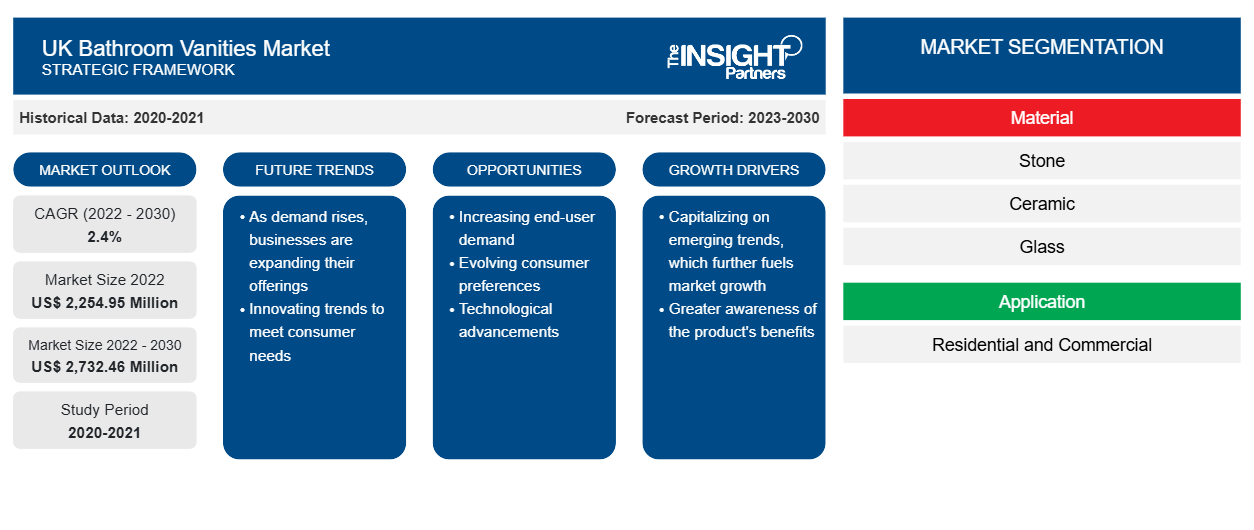

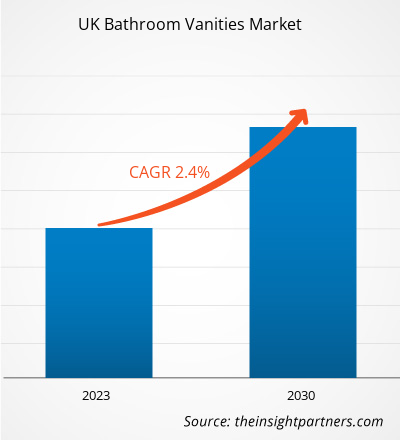

The UK bathroom vanities market size was valued at US$ 2,254.95 million in 2022 and is projected to reach US$ 2,732.46 million by 2030; it is expected to register a CAGR of 2.4% from 2022 to 2030.

Market Insights and Analyst View:

Bathroom vanities are cabinets or storage units typically found in bathrooms. They serve a dual purpose, providing storage space for toiletries, towels, and other bathroom essentials while also housing a sink and a countertop. Under the report scope, we have considered bathroom vanity units that have attached sinks and countertops. Bathroom vanities come in various styles, sizes, and materials, allowing consumers to choose one that suits their aesthetic preferences and functional needs. They are a key element of bathroom design and can enhance both the functionality and appearance of a bathroom.

Growth Drivers and Challenges:

The increase in housing construction and renovations in the UK has significantly impacted the bathroom vanities market. As more people invest in upgrading or constructing new homes, the demand for modern and aesthetically pleasing bathroom fixtures, including vanities, has surged. Homeowners and property developers alike are keen on creating stylish and functional bathrooms. According to a recent survey, more than half of homeowners in the country renovated in 2021, up four percent from 49% in 2020. The most popular projects were painting (36%), followed by the kitchen (34%) and bathroom (32%) renovations.

One key driver of this trend is the desire for increased property value. Homeowners recognize that well-designed bathrooms can significantly enhance their homes' overall appeal and value. Consequently, they are willing to invest in high-quality bathroom vanities that serve practical purposes and contribute to their properties' overall aesthetics. This focus on property value appreciation has propelled the demand for bathroom vanities as an integral part of the home improvement industry.

