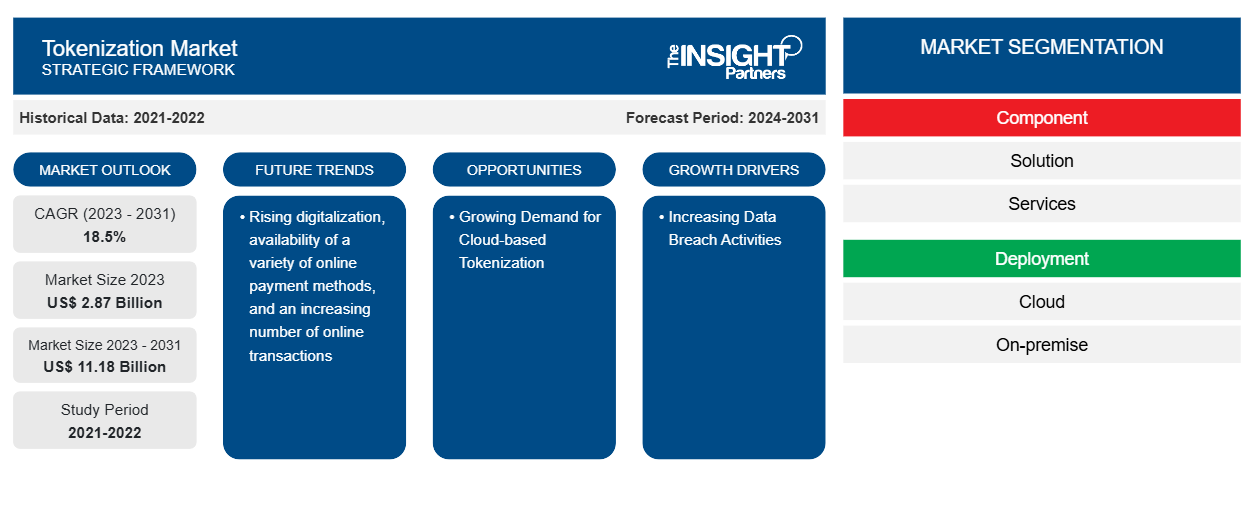

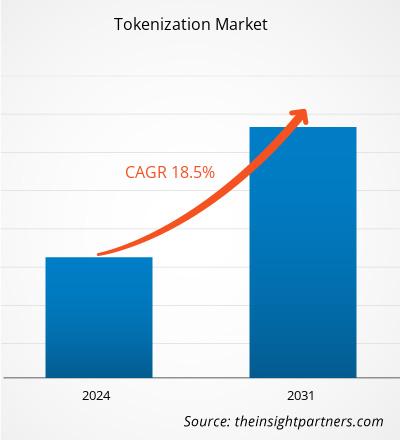

The tokenization market size is projected to reach US$ 11.18 billion by 2031 from US$ 2.87 billion in 2023. The market is expected to register a CAGR of 18.5% in 2023–2031. Rising digitalization, availability of a variety of online payment methods, and an increasing number of online transactions are likely to remain a key tokenization market trend.

Tokenization Market Analysis

The tokenization market is growing at a rapid pace due to the increasing data breach activities and growing data security concerns among consumers across the globe. The market is expanding steadily, driven by the consumer demand for contactless payment. Moreover, the growing demand for cloud-based tokenization and government initiatives for cashless transactions are providing lucrative opportunities for tokenization market growth.

Tokenization Market Overview

Tokenization is the process of exchanging or converting sensitive data for nonsensitive data into smaller parts called “tokens.” It can be used in a database or internal system without bringing it into scope. Tokens have almost no intrinsic value; they are only helpful when they represent something important, such as a credit card primary account number (PAN) or Social Security number (SSN). Most organizations store sensitive data in their systems, whether it's credit card information, medical information, social security numbers, or anything else that has to be secure and protected. Tokenization allows enterprises to continue using this data for commercial purposes without the risk or compliance implications of retaining sensitive data internally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tokenization Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tokenization Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Tokenization Market Drivers and Opportunities

Increasing Data Breach Activities is Driving the Market

Criminals target businesses that accept debit cards and credit credits. The payment made from these cards contains valuable information that can be stolen. This increases the adoption of tokenization among businesses to protect valuable information. Tokenization helps businesses to protect themselves from any negative financial consequences of data theft. Tokenization not only protects financial information but also supports businesses to protect their personal data from breaches. Moreover, the growing adoption of credit card tokenization among businesses to improve data security for online businesses is driving the market. Tokenization provides data security from the time data is being captured to storage by eliminating the actual storing of credit card numbers in POS machines and internal systems.

Growing Demand for Cloud-based Tokenization – An Opportunity in the Tokenization Market

Cloud-based tokenization is the process of exchanging sensitive data for an irreversible, non-sensitive placeholder known as a token while securely maintaining the original, sensitive data outside of the business's internal systems. Cloud-based tokenization is easier to implement and less expensive than traditional on-premise tokenization. This helps businesses in lowering risk and compliance exposure by removing sensitive data from their data environments. Businesses can also safeguard that data while maintaining utility and the agility of their current business processes by utilizing format- and length-preserving tokens as a placeholder for the original, sensitive data. This is significantly creating opportunities in the market during the forecast period.

Tokenization Market Report Segmentation Analysis

Key segments that contributed to the derivation of the tokenization market analysis are component, deployment, enterprise size, and industry vertical.

