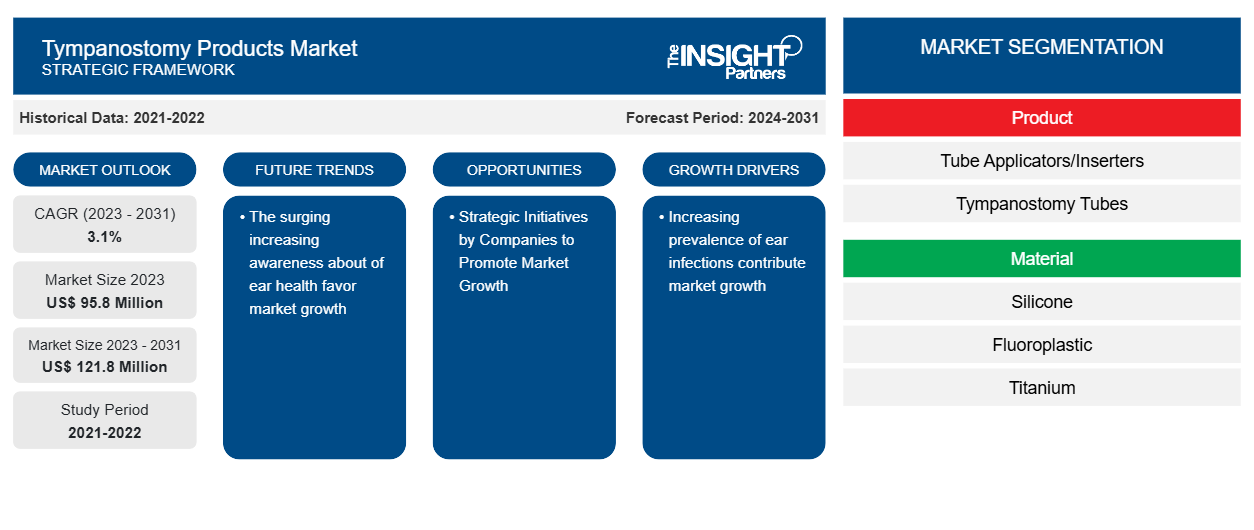

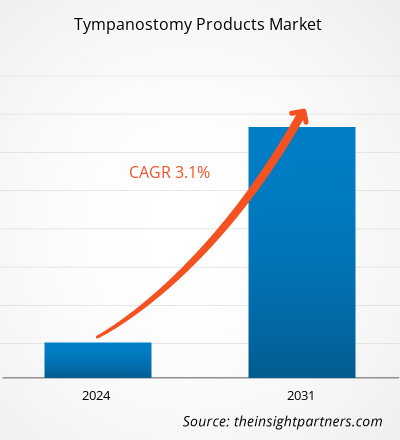

The tympanostomy products market size is projected to reach US$ 121.8 million by 2031 from US$ 95.8 million in 2023. The market is expected to register a CAGR of 3.1% during 2023–2031. Increasing technological advancements and rising investments are likely to continue as key trends in the market.

Tympanostomy Products Market Analysis

Tympanostomy is a surgical procedure that involves inserting small tubes (tympanostomy tubes) into the eardrum to drain fluid or relieve pressure from the middle ear. The procedure is commonly performed to treat conditions such as otitis media, chronic ear fluid, and hearing loss due to fluid buildup in the middle ear. The rising prevalence of ear infections and the burgeoning awareness about ear health are among the key factors bolstering the tympanostomy products market

Tympanostomy Products Market Overview

Ear health is an important aspect of the overall well-being of the human body. Often overlooked due to various reasons, ear infections remain a leading cause of hearing loss. However, these conditions can be prevented and managed with medical and surgical interventions. Ear infections can lead to impaired hearing, the spread of infection to skull and brain tissues and other nearby tissues, speech and developmental delays, and tearing of the eardrum, among other serious issues. The World Health Organization (WHO) observes March 03 as World Hearing Day to raise awareness on how to decrease cases of deafness and hearing loss, and promote ear care globally. In addition, the Hearing Health Sector Committee of the Australian Government developed the Roadmap for Hearing Health in 2019. The roadmap outlines recommended actions for all governments and the hearing sector to improve the ear health of Australians. Under the same initiative, the Australian government also launched the National Hearing Awareness campaign in 2023 to raise awareness of the importance of ear health and prevent unavoidable hearing loss. Thus, initiatives taken to create awareness about ear health bolster the growth of the tympanostomy products market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tympanostomy Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tympanostomy Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Tympanostomy Products Market Drivers and Opportunities

