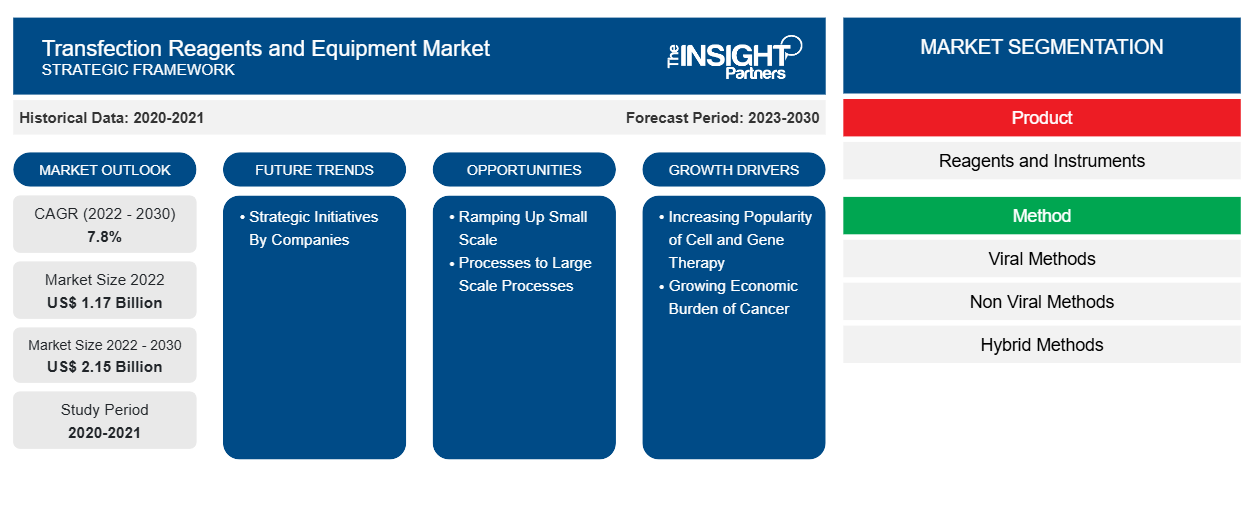

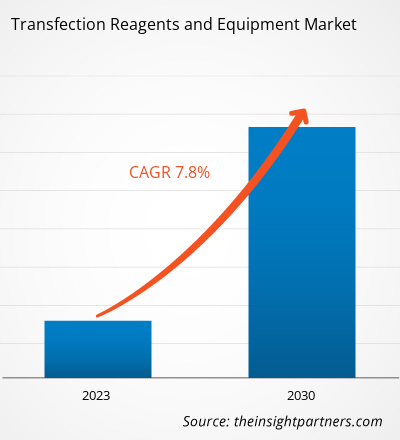

[Research Report] Transfection reagents and equipment market is expected to grow from US$ 1,170.79 million in 2022 to US$ 2,145.03 million by 2030; it is anticipated to record a CAGR of 7.8% from 2022 to 2030.

Market Insights and Analyst View:

The expansion of the transfection reagents and equipment market size is attributed to the rising cases of chronic diseases, and the surging popularity of cell and gene therapy. Transfection is the process of transferring foreign particles and nucleic acids into cells through chemical, physical, and biological means. Transfection reagents are used to improve the efficacy of genetic experiments performed as a part of substantial research conducted in the fields of applied gene therapies. In all transfection experiments, the methods by which compounds are delivered into cells must be carefully chosen. Viral-mediated transfection has demonstrated considerable effectiveness, and the transfected products can induce significant immune responses. However, chemical alternatives have been developed to curb the ill effects associated with the use of viruses in the technique.

Growth Drivers and Challenges:

Cell and gene therapy manufacturing is a complicated process, which makes its execution and monitoring critical. Advancements in biotechnology have led to the adoption of personalized treatments for the treatment of numerous indications. Cell and gene therapies are mostly used to treat chronic diseases such as neurological disorders, cancer, and genetic disorders. The noteworthy advantages of cell and gene therapy include targeted treatment, faster and more efficient recovery, and reduced side effects. Cell and gene therapies are widely adopted worldwide owing to the availability of Food and Drug Administration (FDA) approved products. For instance, the FDA approved an adenovirus, ADSTILADRIN, manufactured by Ferring Pharmaceuticals A/S in 2022. This recombinant adenovirus (rAd-IFNa/Syn3) delivers human interferon alfa-2b cDNA into the bladder epithelium to treat patients suffering from certain types of bladder cancer. In 2022, the FDA approved CARVYKTI, manufactured by Janssen Biotech, Inc.. CARVYKTI is an autologous CAR-T cell engineered with lentivirus to attack BCMA-expressing tumor cells to treat certain kinds of relapsed or refractory multiple myeloma.

