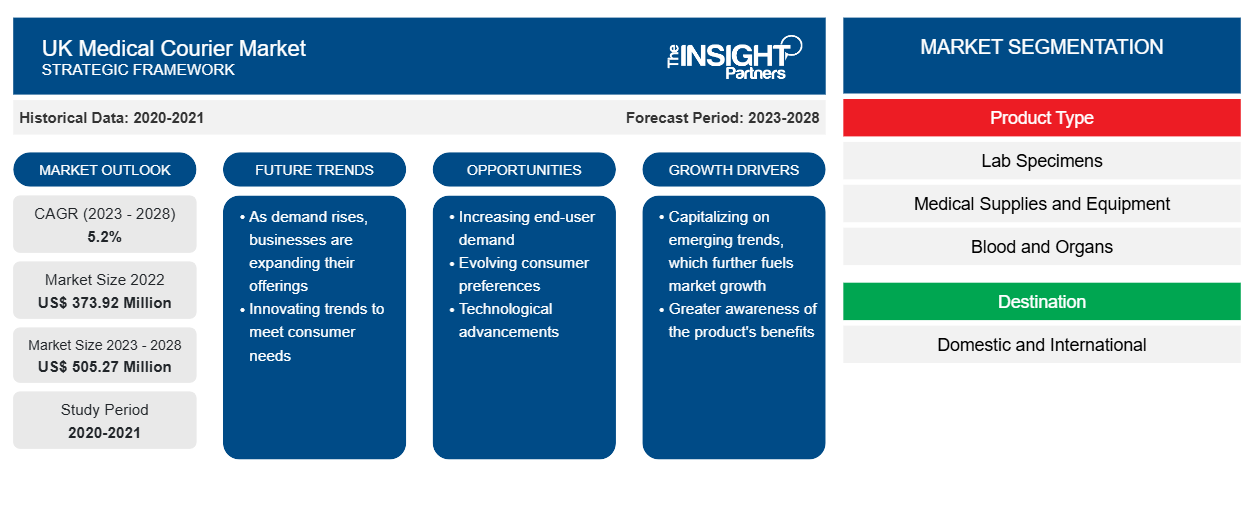

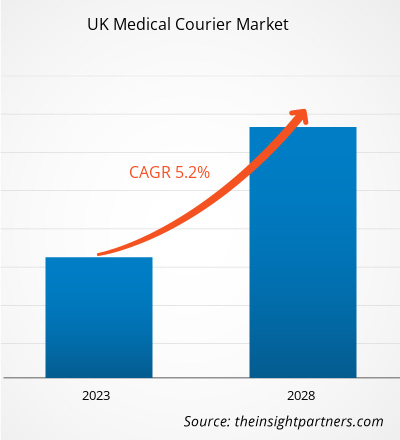

The medical courier market size is expected to reach US$ 505.27 million in 2028 from US$ 373.92 million in 2022; it is estimated to record a CAGR of 5.2% from 2023 to 2028.

Analyst Perspective:

An increase in medical equipment e-commerce websites, effective implementation of e-commerce strategies by medical device manufacturers, sales and marketing teams moving to online channels, and growing preference for home deliveries from the millennial and elderly population are contributing to the growth of the medical courier market

Market Overview

A medical courier allows the movement from one place to another, often from the collection point of a sample, urine, blood, etc., to the healthcare facility centers where the tests are performed. Medical courier companies offer collection and delivery of pathology samples services from regional hospitals to centralized laboratories. Usually, such samples are time-sensitive and require a prompt transfer between doctors, clinics and hospitals, and biochemistry labs. Medical courier services can be offered across borders with medical test samples, delivery reagents, kits, medical equipment and many more products to research, pharmaceutical, and biotechnology companies. The growth of the medical courier market is primarily driven by accelerated increasing incidence of road accidents and growing number of surgeries and rising prevalence of chronic diseases. However, delay in deliveries due to shortage of skilled truck drivers hinder the growth of market.

The medical courier market is segmented on the basis of product type, destination, service, end user, and country. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the competitive landscape analysis of the leading market players across the world.

Medical Courier Market -

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UK Medical Courier Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UK Medical Courier Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights – Medical Courier Market

Increasing Incidence of Road Accidents and Growing Number of Surgeries

Surgery is one of the most important treatments the National Health Service (NHS) offers in secondary care in the UK. According to NHS, approximately 2.5 million units of blood are transfused annually in the UK. The source also stated that during 2021–2022, nearly 4.400 transplants took place, and about 7,000 people are currently on the UK Transplant Waiting List.

In recent years, road traffic has increased significantly in the UK, leading to a surge in road accidents and fatalities, further driving the demand for hospital supplies. For instance, as per the Department for Transport June 2021 report published by the UK government, 115,333 casualties of all severities were reported in 2020, of which 22,014 were seriously injured and 91,847 were slightly injured casualties.

Furthermore, in February 2023, NHS announced that an estimated 780,000 additional surgeries and outpatient appointments would be provided at 37 new surgical hubs, 10 expanded existing hubs, and 81 new theaters dedicated to elective care as part of its biggest and most ambitious catch-up plan. Under the Targeted Investment Fund, almost 600 new beds (584) specifically for elective care, dozens of elective theaters delivering state-of-the-art treatment, and nearly 90 more critical care beds nationwide will be provided. Since the elective recovery plan was published in 2022 the NHS has offered 13.5 million elective appointments and treatments—9% higher than 2022. Further, elective care was delivered to 70,000 more patients in November compared to the pre-pandemic period.

