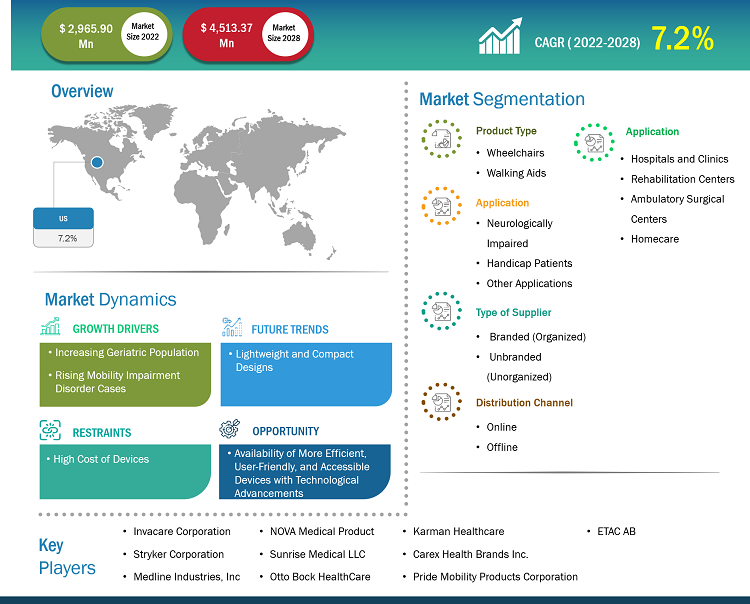

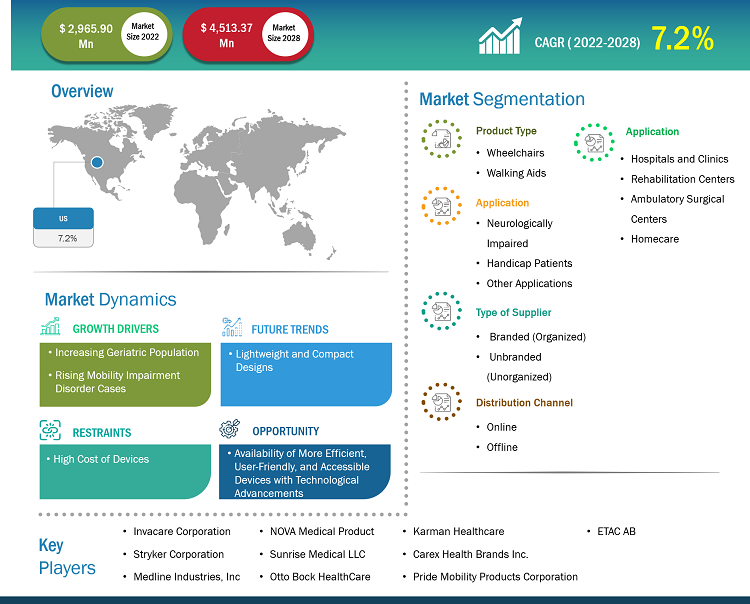

The mobility aids market size was valued at US$ 2,965.90 million in 2022 and is projected to reach US$ 4,513.37 million by 2028. It is estimated to register a CAGR of 7.2% during 2022-2028.

Market Insights and Analyst View:

A mobility assist is a tool that facilitates walking for those with mobility issues; these aids can also be used by people to enhance their mobility. Mobility aids are made to make moving around easier for the elderly and disabled. Additionally, patients who have trouble moving around in their in-home care environments can be transported using these goods. Braces, canes, crutches, and walkers are a few examples of mobility aids. Walking aids include crutches, walkers, and assistive canes, commonly referred to as walking sticks. According to the demands of individual users, these devices can provide improved stability, decreased lower-limb burden, and/or movement generation, which help maintain upright ambulation.

