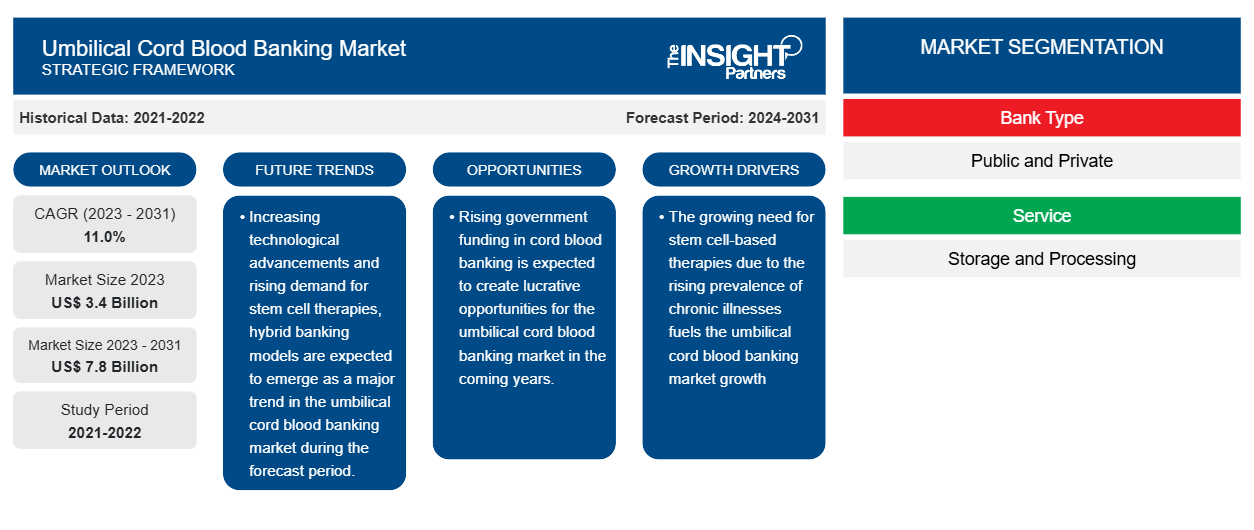

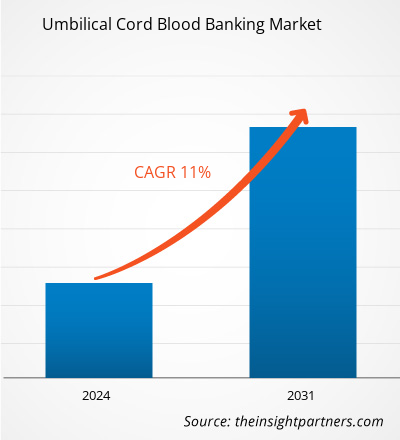

The umbilical cord blood banking market size is projected to reach US$ 7.8 billion by 2031 from US$ 3.4 billion in 2023. The market is expected to register a CAGR of 11.0% during 2023–2031. Increasing hybrid banking models is likely to remain a key trend in the market.

Umbilical Cord Blood Banking Market Analysis

Factors such as the increasing use of umbilical cord blood in genetic rare disease research and treatment propel the umbilical cord blood banking market growth. However, product recalls impede market growth.

Umbilical Cord Blood Banking Market Overview

The rising geriatric population and unhealthy lifestyle contribute to the increasing prevalence of chronic diseases, propelling the demand for alternative and potentially curative treatment options. Around 41,000 people are diagnosed with blood cancer annually, making it the sixth most frequent cancer in the UK, according to Blood Cancer UK. In the UK, there are roughly 250,000 persons who are suffering from blood cancer. At some time in their lives, one in every 16 men and one in every 22 women will develop it. It is the most prevalent type of cancer in children. More than 500 kids under the age of 15 receive a blood cancer diagnosis each year. Of them, roughly 400 have lymphoma, and about 100 have pediatric leukemia. The geriatric population is highly prone to blood cancer. People aged 75 years and above make up slightly under 40% of those diagnosed with the disease. Umbilical cord blood, rich in hematopoietic stem cells, offers a valuable option for treating various conditions, including blood cancers, autoimmune diseases, and genetic disorders. There are rising advancements in stem cell research and the increasing success rates of cord blood transplants in treating a more comprehensive range of diseases. The realization that a child's cord blood can provide a potentially life-saving resource for themselves or a family member is a powerful motivator for parents. Thus, families are increasingly opting to preserve their child's cord blood, recognizing its potential therapeutic value for future use in case of a medical need, particularly in the face of escalating chronic illness rates. Therefore, the growing need for stem cell-based therapies due to the rising prevalence of chronic illnesses fuels the umbilical cord blood banking market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Umbilical Cord Blood Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Umbilical Cord Blood Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Umbilical Cord Blood Banking Market Drivers and Opportunities

