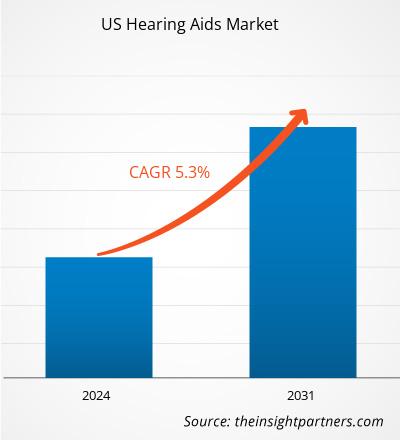

The US hearing aids market size is projected to reach US$ 14.66 billion by 2031 from US$ 9.66 billion in 2023; the market is estimated to register a CAGR of 5.3% during 2023–2031. The availability of over-the-counter hearing aid devices is likely to act as a key trend in the market in the coming years.

US Hearing Aids Market Analysis

Companies operating in the hearing aids market constantly focus on strategic developments such as collaboration, expansion, agreements, partnerships, and product launches. These help them improve their sales, expand their geographic reach, and enhance their capacities to cater to a greater than existing customer base. For instance, In June 2023, Sonova Holding AG launched Sennheiser All-Day Clear in the US. The introduction of the Sennheiser All-Day Clear family expands the company's branded solutions to people with early-stage hearing loss, ranging from prevention to situational assistance. Both current and prospective customers of hearing care professionals in the country can gain access to Sennheiser All-Day Clear devices and other solutions, enabling them to establish connections with hearing care professionals at an earlier stage. Furthermore, in July 2022, Bose Corporation partnered with Lexie Hearing, a direct-to-consumer hearing aid company in the US, to bring self-fitting Bose hearing aids to Lexie Hearing’s product portfolio. The new Lexie B1 hearing aids allow users to seamlessly fit, program, and control their hearing devices without needing a doctor’s visit, a hearing test, or a prescription. These hearing aids deliver clinically proven audiologist-grade results.

Thus, strategic initiatives such as the introduction of innovative products, expansion, and acquisitions by the companies to remain competitive in the market drive the growth of the hearing aids market.

US Hearing Aids Market Overview

Hearing aids are sound-amplifying devices that treat hearing loss. Hearing implants are one type of hearing aid designed to be worn behind or in the ear to improve the hearing ability of patients with hearing loss. Hearing aids are gaining popularity due to technological advancements and an increased desire for attractive designs. The number of patients suffering from hearing loss and hearing impairment in the US is a key factor advancing the production of these devices. The US government is also showing its support through favorable regulatory policies, thereby augmenting the market growth. Furthermore, the approval of over-the-counter (OTC) hearing aids fuels the US hearing aids market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Hearing Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Hearing Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Hearing Aids Market Drivers and Opportunities

Rising Incidence of Hearing Loss Among US Population

Hearing loss profoundly impacts every dimension of the human experience, including physical, emotional, and mental health. The geriatric population contributes to the growing number of people with hearing loss, as the risk of hearing loss is higher in this age group. According to the 2020 Census Bureau population statistics, the US population aged 65 and above grew five times faster than the population from 1920 to 2020. In the US, older population reached 55.8 million (16.8%) of the total population in 2020, from 4.9 million in 1920. As per Deafness and Hearing Loss Statistics 2023, 2 to 4 of every 1,000 people in the US are functionally deaf, most aged 65 years and above. Although hearing loss is more common among aged people, people of all ages can be affected. Exposure to excessive noise is one of the leading causes of hearing loss for millions of young and old Americans. Both short-term and repeated noise exposure can cause lasting damage to the inner ear, resulting in permanent hearing loss. It is particularly risky for people working around loud noises.

Thus, the rising prevalence of hearing loss, wholly or partially, is a key factor boosting the demand for hearing aid devices among the population, thereby driving the growth of the hearing aids market.

Approval of Over-The-Counter Hearing Aids

Earlier, people used to get hearing aids only by undergoing an expensive medical exam or by prescription from a professional who fit the device for the person. The US Food and Drug Administration (FDA) released a new regulation that cuts red tape by creating a new class of hearing aids in August 2022. The US FDA established a regulatory category for over-the-counter (OTC) hearing aids for adults to improve access to hearing aid technology and reduce its costs for millions of Americans. The FDA retained the reliance on “perceived mild-to-moderate hearing loss” as the primary measure for OTC hearing aids. This action enables users with mild to moderate hearing loss to purchase OTC hearing aids directly from online retailers or stores without needing an audiology exam, prescription, or a custom fitting by an audiologist.

