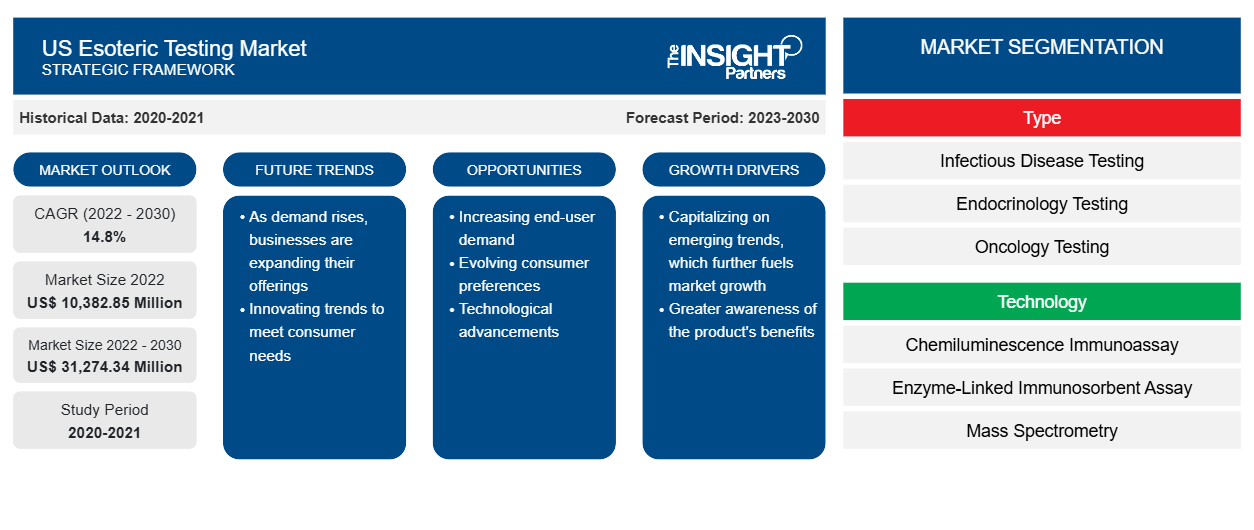

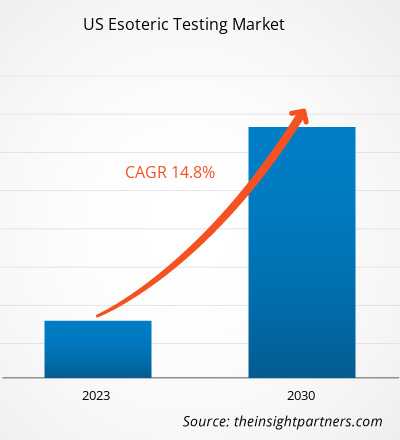

The US esoteric testing market size is projected to grow from US$ 10,382.85 million in 2022 to US$ 31,274.34 million by 2030; the market is estimated to record a CAGR of 14.8% during 2022–2030.

Market Insights and Analyst View:

Esoteric testing comprises testing samples for rare substances or molecules, and it is not performed as a part of routine testing. This segment of diagnostics requires highly skilled professionals along with advanced and complex equipment. They are principally performed in specialized laboratories wherein samples are either referred by physicians or hospitals (inpatient testing) or by patients themselves (outpatient testing). A few of these tests are currently based on the radioimmunoassay technique, which is both expensive and time-consuming. The COVID-19 pandemic provided significant growth prospects for the esoteric testing market in the last couple of years. The RT-PCR test is a common method that is in use for the qualitative identification of SARS-CoV-2 RNA extracted from upper and lower respiratory samples (such as nasopharyngeal or oropharyngeal swabs and sputum) collected from persons suspected of COVID-19.

Growth Drivers:

Rising Prevalence of Chronic Diseases Propels US Esoteric Testing Market

According to a study published by the American Heart Association in 2021, more than 130 million adults in the US are likely to be suffering from some heart disease by 2035. Cancer Facts and Figures 2022, published in January 2022 by the American Cancer Society, states that the US reported nearly 1.9 million new cancer diagnoses and 609,360 cancer-related deaths in 2022. The rising incidence of cancer and the significant burden of other chronic diseases result in the need for precise diagnoses and treatments. According to the American Thyroid Association estimates, over 12% of the US population is expected to develop a thyroid condition in their lifetime. The surging incidence of hormonal disorders due to the consumption of unhealthy food and the adoption of a sedentary lifestyle has led to endocrinology test uptake in North America. Endocrine tests are performed for the diagnosis of hormonal disorders such as pituitary thyroid adrenal bone, carcinoid and neuroendocrine, and parathyroid tumors.