According to the article “Gene therapy process change evaluation framework: Transient transfection and stable producer cell line comparison," published by the University College London (UCL) in 2020, 423 ongoing clinical trials were conducted to test gene therapy products. Scientists nowadays employ the transfection technique for the production of these therapies. Hence, an upsurge in the popularity of cell and gene therapy activities fuels the number of transfection procedures performed, which, in turn, fuels the growth of the transfection reagents and equipment market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Transfection Reagents and Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Transfection Reagents and Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Ongoing efforts to develop approaches to ramp up the small-scale transfection processes act as an opportunity to grow the transfection reagents and equipment market. Transfection is the complex step in developing a viral vector, including adenovirus, adeno-associated virus, and lentivirus. Transient transfection must also be ramped up as the manufacturing processes are scaled up. Process equipment vendors, drug developers, and raw material suppliers are focusing on collaborations to develop cost-effective, practical, and platformizable solutions for rapidly developing and scaling up viral vector manufacturing processes. With planned material volumes and transfer & mixing times, transfecting cells with multiple plasmids becomes feasible on small scales. Scaling up requires experience in industrializing the transfection step since most companies only have transfection experience at the lab level. However, the volume of cell-culture media and transfection reagents required for scaling up the process to a larger level can be impractical, emphasizing the need for optimization.

Nonetheless, broadening the production scale has become common in recent years with the surging demand for viral vectors. With numerous challenges associated with large-scale transfection processes, the best approach to increase production is reducing the process rather than scaling up the process. This top-down approach allows clear identification of the conditions that will impact the process at the industrial level, such as the volume of transfection complex solution. This approach also facilitates process optimization and decision-making.

Report Segmentation and Scope:

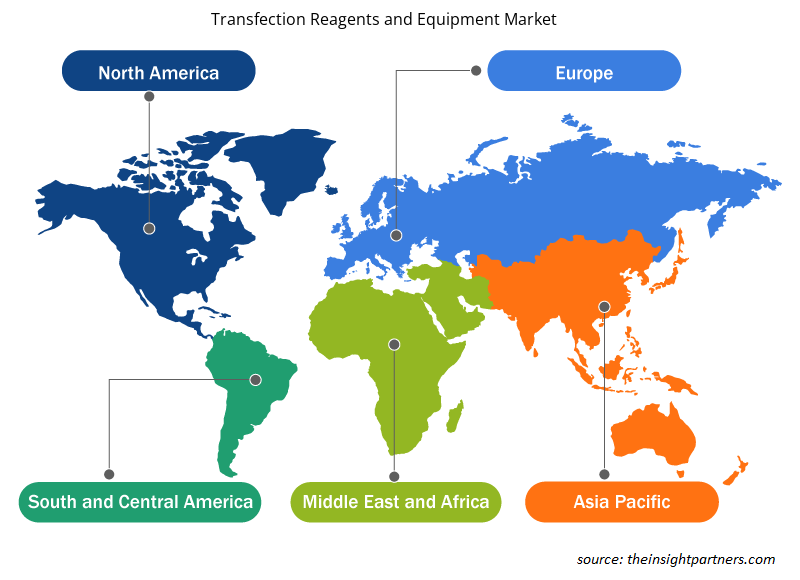

The transfection reagents and equipment market is fragmented based on product, modality, application, end user, and geography. Based on product, the market is classified into reagents and equipment. Based on modality, the transfection reagents and equipment market is classified into viral, non-viral, and hybrid methods. In terms of application, the transfection reagents and equipment market is classified into biomedical research, protein production, and therapeutic delivery. The transfection reagents and equipment market, by end-user, is classified into academic and research institutes and pharmaceutical and biotechnological companies. Based on geography, the transfection reagents and equipment market is segmented into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, and Rest of Asia Pacific), the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