The shift in consumer preferences toward more extensive and luxurious bathrooms has further boosted the demand for bathroom vanities. With larger bathrooms becoming a common feature in modern homes, there is a growing need for spacious and well-equipped vanities that accommodate double sinks, ample storage space, and various design elements. Manufacturers in the UK have responded to this demand by offering a wide range of vanity options, catering to different design tastes and spatial requirements.

The increased awareness of sustainability and eco-friendly products has also influenced the bathroom vanities market. Many consumers are now seeking vanities made from sustainable materials and featuring energy-efficient fixtures. Manufacturers have recognized this demand and are producing eco-friendly bathroom vanities, which align with environmental concerns and attract a niche market segment. Thus, the surge in house constructions and renovations is propelling the UK bathroom vanities market

Bathroom vanity products are made of various materials such as wood, medium-density fiber (MDF), timber, metal, ceramic, glass, and stone. Wood is a widely used material in bathroom vanities; hence, any significant price fluctuations in this material cause dramatic changes in the production of bathroom vanities. Wood product prices have increased with the increase in construction activities. Furthermore, C24-treated timber is a high-strength timber that is commonly used in bathroom vanities. The demand for this product has increased due to a surge in construction activity across the UK, but the supply has been impacted by various factors, including reduced imports from overseas and increased transportation costs. As a result, the cost of C24-treated timber has risen by 12% since the beginning of the year 2023. Hence, the fluctuations in core raw material prices hinder market growth as this factor highly impacts production costs.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UK Bathroom Vanities Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UK Bathroom Vanities Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The UK bathroom vanities market is segmented on the basis of material and application. Based on material, the UK bathroom vanities market is segmented into stone, ceramic, glass, wood, and metal. By application, the UK bathroom vanities market is segmented into residential and commercial.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on material, the UK bathroom vanities market is segmented into stone, ceramic, glass, wood, and metal. The wood segment holds a significant share of the UK bathroom vanities market and is expected to grow significantly during the forecast period. Wood is primarily used in bathroom vanities due to its lightweight, durability, easy maintenance, and availability. Also, the material provides a great extent of customization and an aesthetic view of bathroom vanity products. Thus, the abovementioned factors contribute significantly to the UK bathroom vanities market growth for the wood segment.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the UK bathroom vanities market are listed below:

- In September 2021, Roxor Group Ltd announced the launch of Nuie's 3D Design Tool. The 3D design tool aids in updating the bathroom and can help to see if it's suitable for customers' preferences before committing to installing a new bathroom. It has both traditional and modern options. The 3D design tool is quick and easy to use.

- In August 2020, Roxor Group Ltd entered into a partnership. The Yorkshire-based bathroom brand Nuie, part of the Roxor Group, signed a sponsorship deal with Halifax Town FC.

COVID-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel bans, and business shutdowns in leading countries in the UK negatively affected the growth of various industries, including the consumer goods industry. The shutdown of manufacturing units disturbed supply chains, manufacturing activities, delivery schedules, and sales of various essential and nonessential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in the country on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. All these factors hampered the consumer goods industry in 2020 and early 2021, thereby restraining the growth of the UK bathroom vanities market.

Competitive Landscape and Key Companies:

Hawkers Ltd, Kohler Co, C P Hart & Sons Ltd., Roca Sanitario SA, Inter IKEA Holding BV, Roxor Group Ltd., Geberit AG, Villeroy & Boch AG, Harvey George Ltd., and Duravit AG are a few prominent players operating in the UK bathroom vanities market. These market players are adopting strategic development initiatives to expand, further driving the UK bathroom vanities market growth.

UK Bathroom Vanities Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,254.95 Million |

| Market Size by 2030 | US$ 2,732.46 Million |

| Global CAGR (2022 - 2030) | 2.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | United Kingdom

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Retinal Imaging Devices Market

- Batter and Breader Premixes Market

- Small Molecule Drug Discovery Market

- Playout Solutions Market

- Animal Genetics Market

- Aircraft Wire and Cable Market

- Vision Guided Robotics Software Market

- Adaptive Traffic Control System Market

- Dried Blueberry Market

- Artwork Management Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - UK Bathroom Vanities Market

- Hawkers Ltd

- Kohler Co

- C P Hart & Sons Ltd.

- Roca Sanitario SA

- Inter IKEA Holding BV

- Roxor Group Ltd.

- Geberit AG

- Villeroy & Boch AG

- Harvey George Ltd.

- Duravit AG

Get Free Sample For

Get Free Sample For