The US High-purity electronic-grade phosphoric acid market was valued at US$ 78.73 million in 2023 and is expected to reach US$ 112.21 million by 2031; it is estimated to record a CAGR of 4.5% from 2023 to 2031.

Market Insights and Analyst View:

High-purity electronic-grade phosphoric acid is used in semiconductor manufacturing, electronics etching and cleaning, and other applications. It is a commonly used wet etching agent in compound semiconductor processing. The product also finds applications in the preparation of special high-purity phosphates and organic phosphorus products. The strong presence of the electronics industry and increasing investments in semiconductor manufacturing are among the factors contributing to the growing US high-purity electronic-grade phosphoric acid market size. The US has a vibrant and dynamic electronics manufacturing industry with a long history of innovation and resiliency.

The US high-purity electronic-grade phosphoric acid market report includes company positioning and concentration to evaluate the performance of players in the market. Manufacturers operating in the US high-purity electronic-grade phosphoric acid market produce high-purity electronic-grade phosphoric acid by using different methods—wet process, thermal process, and furnace process; the wet process is the most commonly used method. The choice of production method depends on different factors, such as the quality of phosphate rock, the required purity and concentration of the phosphoric acid, and the economics of scale of the production process. The production of higher-purity phosphoric acid, including electronic-grade phosphoric acid, includes additional purification steps. Further, the phosphoric acid purification process consists of several removal steps that are put in sequence to achieve the target quality.

Growth Drivers and Challenges:

One of the major factors driving the growth of the US high-purity electronic-grade phosphoric acid market is the increasing investments in semiconductor manufacturing. The government of the US strives to boost domestic semiconductor manufacturing by allocating vast amounts to the electronics & semiconductor sector. The US semiconductor industry aims to increase its share in the global chip market to 20% by 2030. As the country grapples with an ongoing chip shortage, the Biden administration and lawmakers passed the CHIPS and Science Act into law in August 2022, making heavy investments in semiconductor manufacturing. The legislation includes US$ 52 billion to strengthen semiconductor manufacturing in the US. This financial aid included US$ 39 billion earmarked for manufacturing incentives, US$ 13.2 billion for research and development and workforce training, and US$ 500 million for the security of international information communications technologies and semiconductor supply chain activities. Several prominent companies have announced significant investments in the US manufacturing sector in the past. For instance, Taiwan Semiconductor Manufacturing Company committed at least US$ 12 billion to build a semiconductor fabrication plant in Arizona, with the expected commencement of production in 2024.

Another major factor driving the growth of US high-purity electronic-grade phosphoric acid market is the strong presence of the electronics industry. This industry is the heart of innovation in every sector of the US economy. For example, smartphones are used for multiple purposes, ranging from the primary applications of calling and messaging to commercial applications such as ordering groceries for home delivery and making online payments or transactions. They are also used to keep track of health by connecting wearable devices to them via Bluetooth or other connectivity technologies. The proliferation of high-speed internet technologies and the growing availability of 5G-compatible smartphones also propel the sales of smartphones in the US. Robots are transforming the warehouse and delivery industries. Various cutting-edge medical diagnostic equipment types are contributing to improving and saving lives. Electronic manufacturers in the US are also empowering the next wave of electric vehicles, autonomous robots, and confidential defense technologies through their R&D and manufacturing capabilities. According to IPC International, Inc., nearly 80% of electronics manufacturers operational in the US are small and medium-sized businesses. Economic activities by these businesses drive innovation, output, and jobs in adjacent industries such as aerospace, automotive, medical, and defense.

IPC International, Inc. emphasizes the fact that the electronics manufacturing sector accounts for roughly US$ 308 billion as a direct contribution to the US GDP (i.e., 4.6% of the GDP) and employs over 1.3 million candidates (i.e., 0.7% of the total employment). The consumer electronics industry is a significant segment of the retail market in the US, offering a wide range of goods that satisfy the needs of various consumer groups. In 2020 and 2021, the country experienced an elevated demand for consumer electronics as the COVID-19 pandemic, along with the subsequent adoption of remote work and education models as well as lockdowns, resulted in the need for better communications and entertainment devices, including laptops, mobile devices, TVs, and home entertainment systems. In the electronics industry, high-purity electronic-grade phosphoric acid is used in applications such as semiconductor manufacturing, and electronics etching and cleaning. Thus, the strong presence of the electronics industry in the US results in a huge demand for high-purity electronic-grade phosphoric acid, thereby fueling the growth of US high-purity electronic-grade phosphoric acid market.

However, the high reliance on imports for high-purity phosphoric acid hinders the US high-purity electronic-grade phosphoric acid market growth. In the US, the wet process is highly used for the production of phosphoric acid. However, this process results in much smaller quantities of purified phosphoric acid, i.e., only ~10% of total production. The majority of domestically produced phosphoric acid in the US is used in fertilizer production. This results in the insufficiency of high-purity phosphoric acid for other end users, leading to an increase in reliance on its import from other countries.

