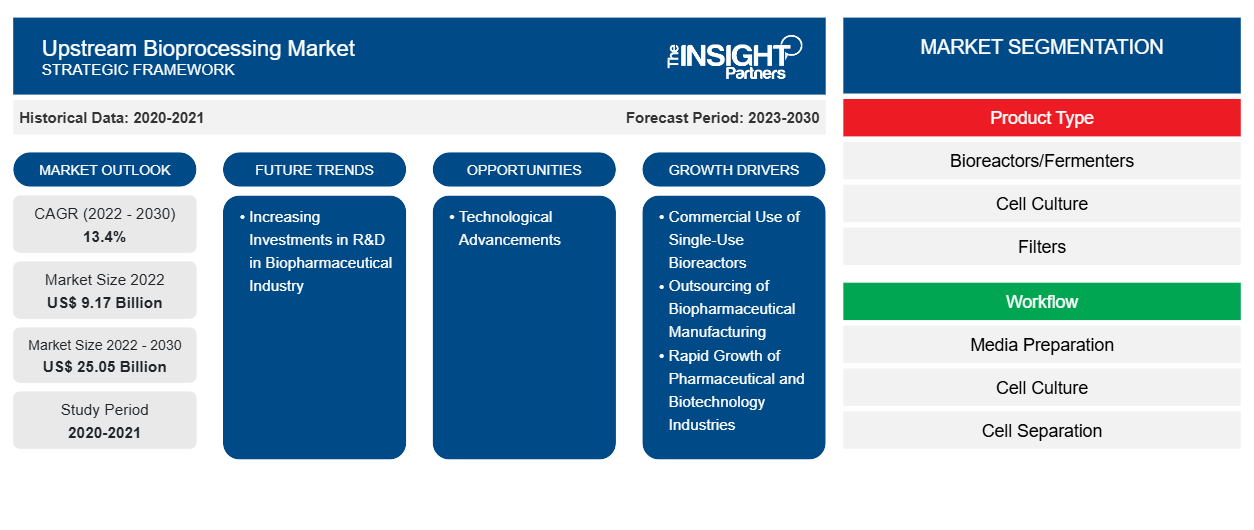

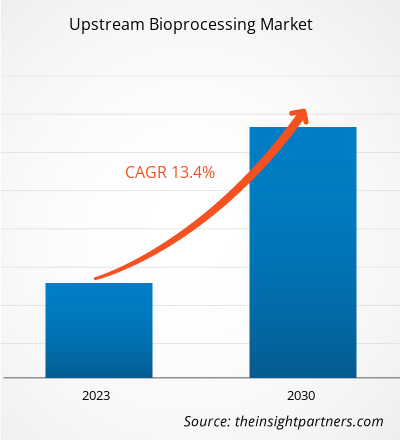

[Research Report] The upstream bioprocessing market value is projected to grow from US$ 9,174.09 million in 2022 to US$ 25,046.69 million by 2030. The upstream bioprocessing market is further anticipated to record a CAGR of 13.4% from 2022 to 2030.

Market Insights and Analyst View:

Upstream bioprocessing, the first stage of bioprocessing, includes cell line development, media development, and cultivation. Key factors driving the upstream bioprocessing market growth include the commercial use of single-use bioreactors, outsourcing of biopharmaceutical manufacturing, and rapid growth of pharmaceutical and biotechnology industries. However, a stringent regulatory framework hinders the upstream bioprocessing market growth.