Surging Incidence of Ear Infections Favors Market Growth

Ear infections are more common in young children than adults. They can affect people with weakened immune systems, chronic skin conditions (such as psoriasis), and respiratory tract infections; these conditions are also common in individuals spending a lot of time in water. Otitis media (OM) is a type of ear infection that occurs in the middle ear and can affect the auditory system and ear structures. Children aged less than 6 are frequently affected by OM due to developing immune systems and anatomical structures. According to the article “A Pediatrician Explains a Spike in Ear Infections After COVID-19 Restrictions Lifted,” nearly 25% of children suffer from ear infections at the age of 1, whereas ~60% of children suffer from ear infections by the age of 5. As per the article “Effect of Ear Infections on Hearing Ability: A Narrative Review on the Complications of Otitis Media,” published in the National Library of Medicine (NLM), the yearly incidence of acute otitis media (AOM) is ~11% globally (i.e., nearly 700 million people). Children account for a huge share of those infected, accounting for more than 50% of the cases. In all, nearly 31 million people with AOM develop chronic suppurative otitis media (CSOM) each year, including >7 million children. Hearing loss affects more than 50% of individuals with CSOM, i.e., ~0.3% of the global population. Tympanostomy, a minor surgical procedure, is generally performed to remove the chronic fluid accumulated behind the eardrum to improve hearing and reduce the frequency of recurrent middle ear infections. Thus, the increasing incidence of ear infections such as OM in children, which may further cause hearing loss, fuels the growth of the tympanostomy products market.

Strategic Initiatives by Companies to Promote Market

Small and big companies operating in the tympanostomy products market adopt various strategies such as geographic expansion, new product launches, and technological advancements to boost their revenues. A few recent developments in the market are mentioned below.

- In April 2024, Integra Lifesciences Holding Corporation completely acquired Acclarent, an ENT division of J&J Medtech. With this acquisition, the company eyes to build a leadership position in the complementary ENT device segment. The addition of Acclarent's innovative product portfolio allows Integra to expand its market-leading brands and provides immediate scale and accretive growth via a dedicated sales channel.

- In February 2023, KARL STORZ acquired AventaMed DAC, an Irish medical technologies company. With this merger, the company acquired a new device called Solo+ TTD. This handheld device complements the treatment of otitis media, a condition that can cause hearing loss. The device comes with a ventilation tympanostomy tube that is pre-loaded at the tip.

- In August 2022, Preceptis Medical Inc received clearance from the US FDA for the expanded indication of use for the Hummingbird Tympanostomy Tube System (TTS) for office-based pediatric ear tube procedures. The product was previously cleared for use in children aged 6–24 months, and the new usage indication allows in-office procedures for all children aged more than 6 months. The Hummingbird TTS uniquely combines the separate tools and steps performed in standard ear tube procedures into one comprehensive device.

Therefore, the active participation of market players in product launches, expansions, partnerships, and mergers and acquisitions creates lucrative opportunities in the tympanostomy products market.

Tympanostomy Products Market Report Segmentation Analysis

Key segments that contributed to the derivation of the tympanostomy products market analysis are component, type, extremity, application, mobility, and end user.

- Based on product, the market is bifurcated into tympanostomy tubes and tube applicators/inserters. The tube applicators/inserters segment held a larger share of the tympanostomy products market in 2023.

- Based on material, the tympanostomy products market is segmented into silicone, fluoroplastic, titanium, and stainless steel. The silicone segment held the largest share of the market in 2023

- Based on application, the tympanostomy products market is classified into acute otitis media, recurrent otitis media with effusion, and others. The acute otitis media segment held the largest share of the market in 2023.

- Based on end user, the market is fragmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment held the largest share of the tympanostomy products market in 2023.

