The blood bank market is projected to reach US$ 7,666.69 million by 2028 from US$ 5,396.79 million in 2021; it is estimated to grow at a CAGR of 5.1% from 2021 to 2028.

In blood banks, donors’ blood is collected, typed, grouped, stored, and qualified for transfusion to recipients. A blood bank may be a separate freestanding office or part of a giant laboratory in a hospital. The crucial operations of blood banking include typing the blood for transfusion as well as testing infectious microorganisms or particles. Factors such as the high prevalence of hematologic diseases and the rise in the number of road accidents across the US drive the blood bank market growth. However, failure to comply with regulations hamper the growth of the market.

Market Insights

High Prevalence of Hematologic Diseases Bolsters Blood Bank Market Growth

Hematologic diseases such as blood cell cancers, hematologic rare genetic disorders, anemia, and sickle cell disease, as well as complications from chemotherapy or transfusions, affect millions of Americans. As per the American Society of Hematology, ~900,000 people in the US develop blood clots, and nearly 100,000 deaths occur every year due to hematologic diseases. Also, as per the CDC, about 400 babies are born with hemophilia every year in the US. As per the American National Red Cross, sickle cell disease affects ~90,000–100,000 people in the US, and about 1,000 babies are born with it every year. Sickle cell patients can require blood transfusions throughout their lives, which, in turn, emphasizes the all-time availability of blood to avoid complications.

According to the United States Census Bureau, Population Projections, the Americans aged 65 and older are thereby projected to double from 52 million in 2018 to 95 million by 2060, and it is thus estimated that the total population would rise from 16 % to 23 %. As per American Red Cross, it is estimated that almost 36000 units of red blood cells are required every day, and almost 7,000 units of platelets and approximately 10,000 units of plasma are needed every day in the United States. Also, over 21 million blood components are approximately transfused each year in the United States. Moreover, leukemia, lymphoma, myeloma, and myelodysplastic disorders are highly prevalent cancers in the country. For instance, as per the American Cancer Society, more than 1.8 million people are expected to be diagnosed with cancer in 2020, and most of them will require blood during their chemotherapy treatment. Therefore, the increasing cases of blood disorders in the US propel the demand for blood and blood-related products for various treatments.

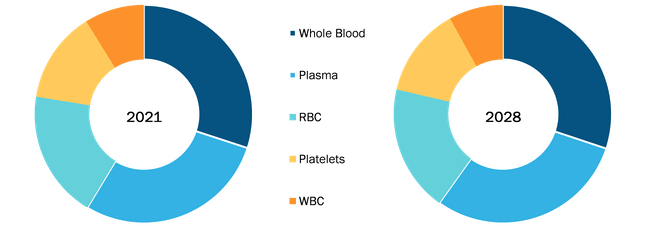

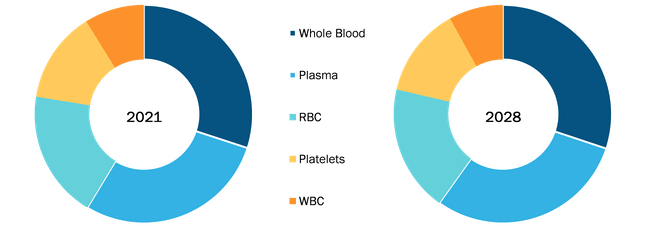

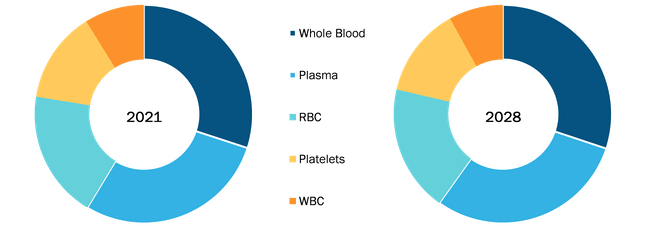

Type-Based Insights

Based on type, the blood bank market is further segmented into whole blood, RBC, platelets, plasma, WBC. The whole blood segment would hold the largest market share in 2021 and is expected to register a higher CAGR during the forecast period.

Blood Bank Market, by Type – 2021 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Function-Based Insights

Based on function, the blood bank market is segmented into the collection, processing, testing, storage, transportation. The testing segment would hold the largest market share of 30.92% in 2021, and it is expected to retain its dominance during the forecast period.