Growth Drivers and Restraints:

Various manufacturers are developing single-use bioreactors (SUBs) due to their robust build and high performance, which are necessary for the commercial manufacturing of biopharmaceuticals. Incorporating technologies associated with biofilm formation, stirring mechanisms, bioreactor designs, and sensor systems, among others, have increased the adoption of disposable reactors at the laboratory and production scales. Single-use bioreactors are operated to manufacture next-generation cell and gene therapies, and they are suitable for continuous bioprocessing. Advancements in cell-culture processes now enable the development of higher titers and cell densities, which indicate a large scope for the adoption of SUBs. Single-use bioreactors operate with a low risk of contamination, shorter production turnaround times, and reduced validation time. In the last few years, the use of single-use bioreactors has increased in modern biopharmaceutical processes owing to their unique ability to aid enhanced flexibility, reduce investments, and limit operational costs. Also, many companies have developed single-use bioreactors for producing a wide range of therapeutics. In March 2021, Thermo Fischer Scientific launched the HyPerforma DynaDrive single-use bioreactors with 3,000 L and 5,000 L capacities. Sartorius AG offers a wide range of single-use bioreactors. The company provides ambr 15 for a 10–15 mL micro bioreactor scale and Biostat STR for 50–2,000L. The use of single-use bioreactors is subsequently increasing in upstream bioprocessing. Thus, the increasing acceptance of single-use bioreactors for the production of therapeutics propels the upstream bioprocessing market.

Regulatory authorities such as the Food & Drug Administration and the European Medicine Agency (EMA) monitor the operations of pharmaceutical manufacturers with consistent stringency. These businesses are thus bound to abide by the updated regulations promoting current good manufacturing practices (cGMP) and good laboratory practices (GLP) for assuring the control and monitoring of manufacturing processes and facilities. Currently, the FDA's CBER regulations do not mention single‑use bioreactors. Any diversions from the registered protocols, demands, and requirements of this guidance may lead to the termination of the clinical trials orchestrated by manufacturers or outsourced organizations. Although the stringent regulations associated with the biotechnology industry bolster the demand for bioreactors, the lack of well-defined regulatory frameworks in developing nations such as China, India, and Brazil hinders the overall growth of the upstream bioprocessing market growth.

The molecules obtained from bioprocessing may not generate the same results in clinical trials as in laboratory environments, which is another significant concern associated with the use of SUBs. The mixing mechanisms of SUBs may also lead to difficulties adhering to regulations, which restricts their use. For instance, in wave-type SUBs, the mixing principle is limited to a rocking movement, leading to uneven mixing and causing errors. Hence, the safety and efficacy of biologics may raise significant concerns in the application of SUBs.

Trends:

Increasing investments in research and development (R&D) in the biopharmaceutical industry are likely to bring new trends into the upstream bioprocessing market in the coming years. In March 2020, Culture Biosciences announced securing the funds of US$ 15 million (€13.4 million) in the Series A investment round, citing the backing of new and existing venture capital backers. According to Culture Biosciences, the money has been used to treble the capacity of bioreactors as well as to develop more cloud-based software monitoring and development tools for biomanufacturing research and development. The company states that this investment will help scientists manage their whole R&D workflow via software applications, hence supporting the digitization of biomanufacturing R&D.

As R&D investments continue to surge, particularly in novel biologics, advanced therapies, and personalized medicine, there is a parallel emphasis on optimizing upstream bioprocessing technologies and methodologies. This trend is leading to the development of innovative bioreactor systems, cell culture media formulations, and process automation solutions to enhance biopharmaceutical production operations' efficiency, scalability, and productivity. Furthermore, the focus on R&D investments favors the development of cutting-edge bioprocessing platforms that cater to the evolving biopharmaceuticals landscape, including next-generation therapeutic modalities and biosimilars. Additionally, dedicating R&D funds for bioprocessing trends such as continuous bioprocessing and advanced analytics for process monitoring is expected to reshape the future of upstream bioprocessing, driving the adoption of state-of-the-art technologies and establishing new benchmarks for process performance, quality, and regulatory compliance.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Upstream Bioprocessing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Upstream Bioprocessing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The upstream bioprocessing market is segmented on the basis of product type, workflow, usage type, and mode. Based on product type, the market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. In terms of workflow, the market is differentiated into media preparation, cell culture, and cell separation. The upstream bioprocessing market, by usage, is divided into single-use and multi-use. Based on mode, the upstream bioprocessing market is bifurcated into in-house and outsourced. In terms of geography, the upstream bioprocessing market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The bioreactors/fermenters segment held the largest share of the upstream bioprocessing market, based on product type, in 2022. The cell culture segment is anticipated to register a significant CAGR in the market during 2022–2030. Bioreactors and fermenters serve as core vessels in which cells and microorganisms are grown for various therapeutic and bioprocessing applications involving the expression and production of biologically derived compounds. These systems are engineered to provide an optimal environment for cell growth, incorporating precise control over parameters such as temperature, pH, dissolved oxygen, and agitation. These parameters are critical for cultivating cells and microorganisms in large-scale bioprocessing operations.

