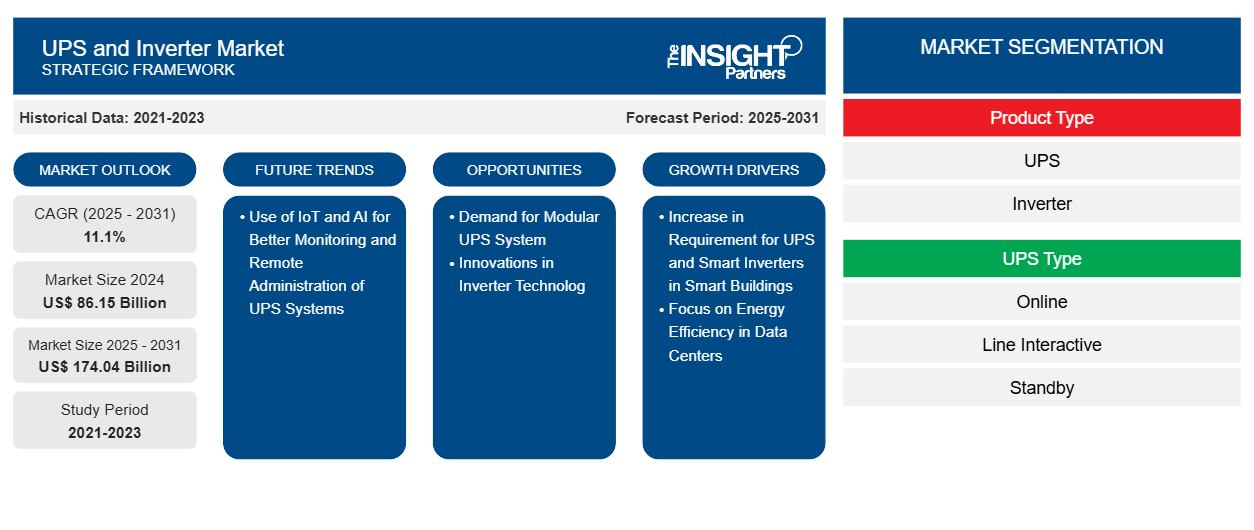

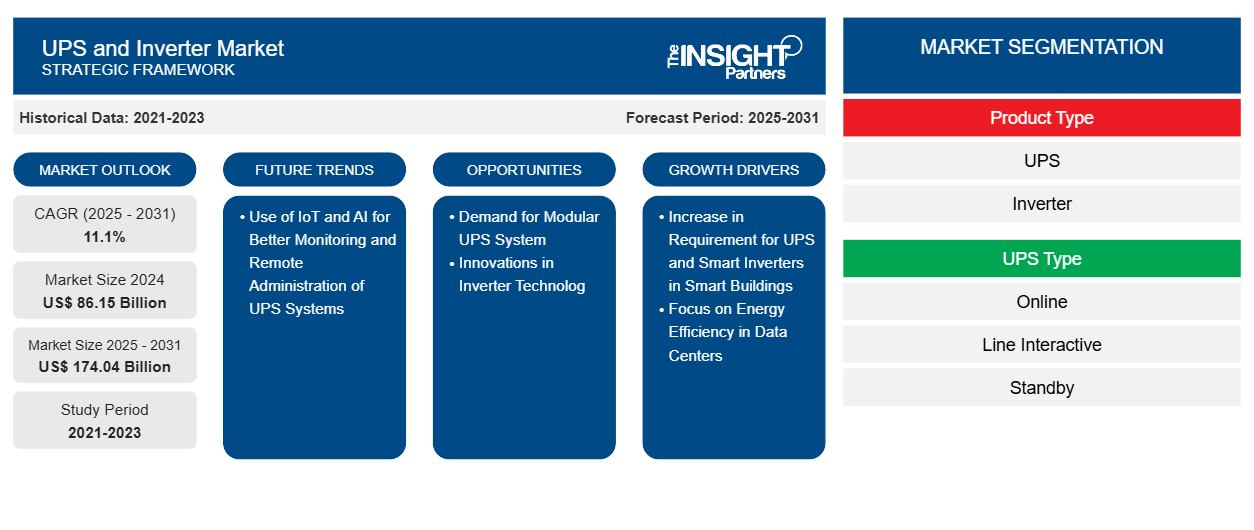

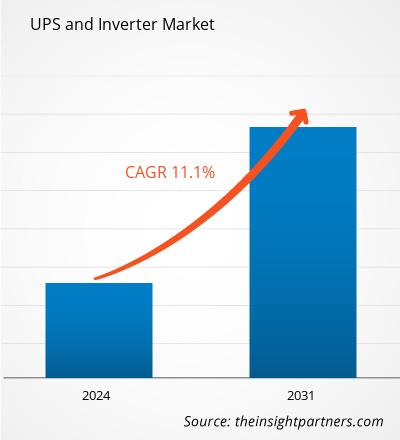

The UPS and Inverter market was valued at valued at US$ 86.15 billion in 2024 and is expected to reach US$ 174.04 billion by 2031. The UPS and Inverter market is estimated to record a CAGR of 11.1% from 2025 to 2031. The use of IoT and AI for better monitoring and remote administration of UPS systems is likely to continue to be a key trend in the market.

