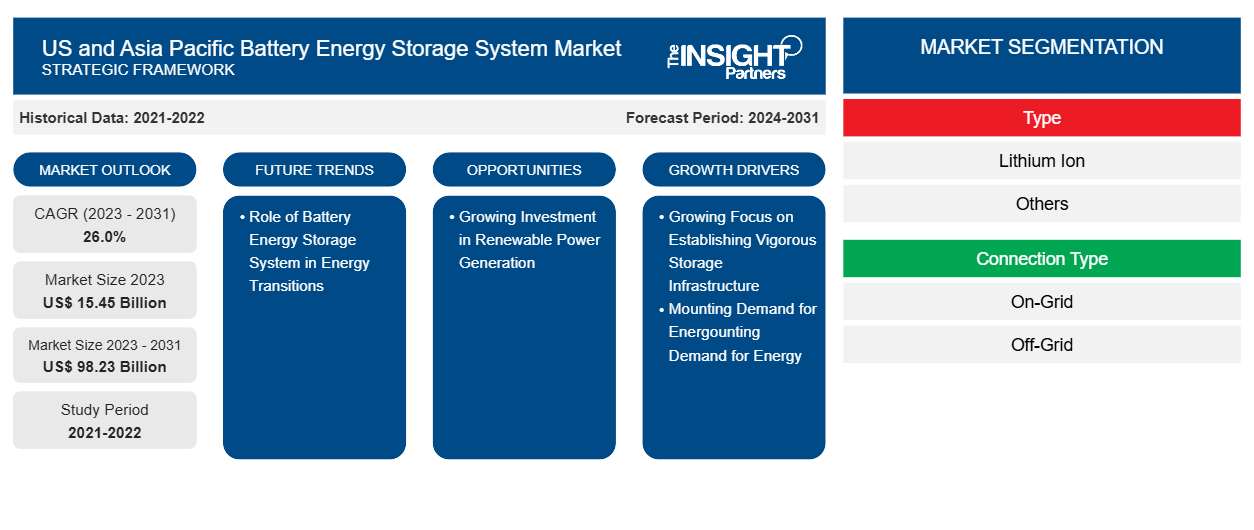

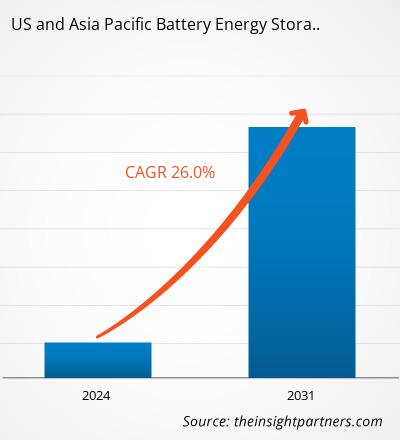

The battery energy storage system market size is projected to reach US$ 98.23 billion by 2031 from US$ 15.45 billion in 2023. The market is expected to register a CAGR of 26.0% during 2023–2031. The role of battery energy storage systems in energy transitions is likely to offer new key trends to the market in the coming years.

Battery Energy Storage System Market Analysis

The rapid growth of the renewable energy industry, surge in demand for battery energy storage systems, and rise in government funding for utility-based renewable energy projects are the key factors fueling the US and Asia Pacific battery energy storage system market growth. Moreover, the growing investment in renewable power generation is anticipated to create lucrative opportunities for the key companies operating in the battery energy storage system market in the US and Asia Pacific during the forecast period. Further, the role of battery energy storage systems in energy transitions is expected to be a key future trend in the market from 2023 to 2031.

Energy producers, transmission system operators, storage providers, and end users are stakeholders involved in the ecosystem of battery energy storage systems. Various sources, including natural gas, fossil fuels, and renewable energy (wind and solar), are used to generate energy. Power generation is followed by the process of transmission and storage. The energy storage process involves large-scale facilities and distributed power or energy storage systems. The final step consists of distributing the stored energy to end users or major application areas. End users of the battery energy storage system market are power plants, commercial, residential, and utility sectors.