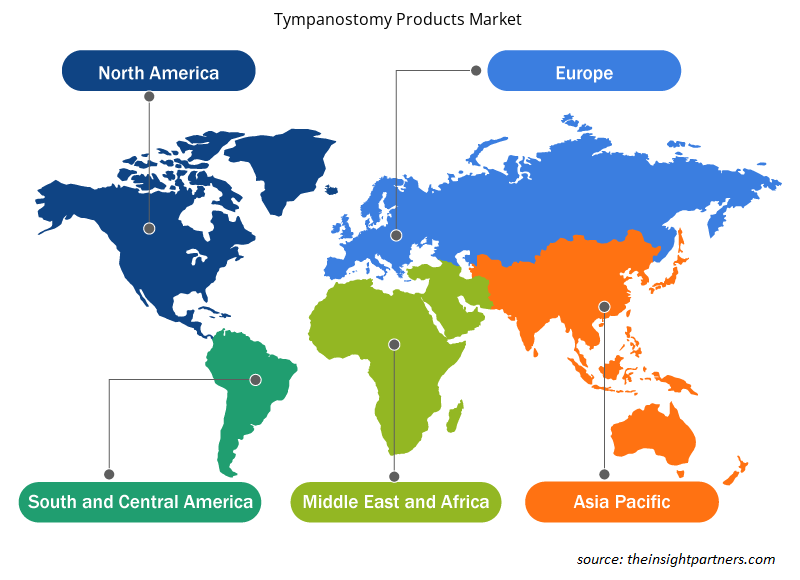

Tympanostomy Products Market Share Analysis by Geography

The geographic scope of the tympanostomy products market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America tympanostomy products market is segmented into the US, Canada, and Mexico. The rising adoption of technologically advanced products, a rise in research and development activities, presence of large healthcare businesses, and increasing approvals from the FDA for tympanostomy products are among the key factors propelling the growth of the tympanostomy products market in North America.

Tympanostomy Products Market Regional Insights

The regional trends and factors influencing the Tympanostomy Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Tympanostomy Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Tympanostomy Products Market

Tympanostomy Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 95.8 Million |

| Market Size by 2031 | US$ 121.8 Million |

| Global CAGR (2023 - 2031) | 3.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

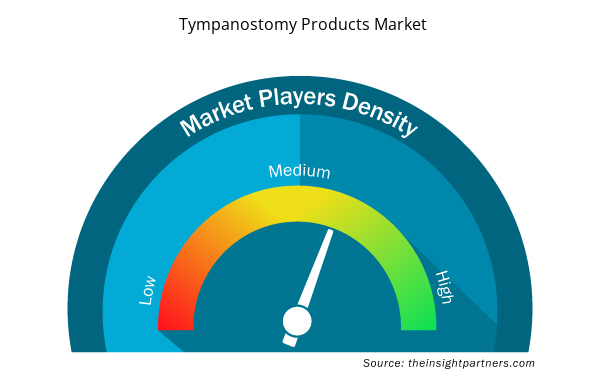

Tympanostomy Products Market Players Density: Understanding Its Impact on Business Dynamics

The Tympanostomy Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Tympanostomy Products Market are:

- Olympus America,

- Medtronic,

- Summit Medical,

- GRACE MEDICAL,

- Preceptis Medical,

- Atos Medical,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Tympanostomy Products Market top key players overview

Tympanostomy Products Market News and Recent Developments

The tympanostomy products market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Integra LifeSciences Holdings Corporation announced the successful acquisition of Acclarent, Inc., a pioneer in ear, nose and throat (ENT) surgical interventions. The addition of Acclarent's innovative product portfolio expanded the breadth of Integra’s market-leading brands. Moreover, it provides immediate scale and accretive growth avenues to Integra through a dedicated sales channel. The acquisition added US$ 1 billion to the total addressable market of the company’s offerings. (Source: Integra LifeSciences Holdings Corporation, Company Website, April 2024)

- Preceptis Medical, Inc. collaborated with a large Medicaid payer to expand access to its Hummingbird in-office ear tube procedure for children. This would help healthcare facilities to meet the increased demand for ear tubes caused by the COVID-19 pandemic and reduce operating room schedules and delays in care for pediatric patients. The pilot program has the potential to increase access to healthcare and address health equity challenges faced by Medicaid populations. (Source: Preceptis Medical, Inc; Company Website; December 2023)

Tympanostomy Products Market Report Coverage and Deliverables

The “Tympanostomy Products Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Tympanostomy products market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Tympanostomy products market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Tympanostomy products market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the tympanostomy products market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America dominated the market in 2023.

The increasing prevalence of ear infections and the surging awareness of ear health are the key factors propelling the market.

Technological advancements and rising investments are likely to persist as key trends in the tympanostomy products market.

Olympus America, Medtronic, Summit Medical, GRACE MEDICAL, Preceptis Medical, Atos Medical, Medasil Surgical Ltd, Adept Medical Limited, Smith and Nephew Plc, Integra Life Science, and Karl Stroz SE & Co Kg are among the key players operating in the market.

The market is anticipated to record a CAGR of 3.8% during 2023–2031.

The tympanostomy products market value is estimated to reach US$ 121.8 million by 2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies- Tympanostomy Products Market

- Olympus America

- Medtronic

- Summit Medical

- GRACE MEDICAL

- Preceptis Medical

- Medasil Surgical Ltd

- Adept Medical Limited

- Smith and Nephew Plc

- Integra Life Science

- Karl Stroz SE & Co Kg

Get Free Sample For

Get Free Sample For