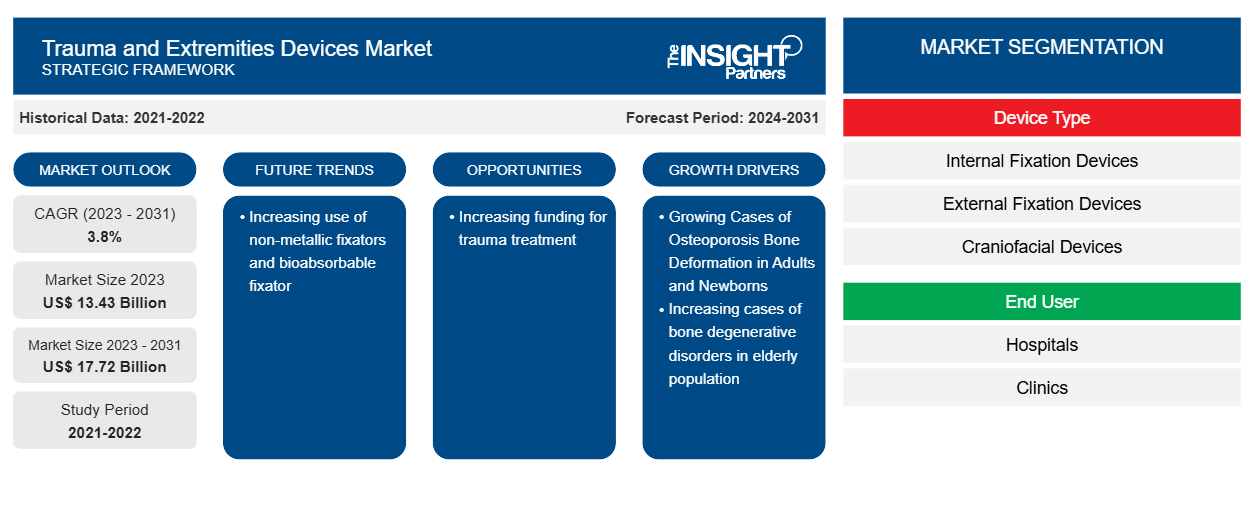

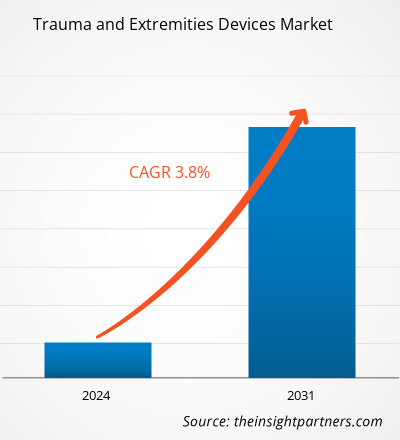

The trauma and extremities devices market size is projected to reach US$ 17.72 billion by 2031 from US$13.43 billion in 2023. The market is expected to register a CAGR of 3.8% in 2023–2031. Increasing use of non-metallic fixators and bioabsorbable fixators are likely to remain key trends in the trauma and extremities devices market.

Trauma and Extremities Devices Market Analysis

According to the World Health Organization (WHO), road traffic crashes result in the death of approximately 1.19 million people every year, and between 20 and 50 million people are suffer from non-fatal injuries that hamper their daily life. On similar lines, the Indian Ministry of Road Transport and Highways (MORTH) and the National Crime Records Bureau (NCRB) provide the estimates of road crashes based on police data. As per the report, nearly 371,884 non-fatal road traffic injuries were reported in 2021, although the figure mentioned may be underestimated. Thus, the growing number of road traffic accidents that result in bone deformities escalate the demand for trauma and extremities devices.