UPS and Inverter Market Analysis

The rising adoption of modular UPS systems, owing to their ability to aid in the adaptation to changing power requirements, is expected to create an opportunity for the growth of the market for UPS in the coming years. Further, the demand for renewable energy and innovations in inverter technology are expected to benefit the market for inverters during the forecast period. Moreover, the growing use of IoT and AI for better monitoring and remote administration is expected to emerge as a key trend in the UPS and inverter market in the coming years. Data centers account for a considerable amount of global energy usage, and this figure is only anticipated to rise as data demand rises. As per the 2023 AFL data, globally, data centers utilize ~3% of total energy output, with hyperscale data centers accounting for 20% of global data center electricity demand, which increased to 50% in 2020. Microsoft's 700,000-square-foot data center in Chicago, Illinois, is one of the world's largest facilities, capable of consuming 198 MW of power.

UPS and Inverter Market Overview

A UPS provides backup power and prevents equipment damage in the case of a grid power outage. UPS systems are extensively used in data servers, computer systems, industrial environments, and laboratories. As a UPS safeguards different types of connected equipment in a plant, it is particularly suitable for facilities located in terrains susceptible to power outages or other power quality issues. For example, UPS systems are often used to back computers and servers since sudden power outages can result in data loss. An inverter converts electrical power from direct current (DC) to alternating current (AC). These systems are utilized in a wide range of applications, including small automobile adapters, household or office applications, and large grid systems. During a power outage, it converts DC electricity stored in a battery, solar panel, or rectifier into AC power, which can subsequently be used by different household equipment such as a refrigerator or television. Solar power systems transform the DC electricity supplied using solar panels into AC power for residential or other large-scale usage.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UPS and Inverter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

UPS and Inverter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

UPS and Inverter Market Drivers and Opportunities

Increase in Requirement for UPS and Smart Inverters in Smart Buildings Favors Market

Smart buildings use modern building automation technologies to optimize energy usage. A UPS provides supplemental power during high-demand periods, lowering the overall energy consumption of buildings. Moreover, its use reduces energy expenses and leads to sustainable and eco-friendly construction. Moreover, UPS can contribute to the overall reliability of a building's electrical system. It can function as a buffer between the electrical system and external power sources, reducing voltage fluctuations and improving power quality. Its role also ensures that this system runs more efficiently, reducing wear and tear on equipment and increasing its lifespan.

Focus on Energy Efficiency in Data Centers to Generate Growth Opportunities in Market

Higher power loads in data centers necessitate the installation of larger UPS systems to support them. Energy-efficient UPS systems may include an "eco-mode," which is characterized by their ability to reduce electricity losses. Running UPS systems in eco-mode can lower their energy expenses by up to 2%. An ENERGY STAR-certified UPS can help cut financial losses associated with energy consumption by 30–55% compared to a standard UPS system. For example, a 1,000 kVA UPS used in a large data center could help save US$ 18,000 annually. In addition, as per the Department of Energy (DOE), a 15,000-square-foot data center operating at 100 watts per square foot requires 13,140 megawatt hours of energy yearly for IT equipment. Extending the efficiency of UPS systems supplying this much power by 90–95% would result in the 768,421 kWh energy reduction annually, cutting down the energy cost by almost US$ 90,000 at a rate of US$ 0.12 per kWh. Thus, the focus on energy efficiency in data centers is expected to bolster the UPS and inverter market during the forecast period.

UPS and Inverter Market Report Segmentation Analysis

Key segments that contributed to the derivation of the UPS and Inverter market analysis are type, UPS type, inverter rating, and application.

- Based on type, the market is categorized into UPS and inverter. The proximity segment dominated the market in 2024.

- On the basis of UPS type, the market is divided into standby, line-interactive, and online. The online segment dominated the market in 2024.

- Based on inverter rating, the UPS and inverter market is segmented into less than 5 kW, 5KW to 100 kW, 100KW to 500 kW, and above 500 kW. The 5KW to 100 kW segment dominated the market in 2024.

- Based on application, the UPS and Inverter market is segmented into commercial, residential, and industrial. The industrial segment dominated the market in 2024.

