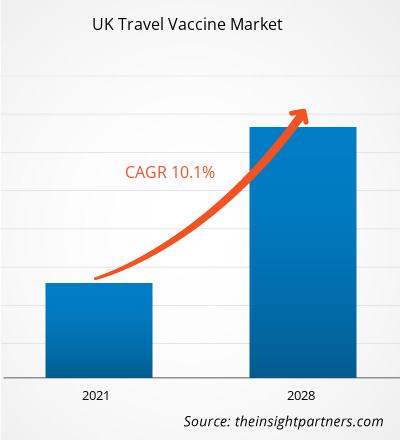

The UK travel vaccine market is expected to grow from US$ 267.56 million in 2021 to US$ 524.88 million by 2028; it is estimated to grow at a CAGR of 10.1% from 2021 to 2028.

Travel vaccines, also called travel immunizations, are shots travelers get before visiting certain areas of the world that help protect them from developing serious illnesses. Vaccinations work by exposing the body to a weakened/dead germ or part of a germ of the disease. These vaccines are recommended to protect against diseases endemic to the country of origin or destination. It is intended to protect travelers and prevent disease spread within or between countries. In many cases, countries require proof of vaccination for travelers wishing to enter or exit the country.

The UK travel vaccine market is segmented based on product and application. Based on product, the market is segmented into hepatitis A, hepatitis B, meningococcal vaccines, and others. In terms of application, the market is bifurcated into domestic travel and outbound travel. This report offers insights and in-depth analysis of the market, emphasizing parameters, such as market trends and dynamics, along with the competitive analysis of the leading market players in the UK.

Market Insights

Growing Incidence of Infectious Diseases and Increasing Travel and Tourism Drive UK Travel Vaccine Market

Hepatitis, HIV/AIDS, human papillomavirus (HPV), meningococcal disease, typhoid, and yellow fever are among the various chronic diseases that are detected worldwide. According to the World Health Organization (WHO), ~500 million people are likely to get infected by hepatitis B or C in 2021. Infectious diseases still heavily burden society and health. Infectious diseases continue to have a continuous impact due to the growing movement of people and commerce. While infectious diseases have a larger impact on mortality in underdeveloped countries, they have high financial, social, and health and well-being costs in England. About a third of general practitioner (GP) visits for adults and half of GP visits for children in the UK are for infectious disorders. With 7% of deaths and USD 40.73 billion (GBP 30 billion) in yearly expenses, infectious diseases represent a substantial strain on the UK's health system and economy.

Moreover, hospital admissions for other infectious diseases have significantly increased during the past 20 years, followed by those for other bacterial infections. In 2020, 106,890 people were living with HIV in the UK, including 97,740 in England, according to the UK government report. An estimated 5,150 (4.8%) of the total number of cases in the UK were undiagnosed and ignorant of their infection. The travel vaccines include routine vaccines for review before traveling, vaccines for certain destinations, and vaccines demanded by the country.

A few examples of developments that have promoted the growth of the UK travel vaccine market are listed below:

- In December 2021, Emergent BioSolutions Inc. announced the first participant dosed in its phase 1 study, EBS-UFV-001, evaluating the safety, tolerability, and immunogenicity of the company’s investigational universal influenza vaccine candidate. The current version of the influenza vaccine candidate contains multiple components intended to induce broad and supra-seasonal immunity against influenza A viruses.

- In June 2021, the first doses of Seqirus’s enhanced influenza vaccine, destined for the UK, came off a new high-speed fill-and-finish line in Liverpool. Seqirus Liverpool produces over 50 million doses of seasonal influenza vaccine each year, with the ability to increase production to 200 million doses in the event of an influenza pandemic.

- In March 2021, Sanofi invested more than USD 704.26 million (EUR 600 million) in a new vaccine manufacturing facility at its existing site in Toronto, Canada. The investment in a new facility provided additional antigen and filling capacity for Sanofi’s Fluzone High-Dose Quadrivalent influenza vaccine, helping to increase supply availability in Canada, the US, and Europe.

- In January 2021, Dynavax Technologies Corporation—a biopharmaceutical company focused on developing and commercializing vaccines—announced the final immunogenicity and interim safety results of the ongoing clinical trial evaluating HEPLISAV-B [Hepatitis B Vaccine (Recombinant), Adjuvanted] in patients undergoing hemodialysis.

- In June 2020, Sanofi made significant investments in France to increase its vaccine research and production capacities and contribute to responding to future pandemic risks. Aligned with its corporate strategy presented in December, Sanofi invested EUR 610 million to create a new production site and research center in France, both dedicated to vaccines.

- In April 2020, Sanofi received approval from the US Food and Drug Administration (FDA) for a Biologics License Application for MenQuadfi Meningococcal (Groups A, C, Y, W) Conjugate Vaccine for the prevention of invasive meningococcal disease.

- In February 2020, Abbott introduced a new inactivated quadrivalent vaccine for influenza in India. The new vaccine is the first of its kind subunit vaccine delivering protection against four virus strains in India. It is the only 0.5 ml quadrivalent flu vaccine in India that has been approved for usage in children below 3 years.