Trauma and Extremities Devices Market Overview

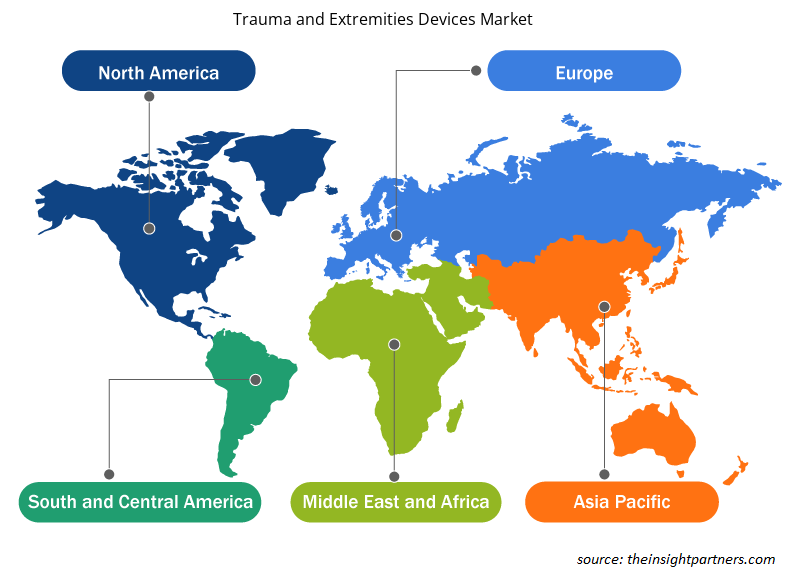

The growth of the trauma and extremities devices market is attributed to the rising prevalence of road crashes that endure non-fatal injuries and the growing aging geriatric population prone to fractures due to reduced bone density. However, the high cost of trauma and extremity devices is a major factor hindering the market growth. The global trauma and extremities devices market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the US held the largest market share due to the presence of key players and rising number of injuries caused by trauma. In addition, continuous product developments is expected to stimulate the growth of trauma and extremities devices market in North America.

Asia Pacific is expected to account for the fastest growth in the trauma and extremities devices market. The improving healthcare facilities and increasing cases of bone degenerative disorders in Asia Pacific are likely to fuel the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trauma and Extremities Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trauma and Extremities Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Trauma and Extremities Devices Market Drivers and Opportunities

Increasing Cases of Bone Degenerative Disorders in Elderly Population to Favor Market

Elderly people are at a greater risk of falls, and minor accidents can cause fractures or bone breakage due to the tendency of muscles and bones to wear off with age. Osteoporosis and other conditions that affect older people may further raise the risk of bone breakage. Thus, an upsurge in the elderly population is correlated with the soaring number of orthopedic injuries and disorders, which creates the demand for trauma and extremities devices. According to the Osteoarthritis (OA) Action Alliance, 88% of people with OA are at least 45 years old, and 43% are 65 or older in the US. Thus, the growing number of road traffic accidents escalates the demand for trauma and extremities devices.

Increasing Funding for Trauma Treatment – An Opportunity

In July 2021, the Substance Abuse and Mental Health Services Administration contributed US$ 62.4 million in grant funding to provide and increase access to effective treatment and service systems across the US. These funds aim to help children, adolescents, and their families who have experienced traumatic events. The White House will also provide additional support through US$ 800,000 in American Rescue Plan (ARP) funding. Thus, increasing funding for trauma treatment is likely to create significant opportunities in the trauma and extremities devices market.

Trauma and Extremities Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the trauma and extremities devices market analysis are device type and end user.

- Based on device type, the trauma and extremities devices market is segmented into internal fixation devices, external fixation devices, craniofacial devices, long bone stimulation, and others. The internal fixation devices segment held the largest market share in 2023.

- By end user, the market is segmented into hospitals, clinics, and others. The hospitals segment held the largest market share in 2023.

Trauma and Extremities Devices Market Share Analysis by Geography

The geographic scope of the trauma and extremities devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominated the trauma and extremities devices market. According to Centers for Disease Control and Prevention estimates, 21.2% of adults in the US, or 53.2 million people, had doctor-diagnosed arthritis from 2019 to 2021. Due to rising incidences of bone degenerative disorders in the region, North America held the largest share of the market in 2022. An inclination toward the development of technologically advanced products and the presence of global market players are factors contributing to the dominance of North America in the trauma and extremities devices market.