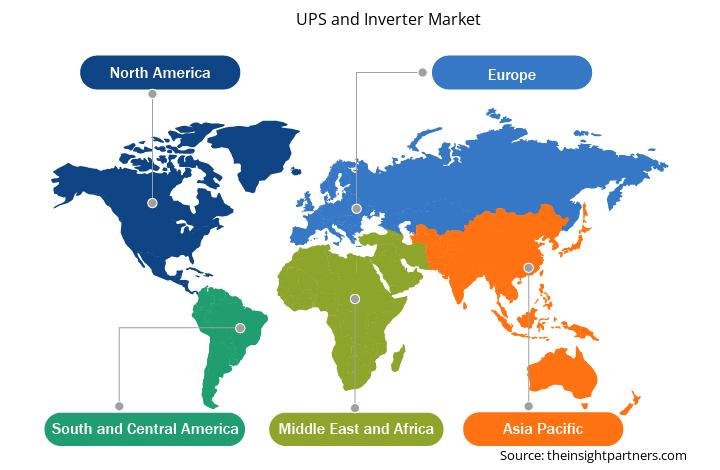

UPS and Inverter Market Share Analysis by Geography

The geographic scope of the UPS and Inverter market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America. North America accounted for a significant market share in 2024. It is an industrially and economically advanced region owing to the presence of well-established data centers. In October 2024, Microsoft announced its plan to develop three data center campuses in Licking County, with US$ 1 billion of investment in the initial stage. The campuses will be developed in New Albany, Heath, and Hebron, with one building on each campus at first; nonetheless, it plans to accommodate several buildings at each site later. The campuses will help Microsoft expand its cloud infrastructure to support global growth in digital services. Apart from these developments, the rise in investment in smart grids in the region also contributes to the increased demand for UPS and inverters. In 2023, the DoE announced US$ 3.5 billion in grants to increase wind and solar power capacity, fortify power lines against extreme weather, integrate batteries and electric vehicles, and develop microgrids to keep lights operational during power outages.

UPS and Inverter Market Regional Insights

UPS and Inverter Market Regional Insights

The regional trends and factors influencing the UPS and Inverter Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses UPS and Inverter Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for UPS and Inverter Market

UPS and Inverter Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 86.15 Billion |

| Market Size by 2031 | US$ 174.04 Billion |

| Global CAGR (2025 - 2031) | 11.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

UPS and Inverter Market Players Density: Understanding Its Impact on Business Dynamics

The UPS and Inverter Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the UPS and Inverter Market are:

- Schneider Electric SE

- ABB Ltd

- TOSHIBA CORPORATION

- Cyber Power Systems (USA) Inc

- Eaton Corp Plc

- Emerson Electric Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the UPS and Inverter Market top key players overview

UPS and Inverter Market News and Recent Developments

The UPS and Inverter market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the UPS and Inverter market are listed below:

- Su-Kam Power Systems Ltd., a leading player in the power backup and solar solutions industry, has set an ambitious target of achieving INR 6,000 crore in revenue over the next 5 years. Expecting to close the current financial year with a turnover of INR 700 crore, the company is positive to reach the targeted figure of revenue by 200% YoY (year-over-year) growth in turnover. (Source: Su-Kam Power Systems Ltd, Press Release, July 2024)

- Delta announced the launch of its latest innovation, the UZR Gen3 Series of UPS Li-ion Battery System. Designed specifically for the data center industry, this state-of-the-art lithium-ion battery rack solution is engineered for unmatched safety, reliability, and total cost of ownership (TCO) reduction. The UZR Gen3 Series represents a significant leap forward in critical power management, offering seamless integration with existing Delta solutions, including electrical power equipment, cooling systems, and other essential electrical hardware. (Source: Delta, Press Release, June 2024)

UPS and Inverter Market Report Coverage and Deliverables

The “UPS and Inverter Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- UPS and inverter market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- UPS and inverter market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- UPS and inverter market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the UPS and Inverter market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific dominated the UPS and inverter market in 2024.

The increase in requirement for UPS and smart inverters in smart buildings, and the focus on energy efficiency in data centers are the major factors bolstering the market.

The use of IoT and AI for better monitoring and remote administration of UPS systems is likely to prevail as a key trend in the market.

Eaton, Cyber Power Systems, Schneider Electric, ABB Ltd, and Toshiba Corporation are among the leading players in the UPS and inverter market.

The UPS and Inverter market is expected to reach an estimated value of US$ 174.04 billion by 2031.

The market is expected to grow at a CAGR of 11.1% over the forecast period.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - UPS and Inverter Market

- Schneider Electric SE

- ABB Ltd

- TOSHIBA CORPORATION

- Cyber Power Systems (USA) Inc

- Eaton Corp Plc

- Emerson Electric Co

- Delta Electronics Inc

- Legrand SA

- Kirloskar Electric Company

- OMRON Corp

- Exide Industries Ltd

- Luminous Power Technologies Pvt Ltd

- Microtek

- Su-Kam Power Systems Ltd.

- Kehua Data Co Ltd

Get Free Sample For

Get Free Sample For