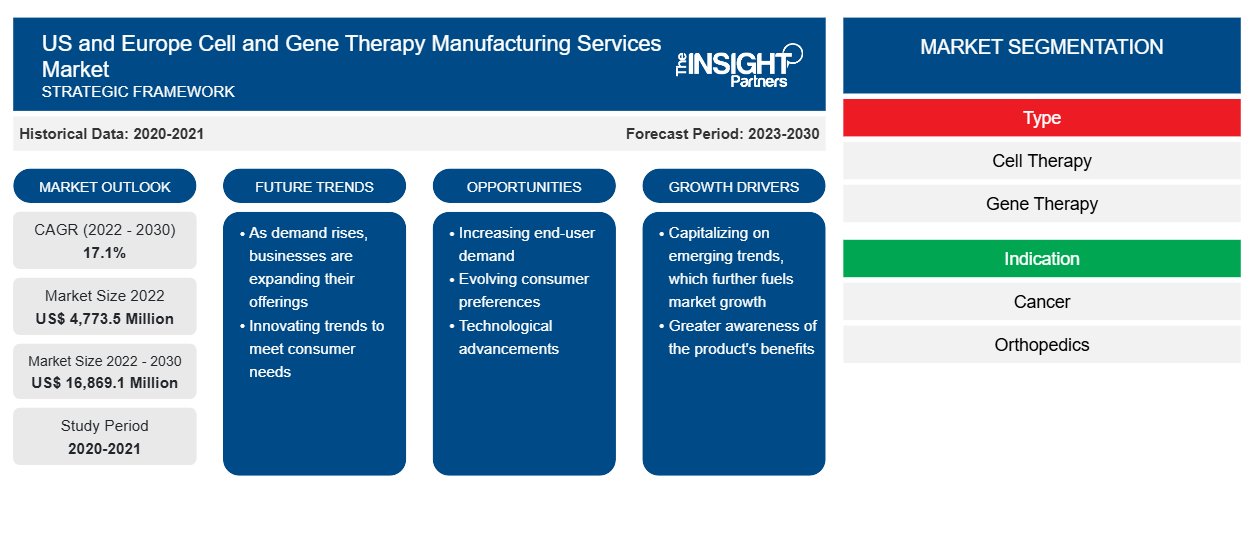

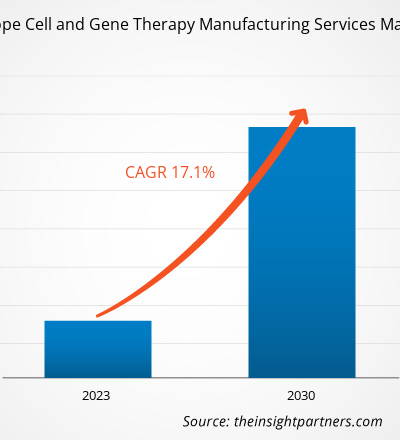

The US and Europe cell and gene therapy manufacturing services market size is expected to grow from US$ 4,773.5 million in 2022 to US$ 16,869.1 million by 2030; it is estimated to register a CAGR of 17.1% from 2022 to 2030.

Analyst’s ViewPoint

The US and Europe cell and gene therapy manufacturing services market aims to support compliance regulations across regions and countries. Once adopted, it provides a comprehensive knowledge-rich environment that enables early detection of rare diseases. Factors such as increase in number of approvals of cell and gene therapies, and increasing popularity of outsourcing cell and gene therapy manufacturing are responsible for the influential growth of the US and Europe cell and gene therapy manufacturing services market. Further, automation of cell and gene therapy manufacturing services acts as a future trend for the market to grow during 2022–2030. According to the segmentation profiled in the report, based on type, the cell therapy segment accounted a maximum share for the US and Europe cell and gene therapy manufacturing services market in 2022. Based on indication, the cancer segment will dominate the market recording maximum share during the forecast period. By application, the commercial manufacturing segment is likely to account considerable share of the cell and gene therapy manufacturing services during the forecast period. In terms of end user, pharmaceutical and biotechnology companies will account a maximum share of the US and Europe cell and gene therapy manufacturing services market during 2022–2030.

Establishing a robust, repeatable, and sustainable process help accelerate development, avoiding manufacturing transfer-related delays. Cell & gene therapy (CGT) programs are rapidly advancing from R&D to clinical trials and commercial approval. The cell and gene therapy comprises the next generation of life-enhancing and curative therapies. With new approvals for these therapies, the demand for skilled professionals in cell and gene therapy manufacturing services would rise in the future, which would encourage more pharmaceutical and biotech companies in the US and Europe to outsource cell and gene therapy manufacturing operations

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US and Europe Cell and Gene Therapy Manufacturing Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US and Europe Cell and Gene Therapy Manufacturing Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increase in Number of Approval of Cell and Gene Therapies Accounts Maximum Share

The advancements in biotechnology have led to the adoption of personalized treatments for a wide range of indications. Stem cell therapies are being used to treat chronic diseases, such as cancer, neurological disorders, and genetic disorders. Further, the advantages of cell therapy, such as targeted treatment, faster and efficient recovery, and reduced side effects, promote the adoption of various products. In US and Europe, cell therapies are widely adopted owing to the availability of Food and Drug Administration (FDA) approved products. Following is the list of cell and gene therapy products approved by the FDA in recent years:

- In April 2020, the FDA awarded regenerative medicine advanced therapy designation to Novartis' Kymriah to treat refractory (r/r) follicular lymphoma (FL) in adults.

