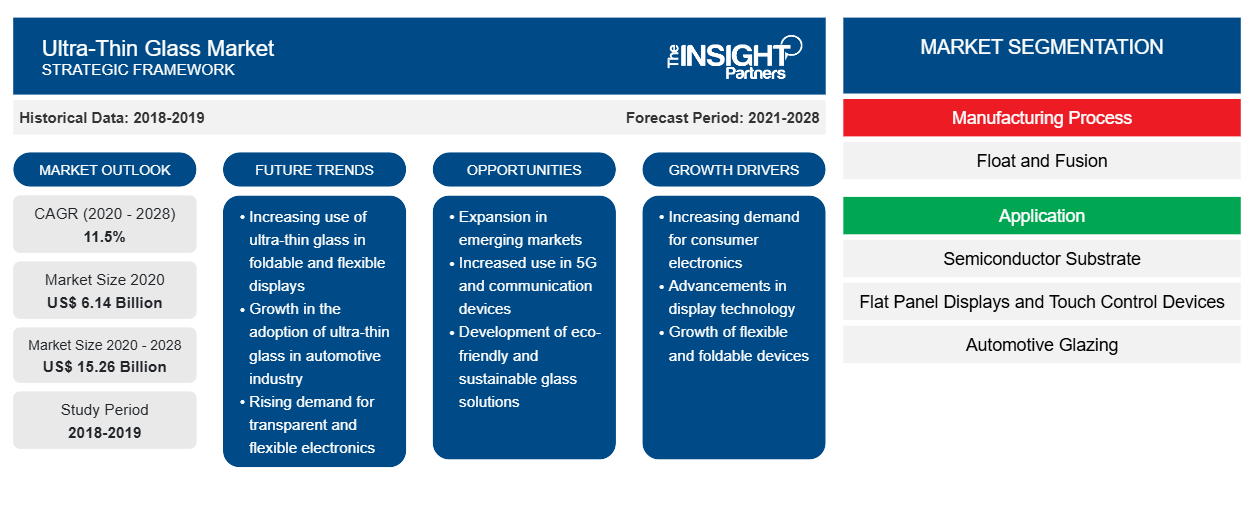

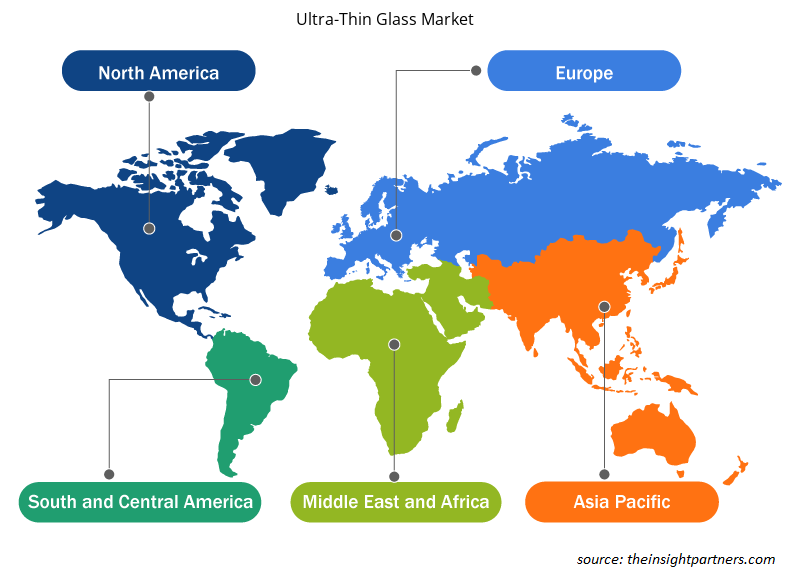

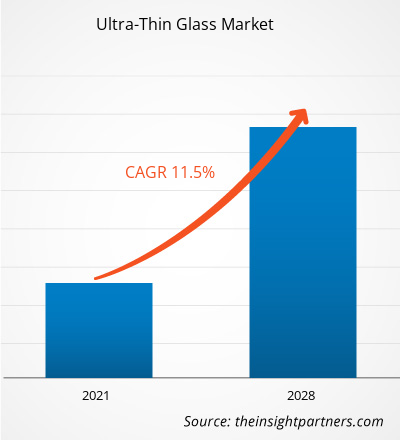

[Research Report] The ultra-thin glass market was valued at US$ 6,139.56 million in 2020 and is projected to reach US$ 15,264.74 million by 2028; it is expected to grow at a CAGR of 11.5% from 2021 to 2028.

