robots Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Surging Number of Surgical Procedures

5.1.2 Rising Number of Product Launches and Approvals

5.2 Market Restraints

5.2.1 High Cost of Surgical Procedures and Installation

5.3 Market Opportunities

5.3.1 Growing Adoption of Robots-Assisted Surgery Systems

5.4 Future Trends

5.4.1 Development and Launch of Innovative Products

5.5 Impact Analysis

6. Global Surgical Robots Market – Global Analysis

6.1 Global Surgical Robots Market Revenue Forecast and Analysis

6.1.1 Global Surgical Robots Market Revenue Forecast and Analysis

6.1.2 Global Surgical Robots Market – Market Potential Analysis, By Region

6.1.3 Company Analysis

6.2 Comparative Company Analysis

6.2.1 Market Share Analysis

6.2.2 Growth Strategy Analysis

6.2.3 Market Positioning of Key Players in Surgical Robots Market

6.2.3.1 Intuitive Surgical.

6.2.3.2 Smith & Nephew

7. Global Surgical Robots Market Revenue and Forecast to 2028 – by Component

7.1 Overview

7.2 Surgical Robots Market, By Product, 2021 & 2028 (%)

7.3 Instruments & Accessories

7.3.1 Overview

7.3.2 Instruments & Accessories: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

7.4 Robotic Systems

7.4.1 Overview

7.4.2 Robotic Systems: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

7.5 Services

7.5.1 Overview

7.5.2 Services: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

8. Global Surgical Robots Market Revenue and Forecasts to 2028 – Application

8.1 Overview

8.2 Global Surgical Robots Market Share by Application - 2021 & 2028 (%)

8.3 Urological Surgery:

8.3.1 Overview

8.3.2 Urological Surgery: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

8.4 Orthopedic Surgery

8.4.1 Overview

8.4.2 Orthopedic Surgery: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

8.5 General Surgery

8.5.1 Overview

8.5.2 General Surgery: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

8.6 Gynecological Surgery

8.6.1 Overview

8.6.2 Gynecological Surgery: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

8.7 Cardiothoracic Surgery

8.7.1 Overview

8.7.2 Cardiothoracic Surgery: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

8.8 Neurosurgery:

8.8.1 Overview

8.8.2 Neurosurgery: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

8.9 Others

8.9.1 Overview

8.9.2 Others: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

9. Global Surgical Robots Market Revenue and Forecasts to 2028 – End User

9.1 Overview

9.2 Global Surgical Robots Market Share by Application - 2021 & 2028 (%)

9.3 Hospitals

9.3.1 Overview

9.3.2 Hospitals: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

9.4 Ambulatory Surgical Centres

9.4.1 Overview

9.4.2 Ambulatory Surgical Centres (ASCs): Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

10. Global Surgical Robots Market Revenue and Forecast to 2028– by Geography

10.1 North America: Global Surgical Robots Market

10.1.1 Overview

10.1.2 North America: Surgical Robots Market- Revenue and Forecast to 2028 (US$ Million)

10.1.3 North America: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.1.4 North America: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.1.5 North America: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.1.6 North America: Surgical Robots Market, by Country, 2021 & 2028 (%)

10.1.6.1 US Surgical Robots Market– Revenue and Forecast to 2028 (US$ Million)

10.1.6.1.1 Overview

10.1.6.1.2 US: Surgical Robots – Revenue and Forecast to 2028 (US$ Million)

10.1.6.1.3 US: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.1.6.1.4 US: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.1.6.1.5 US: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.1.6.2 Canada: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.2.1 Overview

10.1.6.2.2 Canada: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.2.3 Canada: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.1.6.2.4 Canada: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.1.6.2.5 Canada: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.1.6.3 Mexico: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.3.1 Overview

10.1.6.3.2 Mexico: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.3.3 Mexico: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.1.6.3.4 Mexico: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.1.6.3.5 Mexico: Surgical Robots Market, by End-User, 2019–2028 (US$ Million)