Battery Energy Storage System Market Overview

Battery energy storage systems (BESS) strengthen grid resilience and reliability. Moreover, the system eases electricity costs through arbitrage, mitigating the risk of curtailment by providing backup power. These benefits attract developers and governments of the US and APAC, specifically in China, India, Japan, and South Korea, to focus more on battery energy storage infrastructure. State governments are increasingly incentivizing the integration of energy storage with solar. Also, the Inflation Reduction Act (IRA) offers tax credits for installing solar-plus-storage systems and standalone battery energy storage systems, which is propelling the growth of the battery energy storage system market in the US. Similarly, the government of India introduced the Production Linked Incentive scheme for Advanced Chemistry Cell in May 2021 with the aim of decreasing dependency on imported cells and promoting industrial development in the country. The scheme seeks to increase India's manufacturing capacities in the energy storage segment through financial incentives. In order to make reasonable battery storage systems, the government of India has authorized a Viability Gap Funding (VGF) Scheme for setting up 4,000 MWh of battery energy storage system in 2023. The scheme has provision for VGF to the extent of up to ~40% of capital expenditure for BESS, which will bring down the expense of electricity from BESS.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US and Asia Pacific Battery Energy Storage System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US and Asia Pacific Battery Energy Storage System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Battery Energy Storage System Market Drivers and Opportunities

Mounting Demand for Energy

Rising population and growing urbanization are some of the key factors driving the use of energy in the US and Asia Pacific. As per the US Energy Information Administration (EIA), US energy consumption is anticipated to grow by 2050 owing to economic and population growth. EIA also reported that US electricity end-use consumption was ~3.2% higher in 2022 than in 2021. Battery energy storage has the potential application as energy storage used in times of crisis or in remote or distant locations where power networks are not available. Furthermore, due to the increasing energy uncertainties worldwide, the US government is boosting the application of battery energy storage. For instance, Plus Power secured a US$ 82 million tax equity investment from bank Morgan Stanley for the Arizona-based 90 MW/360 MWh Superstition BESS project in May 2024, which is anticipated to be operational in June 2024. Also, RWE completed the construction of three new battery energy storage systems (BESS) totaling 190 MW (361 MWh) in Texas and Arizona in February 2024.

The demand for battery energy storage systems is high in some of the rural countries of Asia Pacific, such as India and Indonesia, where sufficient power supply is still a challenge for authorities. Governments in these countries have been pushing for the installation of battery energy storage system (BESS), which is a reliable power supply during emergencies. For instance, in Q1 2024, Chhattisgarh (one of the rural states of central India) accounted for ~55% of the total country’s BESS cumulative capacity that was commissioned in 2024. Thus, the increasing energy demand fuels the development of the battery energy storage system market in the US and Asia Pacific.

Growing Investment in Renewable Power Generation

The US government is focusing on reducing its carbon footprints, owing to which the energy industry is witnessing a transition toward clean energy. As a result, the government is boosting investments in green energy production. Power generation using fossil fuels is a key contributor to greenhouse gas (GHG) emissions that lead to climate change. The utilization of solar and wind energy is increasing due to rising focus on using clean and green energy, growing climate change concerns, and increasing government initiatives toward encouraging the usage of renewable energy across the US. By 2030, the US government targets to decrease net GHG emissions by ~50–52% compared to 2005 levels and achieve net zero emissions by 2050. Thus, rising concerns regarding greenhouse gas emissions are boosting the investment in renewable power generation, which is anticipated to offer lucrative opportunities in the development of the battery energy storage system market over the forecast period.

Battery Energy Storage System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US and Asia Pacific battery energy storage system market analysis are type, connection type, and end user.

- In terms of type, the US and Asia Pacific battery energy storage system market is bifurcated into lithium-ion and others. The lithium ion segment held a larger share of the market in 2023.

- Based on connection type, the US and Asia Pacific battery energy storage system market is bifurcated into on-grid and off-grid. The on-grid segment dominated the market in 2023.

- By end user, the US and Asia Pacific battery energy storage system market is categorized into commercial, utilities, and residential. The utilities segment held the largest battery energy storage system market share in 2023.

Battery Energy Storage System Market Share Analysis by Geography

The geographic scope of the battery energy storage system market report offers a detailed country analysis in the US and Asia Pacific. The US and China are major countries witnessing significant growth in the battery energy storage system market owing to the rise in government initiatives and investments in renewable power generation, along with the expansion of microgrids and battery energy storage systems (BESS) capacity. The rising awareness regarding adopting renewable energy and increasing investments in solar and wind energy projects are propelling the demand for lithium-ion batteries for energy storage in the US. In 2023, the US witnessed ~37% growth in renewables installation compared to 2021 and a 51% increase compared to 2022 installations.