- In July 2020, the FDA approved a CAR T-cell therapy brexucabtagene autoleucel (Tecartus) for patients with mantle cell lymphoma. It is the first FDA-approved CAR T-cell therapy for mantle cell lymphoma, and it was approved under the Accelerated Approval pathway. Tecartus also received Orphan Drug designation, which encourages the development of drugs for rare diseases. The other approved CAR-T cell therapies for cancer are Kymriah for acute lymphoblastic leukemia and Yescarta for diffuse large B-cell lymphoma.

- In 2022, ADSTILADRIN, an adenovirus manufactured by Ferring Pharmaceuticals A/S, was approved by FDA. This recombinant adenovirus (rAd-IFNa/Syn3) delivers human interferon alfa-2b cDNA into the bladder epithelium to treat patients with certain types of bladder cancer.

- In 2022, CARVYKTI, manufactured by Janssen Biotech, Inc.—an autologous CAR-T cell engineered with lentivirus to attack BCMA-expressing tumor cells for treatment of certain kinds of relapsed or refractory multiple myeloma—was also approved by the FDA.

- In 2022, the FDA approved HEMGENIX, manufactured by CSL Behring LLC, which is a recombinant AAV5 that delivers F9 to treat patients with certain kinds of Hemophilia B.

- In 2023, the FDA approved VYJUVEK, manufactured by Krystal Biotech, Inc., to treat wounds in patients 6 months of age and older with dystrophic epidermolysis bullosa with mutation(s) in the collagen type VII alpha 1 chain (COL7A1) gene.

Therefore, the increasing approval of cell and gene therapies helps the cell and gene therapy manufacturing services market grow considerably.

Report Segmentation and Scope

The “US & Europe Cell & Gene Therapy Manufacturing Services Market” is segmented based on type, indication, application, end user, and region. Based on the type, the US & Europe Cell & Gene Therapy Manufacturing Services market is segmented into cell therapy and gene therapy. Based on indication, the US & Europe cell & gene therapy manufacturing services market is segmented into cancer, orthopedics, and others. Based on application, the market is bifurcated into clinical and commercial. By end user, the market is segmented into pharmaceutical & biotechnology companies and contract research organizations (CROs).

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Application-Based Insights

In terms of application, the cell and gene therapy manufacturing services market is bifurcated into clinical manufacturing and commercial manufacturing. The commercial manufacturing segment held a larger share of cell and gene therapy manufacturing services in 2022 and is anticipated to register a higher CAGR of 17.9% during the forecast period (2022–2030). CGTs provide significant value across multiple therapeutic areas, driven by a combination of clinical benefit, durability, and overall response rate. However, these therapies are yet to gain a significant market reach. The therapeutic gain of CGTs is underestimated due to the difficulty associated with delivering the right therapy to the right patients, and thus, only a few commercial CGTs-based products have reached the market over the past decade. However, the clinical pipeline of CGT-based products in Phase 3 clinical trials indicates the possibility of a dramatic rise in the number of approvals in the near future.

WuXi Advanced Therapies Inc., a prominent CDMO and a wholly subsidiary of WuXi AppTec, announced the opening of new process development and commercial manufacturing facility in Shanghai in October 2021. This new manufacturing facility would help it expand its global capacity through GMP commercial manufacturing and integrated testing services that would support the commercialization of CGT products in the coming years. The aforementioned factors will be responsible for segmental growth ultimately driving the US and Europe cell and gene therapy manufacturing services market growth during the forecast period.

Cell and Gene Therapy Manufacturing Services Market, by Type – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The US dominated the cell and gene therapy manufacturing services market accounting maximum share. Cell and gene therapies (CGTs) treat patients suffering from serious and rare diseases with unaddressed therapeutic needs. Manufacturing CGTs is a highly complex process, with the insufficiency of infrastructure and expertise being a major limiting factor. Logistical challenges associated with intermediates and the final product also limit the CGT manufacturing capacity of companies. The CGT manufacturing process involves the extraction of autologous cells through "apheresis," dispatching them to specialized labs, and sending them back to clinics for administration into patients, all of which must be performed with strict quality control. The US Food and Drug Administration (USFDA) has approved only 7 CGT drugs, with the pipeline of new products reaching ~1,200 experimental therapies. Half of these are in Phase 2 clinical trials, with estimates of annual sales growth accounting for 15% for cell therapies and ~30% for gene therapies, as per the estimates of the Chemical & Engineering News report 2023.

