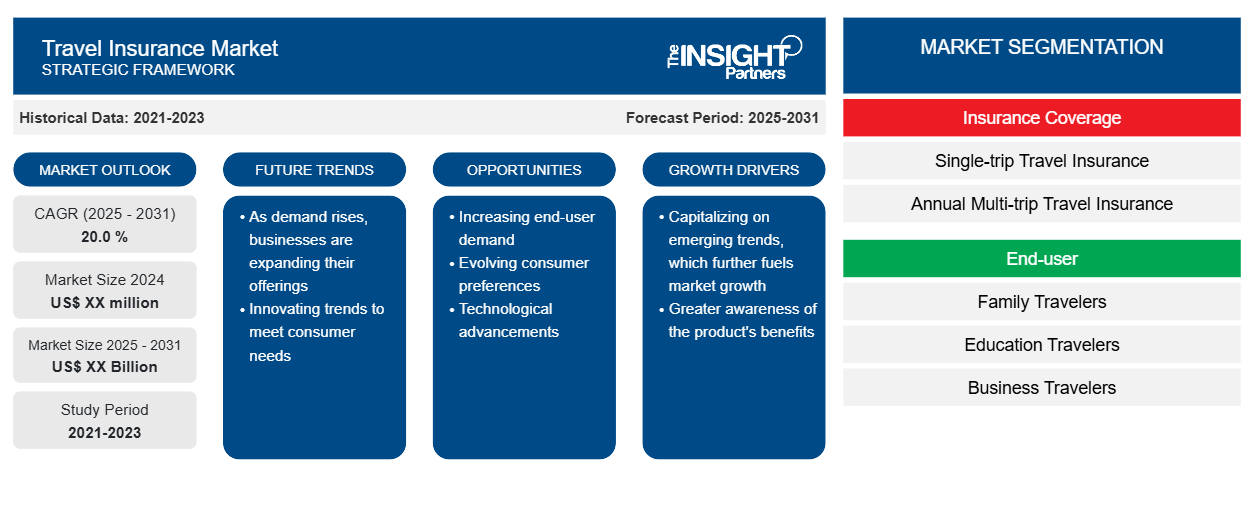

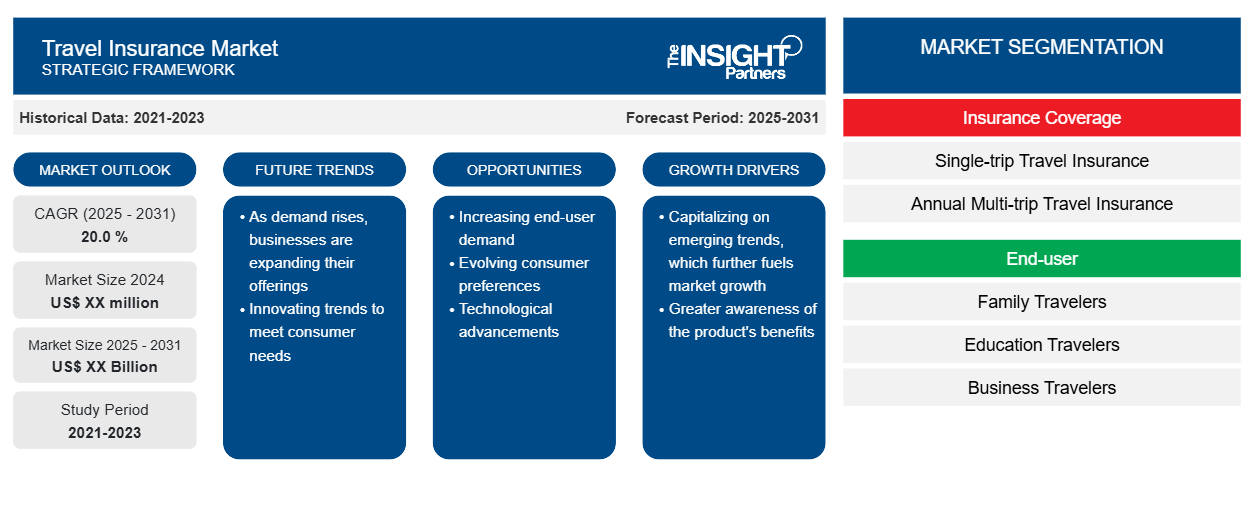

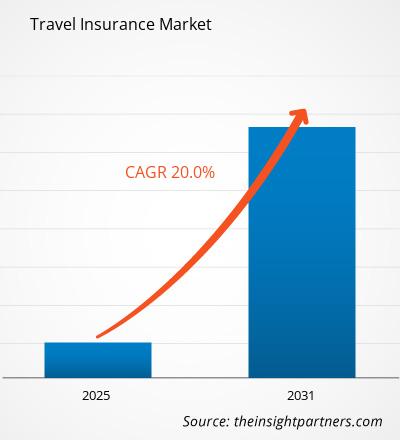

The travel insurance market is anticipated to expand at a CAGR of 20.0 % from 2025 to 2031. The rapid growth in tourism and the expansion of products and services in travel insurance policy is driving the travel insurance market growth.

