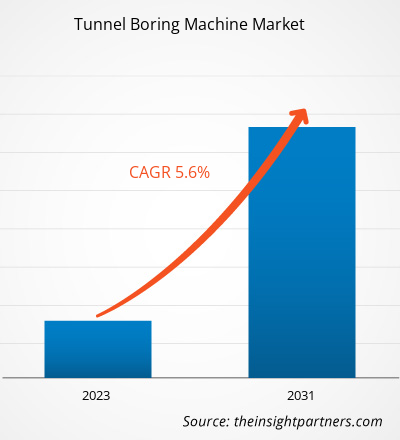

The tunnel boring machine market size is anticipated to reach US$ 9.7 billion by 2031 from US$ 6.3 billion in 2023. The tunnel boring machine market is expected to register a growth rate of 5.6% during 2023–2031. Rise in road infrastructure projects, increase in focus toward micro-tunneling, and technological advancement through automation and rock-cutting technology are among the key factors driving the tunnel boring machine market.

Tunnel Boring Machine Market Analysis

The tunnel boring machine market is anticipated to experience considerable growth during the analyzed timeframe owing to the rising number of construction projects as well as the rise in investment toward infrastructure development in developing and developed economies across the globe. Additionally, the growth of metals & mining and oil & gas industries across the globe is expected to raise the demand for tunnel boring machines for the exploration of wells. Moreover, tunnel boring machines are being increasingly deployed at construction sites to excavate tunnels in hilly areas or, in the case of underground construction.

Tunnel Boring Machine Market Overview

Tunnel boring machines are deployed in several major industries, such as oil & gas, infrastructure development, and metals & mining. The successful application of this machine depends on selecting suitable equipment and cutting tools for the ground conditions to be encountered. Growth in road infrastructure is one of the significant factors propelling the market. Rising government investment in railway projects is anticipated to drive the global tunnel boring machine market. For instance, in January 2021, the construction of the Fehmarnbelt tunnel between Denmark and Germany was initiated in Denmark. The project will be completed by 2029. The project would allow the development of the longest combined road and rail-immersed tube tunnel across the globe. In June 2019, China Railway Engineering Equipment Group Co., Ltd. introduced its tunnel boring machine, which was exported to Italy for a railway project connecting Milan and Verona. The machine has a diameter of 10.03 meters and a length of 155 meters; it weighs 1,800 tons. Increasing levels of industrialization and urbanization in developing economies due to population growth coupled with tunnel infrastructure upgrades and a rise in tunnel safety regulations are further expected to boost the tunnel boring machine market growth globally during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tunnel Boring Machine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tunnel Boring Machine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Tunnel Boring Machine Market Drivers and Opportunities

Increasing Road Infrastructure Projects

The global road infrastructure and construction industry is growing at a significant pace due to rising population and urbanization levels. An increase in government expenditure on infrastructure and growing road network extensions across all the countries are driving the global market. Spending on building and construction of new transport infrastructure in various potential countries and upgrades of existing infrastructure is fueling the demand for tunnel boring machines. Infrastructure upgrading activities, the development of smart cities, and the growing trend of tunnel automation are a few of the major factors fueling the global market. Several governments of major countries are involved in designing tunnels for smooth road transport and reduced travel times.

- In May 2023, the President's Fiscal Year 2024 Appropriations Plan added the Gateway Hudson River Tunnel Project to the list of projects recommended for CIG funding based on the expectation of its completion of all necessary steps in the engineering phase. It will be ready to receive a full funding grant agreement in fiscal year 2024.

- In recent years, the Indian government announced several government-funded infrastructure projects. These projects include the Bharatmala Pariyojana, the Narmada Valley Development Project, the Chenab River Railway Bridge, the Delhi Metro Industrial Corridor, the Mumbai Trans Harbor Link, the Inland Waterways Development Project, the Navi Mumbai International Project, and the Zoji-la and Z-Morh Tunnel Project. These projects aim to modernize India's infrastructure and improve the quality of life of its citizens.

Growing Rail Infrastructure Development across APAC

Tunnels are increasingly used for rail transportation in subways and metros across various APAC countries. Proper construction, management, and maintenance of tunnel systems involve monitoring of key parameters, such as ventilation, signaling, lighting, gas concentration, temperature, air velocity and direction, and emergency response. Developed economie and emerging economies are experiencing growth in the railway sector. Thus, the need for tunnel boring machines in APAC is anticipated to increase. Governments across the region are increasingly investing in developing rail infrastructure that comprises various tunnels in the route and is well equipped with smart devices.

