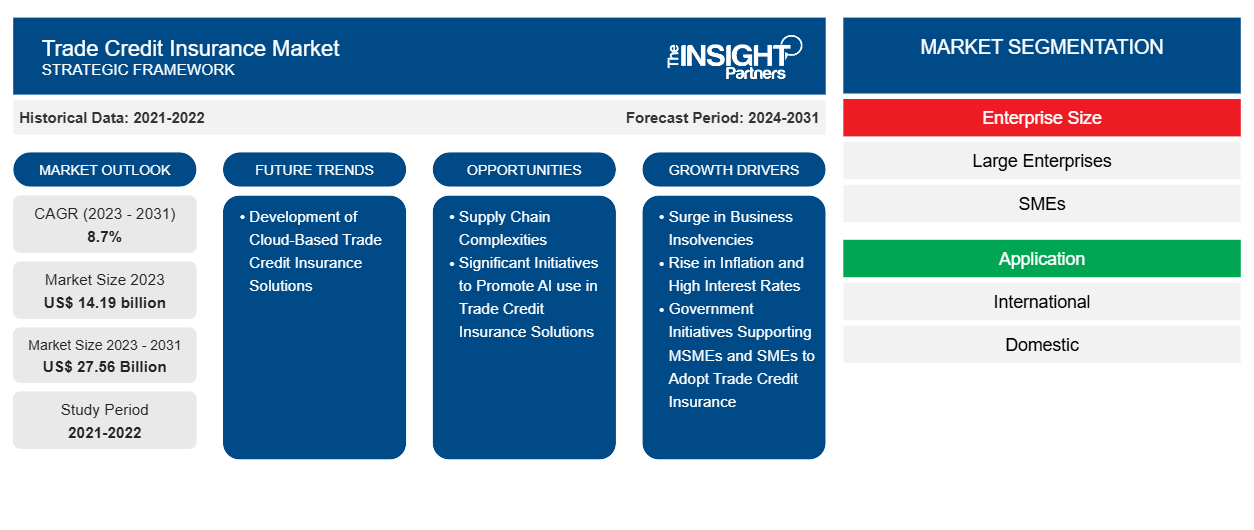

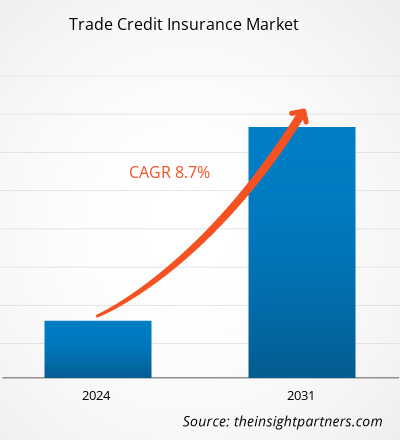

The Trade Credit Insurance market size is projected to reach US$ 27.56 billion by 2031 from US$ 14.19 billion in 2023. The market is expected to register a CAGR of 8.7% during 2023–2031. The development of cloud-based trade credit insurance solutions is likely to remain one of the key trends in the market.

Trade Credit Insurance Market Analysis

Trade credit insurance is an essential credit risk management policy used for safeguarding the development of businesses by protecting them against losses associated with an unpaid invoice. It helps insurers by paying their bills due to insolvency, economic downturns, bankruptcy, and other issues. Political turmoil and unfavorable business developments may result in elevated risks for companies engaged in cross-border trading. This poses a major driving factor for the adoption of trade credit insurance solutions across the globe.

Trade Credit Insurance Market Overview

Trade credit insurance is widely used by IT & telecom, retail, manufacturing, food & beverages, and other industries to protect themselves from financial risks. Technological advancement, a rise in inflation, a surge in complexities associated with the supply chains, and favorable government initiatives are propelling the trade credit insurance market growth. A rise in demand for trade credit insurance in SMEs, MSMEs, and larger enterprises for appropriately maintaining their revenue contributes significantly to the overall trade credit insurance market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Credit Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Credit Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Trade Credit Insurance Market Drivers and Opportunities

Government Initiatives Supporting MSMEs and SMEs to Adopt Trade Credit Insurance

Insurance coverage is critical for micro, small, and medium enterprises (MSMEs) and small and medium enterprises (SMEs) as it lowers financial risks and absorbs risks such as payment defaults. The growing geopolitical issues, economic downturn, instability in the supply chain, inflation, and other factors have increased the risks with exports worldwide, which boosts the demand for trade credit insurance among MSMEs for making seamless payments. Moreover, historical trends indicate that the majority of MSMEs and SMEs in India are uninsured, as they fail to understand the need for insurance. They only purchase insurance when a buyer or a bank requires it, which makes them vulnerable to financial risks. This also encourages the government to take initiatives to support MSMEs and SMEs in adopting trade credit insurance to secure their business from financial risks and payment defaults. For instance, the Insurance Regulatory and Development Authority of India (IRDAI) trade credit insurance guidelines, 2021, support MSMEs and SMEs to adopt trade credit insurance to protect their businesses from evolving insurance risk. The guidelines include:

- The government and market players promote sustainable and strong development of the trade credit insurance business.

