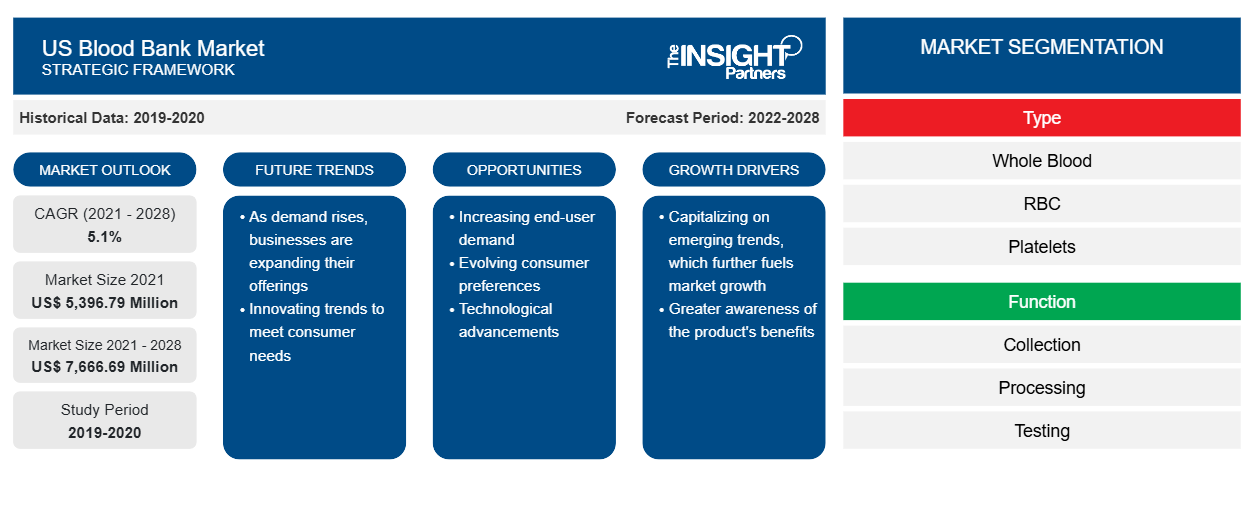

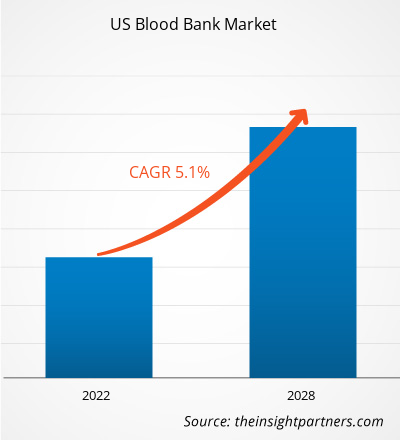

The blood bank market is projected to reach US$ 7,666.69 million by 2028 from US$ 5,396.79 million in 2021; it is estimated to grow at a CAGR of 5.1% from 2021 to 2028.

In blood banks, donors’ blood is collected, typed, grouped, stored, and qualified for transfusion to recipients. A blood bank may be a separate freestanding office or part of a giant laboratory in a hospital. The crucial operations of blood banking include typing the blood for transfusion as well as testing infectious microorganisms or particles. Factors such as the high prevalence of hematologic diseases and the rise in the number of road accidents across the US drive the blood bank market growth. However, failure to comply with regulations hamper the growth of the market.

Market Insights

High Prevalence of Hematologic Diseases Bolsters Blood Bank Market Growth

Hematologic diseases such as blood cell cancers, hematologic rare genetic disorders, anemia, and sickle cell disease, as well as complications from chemotherapy or transfusions, affect millions of Americans. As per the American Society of Hematology, ~900,000 people in the US develop blood clots, and nearly 100,000 deaths occur every year due to hematologic diseases. Also, as per the CDC, about 400 babies are born with hemophilia every year in the US. As per the American National Red Cross, sickle cell disease affects ~90,000–100,000 people in the US, and about 1,000 babies are born with it every year. Sickle cell patients can require blood transfusions throughout their lives, which, in turn, emphasizes the all-time availability of blood to avoid complications.