Based on workflow, the upstream bioprocessing market is classified into media preparation, cell culture, and cell separation. The cell separation segment held the largest share of the upstream bioprocessing market in 2022. The same segment is further anticipated to record a significant CAGR in the market from 2022 to 2030. Cell separation is the initial stage of segregating protein products (cells) from the culture. The amount and quality of the product collected in bioreactors play a pivotal role in the decision-making regarding the discontinuation of a cell culture.

Based on usage type, the global upstream bioprocessing market is classified into single use and multiuse. The single use segment held a larger share of the market in 2022. The market for this segment is expected to grow at a significant CAGR during 2022–2030. The upstream bioprocessing market has experienced a transformative shift with the widespread adoption of single-use technologies. Single-use systems, including bioreactors, bags, and connectors, have gained prominence for their flexibility, cost-effectiveness, and reduced risk of cross-contamination. These disposable components replace traditional stainless-steel equipment, offering a more agile and scalable approach to bioproduction. The single-use trend accelerates process development, minimizes cleaning and validation efforts, and facilitates quick changeovers between production runs.

The upstream bioprocessing market is segmented into in-house and outsourced based on mode. In 2022, the in-house segment held a larger market share. The outsourced segment is expected to record a higher CAGR during 2022–2030. In-house manufacturing is gaining traction in the upstream bioprocessing market as biopharmaceutical companies seek greater control over their production processes. Establishing in-house upstream bioprocessing facilities enables companies to tailor processes to their needs, ensuring a more customized and efficient approach. This strategy often involves investment in state-of-the-art bioreactors, cell culture systems, and associated technologies.

Regional Analysis:

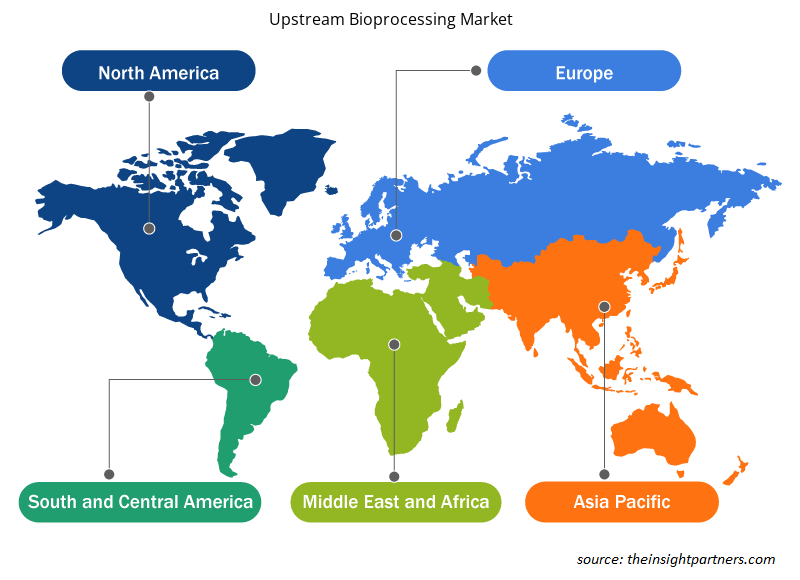

The upstream bioprocessing market, based on region, is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest share of the global upstream bioprocessing market. Asia Pacific is estimated to register the highest CAGR during 2022–2030.