Product Insights

Based on application, the UK travel vaccine market is segmented into domestic travel and outbound travel. The outbound travel segment is expected to hold the largest share of the market in 2021. Outbound travel is the act of traveling outside of the home country for leisure, business, or other purposes. Many people travel internationally for business purposes. The number of visits abroad from the UK dropped sharply in 2020 over the previous year due to the COVID-19 pandemic, then fell further in 2021. That year, holidays accounted for the best outbound visits, with roughly 8.9 million trips made for this purpose. However, the number of vacations abroad only accounted for 15% of the holiday trips made in 2019. Overall, the number of visits abroad from the UK was approximately 19 million in 2021. Spending on trips abroad by residents of the UK increased by 12% in 2021 over the previous year, after dropping sharply in 2020 due to the pandemic. Overall, the outbound tourism expenditure within the UK amounted to roughly US$ 20.7 billion in 2021, rising from US$ 18.73 billion in 2020 but remaining way below pre-pandemic levels. While the outbound expenditure slightly recovered in 2021, the number of visits abroad from the UK declined further compared to the first year of the crisis. In 2022, in a Travel Leaders Group survey, 24% of Americans stated they planned to travel to Europe. Additionally, it is expected that the tourist arrivals are expected to increase steadily in regions such as Asia and Europe.

Traveling outside the country requires immunization as a safety and precautionary measure to avoid the spread of infections from one to another. The WHO recommends some routine vaccinations for all travelers and specific vaccinations for travelers to regions with a high risk of specific diseases.

UK Travel Vaccine Market, by Application – 2021 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product Insights

Based on product, the UK travel vaccine market is categorized into hepatitis A, hepatitis B, meningococcal vaccines, and others. Meningococcal disease is a severe infection caused by Neisseria meningitides and includes meningitis and sepsis. Meningococci reside in the throat and nose of some people (known as carriers) without causing symptoms. However, infection is more common in those who have never been exposed to meningococci before rather than in carriers. Most people with a meningococcal infection feel very ill and show symptoms like fever, headache, red rash, stiff neck, nausea, vomiting, and sensitivity to light. Infection is transferred through direct contact with an infected person's nasal and throat secretions and by carriers. Asymptomatic carriage is transient and typically affects about 5–10% of the population at any given time.

The Advisory Committee on Immunization Practices (ACIP) recommends routine administration of a quadrivalent meningococcal conjugate vaccine (MenACWY) for all people aged 11–18. A booster dose should be given to international travelers at risk for meningococcal illness who have previously received a quadrivalent vaccine. Furthermore, the risk of meningococcal infections and outbreaks can be reduced if appropriate awareness and measures are implemented before travel. Identifying travelers at increased risk of meningococcal disease and vaccinating them is an effective strategy to prevent disease among travelers or their families, especially with the availability of novel conjugate vaccines.

Travel Vaccine – Market Segmentation

The UK travel vaccine market is segmented based on product and application. Based on product, the market is segmented into hepatitis A, hepatitis B, meningococcal vaccines, and others. In terms of application, the market is bifurcated into domestic travel and outbound travel.

Company Profiles

- GlaxoSmithKline plc.

- Merck & Co., Inc.

- Sanofi

- Novartis AG

- Pfizer Inc.

- Dynavax Technologies

- Emergent BioSolutions Inc.

- Abbott

- Valneva SE

- SEQIRUS

UK Travel Vaccine Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 18.73 Billion |

| Market Size by 2028 | US$ 524.88 Million |

| Global CAGR (2021 - 2028) | 10.1% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | United Kingdom

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK

Frequently Asked Questions

Travel vaccines, also called travel immunizations, are shots travelers get before visiting certain areas of the world that help protect them from developing serious illnesses. Vaccinations work by exposing the body to a weakened/dead germ or part of a germ of the disease. These vaccines are recommended to provide protection against diseases endemic to the country of origin or of the destination. It is intended to protect travelers and to prevent disease spread within or between countries. In many cases, countries require proof of vaccination for travelers wishing to enter or exit the country.

The growth of the market is attributed to increasing travel & tourism and growing incidences of infectious diseases. However, higher cost of travel vaccine is hampering the growth.

The diagnostic labs market majorly consists of the players such as GlaxoSmithKline plc.; Merck & Co., Inc.; Sanofi; Novartis AG; Pfizer Inc.; Dynavax Technologies; Emergent BioSolutions Inc.; Abbott; Seqirus; and Valneva SE among others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of companies for UK Travel Vaccines Market:

- GLAXOSMITHKLINE PLC

- MERCK AND CO., INC.

- SANOFI

- NOVARTIS AG

- PFIZER INC.

- DYNAVAX TECHNOLOGIES CORPORATION

- EMERGENT BIOSOLUTIONS INC.

- ABBOTT

- VALNEVA SE

- CSL BEHRING

Get Free Sample For

Get Free Sample For