Ultra-thin glass is those glass whose thickness is below 1–2mm.Chemical strengthening via ion exchange is commonly used to reinforce ultra-thin glass used for high-tech applications.Hardened ultra-thin glass is scratch-resistant and bendable up to a radius of a few millimeters. The properties of ultra-thin glass such as corrosion resistance, transparency, flexibility, excellent gas and water barrier, and high impact resistance make it suitable for various applications such as flat panel displays, automotive glazing, among others. In 2020, Asia Pacific held the largest revenue share of the global ultra-thin glass market. China is the largest consumer of ultra-thin glasses, accounting for more than 50% of the market share in Asia Pacific. The country is the major manufacturing hub for all types of consumer electronic products, such as smartphones and LCDs.

The ongoing COVID-19 pandemic has drastically altered the status of the chemicals & materials sector and negatively impacted the growth of the ultra-thin glass market.The implementation of measures to combat the spread of the novel coronavirus has aggravated the situation and has negatively impacted the growth of several sectors. Industries, such as automotive and consumer electronics, have been negatively impacted by the sudden distortion in operational efficiencies and disruptions in the value chains due to the sudden closure of national and international boundaries. The decline in the growth of the several sectors negatively impacted the demand for ultra-thin glass in the global market. However, as the economies are planning to revive their operations, the demand for ultra-thin glass is expected to rise globally in the coming years. Due to the pandemic, the adoption of remote work culture and online education is growing. Therefore, the demand for products such as laptops, smartphones, and other telecommunication devices is growing. The expanding demand for ultra-thin glass in various industries, such as automotive and consumer electronics, along with significant investments by prominent manufacturers is expected to drive the growth of the ultra-thin glass market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ultra-Thin Glass Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ultra-Thin Glass Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Consumer Electronics Industry

The consumer electronics industry is booming due to the increasing usage of electronic appliances, such as smartphones, laptops, televisions, and other electronics products. Consumer electronic goods have become a necessity in the technological world. People from all generations are somehow dependent on their smartphones, smartwatches, and laptops. With the growing consumer electronics industry, manufacturers are continuously focusing on providing advanced and high-quality products. The ultra-thin glass plays an important role in the consumer electronics industry. It is used in touch and display panels, sensors, and camera systems. Various properties of ultra-thin glass such as corrosion resistance, transparency, flexibility, and gas barrier capability make it suitable for numerous applications in the consumer electronics industry. China dominates in the consumer electronic goods industry. The country is one of the prominent manufacturers of flat panel displays. There is a rapidly increasing demand for Chinese smartphones, fitness trackers, TVs, and other electronic goods, which provides lucrative opportunities to the manufacturers of ultra-thin glass. China has strengthened the construction of new infrastructure; promoted the construction of artificial intelligence, industrial internet, and the Internet of Things; and accelerated the pace of 5G commercialization, which boosts the electronic information manufacturing industry into a new development stage, and further promotes the high-end development of related industries. According to World Population Review, China has 1.6 billion cell phones users, and India has 1.28 billion cell phones users. In 2018, Apple clocked about 22.5 million shipments of the smartwatches. This number has increased from 2017, as the company sold 17.7 million units in 2017. In 2018, Fitbit shipped about 5.5 million units of smartwatches, whereas Samsung shipped about 5.3 million units. Thus, the rapidly growing consumer electronic industry propels the demand for ultra-thin glasses

End-Use Industry Insights

The consumer electronics segment held the largest share of the global ultra-thin glass market in 2020. Ultra-thin glass is widely used in the manufacturing of electronic products, such as flat panel displays and touch panel displays for various devices, such as LCDs, OLEDs, smartphones, and wearable devices. With the growing demand for innovative and technologically advanced electronic products across the world, the demand for ultra-thin glasses is expected to propel in the coming years.