According to the United States Census Bureau, Population Projections, the Americans aged 65 and older are thereby projected to double from 52 million in 2018 to 95 million by 2060, and it is thus estimated that the total population would rise from 16 % to 23 %. As per American Red Cross, it is estimated that almost 36000 units of red blood cells are required every day, and almost 7,000 units of platelets and approximately 10,000 units of plasma are needed every day in the United States. Also, over 21 million blood components are approximately transfused each year in the United States. Moreover, leukemia, lymphoma, myeloma, and myelodysplastic disorders are highly prevalent cancers in the country. For instance, as per the American Cancer Society, more than 1.8 million people are expected to be diagnosed with cancer in 2020, and most of them will require blood during their chemotherapy treatment. Therefore, the increasing cases of blood disorders in the US propel the demand for blood and blood-related products for various treatments.

Type-Based Insights

Based on type, the blood bank market is further segmented into whole blood, RBC, platelets, plasma, WBC. The whole blood segment would hold the largest market share in 2021 and is expected to register a higher CAGR during the forecast period.

Blood Bank Market, by Type – 2021 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Function-Based Insights

Based on function, the blood bank market is segmented into the collection, processing, testing, storage, transportation. The testing segment would hold the largest market share of 30.92% in 2021, and it is expected to retain its dominance during the forecast period.

Bank Type-Based Insights

Based on bank type, the blood bank market is segmented into public and private. The public segment would hold the largest market share of 54.26% in 2021, and it is expected to retain its dominance during the forecast period.

End User-Based Insights

Based on end-user, the blood bank market is segmented into hospitals, ambulatory surgery centers, pharmaceutical companies, and others. The hospitals segment would hold the largest market share of 44.74% in 2021 and is expected to retain its dominance during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Blood Bank Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Blood Bank Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Various companies operating in the blood bank market are adopting strategies such as product launches, mergers and acquisitions, collaborations, product innovations, and product portfolio expansions to expand their footprint worldwide, maintain the brand name, and meet the growing demand from end-users.

Blood Bank Market

The blood bank market is segmented on the basis of type, function, bank type, and end-user. Based on type, the market is further segmented into whole blood, RBC, platelets, plasma, WBC. Based on function, the market is further segmented into the collection, processing, testing, storage, transportation. Based on bank type, the blood bank market is further segmented into private and public. Based on end-user, the blood bank market is sub-segmented into hospitals, ambulatory surgery centers, pharmaceutical companies, and others. Geographically, the blood bank market is segmented into the United States. Companies considered in our research scope are Bloodworks Northwest, San Diego Blood Bank, America’s Blood Centers, CSL Plasma, Blood Centers of America, The American National Red Cross, New York Blood Center, Vitalant and Interstate Blood Bank, Inc amongst others.

Report ScopeUS Blood Bank Market Regional Insights

The regional trends and factors influencing the US Blood Bank Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Blood Bank Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Blood Bank Market

US Blood Bank Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5,396.79 Million |

| Market Size by 2028 | US$ 7,666.69 Million |

| Global CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

US Blood Bank Market Players Density: Understanding Its Impact on Business Dynamics

The US Blood Bank Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Blood Bank Market are:

- Bloodworks Northwest

- San Diego Blood Bank

- America's Blood Centers

- CSL Plasma

- Blood Centers of America

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Blood Bank Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Function, Bank Type, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Blood Bank Market

- Bloodworks Northwest

- San Diego Blood Bank

- America’s Blood Centers

- CSL Plasma

- Blood Centers of America

- The American National Red Cross

- New York Blood Center

- Vitalant

- Interstate Blood Bank, Inc.

Get Free Sample For

Get Free Sample For