Esoteric testing allows the analysis of rare molecules or substances, which are not included in routine clinical laboratory tests. These tests are typically performed in medical specialties such as genetics, immunology, microbiology, endocrinology, molecular diagnostics, serology, toxicology, and oncology. Molecular genetics or molecular diagnostics principles are commonly application in identifying the prognosis of diseases. For example, molecular diagnostic tests performed on bone marrow biopsy samples may include, but are not limited to, BCR/ABL, NPM1, FLT3, CEBPA, and JAK2. Thus, the growing prevalence of chronic diseases propels the need for esoteric testing in diagnoses, which benefits the US esoteric testing market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Esoteric Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Esoteric Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “US esoteric testing market” is segmented on the basis of type, technology, and end user. Based on type, the market is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. In terms of technology, the US esoteric testing market is divided into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. In terms of end user, the market is categorized into hospitals and laboratories, and independent and reference laboratories.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The US esoteric testing market, by type, is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. The oncology testing segment held the largest market share in 2022. The infectious disease testing segment is anticipated to register the highest CAGR during 2022–2030. Infectious diseases are transmitted in multiple ways; thus, on-time diagnosis and treatment are the key to limiting their transmission. Laboratory tests are the only way to confirm the diagnosis of an infection. Some inexpensive and convenient blood tests can diagnose Influenza, Lyme disease, Epstein-Barr virus infection, and so on. Disease-causing bacteria and viruses are easily identified by genetic testing. Major types of tests performed in labs include culturing, microscopy, immunologic tests, nucleic acid–based identification methods, and non-nucleic acid-based identification methods.

Polymerase chain reaction (PCR) is an example of an esoteric test employed for the identification of infectious diseases. This technique is employed to make multiple copies of a particular gene from the infection-causing microorganisms, making their identification easy. PCR tests are the “gold standard” in COVID-19 testing. As per Our World in Data stats, 909.44 million RT-PCR tests were performed in the US till June 2022.

US Esoteric Testing Market, by Type– 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on technology, the US esoteric testing market is segmented into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. The chemiluminescence immunoassay segment held the largest market share in 2022. The enzyme-linked immunosorbent assay segment is anticipated to register the highest CAGR of 18.7% during 2022–2030. An immunoassay exploits the principles of biochemistry for the detection and measurement of an analyte, which can be large proteins, antibodies (produced in response to an infection), or small molecules. These highly adaptable assays can be applied to determine various types of analytes, depending on the needs of users. Chemiluminescent immunoassays are a type of standard enzyme immunoassays (EIA), representing the application of biochemical techniques in immunology.

Direct chemiluminescent methods use luminophore markers, while indirect methods use enzyme markers. The key advantages of chemiluminescent analytical methods include a wide application range, high signal intensity, absence of interfering emissions (high specificity), rapid acquisition of analytical signals, high stability of reagents and their conjugates, low consumption of reagents, random access, reduced incubation time, and full compatibility with immunology assay protocols.

Based on end user, the US esoteric testing market is segmented into hospitals and laboratories, and independent and reference laboratories. The hospitals and laboratories segment held a larger share of the market in 2022. It is further expected to register a higher CAGR of 15.2% during 2022–2030. Almost all hospitals have a laboratory whose operations are proportional in size to the population they serve. Hospital laboratories need to process hundreds of samples in a limited timeframe. This includes all the tests that are required during emergencies and are conducted in high volumes, such as cardiac biomarker (troponin) tests, wherein results are needed rapidly for effective patient care. The workload in hospital labs can be divided on the basis of the type of testing. These facilities are staffed by personnel trained in particular specialties, which mainly include hematology, microbiology, chemistry, and blood banking. Other units may perform specialized tests using electron microscopy and immunohistochemistry, with a focus on surgical pathology and cytology (analyzing cell and tissue structure). Mayo Clinic in Rochester (US) is among the best facilities for the diagnosis of diabetes and endocrinology in the US. The clinic performs esoteric testing for endocrinology.

Country Analysis:

The esoteric testing market in the US is majorly driven by the rising prevalence of chronic diseases and growing awareness regarding early detection of medical conditions. Esoteric tests are generally performed for the analysis of rare and unique substances that are not included in regular tests. For performing these tests, clinical laboratories require expertise in relevant specialties. Therefore, large commercial laboratories outsource these complex tests to reference and esoteric testing laboratories. A few of the labs performing esoteric testing in the US are Quest Diagnostics Incorporated, Mayo Medical Laboratories, ARUP Laboratories, Myriad Genetics, Genomic Health, Foundation Medicine, and Laboratory Corporation of America. The number of laboratories having the capability to perform these specialized tests is further increasing in the country.

As per an article published by the Endocrine Society, in January 2022, hypogonadism is a common condition in the male population, with a higher prevalence in older men, obese men, and men with type 2 diabetes. 35% of men older than 45 years of age and 30–50% of men with type 2 diabetes or obesity are estimated to have hypogonadism. Moreover, as per the US Census Bureau’s estimation, the incidences of hypogonadism in men aged 65 years and more grew from ~35 million in 2000 to ~55 million by 2020. Further, it is estimated to rise to ~87 million by 2050. The surging prevalence of this condition is due to the rise in the geriatric population in the US.

An upsurge in the demand for esoteric testing in the US is also attributed to the rising cases of hepatic cirrhosis. As per Statista, 51,642 adults in the US died from liver disease in 2020. Chronic liver disease/cirrhosis was the 12th leading cause of mortality in the US in 2020; an increase in the incidences of alcoholic cirrhosis is a major risk factor for this disease.