Manufacturing Process Insights

By manufacturing process, the fusion segment dominated the ultra-thin glass market in terms of revenue in 2020. The fusion process, often known as the overflow downdraw method, is widely used to manufacture flat ultra-thin glasses for display panels. Corning was the first company to create specialized glass that was suspended in mid-air, which is a key trait of the fusion method. Glass is not contacted by molten metal, which is a fundamental advantage of the fusion method over the float glass method.

A few of the key market players operating in the ultra-thin glass market are Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd; Xinyi Glass Holdings Limited; and Luoyang Glass Co., Ltd. Major players in the market are adopting strategies such as mergers and acquisitions and product launches to expand their geographic presence and consumer base.

Ultra-Thin Glass Market Regional Insights

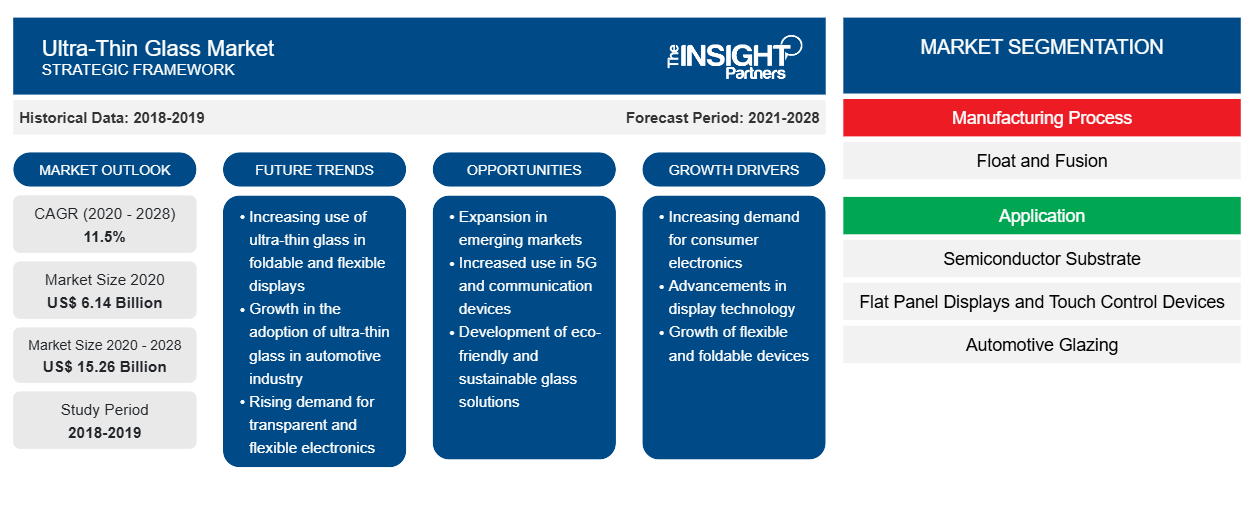

The regional trends and factors influencing the Ultra-Thin Glass Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ultra-Thin Glass Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ultra-Thin Glass Market

Ultra-Thin Glass Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 6.14 Billion |

| Market Size by 2028 | US$ 15.26 Billion |

| Global CAGR (2020 - 2028) | 11.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Manufacturing Process

