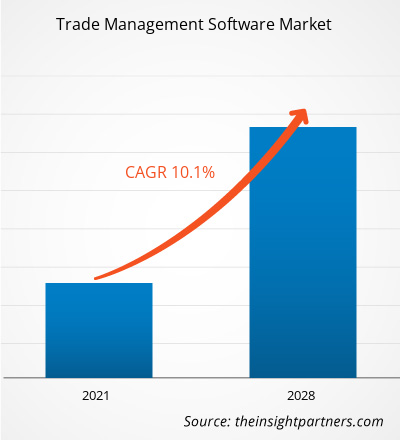

[Research Report] In terms of revenue, the global trade management software market was valued at US$ 825.0 million in 2020 and is projected to reach US$ 1,748.4 million by 2028; it is expected to grow at a CAGR of 10.1% during the forecast period from 2020 to 2027.

The trade management software market is broadly segmented into five major regions—North America, Europe, APAC, MEA, and SAM. The APAC region dominated the trade management software market in 2020. APAC consists of many developing countries witnessing high growth in their respective manufacturing sector; the region has become a global manufacturing hub. China, as well as other developing countries such as India, South Korea, Taiwan, and Vietnam, are attracting several businesses to relocate their low- to medium-skilled manufacturing facilities to neighboring countries, which have labors at a lower cost. Further, governments of these countries are making developments to improve foreign investments in the region. Over the years, the manufacturing spent of the region has grown significantly and is further anticipated to grow at a decent growth rate. This dramatic growth in the manufacturing spends and adoption of novel technologies are the key factors fueling the demand for trade management software in the region.

Impact of COVID-19 Pandemic on Trade Management Software Market

The COVID-19 pandemic has been affecting every business globally since December 2019. The continuous growth in the number of virus-infected patients compelled governments to put a bar on transportation of humans and goods. The manufacturing sector witnessed severe losses due to temporary factory shutdowns and low production volumes, which hindered the growth of retail, e-commerce, and logistics sectors. Additionally, the social or physical distancing measures imposed by governments have put limitations on the operations of logistics and other service providers. This disruption has resulted in the decline in trade business. These adversities led to the reduction in the global trade volumes by 17.7% in May 2020, compared to the trade volumes in May 2019. The decline in first 5 months of 2020 was pervasive, however, it majorly impacted exports from Japan, the US, and European countries. Despite the disruption caused by the COVID-19 pandemic, the trade is likely to surge in the future as businesses are resuming after a long lockdown. With the social distancing measures in effect, the e-commerce, logistics, retail, and other such sectors involved in trade activities are focusing on the adoption of trade management software, to meet compliance by ensuring speed in supply chain. Thus, the uncertainties introduced by COVID-19 have expanded the scope of using cloud-based software/SaaS in logistics.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Management Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Management Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights – Trade Management Software Market

Cost Reduction and Real-Time Visibility

Trade is a complex process that involves the flow of multiple goods and information across a network of suppliers, carriers, and warehouse. Software solutions help users handle these complexities more precisely and easily through the analysis of real-time and real-world data, thereby reducing inefficiencies. The implementation of these software systems also improves supply chain functioning and offers real-time visibility into operations. Increased competitiveness in different industries is a major force compelling them to invest in automation and digitalization. Moreover, the adoption of cloud-based solutions provides enhanced real-time visibility into the exported goods and lowers the operating costs. The implementation of emerging technologies such as blockchain, artificial intelligence (AI), and predictive analysis in logistics operations would further boost the global trade management software market growth in the coming years.

Component Segment Insights

Based on component, the trade management software market is segmented into solution and services. The solution segment is expected to be the leading segment in the global trade management software market during the forecast period. The solutions segment includes trade compliance and international trade visibility and execution. Furthermore, international trade visibility and execution operations include cross-border shipping and transportation. They offer visibility into international trade partner events and processes. These processes must be international and include transactions and agreements among commercial trade partners.

Deployment Segment Insights

Based on deployment, the trade management software market is segmented into on-premise and cloud. The cloud segment is likely to be the leading segment in the global trade management software market during the forecast period. Cloud deployment is largely adopted by small and medium enterprises. Low cost of ownership, reduced costs of maintenance and upgrades, and access to the latest features are among the key advantages of cloud deployment over the on-premise deployment.

Organization Size Segment Insights

Based on organization size, the trade management software market is segmented into small enterprises, medium enterprises, and large enterprises. The large enterprises segment is expected to be the leading segment in the global trade management software market during the forecast period. Globally, there is an increase in demand for trade management software among several organizations to increase efficiency and minimize overall operations cost. The adoption of this software is a common practice among large enterprises to construct a suitable supply chain and gain flexibility in overall operations.