Growth Drivers and Challenges:

The US mobility aids market is continuously progressing at a substantial rate owing to rising mobility impairment disorder cases and increasing geriatric population. Common mobility impairment disorders include arthritis, multiple sclerosis, and Parkinson's disease. In the US, over 90,000 people are diagnosed with Parkinson's disease annually, according to a study funded by the Parkinson's Foundation published in late 2022. This indicates a 50% upsurge from the previously projected rate of 60,000 diagnoses annually. These conditions can cause significant mobility limitations, making it challenging for individuals to move around independently. Mobility aids such as mobility scooters, power wheelchairs, and stairlifts provide individuals with the necessary support and assistance to overcome these limitations. These devices enable individuals with mobility impairments to maintain independence and participate in daily activities. With a soaring number of individuals with mobility impairments, the demand for mobility aids is also on the rise. Sunrise Medical launched the QUICKIE QS5 X wheelchair in July 2023. The company redefines a folding wheelchair through this product, has the lowest weight in its class, along with conferring over 40% energy savings with every fold owing to the highly innovative FreeFold design. QS5 X requires 40% less force than other folding wheelchairs available on the market, and it sets the new standard for the ease and efficiency of folding. Different products offered by companies in the mobility aid market often feature advanced technologies and customizable options to meet the unique needs of each individual. Government initiatives and policies for individuals with mobility impairment disorders also contribute to the growth of the US mobility aids market. Many countries have implemented disability-friendly regulations and accessibility standards that mandate public spaces and transportation to be accessible to individuals with mobility impairments. Thus, the rising prevalence of mobility impairment disorders drives the growth of the US mobility aids market.

The increasing geriatric population benefits the US mobility aids market growth. With age, people become more susceptible to medical conditions limiting their mobility, as a result of which they require medical assistance or aid to avoid dependence on other individuals. The global population is aging rapidly, and the number of older adults is expected to increase significantly in the coming years. According to the 2020 Census, during 1920–2020, the population aged 65 and above in the US surged at a rate nearly five times faster than the overall population growth rate. In 2020, 55.8 million Americans, i.e., 16.8% of the total population, were aged 65 and above.

Older adults often face challenges such as reduced muscle strength, balance issues, and joint problems, making it challenging for them to move around independently. Mobility aids such as walkers, canes, and wheelchairs are designed to provide support and assistance to them. These devices can help prevent falls, reduce the risk of injuries, and enable older adults to remain active and engaged in daily activities. Manufacturers are developing products for older adults, with a greater focus on stability, ease of use, and comfort. Thus, the increasing geriatric population is a significant driver for the growth of the US mobility aids market.

According to Forbes Health, the Pride Go Chair, a basic, portable power wheelchair, costs US$ 2,000 as of August 2023, while the Quickie Q500 M Power Wheelchair, a fully adjustable and highly maneuverable variant, costs nearly US$ 6,000. This research also estimates that the price of fully tailored electric wheelchairs can range from US$ 12,000 to US$ 50,000. Moreover, this type of wheelchair is uncommon for any funding source, including Medicare or private health insurance, to come close to paying the entire retail cost. Several factors contributing to the elevated prices of mobility aids include extensive R&D involved, sophisticated electronics incorporated, and stringent safety and quality standards compliance needs. Creating advanced mobility aids with cutting-edge features and technologies can be expensive due to the involvement of elaborate R&D operations. These devices often incorporate sophisticated electronics, durable materials, and specialized manufacturing processes. Additionally, the stringent safety and quality standards imposed on medical and mobility devices, and limited competition among manufacturers in some market segments can heighten the costs. Thus, the high cost of mobility aid devices, hindering accessibility and affordability for many individuals in need, limits the US mobility aids market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Mobility Aids Market: Strategic Insights

Market Size Value in US$ 2,965.90 million in 2022 Market Size Value by US$ 4,513.37 million by 2028 Growth rate CAGR of 7.2% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Mobility Aids Market: Strategic Insights

| Market Size Value in | US$ 2,965.90 million in 2022 |

| Market Size Value by | US$ 4,513.37 million by 2028 |

| Growth rate | CAGR of 7.2% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

By product type, US mobility devices market is segmented into wheelchairs and walking aids. On the basis of application, the US mobility aids market is classified into neurologically impaired, handicap patients, and other applications. The US mobility aids market, by type of supplier, is segmented into branded and unbranded. On the basis of end user, the market is segmented into homecare, hospitals and clinics, rehabilitation centers, and ambulatory surgical centers. In 2022, the homecare segment held the largest share of the market. Based on distribution channel, the US mobility aids market is bifurcated into online and offline.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