For instance, a tunnel boring machine with a 13.1-meter-wide cutter head was used to dig India's first underwater rail tunnel as part of the Mumbai-Ahmedabad bullet train project. Previously, the largest TBM deployed in the country was 12.2 meters wide and was used to dig tunnels for Mumbai's coastal road project. Thus, the increasing number of rail projects in developed and developing economies and rising investments in new infrastructure development are a few of the key factors projected to offer ample growth opportunities to key players operating in the global tunnel boring machine market.

Tunnel Boring Machine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the tunnel boring machine market analysis are type, geology, and end user.

- Based on type, the tunnel boring machine market is divided into slurry TBM, earth pressure balance shield TBM, open gripper TBM, shielded TBM, multi-mode TBM, and others. The slurry TBM segment held the largest market share in 2023.

- In terms of geology, the tunnel boring machine market is segmented into soft ground, hard rock ground, and variable ground. The soft ground segment held the largest market share in 2023.

- By end user, the market has been segmented into transportation, metals & mining, oil & gas, and others. The transportation segment dominated the market in 2023.

Tunnel Boring Machine Market Share Analysis by Geography

The geographic scope of the tunnel boring machine market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Asia Pacific dominated the tunnel boring machine market in 2023. The market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The growth in building and construction of roads, railways, and other infrastructure development activities are projected to benefit the tunnel boring machine market in Asia Pacific. In APAC, market players are experiencing an increase in demand for their products owing to constant development in transportation and road & rail infrastructure. China and Japan are the leading economies in the APAC tunnel boring machine market. In India, Delhi Metro Rail Corporation is offering a Mass Rapid Transportation System (MRTS) network for Delhi City. The MRTS network is a mix of at-grade, elevated, and underground. For the underground network infrastructure, the tunnels were constructed by slurry-type shield machines. In the next phase of the project, the railway station will use nearly 14 tunnel boring machines to construct a tunnel with a diameter of 5.8 meters.

Tunnel Boring Machine Market Regional Insights

Tunnel Boring Machine Market Regional Insights

The regional trends and factors influencing the Tunnel Boring Machine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Tunnel Boring Machine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Tunnel Boring Machine Market

Tunnel Boring Machine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.3 Billion |

| Market Size by 2031 | US$ 9.7 Billion |

| Global CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

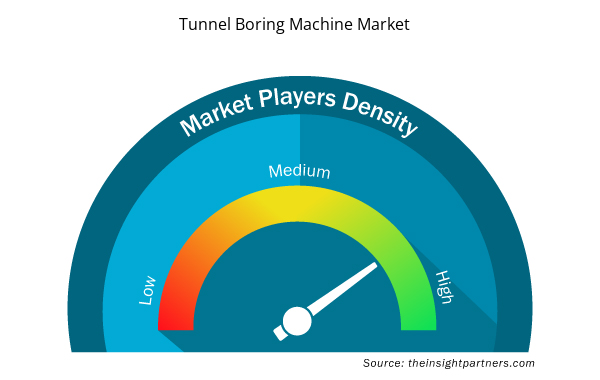

Tunnel Boring Machine Market Players Density: Understanding Its Impact on Business Dynamics

The Tunnel Boring Machine Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Tunnel Boring Machine Market are:

- China Railway Construction Heavy Industries Ltd.

- Kawasaki Heavy Industries Ltd

- CREG TBM Germany GmbH

- Terratec Ltd

- Herrenknecht AG

- Hitachi Zosen Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Tunnel Boring Machine Market top key players overview

Tunnel Boring Machine Market News and Recent Developments

The tunnel boring machine market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the tunnel boring machines market are listed below:

- In November 2023, the Valley Transportation Authority purchased a tunnel boring machine from Herrenknecht for its BART Silicon Valley Phase II project. This strategy has increased the customer base for Herrenknecht and strengthened the position of the company in this market.

- In August 2020, the largest tunnel boring machine by Herrenknecht AG ever used in Europe completed its drive in June. The supersize borer (Earth Pressure Balance Shield, diameter 15.87 meters) was manufactured by Herrenknecht.

Tunnel Boring Machine Market Report Coverage and Deliverables

The "Tunnel Boring Machine Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Tunnel boring machine market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Tunnel boring machine market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Tunnel boring machine market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the tunnel boring machine market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Geology , and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For