Many manufacturers approach contract development manufacturing organizations (CDMOs) such as Labcorp, Lonza, and Catalent to overcome the barriers associated with the production and commercialization of their cell and gene therapy products. Lonza has invested ~US$ 9.2 million to strengthen its cell and gene therapy manufacturing capabilities and support. Such initiatives by CDMOs are contributing to the growth of the cell and gene therapy market in the US.

The report profiles leading players operating in the US and Europe cell and gene therapy manufacturing services market. These include Thermo Fisher Scientific Inc, Merck KGaA, Charles River Laboratories International Inc, Lonza Group AG, WuXi AppTec Co Ltd, Catalent Inc, Takara Bio Inc, Nikon Corp, FUJIFILM Holdings Corp, National Resilience Inc, and Oxford BioMedica Plc.

In April 2022, Erytech Pharma announced acquisition of Catalent acquired from its state-of-the-art, commercial-scale cell therapy manufacturing facility in Princeton, New Jersey, for US$44.5 million. The deal includes an exclusive long-term supply agreement for Catalent to support Erytech’s lead product candidate, eryaspase (GRASPA), a red blood cell-derived product that is currently in late-stage development to treat acute lymphoblastic leukemia. It will also collaborate with Catalent’s existing US clinical-scale cell therapy facility in Houston, Texas.

In January 2022, FUJIFILM Corporation entered into an agreement to acquire a cell therapy manufacturing facility from Atara Biotherapeutics, Inc. for US$ 100 million. The facility is readily expandable with the flexibility to produce both clinical and commercial cell therapies, including allogeneic T-cell and CAR T immunotherapies. As part of the agreement, FUJIFILM and Atara will enter into a long-term manufacturing and services agreement, extending to 10 years to support the production of Atara’s clinical pipeline products.

Company Profiles

- Thermo Fisher Scientific Inc

- Merck KGaA

- Charles River Laboratories International Inc

- Lonza Group AG

- WuXi AppTec Co Ltd

- Catalent Inc

- Takara Bio Inc

- Nikon Corp

- FUJIFILM Holdings Corp

- National Resilience Inc

- Oxford BioMedica Plc

US and Europe Cell and Gene Therapy Manufacturing Services Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,773.5 Million |

| Market Size by 2030 | US$ 16,869.1 Million |

| Global CAGR (2022 - 2030) | 17.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | US and Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Real-Time Location Systems Market

- Collagen Peptides Market

- Joint Pain Injection Market

- Europe Tortilla Market

- Emergency Department Information System (EDIS) Market

- Small Satellite Market

- Data Center Cooling Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Intradermal Injection Market

- Formwork System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Indication, Application, and End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Companies operating in the market are Thermo Fisher Scientific Inc, Merck KGaA, Charles River Laboratories International Inc, Lonza Group AG, WuXi AppTec Co Ltd, Catalent Inc, Takara Bio Inc, Nikon Corp, FUJIFILM Holdings Corp, National Resilience Inc, and Oxford BioMedica Plc.

US and Europe Cell and Gene Therapy Manufacturing Services market is segmented by region into Europe, and the Middle East & Africa. US is likely to continue its dominance in the US and Europe Cell and gene therapy manufacturing services market during 2022–2030. The US holds the largest share of the market and is expected to continue this trend during the forecast period.

Major factors driving the market growth includes increase in number of approvals of cell and gene therapies and increasing popularity of outsourcing cell and gene therapy manufacturing. Additionally, automation of cell and gene therapy manufacturing services are likely to emerge as significant future trends in the market during the forecast period.

US and Europe Cell and Gene Therapy Manufacturing Services market, based on type, is segmented into cell therapy and gene therapy. Cell therapy is segmented as autologous and allogenic. Further, gene therapy is bifurcated into viral vector and non-viral vector. The cell therapy segment held a larger market share in 2022. However, gene therapy segment is anticipated to register the highest CAGR during the forecast period (2022-2030).

Answer:- Cell & gene therapy (CGT) programs are rapidly advancing from research & development to clinical trials and commercial approval. Establishing a robust, repeatable, and sustainable process help accelerate development, avoiding manufacturing transfer-related delays. Additionally, cell and gene therapy comprises the next generation of life-enhancing and curative therapies. With therapies experiencing new approvals, the demand for skilled professionals in cell and gene therapy manufacturing services will rise.

Based on indication, the US and Europe cell and gene therapy manufacturing services market is divided into cancer, orthopedics, and others. The cancer segment held the largest share of the market in 2022 and same segment is expected to grow at the highest CAGR during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US and Europe Cell and Gene Therapy Manufacturing Services Market

- Thermo Fisher Scientific Inc

- Merck KGaA

- Charles River Laboratories International Inc

- Lonza Group AG

- WuXi AppTec Co Ltd

- Catalent Inc

- Takara Bio Inc

- Nikon Corp

- FUJIFILM Holdings Corp

- National Resilience Inc,

- Oxford BioMedica Plc

Get Free Sample For

Get Free Sample For