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

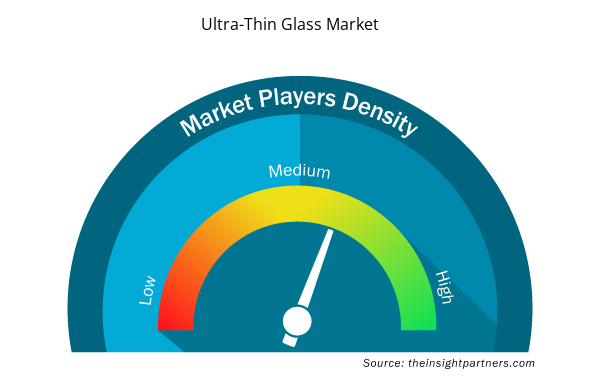

Ultra-Thin Glass Market Players Density: Understanding Its Impact on Business Dynamics

The Ultra-Thin Glass Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ultra-Thin Glass Market are:

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ultra-Thin Glass Market top key players overview

Report Spotlights

- Progressive trends in the ultra-thin glass industry to help players develop effective long-term strategies

- Business growth strategies adopted by companies to secure growth in developed and developing markets

- Quantitative analysis of the global ultra-thin glass market from 2019 to 2028

- Estimation of the demand for ultra-thin glass across various industries

- Porter analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for ultra-thin glass

- Market trends and outlook coupled with factors driving and restraining the growth of the ultra-thin glass market

- Understanding regarding the strategies that underpin commercial interest with regard to global ultra-thin glass market growth, aiding in the decision-making process

- Ultra-thin Glass market size at various nodes of market

- Detailed overview and segmentation of the global ultra-thin glass market as well as its industry dynamics

- Ultra-thin Glass market size in various regions with promising growth opportunities

Ultra-Thin Glass Market, by Manufacturing Process

- Float

- Fusion

Ultra-Thin Glass Market, by Application

- Semiconductor Substrate

- Flat Panel Displays and Touch Control Devices

- Automotive Glazing

- Others

Ultra-Thin Glass Market, by End-Use Industry

- Consumer Electronics

- Automotive

- Medical and Healthcare

- Others

Company Profiles

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Manufacturing Process, Application, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia-Pacific is estimated to register the fastest CAGR in the market over the forecast period. The rising demand for LED and OLED televisions is boosting the market growth across the region. Manufacturers of flat panel displays in China, South Korea, and Taiwan are dominating the global marketplace in terms of production and supply of flat panel displays. These displays can be found in cars, industrial equipment, personal computers, smartphones, and a variety of other goods. Liquid crystal displays are used in the majority of TV screens (LCDs). Other display types used in televisions include organic light-emitting diodes (OLEDs) and quantum dots. LCDs and OLEDs are used in smartphone displays. Thus, the high concentration of flat panel display manufacturers in Asia-Pacific, coupled with the high utilization of ultra-thin glass in designing flat panel displays, is the crucial factor anticipated to further drive the market in the coming years. Furthermore, the growing application of ultra-thin glass by automobile manufacturers in China, India, and South Korea is driving the market. China, as one of the significant producers of automobiles, has a high need for ultra-thin glass for use in various automotive interior panels. Furthermore, the existence of significant players such as AGC Inc. and Nippon Electric Glass Co., Ltd is projected to fuel the market expansion.

Based on end use, consumer electronics segment led the global ultra-thin glass market during the forecasted period. Consumer electronics is one of the prominent end-use industries contributing a major share in the growth of the ultra-thin glass market. Ultra-thin glass is widely used to manufacture electronic goods such as flat panel display devices, smartphones, wearable devices, and touch screen devices. It is extremely thin and flexible. Therefore, it is ideal for devices with wider displays and touch screen features. Moreover, it is used in microprocessors of smartphones as a substrate. Using ultra-thin glass in semiconductor substrates ensures the increased performance of microprocessors, which enables high data transfer rates. The growing utilization of ultra-thin glass in consumer electronic devices is expected to boost the market growth. Moreover, the rising demand for electronic gadgets such as smartphones, laptops, tablets, and televisions in emerging economies, owing to rise in disposable income, significant economic development, increase in adoption of emerging technologies, and improved lifestyles of people, is expected to boost the growth of global ultra-thin glass market in the coming years. Manufacturers of ultra-thin glass are focusing on launching innovative products. Recently, foldable ultra-thin glass was developed by Schott AG which is a Germany-based manufacturer of specialty glass products. This foldable glass was used by Samsung in its Z-fold 3 smartphone which is gaining huge popularity among people worldwide. Such innovations by the prominent manufactures of ultra-thin glass are expected to boost the consumer electronics segment’s growth.