- General insurance companies offer trade credit insurance covers to suppliers, licensed banks, and other financial institutions to help them manage business risk and open access to new markets. Trade credit insurance supports businesses to manage nonpayment risk associated with trade financing portfolios.

- General insurance companies provide customized trade credit insurance covers that improve businesses for SMEs and MSMEs and help protect themselves against evolving insurance risks.

Thus, favorable guidelines and other government initiatives supporting MSMEs and SMEs to adopt trade credit insurance for safeguarding their businesses from financial risks fuel the market growth.

Supply Chain Complexities

The expansion of the e-commerce industry leads to an increased demand for new supply chain arrangements. The development of new supply chain arrangements raises the complexity of the supply chains, which increases the demand for trade credit insurance among e-commerce to streamline business processes. As a result, market players are developing a new range of trade credit insurance services for the e-commerce industry. For instance, in March 2024, Allianz Trade launched Allianz Trade pay services for B2B e-commerce activities. Allianz Trade Pay is a payment solution that offers a variety of services such as a fraud module, digital buyer onboarding solution, trade credit insurance protection, and instant financing solution through Allianz Trade’s financial institution partners. Allianz Trade Pay provides flexibility, security, simplicity, and competitiveness to the e-commerce ecosystem, which increases its adoption in the e-commerce industry to manage complex supply chains.

Various countries are adopting the multipolar system, which requires the presence of advanced market manufacturers for reshoring or friend-shoring production. This created the demand for parallel and multiple supply chains and relocation of production facilities to fulfill customers' needs across the globe. As a result, a reduction in the supply chain activity for intermediate goods leads to a rise in complexities related to trade, particularly for intermediate goods. For instance, according to the World Trade Organization (WTO) data published on October 2023, supply chain activity for intermediate goods declined by 48.5% in the first half of 2023. It fell from an average of 51.0% compared to the previous three years. Thus, supply chain complexities will raise the demand for trade credit insurance protection against counterparty risk, which is expected to create numerous opportunities for the trade credit insurance market growth during the forecast period.

Trade Credit Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the trade credit insurance market analysis are enterprise size, application, and end user.

- Based on enterprise size, the trade credit insurance market is divided into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

- Based on application, the market is bifurcated into domestic and international. The international segment held a larger market share in 2023.

- By end user, the market is segmented into energy, automotive, aerospace, chemicals, metals, agriculture, food and beverages, financial services, technology and telecommunications, transportation, and others. The energy segment held a larger market share in 2023.

Trade Credit Insurance Market Share Analysis by Geography

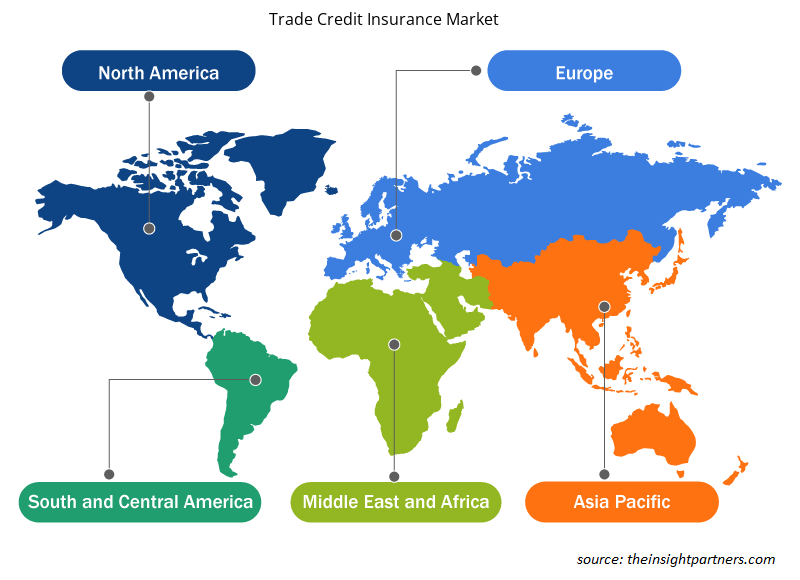

The geographic scope of the trade credit insurance market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Europe dominated the trade credit insurance market share in 2023. According to the Allianz Trade report of April 2023, 76% of companies in Germany have experienced payment delays. These payment delays are surging due to the complexity and disruptions in supply chains. Moreover, according to the same source, Germany has observed more than 22% of 17,800 cases of business insolvencies owing to excessive debt and inadequate capital reserves. Thus, the rise in payment delays and insolvency rates are a few factors that increase the demand for trade credit insurance among businesses to protect themselves against financial risks. The rising demand for trade credit insurance among enterprises encourages insurance companies to expand their business across France. For instance, according to a survey conducted by Allianz Trade in November 2023, 97% of French companies have offered payment terms to their customers, with an overall average timeframe of 48 days. There is a wide presence of major players in the country such as Allianz Trade, COFACE SA, and Atradius NV. These players help businesses by making frequent payments, which also supports the country in reducing the number of payment delays that affect small businesses. All these factors are contributing to the trade credit insurance market growth in France.