Evolving Field of Regenerative Medicine Favors Market

The burgeoning field of regenerative medicine focuses on repairing and regenerating damaged tissues and organs. As researchers unlock the immense potential of stem cells, particularly those found in umbilical cord blood, the demand for these cells is rapidly increasing. The evolving landscape of regenerative medicine is pushing the boundaries of what's possible in treating a wide array of diseases and conditions, from blood cancers and autoimmune disorders to neurological and orthopedic injuries. The promise of regenerative therapies using cord blood stem cells is attracting patients and medical professionals, who are increasingly recognizing the unique therapeutic advantages these cells offer. This expanding awareness, coupled with ongoing research and clinical trials demonstrating the efficacy of cord blood stem cell therapies, is driving a significant increase in the number of families opting to bank their child's cord blood. As regenerative medicine continues to evolve and demonstrate its therapeutic potential, the umbilical cord blood banking market experiences sustained growth driven by the increasing demand for these vital cells.

Rise in Government Funding to Create Market Opportunities

Governments across the world are recognizing the potential life-saving treatments that stem cells derived from umbilical cord blood can offer. This realization has led to enhanced support in the form of grants and subsidies aimed at public and private cord blood banks. The financial backing is instrumental in advancing research and development within the field, enabling the exploration of new therapeutic avenues for conditions that currently have limited treatment options. Moreover, the funding is facilitating the expansion of storage facilities, which is crucial for maintaining the viability of cord blood units over extended periods.

The rising investment is encouraging expectant parents, who are now more informed about the benefits of cord blood banking. This awareness, coupled with financial incentives, is likely to lead to an increase in the number of cord blood units being banked, thereby enriching the diversity and availability of stem cells for transplantation. The rise in government funding is catalyzing scientific progress and creating a more robust infrastructure for the umbilical cord blood banking market. This is also expected to open up new horizons in regenerative medicine and offer hope for many patients affected by challenging medical conditions.

Following is a list of a few key funding initiatives undertaken by governments and organizations.

- In April 2023, Fifty community groups and organizations across England and Wales received US$ 745.30 in funding as part of the Government's commitment to continue to promote organ, blood, and stem cell donation among Black and Asian communities and tackle health inequalities.

- In 2023, Health Resources & Services Administration (HRSA) awarded a total of US$18.3 million to cord blood banks, and HRSA awarded a total of US$17.3 million in 2022.

Thus, rising government funding in cord blood banking is expected to create lucrative opportunities for the umbilical cord blood banking market in the coming years.

Umbilical Cord Blood Banking Market Report Segmentation Analysis

Key segments that contributed to the derivation of the umbilical cord blood banking market analysis are product type, application, end user.Based on bank type, the umbilical cord blood banking market is segmented into bifurcated into public and private. The private segment held a larger market share in 2023.

- By service, the market is segmented into storage and processing. The storage segment held a larger share of the market in 2023.

- Based on end user, the market is segmented into hospitals, research institutes, and others. The hospitals segment dominated the market in 2023.