In 2022, the non-viral methods segment, based on modality, held a larger share of the transfection reagents and equipment market. The non-viral methods segment will record a higher CAGR from 2022 to 2030. The non-viral-based transfection approach can be further classified into physical/mechanical and chemical methods. Popular physical/mechanical transfection methods include electroporation, sonoporation, magnetofection, gene microinjection, and laser irradiation. Electroporation is a commonly used physical transfection method that uses electrical voltage to transiently increase the cell membrane permeability to allow the entry of foreign nucleic acid into cells. Ultrasound-assisted transfection or sonoporation involves using a microbubbles technique to create holes into the cell membrane to ease the transfer of genetic materials, while laser irradiation-assisted transfection uses a laser beam to create small holes in the plasma membrane to allow the entry of foreign genetic substances. Chemical transfection methods can be further categorized as liposomal-based or non-liposomal-based. Liposomal-based transfection reagents permit the formation of positively charged lipid aggregates that can smoothly combine with the phospholipid bilayer of host cells to permit the entry of foreign genetic materials with minimal resistance. Non-liposomal transfection reagents can be divided into several classes: calcium phosphate, dendrimers, polymers, nanoparticles, and non-liposomal lipids. Viral vector systems include retroviruses, adenoviruses (AdV), adenovirus-associated viruses (AAV), lentiviruses (LV), and bacteriophages. Most gene therapy drugs currently available on the market use viruses as vectors. Although viral vectors pose disadvantages such as high immunogenicity, safety hazards, and production difficulties, their higher transfection efficiencies present a unique advantage for gene delivery. Generally, retroviruses can only be used to transfect dividing cells, while adenoviruses, AAVs, and herpes viruses can be used to transfect dividing and non-dividing cells.

In 2022, the reagents segment, based on product, held a larger share of the transfection reagents and equipment market. The reagents segment will record a higher CAGR from 2022 to 2030. The demand for transfection reagents is increasing with an upsurge in product launches and the focus on scaling up the transfection process. In August 2021, Mirus Bio launched the TransIT VirusGEN GMP product line of transfection reagents and enhancers to support viral vector manufacturing for gene therapy development and related processes. The TransIT VirusGEN GMP transfection reagent was developed to enhance the delivery of transfer vaccine DNA to suspension and adherent HEK 293 cells to better the production of recombinant AAV and LV vectors. The growing focus on launching GMP-complaint transfecting reagents to enhance vectors' production capacity further fuels the market's progress for transfection reagents.

Based on application, the biomedical research segment held the largest share of the transfection reagents and equipment market in 2022. The market for this segment is expected to grow at the fastest CAGR during 2022–2030. The academic and research institutes segment accounted for a larger share of the transfection reagents and equipment market, by end-user, in 2022. The market for the pharmaceutical and biotechnological companies segment is expected to grow at a higher CAGR during 2022–2030.

Regional Analysis:

Based on geography, the transfection reagents and equipment market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the largest contributor to the global transfection reagents and equipment market growth. Asia Pacific is expected to register the highest CAGR in the transfection reagents and equipment market from 2022 to 2030. Cell and gene therapies (CGTs) are prescribed to treat patients suffering from serious and rare diseases with unaddressed therapeutic needs. Manufacturing CGTs is a highly complex process, with insufficient infrastructure and expertise being a major limiting factor. Logistics-related challenges associated with intermediates and final products limit companies' CGT manufacturing capacity. The CGT manufacturing process involves extracting autologous cells through "apheresis," dispatching them to specialized laboratories, and sending them back to clinics for patient administration, all of which must be performed with strict quality control. The US Food and Drug Administration (FDA) has approved only 7 CGT drugs so far, and the pipeline of new products has reached ~1,200 experimental therapies. Half of these are in Phase 2 clinical trials. With these prospects, annual sales of cell and gene therapies are estimated to grow by 15% and ~30%, respectively, as stated in the Chemical & Engineering News Report 2023.

Many manufacturers approach contract development manufacturing organizations (CDMOs) such as Labcorp, Lonza, and Catalent to overcome the barriers associated with the production and commercialization of their CGT products. Lonza has invested ~US$ 9.2 million to strengthen its cell and gene therapy manufacturing capabilities. Such initiatives by CDMOs are contributing to the growth of the transfection reagents and equipment market in the US.

