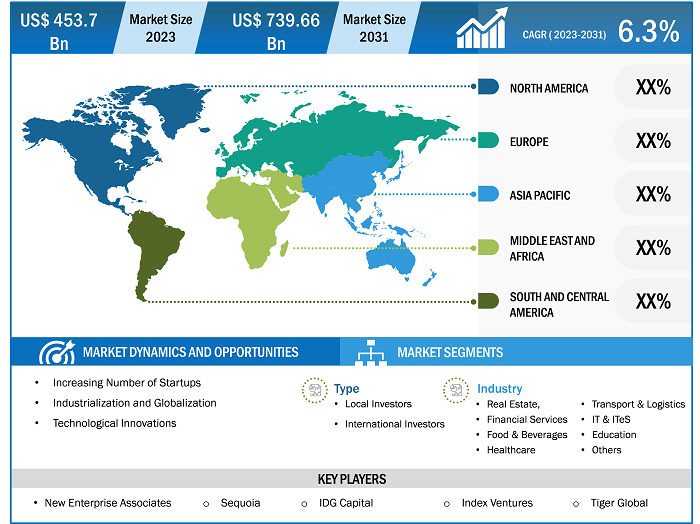

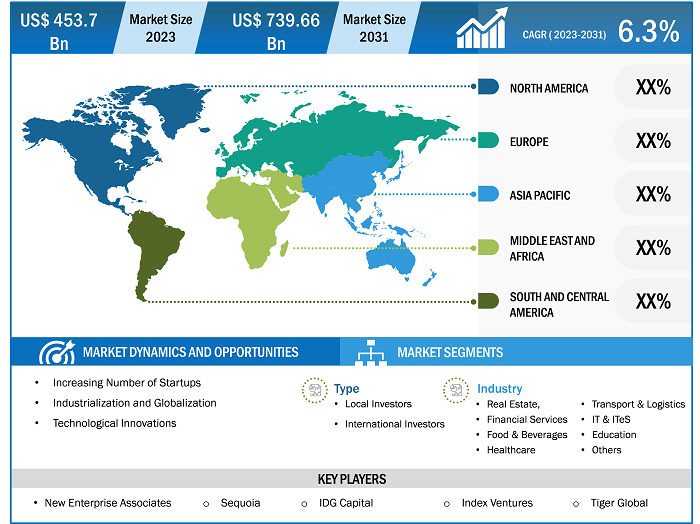

The venture capital market size is expected to grow from US$ 453.7 billion in 2023 to US$ 739.66 billion by 2031; it is anticipated to expand at a CAGR of 6.3% from 2023 to 2031. The venture capital market includes growth prospects owing to the current venture capital market trends and their foreseeable impact during the forecast period. An increasing number of startups, and industrialization and globalization are some of the factors driving the market growth. However, market volatility and regulatory challenges are restraining the market growth.

Venture Capital Market Analysis

Venture capital (VC) represents a subset of private equity that provides funding for start-ups and small enterprises with prospects for sustained expansion. Investment banks, financial institutions, and investors are the usual sources of venture capital. Venture capital (VC) funds startups and small businesses that investors think have significant development potential. Private equity (PE) is the usual form of financing. Through independent limited partnerships, ownership positions are sold to a select group of investors. Whereas PE typically funds established businesses looking for an equity injection, venture capital typically concentrates on developing businesses. Venture capital (VC) is a vital source of funding, particularly for start-ups that do not have access to bank loans, capital markets, or other forms of debt. Seed-stage, early-stage, and late-stage funding are the three types of venture capital.

Globalization has evolved in recent decades as a result of the expansion of commercial and financial networks that cross national borders, making businesses and workers from other economies increasingly interconnected. Greater globalization creates more chances for international investments, resulting in more investment-linked programs. Moreover, industrialization also facilitates increased investments, cross-broader collaborations, partnerships, and joint ventures, facilitating venture capital market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Venture Capital Market: Strategic Insights

Market Size Value in US$ 453.7 billion in 2023 Market Size Value by US$ 739.66 billion by 2031 Growth rate CAGR of 6.3% from 2023 to 2031 Forecast Period 2023-2031 Base Year 2023

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Venture Capital Market: Strategic Insights

| Market Size Value in | US$ 453.7 billion in 2023 |

| Market Size Value by | US$ 739.66 billion by 2031 |

| Growth rate | CAGR of 6.3% from 2023 to 2031 |

| Forecast Period | 2023-2031 |

| Base Year | 2023 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Venture Capital Industry Overview

- Venture capital offers financial support to startups that lack the necessary cash flow to incur debt. Because investors acquire equity in potential companies and businesses receive the funding they require to jumpstart their operations, this arrangement may be advantageous to both parties.