Travel Insurance Market Analysis

The travel insurance market has experienced significant growth in recent years, driven by several key factors. One of the primary drivers is the increasing awareness among travelers about the importance of having comprehensive protection while traveling. With the rise in global travel, people are becoming more conscious of potential risks such as trip cancellations, medical emergencies, natural disasters, and even geopolitical events. Additionally, technological advancements have also played a crucial role in shaping the travel insurance market. The emergence of online booking platforms and mobile applications has made it easier for travelers to research, compare, and purchase travel insurance policies. Additionally, innovations in data analytics and risk assessment have enabled insurers to tailor their offerings to meet the specific needs of different types of travelers, whether they are backpackers, business travelers, or families on vacation.

Travel Insurance Industry Overview

- The travel insurance market refers to the sector within the insurance industry that offers coverage and assistance to travelers. It incorporates a broad range of products and services designed to mitigate risks and provide support for individuals or groups undertaking journeys, whether for leisure, business, or other purposes.

- Travel Insurance is perhaps the most common product within the travel insurance market. Travel insurance typically covers unforeseen events such as trip cancellations, medical emergencies, lost baggage, and travel delays. Policies can vary extensively in terms of coverage limits, exclusions, and premiums, allowing travelers to choose plans that best suit their budgets and needs.

- Many travel insurance providers offer round-the-clock assistance services to travellers in need. This can include access to medical professionals, emergency medical evacuation, assistance with travel arrangements in the event of cancellations or delays, and help with lost or stolen documents.

- Government regulations and international travel restrictions have also influenced the growth of the travel insurance market. As countries implement stricter entry requirements and health protocols, travellers are seeking insurance policies that offer coverage for potential disruptions to their plans.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Travel Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Travel Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Travel Insurance Market Driver and Opportunities

The increasing demand for tourism and technological development is fueling the demand for the travel insurance market.

- The increasing demand for tourism and technological development is significantly impacting the travel insurance market in several ways. Firstly, as more people travel for leisure and business, the risk of unforeseen events such as flight cancellations, medical emergencies, or lost luggage increases, driving up the demand for travel insurance. Additionally, technological developments have made it easier for travelers to book trips online, leading to a higher volume of travelers seeking insurance coverage through digital platforms.

- Technological developments have also facilitated the introduction of innovative insurance products tailored to the specific needs of modern travelers. For instance, some insurance companies now offer policies that cover risks associated with adventure sports, remote work, or digital nomadism, catering to niche segments of the travel market.

- Innovations in artificial intelligence and data analytics have enabled insurers to assess risks better and customize policies based on individual travel patterns and preferences. This personalized approach not only improves customer experience but also increases the relevance and value proposition of travel insurance, driving further demand.

Travel Insurance Market Report Segmentation Analysis

- Based on insurance coverage, the travel insurance market is segmented into single-trip travel insurance, annual multi-trip travel insurance. The single-trip travel insurance segment is anticipated to hold a substantial travel insurance market share in 2023.

- The single-trip travel insurance market has grown as a result of several services like baggage loss, emergency dental care, fire protection, personal liability coverage, trip interruption or cancellation, and many more.