Bank Type-Based Insights

Based on bank type, the blood bank market is segmented into public and private. The public segment would hold the largest market share of 54.26% in 2021, and it is expected to retain its dominance during the forecast period.

End User-Based Insights

Based on end-user, the blood bank market is segmented into hospitals, ambulatory surgery centers, pharmaceutical companies, and others. The hospitals segment would hold the largest market share of 44.74% in 2021 and is expected to retain its dominance during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Blood Bank Market: Strategic Insights

Market Size Value in US$ 5,396.79 million in 2021 Market Size Value by US$ 7,666.69 million by 2028 Growth rate CAGR of 5.1% from 2021 to 2028. Forecast Period 2021-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Blood Bank Market: Strategic Insights

| Market Size Value in | US$ 5,396.79 million in 2021 |

| Market Size Value by | US$ 7,666.69 million by 2028 |

| Growth rate | CAGR of 5.1% from 2021 to 2028. |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Various companies operating in the blood bank market are adopting strategies such as product launches, mergers and acquisitions, collaborations, product innovations, and product portfolio expansions to expand their footprint worldwide, maintain the brand name, and meet the growing demand from end-users.

Blood Bank Market

The blood bank market is segmented on the basis of type, function, bank type, and end-user. Based on type, the market is further segmented into whole blood, RBC, platelets, plasma, WBC. Based on function, the market is further segmented into the collection, processing, testing, storage, transportation. Based on bank type, the blood bank market is further segmented into private and public. Based on end-user, the blood bank market is sub-segmented into hospitals, ambulatory surgery centers, pharmaceutical companies, and others. Geographically, the blood bank market is segmented into the United States. Companies considered in our research scope are Bloodworks Northwest, San Diego Blood Bank, America’s Blood Centers, CSL Plasma, Blood Centers of America, The American National Red Cross, New York Blood Center, Vitalant and Interstate Blood Bank, Inc amongst others.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Function, Bank Type, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Blood Bank Market – By Type

1.3.2 Blood Bank Market – By Function

1.3.3 Blood Bank Market – By Bank Type

1.3.4 Blood Bank Market – By End User

2. Blood Bank Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Blood Bank Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 United States – PEST Analysis