Further, the focus on adopting sustainable practices is emerging as one of the significant US high-purity electronic-grade phosphoric acid market trends. Various manufacturers operating in the phosphoric acid market are focusing on increasingly adopting sustainable practices, such as developing and adopting cleaner production processes, minimizing waste, and recycling by-products. Companies in the market are increasingly recognizing the need for sustainable practices to lower their environmental footprints and ensure long-term viability. Manufacturers emphasize on improving the efficiency of existing production processes by adopting practices aligned with water conservation, energy efficiency, and waste minimization strategies. Also, implementing a closed-loop system to recycle by-products helps to minimize waste generation. Thus, the growing focus on adopting sustainable practices is a notable trend in the US high-purity electronic-grade phosphoric acid market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US High-Purity Electronic-Grade Phosphoric Acid Market: Strategic Insights

US High-Purity Electronic-Grade Phosphoric Acid Market

-

Market Size 2023

US$ 78.73 Million

-

Market Size 2031

US$ 112.21 Million

Market Dynamics

GROWTH DRIVERS

- XXXXXXX

- XXXXXXX

- XXXXXXX

FUTURE TRENDS

- XXXXXXX

- XXXXXXX

- XXXXXXX

OPPORTUNITIES

- XXXXXXX

- XXXXXXX

- XXXXXXX

Regional Overview

- United State

Market Segmentation

Application

Application

- Semiconductor Manufacturing

- Electronics Etching and Cleaning

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US High-Purity Electronic-Grade Phosphoric Acid Market: Strategic Insights

-

Market Size 2023

US$ 78.73 Million -

Market Size 2031

US$ 112.21 Million

Market Dynamics

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Regional Overview

- United State

Market Segmentation

Application

Application - Semiconductor Manufacturing

- Electronics Etching and Cleaning

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

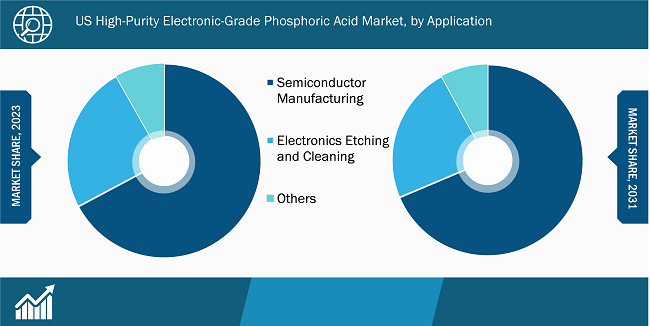

The "US High-Purity Electronic-Grade Phosphoric Acid Market Analysis" has been carried out by considering the application segment. Based on application, the market is segmented into semiconductor manufacturing, electronics etching and cleaning, and others.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on application, the market is segmented into semiconductor manufacturing, electronics etching and cleaning, and others. Semiconductor manufacturing is estimated to hold a significant US high-purity electronic-grade phosphoric acid market share by 2031. High-purity electronic-grade phosphoric acid is a commonly used wet etching agent in compound semiconductor processing. It is used in combination with hydrogen peroxide and water to etch various components. Electronic-grade chemicals with low metal content are an ideal choice for use in etching solutions for semiconductor chips. Particles sticking to the surface of semiconductor wafers may lead to defective semiconductor manufacturing processes. Hence, high-purity phosphoric acid, containing impurities to the absolute minimum, can be used as an etching agent for semiconductors that are sensitive to particles. The flourishing semiconductor manufacturing continues to drive the demand for high-purity electronic-grade phosphoric acid in the US. Various investments in semiconductor manufacturing by the government are further expected to boost the high-purity electronic-grade phosphoric acid market growth in the coming years.

Further, in terms of revenue, electronics etching and cleaning is the second-largest segment in the US high-purity electronic-grade phosphoric acid market share. The semiconductor manufacturing segment is expected to record the fastest CAGR during the forecast period. The other segment includes the use of high-purity electronic-grade phosphoric acid in chemical polishing and the preparation of highly pure special phosphates and organic phosphorus products. Further, with the increasing demand for gadgets such as smartphones, laptops, and wearables, there is a consistent need for reliable batteries. Lithium-iron-phosphate (LFP) batteries find a large-scale adoption in consumer electronics due to their stability and long cycle life. With this, the demand for purified phosphoric acid is further expected to increase in the coming years.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industry Developments and Future Opportunities:

The US high-purity electronic-grade phosphoric acid marketforecast can help stakeholders plan their growth strategies. Various initiatives taken by the key players operating in the market are listed below:

- In 2024, Lab Alley, LLC expanded its operations with a new 33,000 sq. ft. facility in Austin, Texas.

- In 2023, Univar Solutions and Chemi Nutra LLC expanded their business relationship in Canada with an exclusive agreement. Univar Solutions Canada Ltd., a subsidiary of Univar Solutions Inc., a leading global solutions provider to users of specialty ingredients and chemicals, was named the exclusive distributor for Chemi Nutra LLC's specialty, functional, and nutraceutical ingredients in Canada.

- In 2023, Univar Solutions increased its footprint, and product and service portfolio in Eastern Canada with the acquisition of FloChem Ltd.

- In 2023, Prayon, a global player in phosphorus chemistry, successfully acquired Febex from Arkema. With 97% of the shares held, Prayon becomes the majority shareholder in Febex company. This acquisition marks an important step in strengthening Prayon’s position in phosphorus chemistry.

Competitive Landscape and Key Companies:

ICL Group Ltd, Spectrum Chemical Manufacturing Corp, Solvay SA, Capitol Scientific Inc, Lab Alley LLC, Univar Solutions Inc, Prayon SA, OCI Holdings Co Ltd, Advance Scientific & Chemical Inc, and Hubei Xingfa Chemicals Group Co Ltd are among the prominent players profiled in the US high-purity electronic-grade phosphoric acid market report. These players focus on providing high-quality products to fulfill customer demand by adopting various strategies such as mergers and acquisitions, capacity expansions, partnerships, and collaborations to stay competitive in the market.

US High-Purity Electronic-Grade Phosphoric Acid Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 78.73 Million |

| Market Size by 2031 | US$ 112.21 Million |

| CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For