Thus, with rising road accidents, the demand for blood transfusion and organ transplants is also surging, thus propelling the market for medical couriers.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product Type Insights

The UK medical courier market, based on product type, is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The lab specimens segment is anticipated to register the highest CAGR in the market during the forecast period. Increase in number of medical logistics companies offering home sample collection and delivery services is the key factor driving the growth of the lab specimens segment.

Medical Courier Market, by Product Type – 2022 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Destination Insights

The UK medical courier market, by destination, is categorized into domestic and international. The domestic segment held the largest market share in 2022 and international is anticipated to register the highest CAGR of during the forecast period.

Service Insights

The UK medical courier market, by service type, is bifurcated into standard services and rush and on-demand services. The standard services segment held a larger market share in 2022 and rush and on-demand services are anticipated to register the highest CAGR during the forecast period.

End User Insights

The UK medical courier market, based on end user, is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The hospitals and clinics segment held the largest share of the market in 2022 and in home support is anticipated to register the highest CAGR in the market during the forecast period.

The UK medical courier market majorly consists of the players such as companies ERS Transition Ltd, Send Direct Ltd, Med Logistics Group Ltd, CitySprint (UK) Ltd, United Parcel Service Inc, FedEx Corp, Aylesford Couriers Ltd, Reliant Couriers & Haulage Ltd, Coulson Ventures Ltd, and Deutsche Post AG. among others. These companies focus on various growth strategies, such as product launches, and acquisitions among others to retain their position in the UK market. Companies are investing in the expansion to increase their customer base and grow their presence across the globe. Recently, various market players have adopted the expansion and acquisition strategies. A few strategies by market players are listed below:

- In April 2022, FedEx Express, a subsidiary of FedEx Corp. and the world’s largest express transportation company, has expanded its operations at Newcastle International Airport, to serve growing export and import demands in the region. The new facility supports an upgrade to a FedEx-branded B737-400 aircraft, which is three times the size of its current ATR72 aircraft.

- In July 2022, DHL announced plans to invest £482m across its UK e-commerce operation, DHL Parcel UK. The investment comes following a 40% volume uplift since the start of 2020 and soaring demand for its e-commerce and B2B services. The new facility will have the capacity to handle over 500k items per day.

- In February 2023, ERS Medical merged with E-zec to expand their breadth of service expertise. The merger will create opportunities for both companies by combining operational best practice, expertise and high standards. The expanded business is expected to enlarge their business through delivering further opportunities for their employees, customers. In addition, the merger will be a better support for those who need the services most in the communities.

- In April 2023, Diamond logistics partnered with Hemel Logistics located in Hemel Hempstead. With this expansion in the South-East regionthe company can extend its range of same day, next day, and international delivery solutions to a larger pool of enterprises in the locality.

UK Medical Courier Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 373.92 Million |

| Market Size by 2028 | US$ 505.27 Million |

| Global CAGR (2023 - 2028) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | United Kingdom

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Automotive Fabric Market

- Sterilization Services Market

- Drain Cleaning Equipment Market

- Pharmacovigilance and Drug Safety Software Market

- Sleep Apnea Diagnostics Market

- Helicopters Market

- Europe Surety Market

- Genetic Testing Services Market

- Lyophilization Services for Biopharmaceuticals Market

- Greens Powder Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Destination, Service, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Medical courier is the supply of samples and equipment related to healthcare and medical requirements can sometimes be urgent and critical. A medical courier allows the movement from one place to another, often from the collection point of a sample, urine, blood, etc., to the healthcare facility centres where the tests are performed. Usually, such samples are time-sensitive and require a prompt transfer between doctors, clinics and hospitals, and biochemistry labs. Medical courier services can be offered across borders with medical test samples, delivery reagents, kits, and more products to research, pharmaceutical, and biotechnology companies. The report covers detailed insights with respect to the services offered by the market players operating in the sector.

The UK medical courier market majorly consists of the players such as ERS Transition Ltd, Send Direct Ltd, Med Logistics Group Ltd, CitySprint (UK) Ltd, United Parcel Service Inc, FedEx Corp, Aylesford Couriers Ltd, Reliant Couriers & Haulage Ltd, Coulson Ventures Ltd, and Deutsche Post AG.

The growth of the medical courier market in the UK is estimated to grow owing to key driving factor such as increasing incidence of road accidents and growing number of surgeries and rising prevalence of chronic diseases. However, delay in deliveries due to shortage of skilled truck drivers are hindering the growth of the market during the forecast period.

The UK medical courier market is analyzed on the basis of product type, destination, service type, and end user. Based on product type, the segment is bifurcated into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The segment is anticipated to register the highest CAGR in the market during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - UK Medical Courier Market

- ERS Transition Ltd

- Send Direct Ltd

- Med Logistics Group Ltd

- CitySprint (UK) Ltd

- United Parcel Service Inc

- FedEx Corp

- Aylesford Couriers Ltd

- Reliant Couriers & Haulage Ltd

- Coulson Ventures Ltd

- Deutsche Post AG

Get Free Sample For

Get Free Sample For