Based on product type, the US mobility aids market is segmented into wheelchairs and walking aids. The wheelchairs segment is further segregated into powered, unpowered, and smart. The walking aids segment is also further classified into walkers, crutches, rollators, walking sticks, and canes. Growth of the US mobility aids market for the wheelchair segment is ascribed to a rise in accidental and innate mobility deformities, a growing geriatric population, patients’ preference for independent mobility in indoor and outdoor settings, and a high prevalence of Alzheimer's disease and Parkinson's disease. Additionally, the growing availability and accessibility of wheelchairs in middle and low-income countries, and advanced features such as lockable wheels, oxygen tank holders, hemiplegic handles, friction brakes, light frame, larger wheel diameter, and expanded weight-bearing capacity benefit the market for this segment.

US Mobility Aids Market by Product Type – 2022 and 2028

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

The US mobility aids market, by application, is segmented into neurologically impaired, handicap patients, and other applications. In 2022, the neurologically impaired segment held the largest share of the market, and it is further expected to record the highest CAGR during 2022–2030. Neurologically impaired individuals include people suffering from Parkinson's disease, multiple sclerosis, etc., who may experience difficulties moving around. Neurological impairment is a consistent process hampering intellectual function, mobility, communications, and multiple other specific medical issues. It can be mild with reduced muscle tone and coordination, or severe enough to disrupt a person's ability to stand or walk. Mobility aids help these individuals maintain their independence and improve their quality of life. In addition to overcoming physical limitations, these aids can help them enhance their safety while making movements. Mobility aids used by neurologically impaired patients include wheelchairs, walkers, canes, and scooters.

The US mobility aids market, by type of supplier, is segmented into branded and unbranded. In 2022, the branded segment held a larger share of the market, and it is further estimated record a higher CAGR during the 2022-2028. The branded segment includes products offered by leading players who have global presence. It also includes products offered by companies that are exported to other countries. The branded segment focuses on products manufactured and sold under specific brand names by recognized suppliers. These suppliers offer products of established brands (manufacturers) that have been operating in the market for a significant period of time; they build a reputation for providing reliable, and high-quality products and services. Creating such goodwill helps these companies generate more significant sales opportunities and profitable relationships.

The US mobility aids market, by end user, is segmented into homecare, hospitals and clinics, rehabilitation centers, and ambulatory surgical centers. In 2022, the homecare segment held the largest share of the market. Hospitals provide healthcare facilities with specialized scientific equipment. Teams of trained and highly skilled staff members are assigned to resolve the problems associated with modern medical sciences in hospitals. Hospitals offer advanced treatment choices for patients to treat chronic and hard-to-heal wounds. Most surgeries are performed in hospitals due to their continuous patient care and monitoring services. The hospitals and clinics segment plays a crucial role in the mobility aid market. Hospitals are the sources of patients requiring mobility aids for post-surgery recovery, injury rehabilitation, and managing chronic health conditions. With their advanced infrastructure and specialized departments, hospitals are well-equipped to provide comprehensive care, including the provision of mobility aids. Additionally, the availability of advanced equipment in hospitals, such as remote-controlled wheelchairs and innovative gadgets, having the ability to increase the quality of patient care is another reason for patients’ preference to take treatments at hospitals.

Based on distribution channel, the US mobility aids market is divided into online and offline. The offline segment is further segregated into hospitals, pharmacies, and retail. In recent years, there has been an extensive surge in e-commerce and online platforms. Online stores offer better pricing than offline stores, along with better access, lower transaction and product costs, greater convenience, and consumer anonymity. They offer individuals with limited mobility and people in remote areas with better access to mobility aid products. The mobility aids market for the online segment is anticipated to experience significant growth during the forecast period. Leading e-commerce platforms such as Amazon offer a diverse range of mobility aids. Mobility aids manufacturers also have their own online sales sites or e-commerce channels, via which they sell their goods. Invacare and Sunrise Medicals are among other businesses offering a variety of options for assistive medical aid devices online, including manual & motorized wheelchairs and mobility scooters.