5. United States Blood Bank Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 High Prevalence of Hematologic Diseases

5.1.2 Rise in Road Accidents

5.2 Market Restraints

5.2.1 Non-Compliance with Regulations

5.3 Market Opportunities

5.3.1 Increasing Blood Donation Awareness Programs

5.4 Future Trends

5.4.1 Technological Advancement

5.5 Impact Analysis

6. Blood Bank Market – United States Analysis

6.1 United States Blood Bank Market Revenue Forecast And Analysis

6.2 Market Positioning of Key Players

7. Blood Bank Market– By Type

7.1 Overview

7.2 Blood Bank Market Revenue Share, by Type (2021 and 2028)

7.3 Whole Blood

7.3.1 Overview

7.3.2 Whole Blood: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Plasma

7.4.1 Overview

7.4.2 Plasma: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

7.5 RBC

7.5.1 Overview

7.5.2 RBC: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Platelets

7.6.1 Overview

7.6.2 Platelets: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

7.7 WBC

7.7.1 Overview

7.7.2 WBC: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

8. Blood Bank Market Analysis, by Function

8.1 Overview

8.2 Blood Bank Market Revenue Share, by Function (2021 and 2028)

8.3 Collection

8.3.1 Overview

8.3.2 Collection: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Processing

8.4.1 Overview

8.4.2 Processing: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Testing

8.5.1 Overview

8.5.2 Testing: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Storage

8.6.1 Overview

8.6.2 Storage: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

8.7 Transportation

8.7.1 Overview

8.7.2 Transportation: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

9. Blood Bank Market Analysis, by Bank Type

9.1 Overview

9.2 Blood Bank Market Revenue Share, by Bank Type (2021 and 2028)

9.3 Private

9.3.1 Overview

9.3.2 Private: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Public

9.4.1 Overview

9.4.2 Public: Blood Bank Market– Revenue and Forecast to 2028 (US$ Million)

10. Blood Bank Market Analysis, by End User

10.1 Overview

10.2 Blood Bank Market Revenue Share, by End User (2021 and 2028)

10.3 Hospitals

10.3.1 Overview

10.3.2 Hospitals: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Ambulatory Surgery Centers

10.4.1 Overview

10.4.2 Ambulatory Surgery Centers: Blood Bank Market– Revenue and Forecast to 2028 (US$ Million)

10.5 Pharmaceutical Companies

10.5.1 Overview

10.5.2 Pharmaceutical Companies: Blood Bank Market– Revenue and Forecast to 2028 (US$ Million)

10.6 Others

10.6.1 Overview

10.6.2 Others: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

11. Blood Bank Market – Geographic Analysis

11.1 United States: Blood Bank Market

11.1.1 Overview

11.1.2 United States: Blood Bank Market – Revenue and Forecast to 2028 (USD Million)

11.1.3 United States: Blood Bank Market, by Type, 2019–2028 (USD Million)

11.1.4 United States: Blood Bank Market, by Testing, 2019–2028 (USD Million)

11.1.5 United States: Blood Bank Market, by Bank Type, 2019–2028 (USD Million)

11.1.6 US: Blood Bank Market, by End User, 2019–2028 (USD Million)

12. Impact of COVID-19 Pandemic on United States Blood Bank Market

12.1 United States: Impact Assessment of COVID-19 Pandemic

13. U.S Blood Bank Market–Industry Landscape

13.1 Overview

13.2 Growth Strategies in the U.S Blood Bank Market (%)

13.3 Organic Developments

13.3.1 Overview

13.4 Inorganic Developments

13.4.1 Overview

14. Company Profiles

14.1 Interstate Blood Bank, Inc.

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Vitalant

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 New York Blood Center

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 The American National Red Cross

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Blood Centers of America

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 CSL Plasma

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 America’s Blood Centers

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 San Diego Blood Bank

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Bloodworks Northwest

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

15. Appendix

15.1 Glossary of Terms

LIST OF TABLES

Table 1. United States Blood Bank Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 2. United States Blood Bank Market, by Testing – Revenue and Forecast to 2028 (USD Million)

Table 3. United States Blood Bank Market, by Bank Type – Revenue and Forecast to 2028 (USD Million)

Table 4. US Blood Bank Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 5. Organic Developments in the U.S Blood Bank Market

Table 6. Inorganic Developments in the U.S Blood Bank Market

Table 7. Glossary of Terms, Blood Bank Market

LIST OF FIGURES

Figure 1. Blood Bank Market Segmentation

Figure 2. Blood Bank Market – By Geography

Figure 3. United States Blood Bank Market Overview

Figure 4. Whole Blood Segment Held Largest Share of Blood Bank Market

Figure 5. United States PEST Analysis

Figure 6. Blood Bank Market Impact Analysis of Driver and Restraints

Figure 7. United States Blood Bank Market – Revenue Forecast And Analysis – 2020- 2028

Figure 8. Market Positioning of Key Players

Figure 9. Blood Bank Market Revenue Share, by Type (2021 and 2028)

Figure 10. Whole Blood: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. Plasma: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. RBC: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Platelets: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. WBC: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. Blood Bank Market Revenue Share, by Function (2021 and 2028)

Figure 16. Collection: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Processing: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Testing: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Storage: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Transportation: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Blood Bank Market Revenue Share, by Bank Type (2021 and 2028)

Figure 22. Private: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Public: Blood Bank Market– Revenue and Forecast to 2028 (US$ Million)

Figure 24. Blood Bank Market Revenue Share, by End User (2021 and 2028)

Figure 25. Hospitals: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Ambulatory Surgery Centers: Blood Bank Market– Revenue and Forecast to 2028 (US$ Million)

Figure 27. Pharmaceutical Companies: Market: Blood Bank Market– Revenue and Forecast to 2028 (US$ Million)

Figure 28. Others: Blood Bank Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. United States Blood Bank Market Revenue and Forecast to 2028 (USD Million)

Figure 30. Impact of COVID-19 Pandemic on Blood Bank Market in the United States

Figure 31. Growth Strategies in the U.S Blood Bank Market (%)

The List of Companies - US Blood Bank Market

- Bloodworks Northwest

- San Diego Blood Bank

- America’s Blood Centers

- CSL Plasma

- Blood Centers of America

- The American National Red Cross

- New York Blood Center

- Vitalant

- Interstate Blood Bank, Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to US Blood Bank Market

Dec 2021

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2021

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Dec 2021

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2021

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Dec 2021

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Dec 2021

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Dec 2021

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Dec 2021

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For