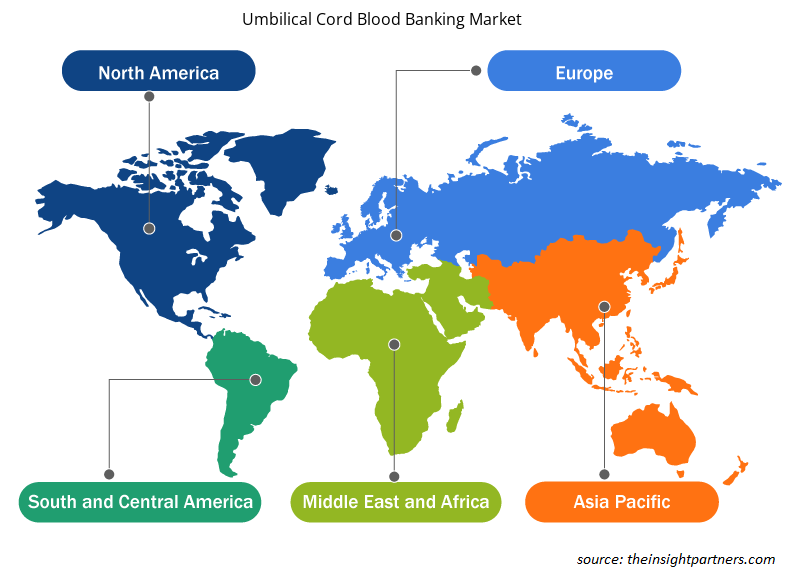

Umbilical Cord Blood Banking Market Share Analysis by Geography

The geographic scope of the umbilical cord blood banking market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. The North America umbilical cord blood banking market has been analyzed on the basis of the US, Canada, and Mexico. The market growth in this region is driven by the availability of a large number of public cord blood banking services, and governments providing support in the form of funding and favorable regulations.

Umbilical Cord Blood Banking Market Regional Insights

The regional trends and factors influencing the Umbilical Cord Blood Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Umbilical Cord Blood Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Umbilical Cord Blood Banking Market

Umbilical Cord Blood Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.4 Billion |

| Market Size by 2031 | US$ 7.8 Billion |

| Global CAGR (2023 - 2031) | 11.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Bank Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

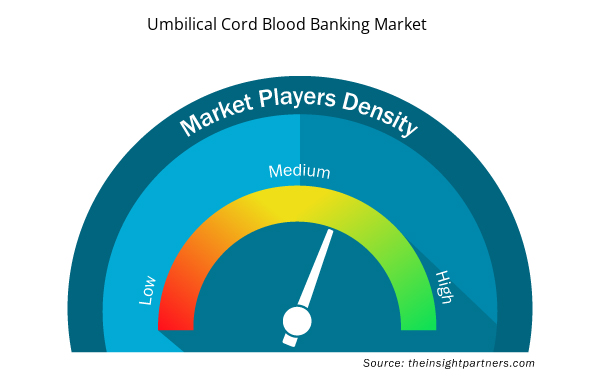

Umbilical Cord Blood Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Umbilical Cord Blood Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Umbilical Cord Blood Banking Market are:

- Cordlife India,

- Biocell,

- CryoStemcell,

- NovaCord,

- LifeCell,

- HÉMA-QUÉBEC,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Umbilical Cord Blood Banking Market top key players overview

Umbilical Cord Blood Banking Market News and Recent Developments

The umbilical cord blood banking market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the umbilical cord blood banking market are listed below:

- The US FDA announced approval of OMISIRGE’s expanded cord blood products intended for use in stem cell transplantation. The approval by the US FDA has the potential to transform the field of regenerative medicine, proving effective in patients aged 12 and above suffering from high-risk blood cancers and other hematological disorders [Source: OMISIRGE’s, Company Website, February 2023]

Umbilical Cord Blood Banking Market Report Coverage and Deliverables

The "Umbilical Cord Blood Banking Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Transient protein expression market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Transient protein expression market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Transient protein expression market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the umbilical cord blood banking market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Key factors that are driving the growth of the market are Rising Prevalence of Chronic Illnesses and evolving field of regenerative medicine. However, the stringent rules and regulations are expected to hamper the market during the forecast period.

The umbilical cord blood banking market is anticipated to record a CAGR of 11.0% during 2023–2031.

Cordlife India, Biocell, CryoStemcell, NovaCord, LifeCell, HÉMA-QUÉBEC, Atlantic Health System, WMDA, CryoViva Singapore, and ViaCord, Inc. are among the key players operating in the market.

Increasing hybrid banking models are likely to remain key trends in the umbilical cord blood banking market.

North America dominated the market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Umbilical Cord Blood Banking Market

- Cordlife India

- Biocell

- CryoStemcell

- NovaCord

- LifeCell

- HÉMA-QUÉBEC

- Atlantic Health System

- WMDA

- CryoViva Singapore

- ViaCord, Inc.

Get Free Sample For

Get Free Sample For