10.2 Europe Surgical Robots Market, Revenue and Forecast to 2028

10.2.1 Overview

10.2.2 Europe Surgical Robots Market, Revenue and Forecast to 2028 (US$ Mn)

10.2.3 Europe: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.4 Europe: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.5 Europe: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.2.6 Europe Surgical Robots Market, Revenue and Forecast to 2028, by Country (%)

10.2.6.1 Germany: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.1.1 Germany: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.1.2 Germany: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.6.1.3 Germany: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.6.1.4 Germany: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.2.6.2 UK: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.2.1 UK: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.2.2 UK: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.6.2.3 UK: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.6.2.4 UK: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.2.6.3 France: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.3.1 France: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.3.2 France: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.6.3.3 France: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.6.3.4 France: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.2.6.4 Italy: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.4.1 Italy: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.4.2 Italy: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.6.4.3 Italy: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.6.4.4 Italy: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.2.6.5 Spain: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.5.1 Spain: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.5.2 Spain: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.6.5.3 Spain: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.6.5.4 Spain: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.2.6.6 Rest of Europe: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.6.1 Rest of Europe: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.2.6.6.2 Rest of Europe: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.2.6.6.3 Rest of Europe: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.2.6.6.4 Rest of Europe: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3 Asia Pacific Surgical Robots Market, Revenue and Forecast to 2028

10.3.1 Overview

10.3.2 Asia Pacific: Surgical Robots Market - Revenue and Forecast to 2028 (US$ Million)

10.3.3 Asia Pacific: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.4 Asia Pacific: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.5 Asia Pacific: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3.6 Asia Pacific Surgical Robots Market, Revenue and Forecast to 2028, by Country (%)

10.3.6.1 China: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.1.1 China: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.1.2 China: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.6.1.3 China: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.6.1.4 China: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3.6.2 Japan: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.2.1 Japan: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.2.2 Japan: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.6.2.3 Japan: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.6.2.4 Japan: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3.6.3 India: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.3.1 India: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.3.2 India: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.6.3.3 India: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.6.3.4 India: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3.6.4 South Korea: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.4.1 South Korea: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.4.2 South Korea: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.6.4.3 South Korea: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.6.4.4 South Korea: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3.6.5 Australia: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.5.1 Australia: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.5.2 Australia: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.6.5.3 Australia: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.6.5.4 Australia: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.3.6.6 Rest of Asia Pacific: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.6.1 Rest of Asia Pacific: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.3.6.6.2 Rest of Asia Pacific: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.3.6.6.3 Rest of Asia Pacific: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.3.6.6.4 Rest of Asia Pacific: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.4 South & Central America Surgical Robots Market Revenue and Forecasts to 2028