Transfection Reagents and Equipment Market Regional Insights

Transfection Reagents and Equipment Market Regional Insights

The regional trends and factors influencing the Transfection Reagents and Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Transfection Reagents and Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Transfection Reagents and Equipment Market

Transfection Reagents and Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.17 Billion |

| Market Size by 2030 | US$ 2.15 Billion |

| Global CAGR (2022 - 2030) | 7.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

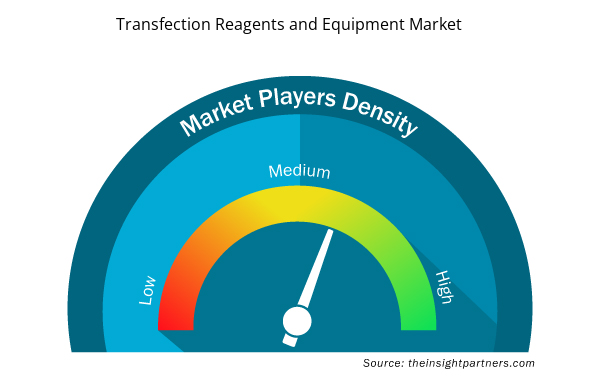

Transfection Reagents and Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Transfection Reagents and Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Transfection Reagents and Equipment Market are:

- Thermo Fisher Scientific Inc.

- Promega Corporation

- Qiagen N.V.

- Merck KGaA

- Lonza Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Transfection Reagents and Equipment Market top key players overview

Industry Developments and Future Opportunities:

One of the prominent initiative by key players operating in the Transfection Reagents and Equipment Market are listed below:

- In September 2023, Polyplus made the FectoVIR-LV transfection reagent for lentiviral vector (LV) synthesis available for pre-ordering. With this, the company also extended new design of experiment (DoE) services at no cost to optimize transfection conditions for better LV vector titers and quality in suspension systems. In suspension HEK-293 cell systems, FectoVIR-LV is a next-generation transfection that enhances LV production. The reagent has been engineered to reduce complexation volume and boost complex stability while maintaining its animal-free composition, making it suitable for large-scale production.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the transfection reagents and equipment market are Thermo Fisher Scientific Inc., Promega Corporation, Qiagen N.V., Merck KGaA, Lonza Group, F.Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc., Mirus Bio LLC, MaxCyte Inc, and Polyplus-Transfection SA. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and expand their product range with specialty portfolios. Their global presence allows them to serve a large base of customers, subsequently facilitating market expansion.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Method, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Transfection reagents are used to improve the efficacy of genetic experiments performed as a part of substantial research in applied gene therapies. In all transfection experiments, the methods by which compounds are delivered into cells must be carefully chosen. Viral-mediated transfection has demonstrated considerable effectiveness, and the transfected products can induce significant immune responses. However, chemical alternatives have been developed to curb the ill effects associated with the use of viruses in the technique.

The factors driving the market include the increasing popularity of cell and gene therapy and the growing economic burden of cancer. However, the high cost of instruments and consumables hinders the market growth.

The transfection reagents and equipment market majorly consists of players such as Thermo Fisher Scientific Inc., Promega Corporation, Qiagen N.V., Merck KGaA, Lonza Group, F.Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc., Mirus Bio LLC, MaxCyte Inc, and Polyplus-Transfection SA.

The transfection reagents and equipment market is fragmented based on product, modality, application, end user, and geography. Based on product, the market is classified into reagents and equipment. In 2022, the reagents segment, based on product, held a larger share of the transfection reagents and equipment market. The reagents segment will record a higher CAGR from 2022 to 2030.

Based on modality, the transfection reagents and equipment market is classified into viral, non-viral, and hybrid methods. In 2022, the non-viral methods segment, based on modality, held a larger share of the transfection reagents and equipment market. The non-viral methods segment will record a higher CAGR from 2022 to 2030.

In terms of application, the transfection reagents and equipment market is classified into biomedical research, protein production, and therapeutic delivery. Based on application, the biomedical research segment held the largest share of the transfection reagents and equipment market in 2022. The market for this segment is expected to grow at the fastest CAGR from 2022 to 2030.

The transfection reagents and equipment market, by end-user, is classified into academic and research institutes and pharmaceutical and biotechnological companies. The academic and research institutes segment accounted for a larger share of the transfection reagents and equipment market, by end user, in 2022. The market for the pharmaceutical and biotechnological companies segment is expected to grow at a higher CAGR from 2022 to 2030.

Based on geography, the transfection reagents and equipment market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). North America is the largest contributor to the global transfection reagents and equipment market growth. Asia Pacific is expected to register the highest CAGR in the transfection reagents and equipment market from 2022 to 2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Transfection Reagents And Equipment Market

- Thermo Fisher Scientific Inc.

- Promega Corporation

- Qiagen N.V.

- Merck KGaA

- Lonza Group

- F.Hoffmann-La Roche Ltd

- Bio-Rad Laboratories Inc.

- Mirus Bio LLC

- MaxCyte Inc

- Polyplus-Transfection SA.

Get Free Sample For

Get Free Sample For