The US is the largest market for bioreactors—several market players in the US manufacture bioreactors for pharmaceutical and biotechnology companies. Launch of new bioreactors, geographic expansion strategies, and partnerships among market players bolster the upstream bioprocessing market growth in the US. In April 2023, BioMADE announced 5 new projects focused on addressing gaps in research and the adoption of bioreactors in bioindustrial manufacturing in the US. With a funding commitment of US$ 10.5 million, these projects would span engineering, hardware development, and scalability to address difficulties associated with the economies of scale. These projects would focus on innovation to introduce advanced bioreactor designs supported by Schmidt Futures. In April 2023, Cytiva launched X-platform bioreactors to simplify upstream bioprocessing operations with single-use products. Initially, bioreactors were available in 50 L and 200 L sizes. The X-Platform bioreactors are equipped with Figurate automation solution software, and they can increase process efficiency through ergonomic improvements, production capacity, and simplified supply chain operations.

The growth of the biopharmaceutical sector, mainly due to technological advancements, increasing flexibility, and low operational costs, also benefits the upstream bioprocessing market in the US. As per the International Trade Administration (ITA), the US is the largest market for biopharmaceuticals, and it is also the global leader in biopharmaceutical R&D. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), companies in the US account for nearly 50% of the global pharmaceutical R&D work, and they have succeeded in developing many novel medicines for which they hold intellectual property rights. A continuous increase in the development of new biologics, resulting in the approval of more new molecular entities (NME) by regulatory authorities, creates opportunities for the growth of the upstream bioprocessing market in the US. According to the Chemical & Engineering News, the US Food and Drug Administration (FDA) approved ~37, 50, and 53 new NMEs in 2022, 2021, and 2020, respectively. Furthermore, increasing R&D investments by US-based pharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety contributes to the growth of the upstream bioprocessing market in the US. The subsequently growing traction toward precision medicine with rising investments by the US government is likely to contribute to market growth in the coming years.

Upstream Bioprocessing Market Regional Insights

Upstream Bioprocessing Market Regional Insights

The regional trends and factors influencing the Upstream Bioprocessing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Upstream Bioprocessing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Upstream Bioprocessing Market

Upstream Bioprocessing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 9.17 Billion |

| Market Size by 2030 | US$ 25.05 Billion |

| Global CAGR (2022 - 2030) | 13.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

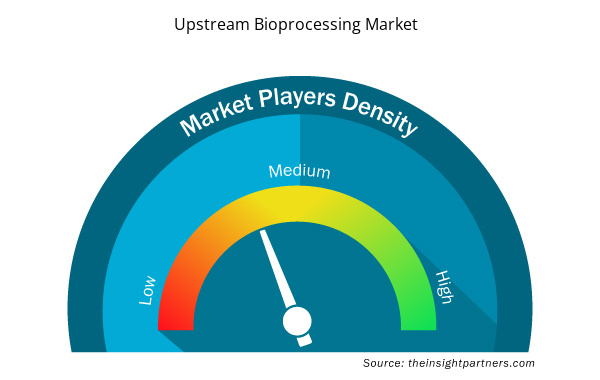

Upstream Bioprocessing Market Players Density: Understanding Its Impact on Business Dynamics

The Upstream Bioprocessing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Upstream Bioprocessing Market are:

- Thermo Fisher Scientific Inc

- Esco Micro Pte Ltd

- Cellexus International Ltd

- Sartorius AG

- Danaher Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Upstream Bioprocessing Market top key players overview

Industry Developments and Future Opportunities:

Different initiatives by prominent players in the global upstream bioprocessing market are listed below:

- In December 2023, Merck acquired Erbi Biosystems, a Massachusetts-based company that developed the "Breez" 2 ml micro-bioreactor platform technology. The purchase boosts Merck's upstream therapeutic protein portfolio, enabling it to promptly develop lab-scale protocols for scalable cell-based perfusion bioreactor processes with capacities ranging from 2 ml to 2000 l. Additionally, it offers opportunities for further study and advancement in cutting-edge modality applications, like cell therapies.