Competitive Landscape and Key Companies:

Invacare Corporation, Stryker Corporation, Medline Industries, Inc, NOVA Medical Product, Sunrise Medical LLC, Otto Bock HealthCare, Karman Healthcare, Carex Health Brands Inc., Pride Mobility Products Corporation, and ETAC AB are a few of the prominent players operating in the mobility aids market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their widescale presence allows them to serve a large base of customers, subsequently allowing them to expand their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, Type of Supplier, End User, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US mobility aids market majorly consists of the players such as Invacare Corporation, Stryker Corporation, Medline Industries, Inc, NOVA Medical Product, Sunrise Medical LLC, Otto Bock HealthCare, Karman Healthcare, Carex Health Brands Inc., Pride Mobility Products Corporation, and ETAC AB.

The factors driving the market include increasing geriatric population, and rising mobility impairment disorder cases, However, high cost of devices hinder the market growth.

A mobility assist is a tool that facilitates walking for those with mobility issues or otherwise enhances their mobility. Devices called mobility aids are made to make moving around easier for the elderly and disabled. Additionally, patients who have trouble moving around in their in-home care environments can be transported using these goods. Braces, canes, crutches, and walkers are a few examples of mobility aids. Walking aids include crutches, walkers, and assistive canes, commonly referred to as walking sticks. According to the demands of the individual user, these devices can provide any or all of the following: improved stability, decreased lower-limb burden, and movement generation, helping to maintain upright ambulation.

The US mobility devices market, by product type, is segmented into wheelchairs and walking aids. In 2022, the wheelchairs segment held a larger share of the market and is expected to grow at the fastest rate during the coming years. The mobility aids market, by application, is segmented into neurologically impaired, handicap patients, and other applications. The mobility aids market, by type of supplier, is segmented into branded and unbranded. Based on end users, US mobility market is segmented into homecare, hospitals and clinics, rehabilitation centers, and ambulatory surgical centers.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Mobility Aids Market - Key Industry Dynamics

