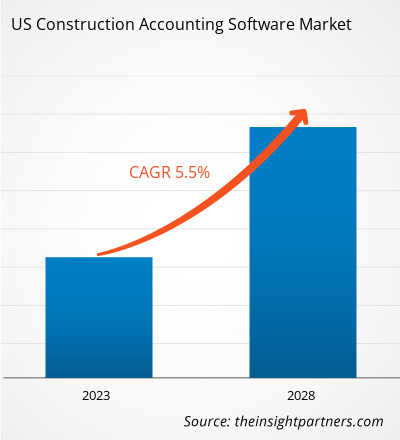

The US construction accounting software market is projected to grow from US$ 239.56 million in 2022 to US$ 331.00 million by 2028; it is estimated to record a CAGR of 5.5% from 2022 to 2028.

The construction industry has begun to undergo technological transformation. Companies are implementing technologies to reduce costs and improve safety, efficiency, and quality of construction activities. The US is experiencing a rise in the number of construction projects, which are inclined toward adopting software-based solutions. As construction companies increasingly emphasize accounting decisions to determine the ROI and future of respective businesses, the demand for construction accounting software is rising. Analyzing finance using accounting software before starting a business allows emerging entrepreneurs to carry out unique business ideas and rapidly and efficiently reflect their vision. A business plan software analysis enables new business owners to understand the fundraising strategies and expansion policies. Additionally, the software-based accounting plans help end users foresee potential problems and obstacles. The awareness regarding the benefits of accounting software in construction projects is strongly growing among entrepreneurs in the US. Thus, many companies are offering construction accounting software due to the rising awareness among new entrepreneurs, which is expected to offer lucrative business opportunities for US construction accounting software market growth in the coming years.

Impact of COVID-19 Pandemic on US Construction Accounting Software Market

Since 2021, the construction industry has been improving rapidly due to rising construction projects and increasing investments in mega infrastructure development. According to the new residential construction statistics by the US Census Bureau and the US Department of Housing and Urban Development, privately‐owned housing completions were at an annual rate of 1,309,000 in February 2022, an increase of 5.9% from the January estimate of 1,236,000. Furthermore, single‐family housing completions in February 2022 were at a rate of 1,034,000, 12.1% higher than that of January at 922,000. Thus, such growth prospects in private home constructions in the post-pandemic scenario are expected to bolster the demand for construction accounting software in the country, which would propel the US construction accounting software market growth during the forecast period.

US Construction Accounting Software Market Insights

The construction industry is a major contributor to the US economy. As of 2020, the industry has more than 680,000 employers with ~7 million employees. Also, it creates nearly US$ 1.3 trillion worth of structures each year. The US economy has increased spending on the construction industry. In 2019, a few topmost construction spenders in the US were Texas (US$ 45.4 billion), New York (US$ 32.1 billion), California (US$ 24.8 billion), Florida (US$ 23 billion), and Pennsylvania (US$ 12.6 billion). Residential and nonresidential construction activities are increasing in the US. The US Census Bureau and the US Department of Housing and Urban Development have released their new residential construction statistics, which show 1,526,000 building permits, 1,425,000 housing construction starts, and 133,900 housing completions for October 2022 in the US. Further, public investment in affordable housing is supporting the residential building construction industry. All aspects described above about the construction of commercial and residential buildings in the US are projected to increase the penetration of construction accounting software. Also, the presence of construction accounting software providers such as Sage, Xero Limited, and Quickbooks would drive the US construction accounting software market growth during the forecast period.

Offering-Based Market Insights

The US construction accounting software market, by offering, is segmented into solution and services. In 2021, the solution segment accounted for a larger market share.

Deployment-Based Market Insights

The US construction accounting software market, based on deployment, is bifurcated into on premise and cloud. In 2021, the cloud segment accounted for a larger market share.

Application-Based Market Insights

The US construction accounting software market, based on application, is segmented into small and mid-sized construction companies and large construction companies. In 2021, the large construction companies segment accounted for a larger share in US construction accounting software market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Construction Accounting Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Construction Accounting Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The players operating in the US construction accounting software market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the US construction accounting software market. A few developments by in the US construction accounting software market are listed below:

- In 2022, Chetu Inc., a provider of world-class software development and support services, announced the opening of its latest software delivery center in Brandon, Florida.

- In 2020, Sage, the market leader in cloud business management solutions, announced the launch of Sage Intacct Construction. Company stated that the new cloud financial management solution is designed to meet the unique needs of construction companies by building the leading construction management functionality of Sage 300 Construction (formerly Sage Timberline) onto the Sage Intacct multi-tenant cloud platform.

Company Profiles

- Deltek Inc.

- Sage Group

- Xero Limited

- Viewpoint Inc.

- Intuit Inc.

- Acclivity Group LLC

- Chetu Inc.

- Corecon Technologies Inc.

- Freshbook

- Foundation Software, LLC

US Construction Accounting Software Market Regional Insights

The regional trends and factors influencing the US Construction Accounting Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Construction Accounting Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Construction Accounting Software Market

US Construction Accounting Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 239.56 Million |

| Market Size by 2028 | US$ 331.00 Million |

| Global CAGR (2022 - 2028) | 5.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

US Construction Accounting Software Market Players Density: Understanding Its Impact on Business Dynamics

The US Construction Accounting Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Construction Accounting Software Market are:

- Acclivity Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Construction Accounting Software Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Deltek Inc.; Sage Group; Xero Limited; Viewpoint Inc.; and Intuit Inc are the top five key market players operating in the US construction accounting software market.

Enhancing data security to prevent data loss is one of the major trend in the US construction accounting software market.

Solution segment held the largest share in the construction accounting software market as construction accounting software solution allows contractors to manage their vendors and clients in a single dashboard and helps in construction companies’ credit management, cash application, invoicing, payments, collection, and other processes.

Increasing awareness of implementing technologies in construction industry is expected to offer lucrative business opportunities for market players in the coming years.

Continuous rise in the number of construction projects worldwide generates significant demand for software-based accounting services., which is enduring the demand for construction accounting software.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - US Construction Accounting Software Market

- Acclivity Group LLC

- Chetu Inc.

- Corecon Technologies Inc.

- Deltek Inc.

- Foundation Software, LLC

- Freshbook

- Intuit Inc.

- Sage Group

- Viewpoint Inc.

- Xero Limited

Get Free Sample For

Get Free Sample For