10.4.1 Overview

10.4.2 South and Central America Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

10.4.3 South and Central America Surgical Robots Market Revenue and Forecasts to 2028, By Component (US$ Million)

10.4.4 South and Central America: Surgical Robots Market Revenue and Forecasts to 2028, By Application (US$ Million)

10.4.5 South and Central America: Surgical Robots Market Revenue and Forecasts to 2028, By End-User (US$ Million)

10.4.6 South and Central America Surgical Robots Market Revenue and Forecasts to 2028, By Country (%)

10.4.6.1 Brazil: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

10.4.6.1.1 Overview

10.4.6.1.2 Brazil: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

10.4.6.1.3 Brazil: Surgical Robots Market Revenue and Forecasts to 2028, By Component (US$ Million)

10.4.6.1.4 Brazil: Surgical Robots Market Revenue and Forecasts To 2028, By Application (US$ Million)

10.4.6.1.5 Brazil: Surgical Robots Market Revenue and Forecasts To 2028, By End User (US$ Million)

10.4.6.2 Argentina Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

10.4.6.2.1 Overview

10.4.6.2.2 Argentina Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

10.4.6.2.3 Argentina: Surgical Robots Market Revenue and Forecasts to 2028, By Component (US$ Million)

10.4.6.2.4 Argentina: Surgical Robots Market Revenue and Forecasts To 2028, By Application (US$ Million)

10.4.6.2.5 Argentina: Surgical Robots Market Revenue and Forecasts To 2028, By End User (US$ Million)

10.4.6.3 Rest of South and Central America: Surgical Robots Market– Revenue and Forecast to 2028 (USD Mn)

10.4.6.3.1 Overview

10.4.6.3.2 Rest of South and Central America: Surgical Robots Market– Revenue and Forecast to 2028 (USD Mn)

10.4.6.3.3 Rest of South & Central America: Surgical Robots Market Revenue and Forecasts to 2028, By Component (US$ Million)

10.4.6.3.4 Rest of South & Central America: Surgical Robots Market Revenue and Forecasts To 2028, By Application (US$ Million)

10.4.6.3.5 Rest of South & Central America: Surgical Robots Market Revenue and Forecasts To 2028, By End-User (US$ Million)

10.5 Middle East & Africa Surgical Robots Market

10.5.1 Overview

10.5.2 Middle East & Africa Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

10.5.3 Middle East & Africa: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.5.4 Middle East & Africa: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.5.5 Middle East & Africa: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.5.6 Middle East & Africa: Surgical Robots Market, by Country, 2021 & 2028 (%)

10.5.6.1 Saudi Arabia: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.1.1 Saudi Arabia: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.1.2 Saudi Arabia: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.5.6.1.3 Saudi Arabia: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.5.6.1.4 Saudi Arabia: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.5.6.2 South Africa: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.2.1 South Africa: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.2.2 South Africa: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.5.6.2.3 South Africa: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.5.6.2.4 South Africa: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.5.6.3 UAE: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.3.1 UAE: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.6.3.2 UAE: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.5.6.3.3 UAE: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.5.6.3.4 UAE: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

10.5.7 Rest of Middle East and Africa: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.7.1.1 Rest of Middle East and Africa: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

10.5.7.1.2 Rest of Middle East & Africa: Surgical Robots Market, by Components, 2019–2028 (US$ Million)

10.5.7.1.3 Rest of Middle East & Africa: Surgical Robots Market, by Application, 2019–2028 (US$ Million)

10.5.7.1.4 Rest of Middle East & Africa: Surgical Robots Market, by End User, 2019–2028 (US$ Million)

11. Impact of COVID-19 Pandemic on Geographic Regions

11.1 North America: Impact Assessment of COVID-19 Pandemic

11.2 Europe: Impact Assessment of COVID-19 Pandemic

11.3 Asia Pacific: Impact Assessment Of COVID-19 Pandemic

11.4 South And Central America: Impact Assessment Of COVID-19 Pandemic

11.5 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

12. Global Surgical Robots Market –Industry Landscape

12.1 Overview

12.2 Growth Strategies Done by the Companies in the Market, (%)

12.3 Organic Developments

12.3.1 Overview

12.4 Inorganic Developments

12.4.1 Overview

13. Company Profiles

13.1 Intuitive Surgical

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Smith+Nephew

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Johnson & Johnson Services, Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Stryker

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Zimmer Biomet

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Medtronic

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Siemens Healthineers AG

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 THINK Surgical

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Asensus Surgical, Inc.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Renishaw plc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Recent Launches/Approvals of Surgical Robots

Table 2. Prices of Surgeries Types Performed in the US and the UK

Table 3. North America Surgical Robots Market, by Components – Revenue and Forecast to 2028 (USD Million)

Table 4. North America Surgical Robots Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 5. North America Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 6. US Surgical Robots Market, by Components – Revenue and Forecast to 2028 (USD Million)

Table 7. US Surgical Robots Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 8. US Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 9. Canada Surgical Robots Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 10. Canada Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 11. Mexico Surgical Robots Market, by Components – Revenue and Forecast to 2028 (USD Million)