Trauma and Extremities Devices Market News and Recent Developments

The trauma and extremities devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments and strategies in the market for trauma and extremities devices:

- Stryker launched its Gamma4 Hip Fracture Nailing System in most European markets. This newest Gamma system is designed to provide surgeons with the next generation of Stryker's intramedullary nailing system, and it is specifically designed to treat hip and femur fractures. The Gamma4 system aims to streamline procedural workflows for surgeons. In September 2023, the system received CE certification in Europe. (Source: Stryker, Press Release, 2023)

- DePuy Synthes, the Orthopaedics Company of Johnson & Johnson, launched the UNIUM System as the newest addition to its Power Tools portfolio. The system is designed with a commitment to ergonomics, reliability, and efficiency in the trauma setting. It can be used across small bone, sports medicine, spine, and thorax procedures. (Source: Johnson & Johnson, Press Release, 2021)

Trauma and Extremities Devices Market Regional Insights

The regional trends and factors influencing the Trauma and Extremities Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Trauma and Extremities Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Trauma and Extremities Devices Market

Trauma and Extremities Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.43 Billion |

| Market Size by 2031 | US$ 17.72 Billion |

| Global CAGR (2023 - 2031) | 3.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Device Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

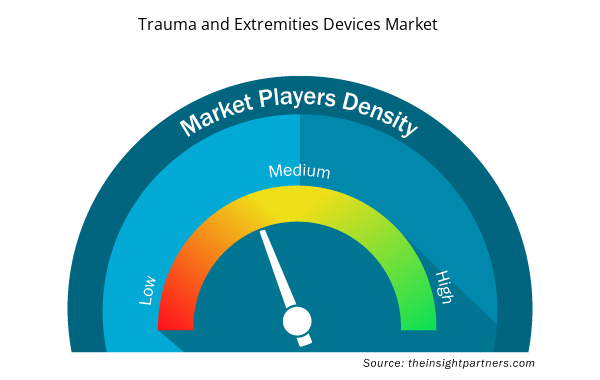

Trauma and Extremities Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Trauma and Extremities Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Trauma and Extremities Devices Market are:

- Stryker

- Zimmer Biomet

- Smith & Nephew

- Wright Medical Group N.V

- Advanced Orthopaedic Solutions

- Integra LifeSciences Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Trauma and Extremities Devices Market top key players overview

Trauma and Extremities Devices Market Report Coverage and Deliverables

The “Trauma and Extremities Devices Market Size and Forecast (2022–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The trauma and extremities devices market was valued at US$ 13.43 billion in 2023.

Orthopedic trauma describes all kinds of injuries affecting the bones, muscles, joints, and ligaments in any part of the body that are caused by trauma. The term may refer to minor fractures or severely broken bones with a direct threat to life.

The trauma and extremities devices market is expected to be valued at US$ 17.72 billion in 2031.

Based on device type, the trauma and extremities devices market is segmented into internal fixation devices, external fixation devices, craniofacial devices, long bone stimulation, and others. The internal fixation devices segment held the largest market share in 2023.

The trauma and extremities devices market majorly consists of the players, including Stryker, Zimmer Biomet, Smith & Nephew, Wright Medical Group N.V, Advanced Orthopaedic Solutions, Integra LifeSciences Corporation, Acumed LLC, Orthofix Holdings, Inc, Medartis AG, Corin, Matrix Meditec Private Limited, Electramed Ltd., and Miraclus.

Key factors driving the trauma and extremities devices market growth are rising number of road accidents and increasing cases of bone degenerative disorders in elderly population.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Trauma And Extremities Devices Market

- Stryker

- Zimmer Biomet, Smith & Nephew

- Wright Medical Group N.V

- Advanced Orthopaedic Solutions

- Integra LifeSciences Corporation

- Acumed LLC

- Orthofix Holdings, Inc

- Medartis AG

- Corin

- Matrix Meditec Private Limited

Get Free Sample For

Get Free Sample For