On the basis of manufacturing process, fusion segment is leading the ultra-thin glass market during the forecast period. The fusion process, often known as the overflow downdraw method, is widely used to manufacture flat ultra-thin glass for display panels. Corning was the first company to create specialized glass that was suspended in mid-air, which is a key trait of the fusion method. Glass is not contacted by molten metal, which is a fundamental advantage of the fusion method over the float glass method. The raw materials, including pure sand and other inorganic elements, are fed into a massive melting tank that is heated to temperatures beyond 1000â° Celsius. The molten glass is homogenized and conditioned before being discharged into an isopipe, a huge collection trough with a V-shaped bottom. The isopipe is carefully heated to ensure optimum viscosity of the mixture and consistent flow. The molten glass flows uniformly over the isopipe's top edges, generating two thin, sheet-like streams along the outer surfaces. The two sheets meet at the bottom of the isopipe and are fused into a single glass sheet. As the sheet lengthens and cools in mid-air, it feeds into drawing equipment while still linked to the bottom of the isopipe. With precise control of the fusion glass process parameters, thinner glass panels can be produced. Commercial manufacturers such as Corning, Schott, AGC, and Nippon Electric Glass use the drawdown or fusion process for producing ultra-thin glass.

Based on application, flat-panel display segment is expected to grow at the fastest CAGR from 2021 to 2028. Flat panel displays are video devices that replace the conventional cathode ray tube (CRT) with a thin panel design. Ultra-thin glass is widely used to manufacture flat panel displays such as LCD, LED, OLED screens, smartphone displays, and monitor screens. Moreover, ultra-thin glass is used in the touch module of touch screen devices such as smartphones, tablets, and laptops. It provides fundamental functions for flat-panel display and touch screen devices such as high definition (HD) display, touch-control and scratch resistance, and protection to the screens. Consumer electronic goods are being upgraded at a faster rate as the technological landscape is changing rapidly. Panel display components used in flat-panel display and touch-control devices have emerged as the most important downstream application products for ultra-thin glass substrates with the highest market demand. The need for ultra-thin glass substrate is predicted to rise since it is a crucial component and key fundamental material for flat-panel display and touch-control systems. Moreover, ultra-thin glass substrates are non-substitutable and have a promising future as the entire electronic device market develops.

The major players operating in the ultra-thin glass market are Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd; Xinyi Glass Holdings Limited; and Luoyang Glass Co., Ltd.

In 2020, Asia Pacific held the largest revenue share of the global ultra-thin glass market and is also expected to register the highest CAGR during the forecast period. The ultra-thin glass market across the region is projected to witness remarkable growth, owing to the rapidly expanding consumer electronics industry in countries such as China, Japan, and South Korea. China is one of the largest consumer electronics markets across the world, along with Japan and South Korea. Due to the high concentration of consumer electronics manufacturers in Asia-Pacific, the demand for ultra-thin glass from the manufacturers of electronic goods across the region is expected to grow significantly over the forecast period. Moreover, China and Japan are the leading exporters of semiconductor components used in electronic gadgets. Many leading manufacturers of smartphones and electronic gadgets heavily rely on Asia-Pacific countries for sourcing semiconductor components. For chip packing and interposer applications, the semiconductor industry is progressively designing products using thin glass substrates. When organic substrate materials are employed, the locally generated heat of the small core parts of mobile devices causes deflection and reliability issues. Ultra-thin glass has excellent dimensional stability over a wide range of temperatures while also providing the foundation for an exceedingly flat chip package. Thus, the increasing utilization of ultra-thin glass for designing electronic goods across the region is projected to potentially drive the market over the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Ultra-thin Glass Market

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd.

Get Free Sample For

Get Free Sample For