- In October 2023, Getinge AB acquired High Purity New England, Inc. for US$ 120 million. By the end of 2024, the company will fully integrate High Purity New England, Inc. The acquisition has helped Getinge AB acquire a comprehensive range of proprietary and distributed products from drug discovery, upstream and downstream processing, and fill-and-finish.

- In January 2023, Sartorius collaborated with RoosterBio Inc. to address purification challenges and establish scalable downstream manufacturing processes for exosome-based therapies. Through this collaboration, Sartorius and RoosterBio will provide best-in-class solutions and expertise for a human mesenchymal stem/stromal cell (hMSC) - based exosome production platform that delivers industry-leading yield, purity, and potency.

- In February 2022, Thermo Fisher Scientific In announced an expansion for its Bioprocessing. The company has invested US$40 million to construct and maintain a manufacturing plant for single-use technologies in Millersburg, Pennsylvania. The expansion was part of a multi-year, US$ 650 million investment to improve the company's capacity to produce bioprocessing in a flexible, scalable, and dependable manner.

- In March 2021, Thermo Fisher Scientific Inc launched HyPerforma DynaDrive S.U.B. in different volumes, 3,000 L and 5,000 L models. Thermo Fisher Scientific's largest commercially accessible S.U.B., the first-of-its-size 5,000 L S.U.B., allows biopharmaceutical businesses to incorporate single-use technologies into large-scale bioprocesses, such as cGMP manufacture at very high cell density and perfusion cell culture.

Competitive Landscape and Key Companies:

Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Cellexus International Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, Entegris Inc, and PBS Biotech Inc are among the prominent players operating in the upstream bioprocessing market. These companies focus on the development and adoption of new technologies, advancements in existing products, and expansion of their geographic presence to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fish Protein Hydrolysate Market

- Non-Emergency Medical Transportation Market

- Automotive Fabric Market

- Sweet Potato Market

- Malaria Treatment Market

- Fill Finish Manufacturing Market

- Vision Guided Robotics Software Market

- Identity Verification Market

- Airline Ancillary Services Market

- Data Center Cooling Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Workflow, Usage Type, Mode, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Upstream bioprocessing is the first stage of the bioprocess. Upstream phase includes processes such as cell line development, media development and cultivation.

Factors such as the commercial use of single-use bioreactors, outsourcing of biopharmaceutical manufacturing, and rapid growth of pharmaceutical and biotechnology industries propel market growth.

The upstream bioprocessing market majorly consists of the players, including Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Cellexus International Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, Entegris Inc, and PBS Biotech Inc.

The upstream bioprocessing market is expected to be valued at US$ 25,046.69 million in 2030.

The upstream bioprocessing market, based on product type, is segmented into bioreactors and fermenters, cell culture media, filters, bags and containers, and others. The bioreactors/fermenters segment held the largest share of the upstream bioprocessing market in 2022. Moreover, the cell culture segment is anticipated to register a significant CAGR during 2022–2030.

The upstream bioprocessing market was valued at US$ 9,174.09 million in 2022.

Based on workflow, the upstream bioprocessing market is classified into media preparation, cell culture, and cell separation. The cell separation segment held the largest share of the upstream bioprocessing market in 2022. It is further anticipated to register a significant CAGR from 2022 to 2030.

Based on mode, the upstream bioprocessing market is segmented into in-house and outsourced. In 2022, the in-house segment held a larger market share. The outsourced segment is expected to record a higher CAGR during 2022–2030.

The global upstream bioprocessing market, based on usage type, is classified into single use and multiuse. The single use segment held a larger share of the market in 2022. The same segment is anticipated to record a significant CAGR in the upstream bioprocessing market during 2022–2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Upstream Bioprocessing Market

- Thermo Fisher Scientific Inc

- Esco Micro Pte Ltd

- Cellexus International Ltd

- Sartorius AG

- Danaher Corp

- Getinge AB

- Merck KGaA

- Corning Inc

- Entegris Inc

- PBS Biotech Inc

Get Free Sample For

Get Free Sample For