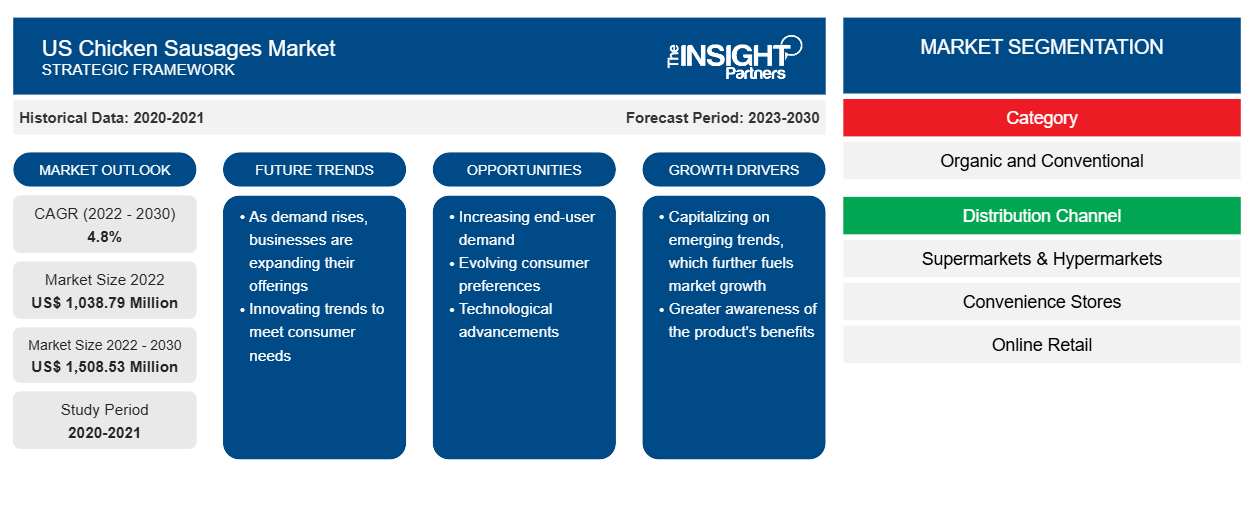

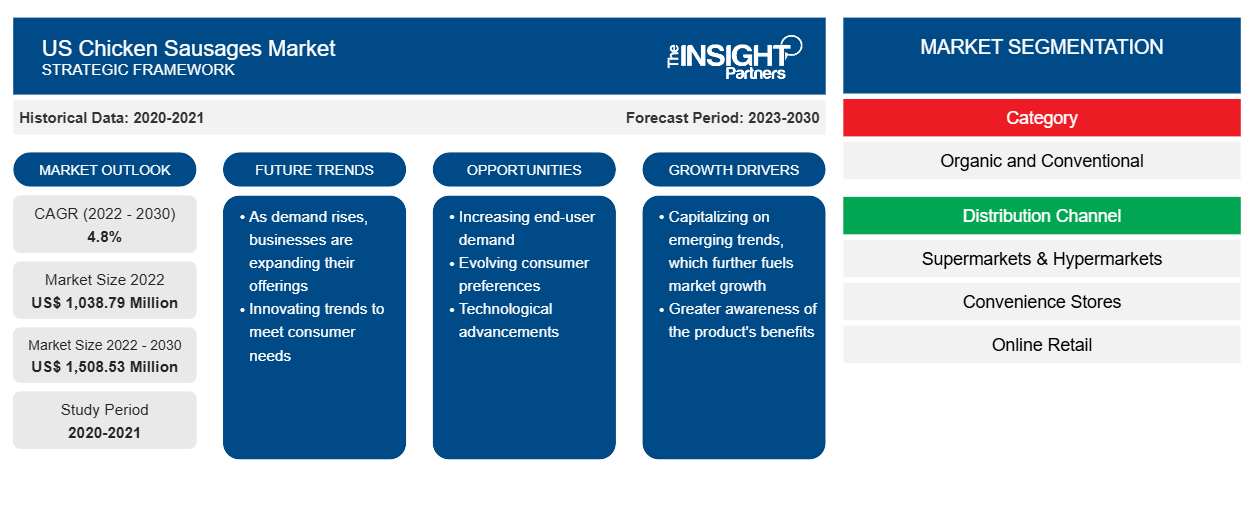

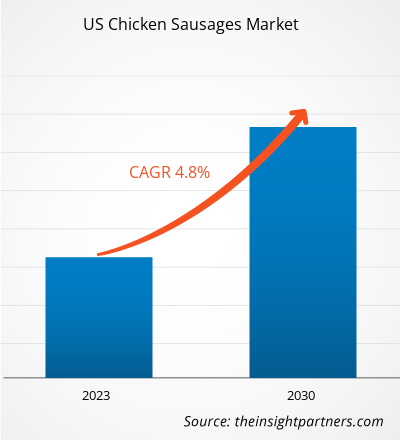

The US chicken sausages market size was valued at US$ 1,038.79 million in 2022 and projected to reach US$ 1,508.53 million by 2030. The market is expected to record a CAGR of 4.8% from 2022 to 2030.

Market Insights and Analyst View:

The chicken sausages market is significantly growing in the US. Sausages are considered one of the most preferred convenience foods among youth and kids. Thus, the increasing demand for protein-rich convenience food is anticipated to surge the demand for chicken sausages in the country. In the past few years, consumers have been inclined toward the consumption of chicken over red meat, such as pork and beef, as they perceive chicken to be healthier than red meat. Hence, the popularity of chicken-based sausages is rising across the country. Further, the rising popularity of high-protein foods and growing preference for organic and natural products are anticipated to boost the demand for organic chicken sausages in the US. Hillshire Farm, Oscar Mayer, and Applegate are a few of the popular chicken sausage brands in the US.

