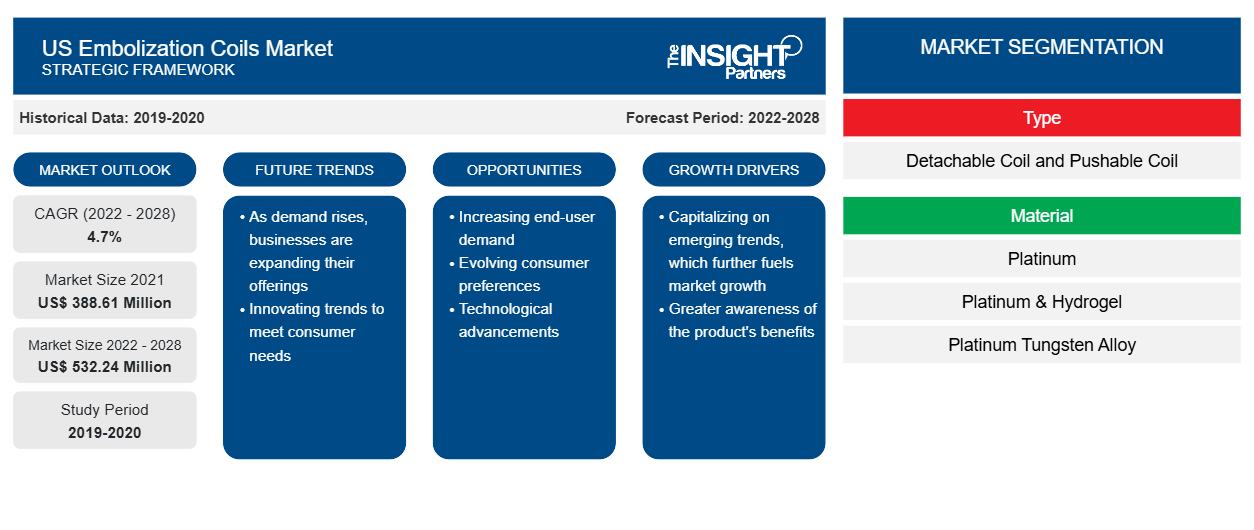

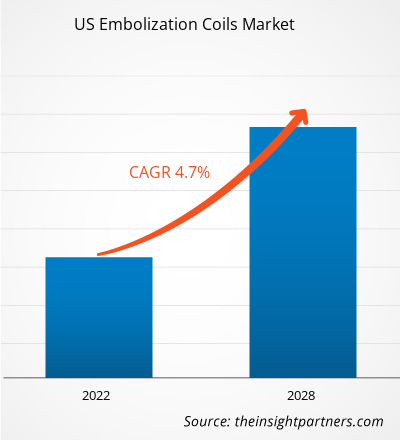

The US embolization coils market is expected to grow from US$ 388.61 million in 2021 to US$ 532.24 million by 2028; it is estimated to grow at a CAGR of 4.7% from 2022 to 2028.

Embolization coils are used to treat brain and cardiac aneurysms and other blood-related conditions. This is used as an alternative to surgical embolization to cut the blood supply to the tumor. It is used to treat various types of diseases such as liver cancer, kidney cancer, aortic artery disorders, neuroendocrine tumors, and peripheral vascular diseases.

Market Insights

Rise in Prevalence of Cardiac Aneurysm

Cardiovascular diseases (CVDs) are disorders of the heart and blood vessels and include cerebrovascular disease, coronary heart disease, rheumatic heart disease, and other conditions. Factors such as tobacco use, an unhealthy diet, and physical inactivity increase the risk of heart attacks and strokes. CVDs are the leading cause of death across the globe, and they affect more people than any other disease.

The cardiac aneurysm is majorly caused due to blockages in the aortic artery. The disease is categorized into two diseases according to the site of blockages. The blockages in the chest are called thoracic aortic aneurysms, and those in the abdomen are called abdominal aortic aneurysms. There is a rise in the prevalence of cardiac aneurysms worldwide. For instance, the Society for Vascular Surgery (SVS) stated that every year in the US, 2 million people are diagnosed with an abdominal aortic aneurysm. It also stated that a rupture abdominal aortic aneurysm is the 15th leading cause of death in the country. It is most commonly seen in people above 55 years of age.

In addition, the abdominal aortic aneurysm is majorly based on family history or inheritance. The immediate relative is more prone to getting an abdominal aortic aneurysm. They are 10 times more likely to develop an abdominal aortic aneurysm. And the person may have different type of aneurysm. Therefore, the rise in the prevalence of cardiac aneurysms is fueling the growth of the embolization coils market.