4.1 Market Drivers

4.1.1 Increasing Geriatric Population

4.1.2 Rising Mobility Impairment Disorder Cases

4.2 Market Restraints

4.2.1 High Cost of Devices

4.3 Market Opportunities

4.3.1 Availability of More Efficient, User-Friendly, and Accessible Devices with Technological Advancements

4.4 Future Trends

4.4.1 Lightweight and Compact Designs

4.5 Impact Analysis:

5. Mobility Aids Market - Market Analysis

5.1 Mobility Aids Market Revenue (US$ Mn), 2022 – 2028

6. Mobility Aids Market – Revenue and Forecast to 2028 – by Product Type

6.1 Overview

6.2 Mobility Aids Market Revenue Share, by Product Type, 2022 & 2028 (%)

6.3 Wheelchairs

6.3.1 Overview

6.3.2 Wheelchairs: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

6.3.2.1 Mobility Aids Market, by Wheelchairs, 2020–2028 (US$ Million)

6.3.2.2 Mobility Aids Market, by Wheelchairs, 2020–2028 (Unit)

6.4 Walking Aids

6.4.1 Overview

6.4.2 Walking Aids: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

6.4.2.1 Mobility Aids Market, by Walking Aids, 2020–2028 (US$ Million)

6.4.2.2 Mobility Aids Market, by Walking Aids, 2020–2028 (Unit)

7. Mobility Aids Market – Revenue and Forecast to 2028 – by Application.

7.1 Overview

7.2 Mobility Aids Market Revenue Share, by Application 2022 & 2028 (%)

7.3 Neurologically Impaired

7.3.1 Overview

7.3.2 Neurologically Impaired: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Handicap Patients

7.4.1 Overview

7.4.2 Handicap Patients: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Other Applications

7.5.1 Overview

7.5.2 Other Applications: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

8. Mobility Aids Market – Revenue and Forecast to 2028 – by Type of Supplier

8.1 Overview

8.2 Mobility Aids Market Revenue Share, by Type of Supplier, 2022 & 2028 (%)

8.3 Branded

8.3.1 Overview

8.3.2 Branded: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

8.3.2.1 Mobility Aids Market, by Branded, 2020–2028 (US$ Million)

8.4 Unbranded

8.4.1 Overview

8.4.2 Unbranded: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

8.4.2.1 Mobility Aids Market, by Unbranded, 2020–2028 (US$ Million)

9. Mobility Aids Market – Revenue and Forecast to 2028 – by End Users

9.1 Overview

9.2 Mobility Aids Market Revenue Share, by End Users, 2022 & 2028 (%)

9.3 Hospitals and Clinics

9.3.1 Overview

9.3.2 Hospitals and Clinics: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Rehabilitation Centres

9.4.1 Overview

9.4.2 Rehabilitation Centres: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Ambulatory Surgical Centers

9.5.1 Overview

9.5.2 Ambulatory Surgical Centers: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Homecare

9.6.1 Overview

9.6.2 Homecare: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

10. Mobility Aids Market – Revenue and Forecast to 2028 – by Distribution Channel

10.1 Overview

10.2 Mobility Aids Market Revenue Share, by Distribution Channel, 2022 & 2028 (%)

10.3 Online

10.3.1 Overview

10.3.2 Online: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Offline

10.4.1 Overview

10.4.2 Offline: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

10.4.2.1 Mobility Aids Market, by Offline, 2020–2028 (US$ Million)

11. Company Profiles

11.1 Medline Industries LP

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Sunrise Medical LLC

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Ottobock SE & Co KGaA

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Karman Healthcare Inc

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Carex Health Brands Inc

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Stryker Corp

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Invacare Corp

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 NOVA Ortho-Med Inc

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Pride Mobility Products Corp

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 Etac AB

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

LIST OF TABLES

Table 1. Mobility Aids Market Segmentation

Table 2. Mobility Aids Market, by Wheelchairs – Revenue and Forecast to 2028 (US$ Million)

Table 3. Mobility Aids Market, by Wheelchairs – Revenue and Forecast to 2028 (Unit)

Table 4. Mobility Aids Market, by Walking Aids – Revenue and Forecast to 2028 (US$ Million)

Table 5. Mobility Aids Market, by Walking Aids – Revenue and Forecast to 2028 (Unit)

Table 6. Mobility Aids Market, by Branded – Revenue and Forecast to 2028 (US$ Million)

Table 7. Mobility Aids Market, by Unbranded – Revenue and Forecast to 2028 (US$ Million)

Table 8. Mobility Aids Market, by Offline – Revenue and Forecast to 2028 (US$ Million)

LIST OF FIGURES

Figure 1. Mobility Aids Market Segmentation, By Geography

Figure 2. Mobility Aids Market - Key Industry Dynamics

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Mobility Aids Market Revenue (US$ Mn), 2022 – 2028

Figure 5. Mobility Aids Market Revenue, Geography (US$ Mn), 2022 – 2028

Figure 6. Mobility Aids Market Revenue Share, by Product Type, 2022 & 2028 (%)

Figure 7. Wheelchairs: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 8. Walking Aids: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 9. Mobility Aids Market Revenue Share, by Application 2022 & 2028 (%)

Figure 10. Neurologically Impaired: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. Handicap Patients: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. Other Applications: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Mobility Aids Market Revenue Share, by Type of Supplier, 2022 & 2028 (%)

Figure 14. Branded: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. Unbranded: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Mobility Aids Market Revenue Share, by End Users, 2022 & 2028 (%)

Figure 17. Hospitals and Clinics: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Rehabilitation Centers: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Ambulatory Surgical Centers: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Homecare: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Mobility Aids Market Revenue Share, by Distribution Channel, 2022 & 2028 (%)

Figure 22. Online: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Offline: Mobility Aids Market – Revenue and Forecast to 2028 (US$ Million)

The List of Companies - US Orthotic Aids Market

- Invacare Corporation

- Stryker Corporation

- Medline Industries, Inc

- NOVA Medical Product

- Sunrise Medical LLC

- Otto Bock HealthCare

- Karman Healthcare

- Carex Health Brands Inc.

- Pride Mobility Products Corporation

- ETAC AB

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to US Mobility Aids Market

Oct 2023

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Oct 2023

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Oct 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Oct 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Oct 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Oct 2023

Ovo-Sexing Technology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technique (Non-Invasive Imaging, Genetic Editing, Volatile Analysis, Sex Reversal, and Liquid-Based Analysis), End User (Hatcheries and Poultry Farms), and Geography (US, Germany, France, Italy, Spain, Rest of Europe, Israel, and ROW)

Get Free Sample For

Get Free Sample For