Table 12. Mexico Surgical Robots Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 13. Mexico Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 14. Europe Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 15. Europe Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 16. Europe Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 17. Germany Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 18. Germany Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 19. Germany Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 20. UK Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 21. UK Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 22. UK Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 23. France Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 24. France Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 25. France Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 26. Italy: Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 27. Italy Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 28. Italy Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 29. Spain Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 30. Spain Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 31. Spain Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 32. Rest of Europe Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 33. Rest of Europe Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 34. Rest of Europe Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 35. Asia Pacific Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 36. Asia Pacific Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 37. Asia Pacific Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 38. China Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 39. China Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 40. China Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 41. Japan Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 42. Japan Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 43. Japan Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 44. India Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 45. India Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 46. India Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 47. South Korea Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 48. South Korea Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 49. South Korea Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 50. Australia Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 51. Australia Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 52. Australia Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 53. Rest of Asia Pacific Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 54. Rest of Asia Pacific Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 55. Rest of Asia Pacific Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 56. South and Central America Surgical Robots Market Revenue and Forecasts to 2028, By component (US$ Million)

Table 57. South and Central America: Surgical Robots Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 58. South and Central America Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 59. Brazil Surgical Robots Market, by Components – Revenue and Forecast to 2028 (USD Million)

Table 60. Brazil Surgical Robots Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 61. Brazil Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 62. Argentina Surgical Robots Market, by Components – Revenue and Forecast to 2028 (USD Million)

Table 63. Argentina: Surgical Robots Market Revenue and Forecasts to 2028, By Application (US$ Million)

Table 64. Argentina Surgical Robots Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 65. Rest of South & Central America: Surgical Robots Market Revenue and Forecasts to 2028, By Component (US$ Million)

Table 66. Rest of South & Central America: Surgical Robots Market Revenue and Forecasts to 2028, By Application( US$ Million)

Table 67. Rest of South & Central America: Surgical Robots Market Revenue and Forecasts to 2028, By End-User (US$ Million)

Table 68. Middle East & Africa Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 69. Middle East & Africa Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 70. Middle East & Africa Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 71. Saudi Arabia Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 72. Saudi Arabia Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 73. Saudi Arabia Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 74. South Africa Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 75. South Africa Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 76. South Africa Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 77. UAE Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 78. UAE Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 79. UAE Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 80. Rest of Middle East & Africa Surgical Robots Market, by Components – Revenue and Forecast to 2028 (US$ Million)

Table 81. Rest of Middle East & Africa Surgical Robots Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 82. Rest of Middle East & Africa Surgical Robots Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 83. Organic Developments Done By Companies

Table 84. Inorganic Developments Done by Companies

Table 85. Glossary of Terms, Surgical Robots Market

LIST OF FIGURES

Figure 1. Global Surgical Robots Market Segmentation

Figure 2. Global Surgical Robots Market Segmentation, By Region

Figure 3. Global Surgical Robots Market Overview

Figure 4. Instruments and Accessories Segment Held Largest Share by Product in Surgical Robots market

Figure 5. Asia-Pacific Region Is Expected to Show Remarkable Growth During the Forecast Period

Figure 6. Global Surgical Robots Market, By Geography (US$ Million)

Figure 7. Global Surgical Robots Market - Leading Country Markets (US$ Million)

Figure 8. Global Surgical Robots Market, Industry Landscape

Figure 9. North America: PEST Analysis

Figure 10. Europe: PEST Analysis

Figure 11. Asia Pacific: PEST Analysis

Figure 12. South & Central America: PEST Analysis

Figure 13. Middle East & Africa: PEST Analysis

Figure 14. Global Surgical Robots Market Impact Analysis of Drivers and Restraints

Figure 15. Global Surgical Robots Market – Revenue Forecast and Analysis – 2020- 2028

Figure 16. Global Surgical Robots Market – Revenue Forecast and Analysis – 2022- 2028

Figure 17. Global Surgical Robots Market – Market Potential Analysis, By Region

Figure 18. Market Share Analysis of Key Players in Surgical Robots Market

Figure 19. Global Surgical Robots Market – Comparative Company Analysis

Figure 20. Global Surgical Robots Market – Growth Strategy Analysis

Figure 21. Surgical Robots Market, by Product, 2021 & 2028 (%)