In the US, lung cancer is the leading cause of cancer-related death. Additionally, breast cancer has at least a 25% higher incidence among women and cervical carcinoma is the leading cause of death in 2020. Moreover, according to the American Cancer Society journal, in 2021, ~1.9 million new cancer cases were diagnosed, and there were ~608,570 cancer deaths in the US. Further, according to National Center for Health Statistics and National Vital System, Mortality Data of the US, in 2020, ~1,153 children younger than 15 years old died of cancer, and 8,863 adolescents and young adults between 15 and 39 years old died of cancer. In addition, 151,578 adults between 40 and 64 years old died of cancer; 338,340 adults between 65 and 84 years old died of cancer; and 102,413 adults who were 85 years and older died of cancer.

Type Insights

Based on type, the US embolization coils market is segmented into detachable coil and pushable coil. In 2021, the detachable coil segment held a larger market share. Moreover, the same segment is estimated to grow at a significant CAGR of 5.0% during the forecast period. Detachable coils are generally made up of platinum and are used for precisely placing the coils at the desired site of treatment. The detachable coils take less time for the procedure compared to the pushable coils. Detachable coils are characterized as soft or standardized coils used for aneurysms and vessels in various clinical applications. The coils are placed with the one-click mechanical detachment handle technology.

US Embolization Coils Market, by Type – 2022 and 2028

Application Insights

Based on application, the US embolization coils market is segmented into neurology, cardio, urology, oncology, peripheral vascular disease, and other. In 2021, the neurology segment held the largest share of the market. Moreover, the same segment is expected to grow at the fastest rate in the coming years. The application of the embolization coils in the field of neurology is generally used to treat brain aneurysms and arteriovenous malformations (AVM). An arteriovenous malformation (AVM) is a tangle of blood vessels connecting arteries and veins that disrupts blood flow and oxygen circulation, resulting in a lack of oxygen for surrounding tissues.

Material Insights

Based on material, the US embolization coils market is segmented into platinum, platinum & hydrogel, and platinum tungsten alloy. The platinum segment held the largest share of the market in 2021. Moreover, the same segment is expected to register the highest CAGR from 2022 to 2028.

End User Insights

Based on end user, the US embolization coils market is segmented into hospital, cardiac center, ambulatory center, and other. The hospital segment will hold the largest share of the market in 2021. Moreover, the same segment is expected to register the highest CAGR from 2022 to 2028.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Inorganic developments such as mergers and acquisitions are highly adopted strategies by companies in the US embolization coils market. A few of the recent key market developments are listed below:

- In August 2022, Boston Scientific Corporation BSX announced the acquisition of Obsidio, Inc. It is a privately held company and the renowned developer of the FDA-authorized Gel Embolic Material (GEM) technology.

- In May 2022, Boston Scientific gained FDA clearance for its Embold Fibered Detachable Coil, a new device developed to assist interventional clinicians with embolization procedures. The Embold Fibered Coil obstructs or reduces blood flow in the patient’s peripheral vasculature.

- In August 2022, Boston Scientific Corporation announced that it had received FDA 510(k) clearance for the Embold fibered detachable coil, which is indicated to obstruct or reduce the rate of blood flow in the peripheral vasculature. A full commercial launch of the device will begin in the US in the coming weeks.

Company Profiles

- Terumo Corporation

- Medtronic

- Boston Scientific Corporation

- Stryker

- KANEKA CORPORATION

- MicroPort Scientific Corporation

- Penumbra, Inc

- Cook Medical LLC

- Johnson & Johnson Services, Inc.

- Shape Memory Medical INC,

US Embolization Coils Market Regional Insights

The regional trends and factors influencing the US Embolization Coils Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Embolization Coils Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Embolization Coils Market

US Embolization Coils Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 388.61 Million |

| Market Size by 2028 | US$ 532.24 Million |

| Global CAGR (2022 - 2028) | 4.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

US Embolization Coils Market Players Density: Understanding Its Impact on Business Dynamics

The US Embolization Coils Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Embolization Coils Market are:

- Terumo Corporation

- Medtronic

- Boston Scientific Corporation

- Stryker

- Johnson & Johnson Services, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Embolization Coils Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Terumo Corporation

- Medtronic

- Boston Scientific Corporation

- Stryker

- Johnson & Johnson Services, Inc

- Cook Medical LLC

- Penumbra, Inc

- KANEKA CORPORATION

- Shape Memory Medical INC

- Microport Scientific Corporation

Get Free Sample For

Get Free Sample For