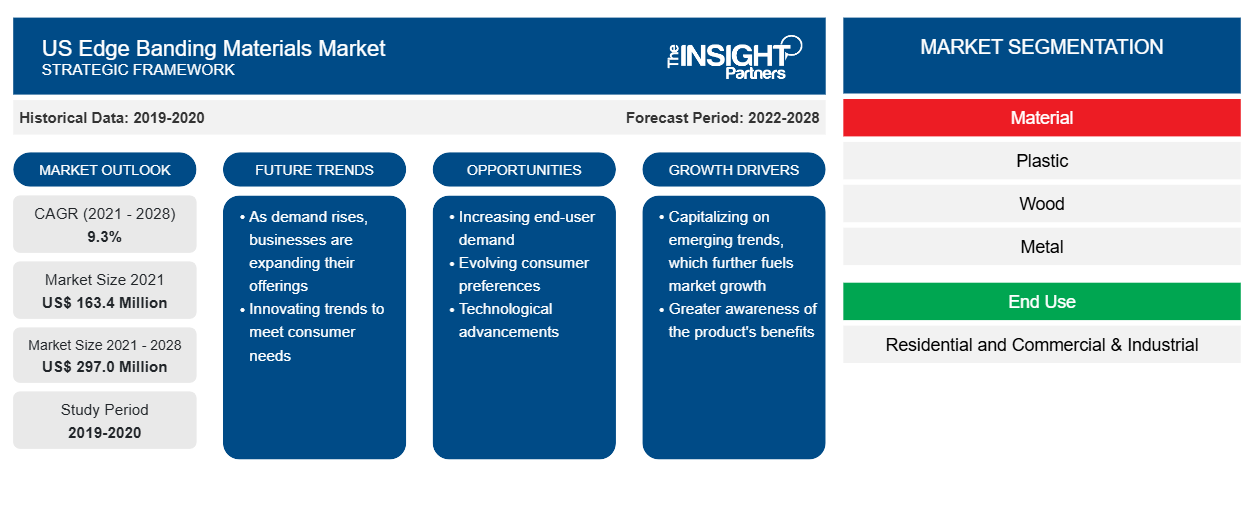

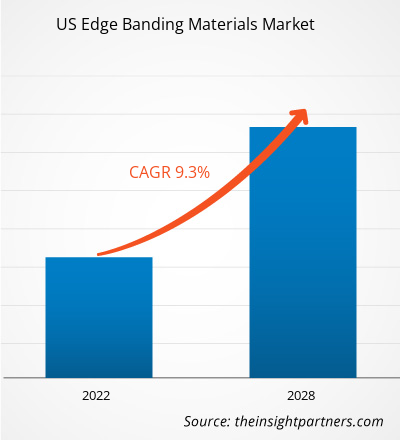

The US edge banding materials market is expected to grow from US$ 163.4 million in 2021 to US$ 297.0 million by 2028; it is expected to grow at a CAGR of 9.3% from 2021 to 2028.

Edge banding is the process of covering the raw edges of medium-density fiberboard, plywood, block boards, or other materials with the help of edge banding tape. Edge banding creates durable and visually appealing trim edges during finish carpentry. Edge banding can be made of different materials, such as plastic, wood, metal, and others.

The rough edges of the plywood and other wood material can easily absorb atmospheric moisture, which can lead to the deterioration of the plywood. The edge banding helps prevent moisture from entering the plywood, thereby increasing its durability. The edge banding tapes generally have a smooth finish that provides an aesthetic appearance.

Due to its excellent processing characteristics, plastic is most commonly used in manufacturing edge bands for the furniture industry. Plastic edge banding tapes are usually flame retardant and are recyclable. Moreover, plastic edge banding is popularly used in modular furniture as it is durable, easy to fix, and has an extremely long life. They offer high-impact resistance and are appropriate for straight and curved panel processing. They are used extensively across the furniture industry, including manufacturing kitchens, bathrooms, and shop fittings.

The rapidly expanding construction industry across the US is boosting the consumption of edge banding materials. Residential and commercial constructions are developing in emerging economies. In the building & construction industry, edge banding is used in carpentry and furniture-making. Edge banding is utilized to cover the exposed sides of materials such as plywood and particle board, giving the appearance of a solid material. Edge banding can also be used instead of features such as face frames or molding. Thus, the growing use of edge banding in the building & construction industry is expected to propel the edge banding materials market growth during the forecast period.

The rising adoption of edge banding materials owing to the advent of cutting-edge industry-grade hot-melt adhesives with heat applicators is one of the major factors boosting the growth of the US edge banding materials market. The growth of the US housing industry, especially in developing countries consisting of builders, contractors, and other entities affiliated with the government, and the rise in demand for user-friendly and sustainable edge banding materials are fueling the market growth. The popularity of plastic is increasing owing to the choice of different color schemes, impermeability, customization, ease of usage on curved surfaces, and the better durability of plastic edge bands as compared to wood edge bands, which is further influencing the market growth.