Travel Insurance

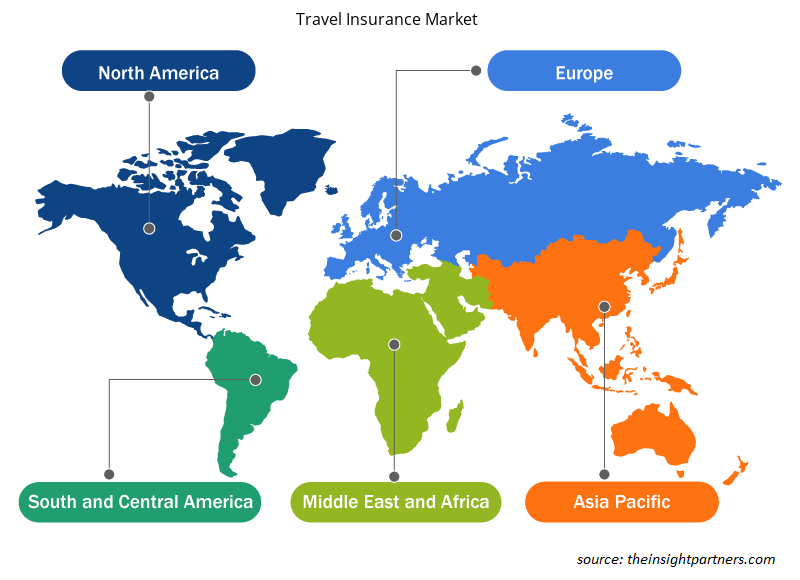

Market Share Analysis by Geography

The scope of the travel insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Europe is experiencing rapid growth and is anticipated to hold a significant travel insurance market share. It is anticipated to stay the biggest market as we advance, mostly due to the rising demand for travel and tourism in Europe. The industry is expected to develop as a result of the region's economic expansion as well as the growing benefits that travel insurance providers provide to regular customers. The European government has set mandatory rules and regulations that compel consumers to buy travel insurance services as a prerequisite to acquiring a VISA. In addition, the growth of the travel business and tourism has brought about a number of consumer-affecting events, including medical emergencies, lost luggage, and misplaced important documents. The region's growing need for travel insurance is further fueling the travel insurance market growth.

Travel Insurance Market Regional Insights

Travel Insurance Market Regional Insights

The regional trends and factors influencing the Travel Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Travel Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Travel Insurance Market

Travel Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Billion |

| Global CAGR (2025 - 2031) | 20.0 % |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insurance Coverage

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

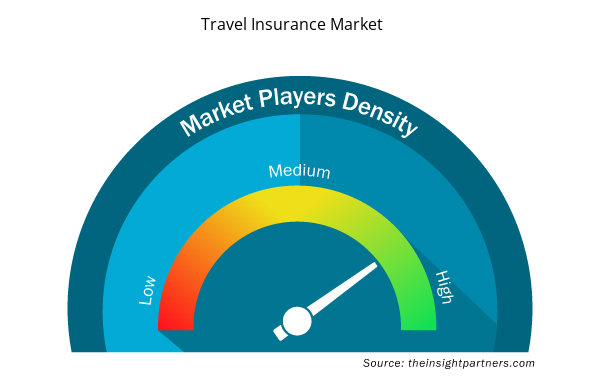

Travel Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Travel Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Travel Insurance Market are:

- Allianz Global Assistance(AGA Service Company)

- AXA SA

- American International Group, Inc.

- CSA Travel Protection DBA Generali Global Assistance and Insurance Services

- Insure and Go Insurance Services Limited

- Seven Corners Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Travel Insurance Market top key players overview

The report includes growth prospects in light of current travel insurance market trends and driving factors influencing the market growth. The " Travel Insurance Market Analysis" was carried out based on insurance coverage, end-user, and geography. In terms of insurance coverage, the market is segmented into single-trip travel insurance and annual multi-trip travel insurance. Based on end-users, the travel insurance market is segmented into family travelers, education travelers, business travelers, senior citizens, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Travel Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the travel insurance market. A few recent key market developments are listed below:

- In February 2024, Travel insurer Battle Face has teamed up with insurance.com.au. This new alliance enables clients of insurance.com.au to personalize their travel insurance to match their specific journey requirements, ensuring coverage that aligns with their intended destinations and activities. The partnership aims to simplify the insurance selection process, offering consumers a more tailored and flexible choice for securing their travel needs.

(Source: Company Website)

- In October 2023, Blink Parametric, a pioneer in real-time travel insurance solutions, entered a global agreement with MAWDY, an international insurance, reinsurance, and services firm and a part of the MAPFRE Group. The collaboration's purpose is to meet the growing demand for real-time travel insurance solutions, especially in instances of flight delays and cancellations, ensuring travelers are supported when they need it most.

(Source: Company Website)

Travel Insurance Market Report Coverage & Deliverables

The market report on “Travel Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The increasing demand for tourism and technological development are the major factors that propel the global travel insurance market.

The growing adoption of multigenerational travel is anticipated to play a significant role in the global travel insurance market in the coming years.

The key players holding majority shares in the global travel insurance market are Travelex Insurance Services Inc.; Bajaj Allianz; IMT SERVICES, LLC; Aviva; AXA Assistance.

The global alternative data market is expected to grow at a CAGR of 20% during the forecast period 2024 - 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. Allianz Global Assistance(AGA Service Company)

2. AXA SA

3. American International Group, Inc.

4. CSA Travel Protection DBA Generali Global Assistance and Insurance Services

5. Insure and Go Insurance Services Limited

6. Seven Corners Inc.

7. Travelex Insurance Services Inc.

8. TravelSafe Insurance

9. Trip Mate, Inc.

10. USI Affinity Travel Insurance Services

Get Free Sample For

Get Free Sample For