US Hearing Aids Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US hearing aids market analysis are type, product type, technology, type of hearing loss, patient type, and distribution channel.

- Based on type, the US hearing aids market is bifurcated into prescription hearing aids and OTC hearing aids. The prescription hearing aids segment held a larger market share in 2023, and the OTC hearing aids segment is anticipated to register a higher CAGR during the forecast period.

- In terms of product type, the market is segmented into hearing aid devices and hearing implants. The hearing aid devices segment held a larger market share in 2023 and is expected to retain its dominance in 2031.

- The US hearing aids market, by technology, is bifurcated into conventional hearing aids and digital hearing aids. The conventional hearing aids segment held a larger share of the market in 2023.

- By type of hearing loss, the market is bifurcated into sensorineural hearing loss and conductive hearing loss. The sensorineural hearing loss segment held a larger share of the market in 2023.

- By patient type, the market is bifurcated into adults and pediatrics. The adults segment dominated the market in 2023.

- In terms of distribution channel, the US hearing aids market is segmented into pharmacies, retail stores, and online. The pharmacies segment held the largest share of the market in 2023.

US Hearing Aids Market Share Analysis by Country

The US hearing aids market is driven by several key factors, including an aging population, the increasing prevalence of hearing loss, and advancements in medical technologies. As per the Population Reference Bureau, the number of Americans aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050. This is likely to increase the demand for hearing aids in the US.

The development of digital and smart hearing aids is likely to drive the growth of the market during the forecast period. Furthermore, features such as Bluetooth connectivity, rechargeable batteries, and AI-powered enhancements that ensure better sound quality and customization are likely to favor the growth of the market.

The US hearing aids market is expected to grow with the increasing demand for better hearing solutions, spurred by an aging population, regulatory changes, and consumer interest in more affordable, user-friendly devices.

US Hearing Aids Market Regional Insights

The regional trends and factors influencing the US Hearing Aids Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Hearing Aids Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Hearing Aids Market

US Hearing Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 9.66 Billion |

| Market Size by 2031 | US$ 14.66 Billion |

| Global CAGR (2023 - 2031) | 5.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | US

|

| Market leaders and key company profiles |

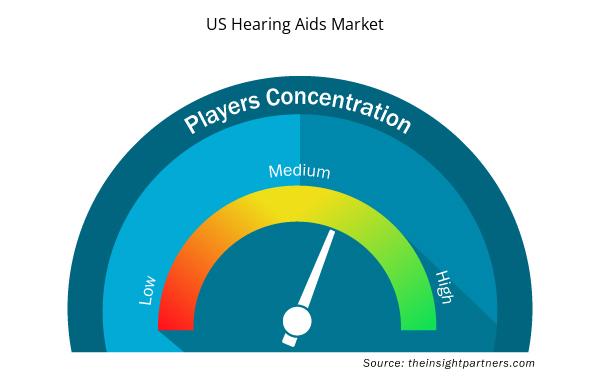

US Hearing Aids Market Players Density: Understanding Its Impact on Business Dynamics

The US Hearing Aids Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Hearing Aids Market are:

- Starkey Laboratories Inc.

- Audina Hearing Instruments Inc.

- SeboTek Hearing Systems LLC

- Earlens Corp

- GN Store Nord AS

- Cochlear Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Hearing Aids Market top key players overview

US Hearing Aids Market Report Coverage and Deliverables

The "US Hearing Aids Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- US hearing aids market size and forecast at country levels for all the key market segments covered under the scope

- US hearing aids market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- US hearing aids market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US hearing aids market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Product Type, Technology, Type of Hearing Loss, Patient Type, and Distribution channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The growing focus on customized hearing solutions is expected to emerge as a prime trend in the market in the coming years.

Starkey Laboratories Inc., Audina Hearing Instruments Inc., SeboTek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, Amplifon Hearing Health Care Corp, WS Audiology AS, Sonova Holding AG, and Sonic Innovations Inc are among the key players in the market.

The increasing prevalence of hearing loss and the rising aging population in the US are among the most significant factors fueling the market growth.

The US hearing aids market value is expected to reach US$ 14.66 billion by 2031.

The market is expected to register a CAGR of 5.3% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Hearing Aids Market

- Starkey Laboratories Inc.

- Audina Hearing Instruments Inc

- Sebotek Hearing Systems LLC

- Earlens Corp

- GN Store Nord AS

- Cochlear Ltd

- WS Audiology AS

- Sonova Holding AG

- Sonic Innovations Inc

- Amplifon Hearing Health Care Corp

Get Free Sample For

Get Free Sample For