Growth Drivers and Challenges:

Processed meat products such as sausages allow consumers to save time and efforts associated with ingredient shopping, consumption, meal preparation and cooking, and post-meal activities. Convenience and taste are among the major desired attributes among consumers across the US while buying food. The increasing demand for protein-rich food and changes in food habits and meal patterns further boost the demand for meat-based convenience food. According to the US Department of Agriculture, consumer demand for convenience food has increased; as a result, it has become the American staple food. Similarly, as per the Food and Health Survey of the "International Food Information Council" (IFIC), millennials consider convenience while purchasing food, whereas taste is essential for boomers. Thus, the demand for processed meat products such as sausages is significantly increasing across the country.

Moreover, to cater to the increasing demand, manufacturers are launching a variety of chicken sausages in the country. For instance, in July 2021, Johnsonville LLC, a US-based manufacturer, launched sausage strips across the country, which are available nationwide at additional US retailers, including Kroger, Meijer, Albertsons-Safeway, HEB, Food Lion, and many Walmart stores. Additionally, these sausage strips received the “2021 Best New Product” status in the breakfast meat category by BrandSpark International. Such product launch recognitions for sausages fuel the product demand, which is expected to propel the market growth in the country during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Chicken Sausages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Chicken Sausages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The US chicken sausages market is bifurcated on the basis of category and distribution channel. The market, by category, is bifurcated into organic and conventional. Based on distribution channel, the market is categorized into supermarkets & hypermarkets, convenience stores, online retail, and others.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on distribution channel, the US chicken sausages market is categorized into supermarkets & hypermarkets, convenience stores, online retail, and others. The supermarkets & hypermarkets segment holds a significant share of the market. Supermarkets & hypermarkets are large retail establishments that offer a wide range of products, such as groceries, beverages, meat-based products, and other household goods. Products from different brands are available at reasonable prices in these stores, allowing shoppers to find the right product quickly. Additionally, these stores offer attractive discounts, offers, multiple payment options, and a pleasant customer experience. These factors drive the segment growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Country Analysis:

The US chicken sausages market is significantly growing. In the US, the increasing popularity of convenience food and rising meat consumption rate has contributed to the demand for chicken sausages. The convenience trend in food consumption is a key driver behind the growing demand for meat-based snacks such as sausages. As busy lifestyles become prevalent, there is an increasing preference for convenient and easy-to-prepare meals. Thus, owing to all the factors mentioned above, the US chicken sausages market is expected to grow significantly during the forecast period. The popularity of meat-based snacks aligning with the convenience-driven lifestyles of many consumers in the country boosts the demand for chicken sausages in the country.

However, the rise in issues of contamination in chicken sausages can hamper the market growth in the country. For instance, in September 2021, Espi’s Sausage and Tacino Co. recalled more than 2,000 pounds of frozen ready-to-eat chicken and pork products, including sausages. The US Department of Agriculture’s Food Safety and Inspection Service (FSIS) announced the recall, as the products were contaminated with Listeria monocytogenes.

Industry Developments and Future Opportunities:

Initiatives taken by key players operating in the US chicken sausages market are listed below:

- In May 2021, Tyson Foods, Inc.—a US-based manufacturer—launched a line of Italian chicken sausages. These newly launched chicken sausages are made with 100% all-natural, no antibiotics chicken and are widely available in three varieties: Hot Italian, Mild Italian, and Sweet Italian flavor.

- In April 2023, Charcutnuvo, a US-based manufacturer, announced the launch of “Breakfast Sausage Links Made with Chicken” in organic and all-natural varieties. With the launch, the manufacturers are fulfilling the demand for natural and organic sausages across the country.

- In November 2022, Logan’s Sausage acquired US-based Family-owned Gunnoe’s Sausage Co., including its production and distribution operations.

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in the US. Lockdowns, travel restrictions, and business shutdowns in the country hampered the growth of several food and beverage manufacturing companies. The shutdown of manufacturing units disturbed supply chains, production activities, delivery schedules, and essential and nonessential product sales. Many companies reported delays in product deliveries and a slump in their product sales in 2020, which also hampered the US chicken sausages market. The shortage of workforce, ban on import and export, and limited supply of raw materials also led to a halt in operations and processes across the region during the COVID-19 pandemic. These factors negatively impacted the market growth during the pandemic.

However, trend of consuming packaged food products increased drastically in the pandemic as people stayed indoor and the culture of work from home emerged. This gave a boost to the sales of chicken sausages in the country. Also, a shift to e-commerce platforms for purchase of food items including chicken sausages was witnessed during this period.

Competitive Landscape and Key Companies:

Applegate Farms LLC, Conagra Brands Inc, Tyson Foods Inc, Bilinski's Sausage Co, Trader Joe's Co, Amylu Foods LLC, Kayem Foods Inc, Gilbert's Craft Sausages LLC, Boar's Head Provision Co Inc, and Dietz & Watson Inc are among the prominent players operating in the US chicken sausages market. These market players adopt strategic development initiatives to expand their businesses, further driving the US chicken sausages market growth.

US Chicken Sausages Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,038.79 Million |

| Market Size by 2030 | US$ 1,508.53 Million |

| Global CAGR (2022 - 2030) | 4.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Category

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Category, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - US Chicken Sausages Market

- Applegate Farms LLC

- Conagra Brands Inc

- Tyson Foods Inc

- Bilinski's Sausage Co

- Trader Joe's Co

- Amylu Foods LLC

- Kayem Foods Inc

- Gilbert's Craft Sausages LLC

- Boar's Head Provision Co Inc

- Dietz & Watson Inc

Get Free Sample For

Get Free Sample For