- VCs frequently offer networking and mentoring services to assist in locating advisers and talent. Having solid venture capital backing can help businesses make more investments.

- However, a business that accepts venture capital support can lose creative control over its future direction. Venture capitalists (VCs) are likely to want a sizable portion of the company's stock and might even put pressure on the management team.

- Many VCs may put pressure on the company to exit quickly because their main goal is to achieve a quick, high-return payout.

Venture Capital Market Driver

Increasing Number of Startups to Drive the Venture Capital Market

- Accessibility to technology and resources growing culture of entrepreneurship and innovation are making it easier for individuals with ideas to turn them into viable businesses. For instance, according to SBA, in 2022, 30.2 million small businesses were operating and 1,000 active unicorns in the US.

- According to CB Insights, as of January 2024, there are over 1,200 billion-dollar unicorn startups in the world. Moreover, according to Microsoft, 50 million new startups are established every year. That means, on average, 137,000 startups are launched every day.

- As more entrepreneurs launch startups with innovative ideas, they seek funding to grow their businesses.

- Venture capitalists, drawn by the potential for high returns, invest in these startups in exchange for equity. This influx of capital fuels the growth of startups, allowing them to expand their operations, develop new products, and enter new markets.

- As successful startups generate returns for investors, more capital is attracted to the venture capital market, creating a cycle of growth.

- The success stories of well-known startups further fuel this cycle, inspiring more entrepreneurs to take the leap and seek funding, thus driving the venture capital market growth.

Venture Capital Market Report Segmentation Analysis

- Based on type, the venture capital market is segmented into local investors and international investors.

- The local investor segment is expected to hold a substantial venture capital market share in 2023.

- Local investors often have a deeper understanding of the local market dynamics, regulations, and cultural nuances, which can give them an edge in identifying promising investment opportunities.

- On the other hand, international investors may bring broader networks, diverse perspectives, and access to larger pools of capital, which can be advantageous for startups looking to scale globally.

Venture Capital Market Share Analysis By Geography

The scope of the venture capital market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant venture capital market share. The region's significant economic development, growing population, and increasing number of startups requiring venture capital have contributed to the growth of the market.

Venture Capital Market Report Scope

The "Venture Capital Market Analysis" was carried out based on type, industry, and geography. On the basis of type, the market is segmented into local investors and international investors. Based on industry, the venture capital market is segmented into real estate, financial services, food & beverages, healthcare, transport & logistics, IT & ITeS, education, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Venture Capital Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the venture capital market. A few recent key market developments are listed below:

- In November 2023, IBM announced the launch of a US$ 500 million venture fund to invest in a range of AI companies - from early-stage to hyper-growth startups - focused on accelerating generative AI technology and research for the enterprise.

[Source: IBM Corporation, Company Website]

- In September 2023, Amazon Catalytic Capital announced it had invested in four new venture capital funds, bringing its total portfolio to eight funds.

[Source: Amazon, Company Website]

Venture Capital Market Report Coverage & Deliverables

The venture capital market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Venture Capital Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Industry and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

An increasing number of startups, industrialization, and globalization are the major factors that propel the global venture capital market.

The global venture capital market was estimated to be US$ 453.7 billion in 2023 and is expected to grow at a CAGR of 6.3 % during the forecast period 2023 - 2031.

The rise in mega deals is anticipated to play a significant role in the global venture capital market in the coming years.

The key players holding majority shares in the global venture capital market are New Enterprise Associates, Sequoia, IDG Capital, Index Ventures, Tiger Global, and United Health Group.

The global venture capital market is expected to reach US$ 739.66 billion by 2031.

- Tiger Global Management

- New Enterprises Associates

- Sequoia Capital

- DST Global

- IDG Capital

- Index Ventures

- Healthcare Royalty Partners

- GGV Capital

- Greylock Partners

- Nexus Venture Partners

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Venture Capital Market

Apr 2024

Trade Credit Insurance Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Enterprise Size (Large Enterprises and SMEs), Application (International and Domestic), End User (Energy, Automotive, Aerospace, Chemicals, Metals, Agriculture, Food and Beverages, Financial Services, Technology and Telecommunications, Transportation, and Others), and Geography

Apr 2024

Revenue Assurance for BFSI Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Component (Solution and Services), Deployment (Cloud and On-Premise), Organization Size (Large Enterprises and SMEs), and Geography

Apr 2024

Insurance Third-Party Administrator Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Insurance Type (Healthcare, Retirement Plans, Commercial General Liability Insurers, and Other Insurance Types), End User (Large Enterprises and SMEs), and Geography

Apr 2024

Voice-based Payments Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), By Enterprise Size (Large Enterprises and Small and Medium-Sized Enterprises), By Industry (BFSI, Automotive, Healthcare, Retail, Government, and Others), and by Geography

Get Free Sample For

Get Free Sample For