A rise in demand for backup power during power outages or when the grid access is limited is expected to drive the demand for BESS in the country. In addition, the rise in usage of battery energy storage systems (BESS) in microgrids and off-grid systems across the US to ensure stable and reliable power supply is projected to boost the battery energy storage system market growth during 2023–2031. Moreover, the increase in investment and initiatives toward the development of solar and wind power projects across the country is anticipated to fuel the battery energy storage system market growth in the coming years. In 2023, Texas installed around 6,500 MW worth of solar energy systems across the region and surpassed California states to become the largest renewable installed state across the US.

Battery Energy Storage System Market Report Coverage and Deliverables

The "Battery Energy Storage System Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Battery energy storage system market size and forecast at country levels for all the key market segments covered under the scope

- Battery energy storage system market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Battery energy storage system market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the battery energy storage system market

- Detailed company profiles

US and Asia Pacific Battery Energy Storage System Market Regional Insights

The regional trends and factors influencing the US and Asia Pacific Battery Energy Storage System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US and Asia Pacific Battery Energy Storage System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US and Asia Pacific Battery Energy Storage System Market

US and Asia Pacific Battery Energy Storage System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 15.45 Billion |

| Market Size by 2031 | US$ 98.23 Billion |

| Global CAGR (2023 - 2031) | 26.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | US, Asia Pacific

|

| Market leaders and key company profiles |

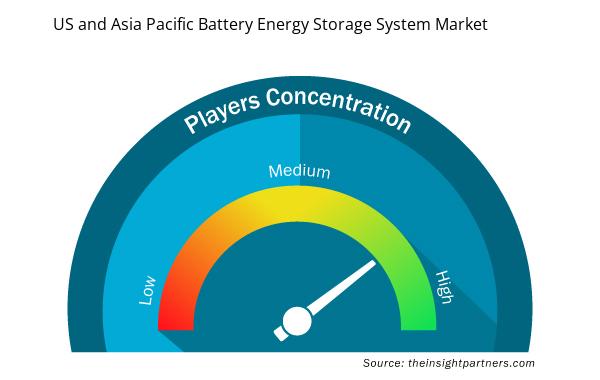

US and Asia Pacific Battery Energy Storage System Market Players Density: Understanding Its Impact on Business Dynamics

The US and Asia Pacific Battery Energy Storage System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US and Asia Pacific Battery Energy Storage System Market are:

- BYD Co. Ltd

- Saft America Inc.

- CATL

- Tesla Inc.

- Samsung SDI Co Ltd

- Panasonic Holdings Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US and Asia Pacific Battery Energy Storage System Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US & APAC battery energy storage system market is expected to reach US$ 98.23 billion by 2031.

Growing Focus on Establishing Vigorous Storage Infrastructure; and Mounting Demand for Energy are some of the major drivers of the US & APAC battery energy storage system market.

India is anticipated to grow at the fastest CAGR over the forecast period.

The key players operating in the US & APAC battery energy storage system market include BYD Co. Ltd; Samsung SDI Co Ltd; Panasonic Holdings Corp; Contemporary Amperex Technology Co Ltd; Tesla Inc; AES Corp; Ameresco Inc; Siemens AG; KORE Power Inc; General Electric Co; NextEra Energy Inc; Eos Energy Enterprises Inc; Saft Groupe SA; LG Chem Ltd; and ESS Inc.

The lithium-ion segment led the battery energy storage system market with a significant share in 2023.

The battery energy storage system market was valued at US$ 15.45 billion in 2023; it is expected to register a CAGR of 26.0% during 2023–2031.

Role of battery energy storage system in energy transitions is expected to drive the growth of the US & APAC battery energy storage system market in the coming years.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - US and Asia Pacific Battery Energy Storage System Market

- BYD Co. Ltd

- Samsung SDI Co Ltd

- Panasonic Holdings Corp

- Contemporary Amperex Technology Co Ltd

- Tesla Inc

- AES Corp

- Ameresco Inc

- Siemens AG

- KORE Power Inc

- General Electric Co

- NextEra Energy Inc

- Eos Energy Enterprises Inc

- Saft Groupe SA

- LG Chem Ltd

- ESS Inc

Get Free Sample For

Get Free Sample For