Furthermore, the increase in demand for variations of plastic edge banding materials such as acrylic and acrylonitrile butadiene styrene, the rise in the number of construction projects, expansion of construction and housing sectors, rising disposable income of the middle-class population, and advancements in the interior design is expected to fuel the US edge banding materials market growth. Furthermore, product and innovative product diversification extend profitable opportunities to the US edge banding materials market players during the forecast period.

Market Insights

Growing Demand for Sustainable Material

Sustainability has become an important aspect of many industries. Many furniture manufacturers are influenced by consumer and business interest in green products, in line with the increased focus on sustainability. Furniture can be made with recycled materials or more sustainable and eco-friendly products to reduce the harmful impacts on the environment. Many furniture brands are offering sustainable product lines. Furthermore, various edge banding material manufacturers are also offering products made from eco-friendly materials. For example, BioPlastic Solutions, LLC, a US-based company involved in bioplastic engineering and manufacturing proprietary bio-based poly-resins and products, provides an eco-friendly PVC alternative BioEdge Edgebanding. It is made from BioBest, a patented, proprietary plastic material manufactured from corn and sugar cane processing. The product eliminates the use of oil and harmful chemicals. It is a complete bio-replacement for PVC and ABS edge banding. Hence, the growing trend of using eco-friendly products is expected to boost the demand for bio-based and eco-friendly edge banding materials during the forecast period.

Moreover, changing consumer preferences, inclination toward a luxurious lifestyle, increasing income levels of consumers, and a growing number of commercial spaces are also boosting demand for wood-based edge banding materials. In modern furniture manufacturing, edge banding quality is one of the key criteria for evaluating the quality of the entire furniture item. Thus, furniture manufacturers use wood-based edge banding to get an aesthetic and natural finish. These factors are driving the growth of the US edge banding materials market.

Material Insights

Based on the material, the US edge banding materials market is segmented into plastic (PVC, ABS, acrylic, and others), wood, metal, and others. In 2021, the plastic segment dominated the US edge banding materials market.

US Edge Banding Materials Market Share, by Material, 2021 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product Resources, Inc.; EdgeCo Incorporated; Surteco USA Inc.; Charter Industries, LLC; JSO Wood Product; Product Resources, Inc.; Sauers & Company Veneers; EdgeCo Incorporated; Edgebanding Services, Inc. (ESI); and REHAU Incorporated are the key players operating in the US edge banding materials market. Leading players are adopting various strategies, such as mergers and acquisitions and product launches, expanding their geographic presence and consumer base.

Report Spotlights

- Progressive trends in the edge banding materials industry to help players develop effective long-term strategies

- Business growth strategies adopted by companies to secure growth in developed and developing markets

- Quantitative analysis of the US edge banding materials market from 2021 to 2028

- Estimation of the demand for edge banding materials across various industries

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict the market growth

- Recent developments to understand the competitive market scenario and the demand for the edge banding materials

- Market trends and outlook coupled with factors driving and restraining the growth of the US edge banding materials market

- Understanding the strategies that underpin commercial interest with regard to the US edge banding materials market growth, aiding in the decision-making process

- The US edge banding materials market size at various nodes of market

- Detailed overview and segmentation of the US edge banding materials market as well as its industry dynamics

The "US Edge Banding Materials Market Forecast to 2028" is a specialized and in-depth study of the chemicals & material industry, focusing on the US edge banding materials market trend analysis. The report aims to provide an overview of the market with detailed market segmentation. The US edge banding materials market is bifurcated on the basis of material and end use. Based on material, the market is segmented into plastic (PVC, ABS, acrylic, and others), wood, metal, and others. Based on end use, the market is segmented into residential and commercial & industrial.

Company Profiles

- Product Resources, Inc.

- EdgeCo Incorporated

- Surteco USA Inc.

- A Charter Industries, LLC.

- JSO Wood Product

- Product Resources, Inc.

- Sauers & Company Veneers

- EdgeCo Incorporated

- Edgebanding Services, Inc. (ESI)

- REHAU Incorporated

US Edge Banding Materials Market Regional Insights

The regional trends and factors influencing the US Edge Banding Materials Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Edge Banding Materials Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Edge Banding Materials Market

US Edge Banding Materials Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 163.4 Million |

| Market Size by 2028 | US$ 297.0 Million |

| Global CAGR (2021 - 2028) | 9.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

US Edge Banding Materials Market Players Density: Understanding Its Impact on Business Dynamics

The US Edge Banding Materials Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Edge Banding Materials Market are:

- Product Resources, Inc.

- EdgeCo Incorporated

- Surteco USA Inc.

- A Charter Industries, LLC.

- JSO Wood Product

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Edge Banding Materials Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

- Product Resources, Inc.

- EdgeCo Incorporated

- Surteco USA Inc.

- A Charter Industries, LLC.

- JSO Wood Product

- Product Resources, Inc.

- Sauers & Company Veneers

- EdgeCo Incorporated

- Edgebanding Services, Inc. (ESI)

- REHAU Incorporated

Get Free Sample For

Get Free Sample For