Collaborations and partnerships are also expected to propel the growth of the esoteric testing market in the US in the coming years. As per the October 2021 press release of the National Institutes of Health (NIH)—the NIH, the US Food and Drug Administration (FDA), 10 pharmaceutical companies, and 5 nonprofit organizations have joined forces to accelerate developments related to the field of gene therapy to support 30 million Americans suffering from rare diseases. There are nearly 7,000 rare diseases, and currently, only 2 heritable diseases have FDA-approved gene therapies. The recently launched Bespoke Gene Therapy Consortium (BGTC), a section of the NIH Accelerating Medicines Partnership (AMP) program and a project led by the Foundation of NIH, aims to enhance and streamline the development process of gene therapy to support the unmet medical needs of individuals suffering from various rare diseases.

Thus, the burgeoning cases of hypogonadism, hepatic cirrhosis, and other similar disease is driving the growth of the esoteric testing market in the US.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the US esoteric testing market are listed below:

- In March 2022, Waters Corporation launched the Xevo TQ Absolute system, a highly sensitive and compact benchtop tandem mass spectrometer. This latest mass spectrometer quantifies negatively ionizing compounds with up to 15 times greater sensitivity than its predecessor, with a 45% smaller size. Moreover, it consumes up to 50% less electricity and gas.

- In February 2021, Quest Diagnostics collaborated with Grail for its Galleri multicancer blood tests. Quest Diagnostics had plans to provide phlebotomy services using the Galleri multicancer early-detection blood tests.

- In January 2021, BioReference Laboratories, Inc., an OPKO Health (OPK) company, introduced Scarlet Health. It is an in-home, fully integrated digital platform that provides access to on-demand diagnostic services. Similar to devices that are used on a daily basis, Scarlet has been designed to confer ease of use, ubiquity, and convenience. The platform delivers an innovative, flexible, mobile alternative to traditional patient service centers or other draw locations when phlebotomy and other specimen collection services are needed.

- In September 2021, LabCorp acquired operating assets and intellectual property (IP) from Myriad Genetics’ autoimmune business unit, including the Vectra rheumatoid arthritis (RA) assay. With this acquisition, LabCorp is expected to bolster its scientific leadership in rheumatology.

- In 2020, Quest Diagnostics acquired Blueprint Genetics, an outreach laboratory service business of Memorial Hermann Health System. Via this multiyear acquisition agreement, Quest plans to offer professional laboratory management services for all 21 hospital laboratories of Memorial Hermann, which provide onsite rapid-response testing. Quest also plans to become the sole laboratory service provider for the Memorial Hermann Health Plan.

- In 2019, Sonic Healthcare acquired Aurora Diagnostics to augment its presence in the anatomical pathology specialty in the US.

Competitive Landscape and Key Companies:

Georgia Esoteric & Molecular Laboratory LLC, Laboratory Corp of America Holdings, Quest Diagnostics Inc, National Medical Services Inc, OPKO Health Inc, ARUP Laboratories Inc, bioMONTR Labs, Athena Esoterix LLC, Stanford Hospital & Clinics, and Foundation Medicine Inc are among the prominent companies in the US esoteric testing market. These companies focus on the introduction of new technologies, upgrading of existing products, and expansion of their geographic reach to meet the growing consumer demand worldwide.

US Esoteric Testing Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10,382.85 Million |

| Market Size by 2030 | US$ 31,274.34 Million |

| Global CAGR (2022 - 2030) | 14.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Tortilla Market

- Dried Blueberry Market

- Artificial Intelligence in Defense Market

- Sports Technology Market

- Mail Order Pharmacy Market

- Intraoperative Neuromonitoring Market

- Equipment Rental Software Market

- Space Situational Awareness (SSA) Market

- Energy Recovery Ventilator Market

- Sandwich Panel Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US esoteric testing market is analyzed on type, technology, and end user. Based on type, the market is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. In terms of technology, the US esoteric testing market is divided into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. In terms of end user, the market is categorized into hospitals and laboratories, and independent and reference laboratories. infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. The oncology testing by type segment held the largest market share in 2022. The infectious disease testing segment is anticipated to register the highest CAGR during 2022–2030.

The US esoteric testing market majorly consists of the players such as Georgia Esoteric & Molecular Laboratory LLC, Laboratory Corp of America Holdings, Quest Diagnostics Inc, National Medical Services Inc, OPKO Health Inc, ARUP Laboratories Inc, bioMONTR Labs, Athena Esoterix LLC, Stanford Hospital & Clinics, and Foundation Medicine Inc.

The growth of the market is attributed to rising prevalence of chronic diseases and growing awareness regarding early detection of medical conditions are the key driving factors behind the market development. However, the lack of skilled personnel and high cost of procedure are hampering the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Esoteric Testing Market

- Georgia Esoteric & Molecular Laboratory LLC

- Laboratory Corp of America Holdings

- Quest Diagnostics Inc

- National Medical Services Inc

- OPKO Health Inc

- ARUP Laboratories Inc

- bioMONTR Labs

- Athena Esoterix LLC

- Stanford Hospital & Clinics

- Foundation Medicine Inc

Get Free Sample For

Get Free Sample For