- Based on component, the tokenization market is divided into solution and services. The solution segment held a larger market share in 2023.

- In terms of deployment, the market is categorized as cloud and on-premise. The cloud segment held a larger market share in 2023.

- On the basis of enterprise size, the tokenization market is divided into SMEs and large enterprises. The SMEs segment held a larger market share in 2023.

- In terms of industry vertical, the tokenization market is segmented into BFSI, Retail, IT & telecom, healthcare, government, and others. The BFSI segment held a larger market share in 2023.

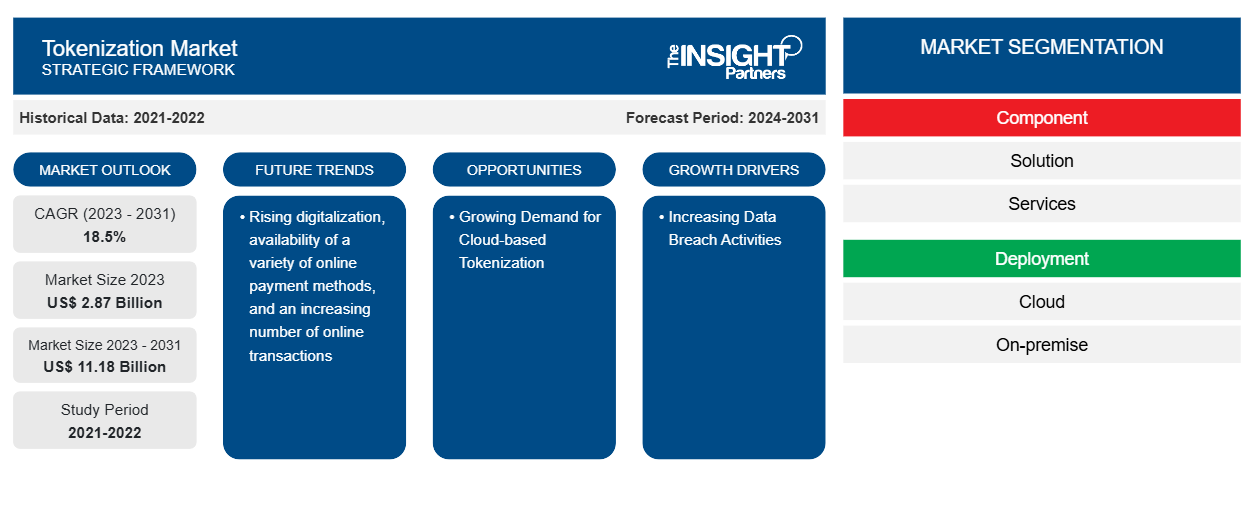

Tokenization Market Share Analysis by Geography

The geographic scope of the tokenization market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, North America accounted for the largest tokenization market share, due to the rapid adoption of new innovative technologies and increasing demand for cloud-based solutions among businesses. Increasing use of online payment methods and growing buy now, pay later with cryptocurrencies is fueling the market. Many financial firms in the US, such as Visa and Mastercard, are providing online transaction services and payment solutions to customers across the globe. This increases the demand for tokenization for protecting data. For instance, in August 2022, Visa issued over 4 billion network tokens globally through Visa Token Service (VTS) to support digital tokens.

Tokenization Market Regional Insights

The regional trends and factors influencing the Tokenization Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Tokenization Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Tokenization Market

Tokenization Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.87 Billion |

| Market Size by 2031 | US$ 11.18 Billion |

| Global CAGR (2023 - 2031) | 18.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Tokenization Market Players Density: Understanding Its Impact on Business Dynamics

The Tokenization Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Tokenization Market are:

- Broadcom, Inc

- FUTUREX

- Fiserv, Inc.

- Micro Focus International plc

- OpenText Corporation

- Sequent Software Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Tokenization Market top key players overview

Tokenization Market News and Recent Developments

The tokenization market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for tokenization and strategies:

- January 2024: The BIS Innovation Hub announces the first six projects for the 2024 work program, including upcoming projects focusing on safety and security, green finance, and next-generation financial infrastructures, and additional work on advanced data analytics and tokenization is also planned. (Source: BIS, Press Release, 2024)

Tokenization Market Report Coverage and Deliverables

The “Tokenization Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Rugged Phones Market

- Portable Power Station Market

- Vertical Farming Crops Market

- Digital Language Learning Market

- Non-Emergency Medical Transportation Market

- Molecular Diagnostics Market

- Grant Management Software Market

- Sports Technology Market

- Energy Recovery Ventilator Market

- Adaptive Traffic Control System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , Deployment , Enterprise Size , Industry Vertical , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global tokenization market was estimated to be US$ 2.87 billion in 2023 and is expected to grow at a CAGR of 18.5% during the forecast period 2023 - 2031.

The increasing data breach activities and growing data security concerns among consumers across the globe are the major factors that propel the global tokenization market.

The Rising digitalization, availability of a variety of online payment methods, and increasing number of online transactions are anticipated to play a significant role in the global tokenization market in the coming years.

The key players holding majority shares in the global tokenization market are Broadcom, Inc, FUTUREX, Fiserv, Inc., Micro Focus International plc, and OpenText Corporation.

The incremental growth expected to be recorded for the global tokenization market during the forecast period is US$ 8.31 billion.

The global tokenization market is expected to reach US$ 11.18 billion by 2031.

Get Free Sample For

Get Free Sample For