Figure 22. Instruments & Accessories: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 23. Robotic Systems: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 24. Services: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 25. Global Surgical Robots Market Share by Application - 2021 & 2028 (%)

Figure 26. Urological Surgery: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 27. Orthopedic Surgery: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 28. General Surgery: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 29. Gynecological Surgery: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 30. Cardiothoracic Surgery: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 31. Neurosurgery: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 32. Others: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 33. Global Surgical Robots Market Share by Application - 2021 & 2028 (%)

Figure 34. Hospitals: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 35. Ambulatory Surgical Centres (ASCs) : Surgical Robots Market Revenue and Forecasts To 2028 (US$ Million)

Figure 36. Others: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 37. North America Surgical Robots Market, by Key Country – Revenue (2021) (US$ Million)

Figure 38. North America Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

Figure 39. North America: Surgical Robots Market, by Country, 2021 & 2028 (%)

Figure 40. US: Surgical Robots – Revenue and Forecast to 2028 (US$ Million)

Figure 41. Canada: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 42. Mexico: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 43. Europe Surgical Robots Market, Revenue by Country (2021) (US$ Mn)

Figure 44. Europe Surgical Robots Market Revenue and Forecast to 2028 (US$ Mn)

Figure 45. Europe Surgical Robots Market, Revenue and Forecast to 2028, by Country (%)

Figure 46. Germany: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 47. UK: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 48. France: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 49. Italy: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 50. Spain: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 51. Rest of Europe: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 52. Asia Pacific Surgical Robots Market, Revenue by Country (2021) (US$ Mn)

Figure 53. Asia Pacific Surgical Robots Market Revenue and Forecast to 2028 (USD Million)

Figure 54. Asia Pacific Surgical Robots Market, Revenue and Forecast to 2028, by Country (%)

Figure 55. China: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 56. Japan: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 57. India: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 58. South Korea: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 59. Australia: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 60. Rest of Asia Pacific: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 61. South and Central America: Surgical Robots Market, by Key Country – Revenue (2022) (USD Million)

Figure 62. South and Central America Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 63. South and Central America Surgical Robots Market Revenue and Forecasts to 2028, By Country (%)

Figure 64. Brazil: Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 65. Argentina Surgical Robots Market Revenue and Forecasts to 2028 (US$ Million)

Figure 66. Rest of South and Central America: Surgical Robots Market– Revenue and Forecast to 2028 (USD Mn)

Figure 67. Middle East & Africa Surgical Robots Market Revenue Overview, by Country, 2021 (US$ Million)

Figure 68. Middle East & Africa Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

Figure 69. Saudi Arabia: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 70. South Africa: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 71. UAE: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 72. Rest of Middle East and Africa: Surgical Robots Market – Revenue and Forecast to 2028 (US$ Million)

Figure 73. Impact of COVID-19 Pandemic on North American Country Markets

Figure 74. Impact of COVID-19 Pandemic on European Country Markets

Figure 75. Impact of COVID-19 Pandemic on Asia Pacific Country Markets

Figure 76. Impact of COVID-19 Pandemic on South & Central America Country Markets

Figure 77. Impact of COVID-19 Pandemic in Middle East & Africa Country Markets

Figure 78. Growth Strategies Done by the Companies in the Market, (%)

The List of Companies - Surgical Robots Market

- Intuitive Surgical

- Smith + Nephew

- Johnson & Johnson Services, Inc

- Stryker

- Medtronic

- Siemens Healthineers AG

- Asensus Surgical, Inc

- THINK Surgical

- Renishaw plc.

- Zimmer Biomet

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Surgical Robots Market

Aug 2022

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2022

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Aug 2022

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2022

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Aug 2022

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Aug 2022

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Aug 2022

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Aug 2022

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For