Industry Segment Insights

Based on industry, the logistics & transport segment is anticipated to be the leading segment in the global trade management software market during the forecast period. The demand for logistics providers offering services that are beyond traditional is rising. In some instances, third-party logistics providers operate or manage foreign trade zones of their partners. Also, in other cases, they provide warehousing as well as value-added services associated with the production or procurement of goods. Moreover, they organize all the logistics and transportation processes essential to transfer goods from source to end users efficiently and economically.

The market players are focusing on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

- In January 2021, SAP Hong Kong and consulting powerhouse Deloitte partnered to offer substantial benefits to businesses engaged in cross-border trade.

- In January 2019, Bamboo Rose launched services as a subscription model, which helps customers to plan better, innovate, and collaborate with their multi-enterprise retail communities, saving 10 to 30 percent on technology investments.

- In March 2019, Thomson Reuters purchased global trade management (GTM) software provider Integration Point for an undisclosed amount in a deal that significantly expands its pool of North America-based importer and exporter customers.

Trade Management Software Market Regional Insights

The regional trends and factors influencing the Trade Management Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Trade Management Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Trade Management Software Market

Trade Management Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 825.0 Million |

| Market Size by 2028 | US$ 1,748.4 Million |

| Global CAGR (2020 - 2028) | 10.1% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

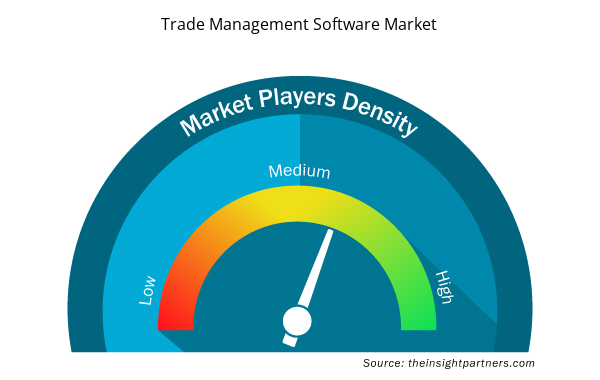

Trade Management Software Market Players Density: Understanding Its Impact on Business Dynamics

The Trade Management Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Trade Management Software Market are:

- Amber Road, Inc.

- Bamboo Rose LLC

- Expeditors International of Washington, Inc.

- Integration Point, LLC

- Livingston International

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Trade Management Software Market top key players overview

The global trade management software market has been segmented as follows:

Trade Management Software Market – by Component

- Solution

- Services

Trade Management Software Market – by Deployment

- On-Premise

- Cloud

Trade Management Software Market – by Organization Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Trade Management Software Market – by End User

- Retail & CG

- Automotive

- Logistics and Transportation

- Healthcare and Pharma

- Government

- Aerospace and Defense

- Chemicals and Minerals

- Manufacturing

- Others

Trade Management Software Market – by Region

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Trade Management Software Market – Company Profiles

- Amber Road, Inc.

- Bamboo Rose LLC

- Expeditors International of Washington, Inc.

- Integration Point, LLC

- Livingston International

- MIC

- Oracle Corp

- QAD, Inc

- QuestaWeb

- SAP SE

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component , Deployment , Organization Size , and End User , Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, Chile, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, Taiwan, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The logistics & transport segment is leading the global trade management software market. The demand for logistics providers offering services that are beyond traditional is rising. In some instances, third-party logistics providers operate or manage foreign trade zones of their partners. Also, in other cases, they provide warehousing as well as value-added services associated with the production or procurement of goods. Moreover, they also organize all the logistics and transportation processes essential to transfer goods from source to end users efficiently and economically.

The management of global trade is more complex than the management of domestic distribution. Diversification in country laws and regulations, currencies, languages, time zones, and transport modes are among the major factors influencing the trade management market growth. Complexities involved in the global trade are compounded by the unique position of each global trade participant in the field. Vendors offer customized GTM solutions that are flexible and adapt to changing regulations and business requirements.

Presently, North America held the largest share of the global trade management software market. The region experiences huge export and import of goods between the US and Mexico will propel the demand for trade management software. Companies such as SAP SE, Oracle Corporation, Descartes, and QAD Inc. are a few of the key players prevailing in North America to address the trade management needs. The presence of companies offering trade management software in the region would attract more companies toward these software solutions owing to the rise in trade.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Trade Management Software Market

- Amber Road, Inc.

- Bamboo Rose LLC

- Expeditors International of Washington, Inc.

- Integration Point, LLC

- Livingston International

- MIC

- Oracle Corp

- QAD, Inc

- QuestaWeb

- SAP SE

Get Free Sample For

Get Free Sample For