Trade Credit Insurance Market Regional Insights

The regional trends and factors influencing the Trade Credit Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Trade Credit Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Trade Credit Insurance Market

Trade Credit Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 14.19 billion |

| Market Size by 2031 | US$ 27.56 Billion |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

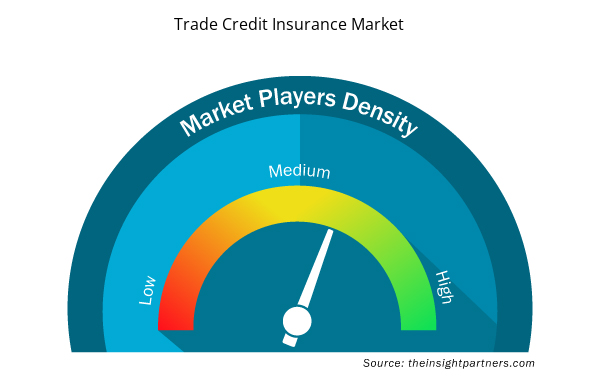

Trade Credit Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Trade Credit Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Trade Credit Insurance Market are:

- Allianz Trade

- COFACE SA

- American International Group Inc

- Chubb Ltd

- QBE Insurance Group Ltd

- Aon Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Trade Credit Insurance Market top key players overview

Trade Credit Insurance Market News and Recent Developments

The trade credit insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market for trade credit insurance are listed below:

- Coface, a global credit insurer, announced it had opened a branch in New Zealand after receiving approval from the Reserve Bank of New Zealand on April 1. This expansion in a new country is further strengthening the Group's international coverage. (Source: Coface, Press Release, April 2024)

- Chubb collaborated with UK-based Insurtech Cytora for generative AI on insurance claims processing. This collaboration aims to transform Chubb's claims document management by automating the digitization process. (Source: Chubb, Press Release, March 2024)

Trade Credit Insurance Market Report Coverage and Deliverables

The “Trade Credit Insurance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Trade credit insurance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Trade credit insurance market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Trade credit insurance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the trade credit insurance market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Cosmetic Bioactive Ingredients Market

- Dealer Management System Market

- Trade Promotion Management Software Market

- GMP Cytokines Market

- Arterial Blood Gas Kits Market

- Airport Runway FOD Detection Systems Market

- Sleep Apnea Diagnostics Market

- Artificial Intelligence in Defense Market

- Semiconductor Metrology and Inspection Market

- Compounding Pharmacies Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The trade credit insurance market is expected to register an incremental growth value of US$ 13.37 billion during the forecast period

Large enterprises segment is expected to hold a major market share of trade credit insurance market in 2023

The global market size of trade credit insurance market by 2031 will be around US$ 27.56 billion

The United States is expected to hold a major market share of trade credit insurance market in 2023

Asia Pacific is expected to register highest CAGR in the trade credit insurance market during the forecast period (2023-2031)

United States, China, and Rest of Europe are expected to register high growth rate during the forecast period

BEA, BBC Bircher AG, GEZE GmbH, Hotron Ltd, MS SEDCO, OPTEX TECHNOLOGIES INC, Pepperl+Fuchs SE, Nabtesco Corp, Ningbo VEZE Automatic Door Co., Ltd., and TORMAX USA Inc. are the key market players expected to hold a major market share of trade credit insurance market in 2023

Development of cloud-based trade credit insurance solutions are anticipated to play a significant role in the trade credit insurance market in the coming years.

Surge in business insolvencies, rise in inflation and high interest rates, and government initiatives supporting MSMEs and SMEs to adopt trade credit insurance are the major factors that propel the trade credit insurance market.

The estimated global market size for the trade credit insurance market in 2023 is expected to be around US$ 14.19 billion

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies - Trade Credit Insurance Market

- Allianz Trade

- COFACE SA

- American International Group Inc

- Chubb Ltd

- QBE Insurance Group Ltd

- Aon Plc

- Credendo

- Atradius NV

- Zurich Insurance Group AG

- Great American Insurance Company

Get Free Sample For

Get Free Sample For