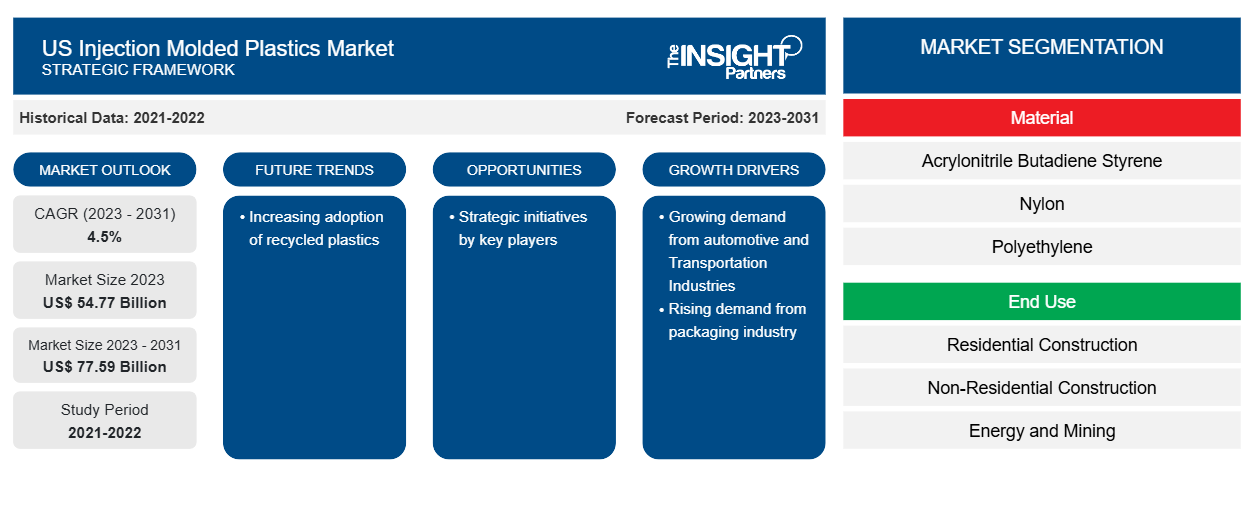

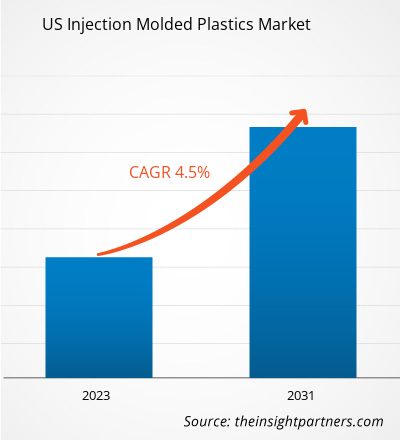

The US injection molded plastics market is projected to reach US$ 77.59 billion by 2031 from US$ 54.77 billion in 2023. The market is expected to register a CAGR of 4.5% during 2023–2031. The increased adoption of recycled plastics is likely to remain a key US injection molded plastics market trend during the forecast period.

US Injection Molded Plastics Market Analysis

The growing demand from the automotive and transportation industry, as well as the packaging industry, drives the growth of the market. Injection molded plastics offer unparalleled versatility, durability, and cost-effectiveness, making them ideal for various packaging applications. The increasing preference for lightweight and sustainable packaging solutions has further propelled the demand for injection molded plastics. The expansion of the e-commerce sector is surging the demand for durable, lightweight, and customizable packaging solutions. The e-commerce boom and shifting consumer behaviors have accelerated the demand for packaging materials, particularly for online retail and delivery services.

US Injection Molded Plastics Market Overview

Injection molded plastics are packed and sold to various end-use industries such as residential construction, nonresidential construction, energy & mining, retail stores & restaurants, petrochemicals & chemicals, HVAC, and aerospace. Butler Machinery Company, Giant Oil, Deere & Company, Ford Motor Company, The Lockheed Martin Corporation, and Northrop Grumman Corporation are a few of the end-use industries in the market. Technological developments in the injection molding process have increased production efficiency, reducing waste and energy consumption. Innovations such as 3D printing and automation have also enhanced the capabilities and application of plastics. These technologies enable market players to produce complex components, expanding the potential uses of injection molded plastics in various industries. Thus, constant technological advancements are expected to fuel the US injection molded plastics market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Injection Molded Plastics Market Drivers and Opportunities

Rising Demand from Packaging Industry to Favor Market Growth

The demand for injection molded plastics in packaging is increasing due to its properties, such as versatility, that appeal to consumers. Additionally, these plastics are lightweight yet durable, making them ideal for use in cutlery and serving utensils in restaurants, where ease of cleaning and durability are crucial for maintaining hygiene standards and ensuring customer satisfaction. Moreover, the cost-effectiveness of injection molding helps to minimize expenses while still maintaining quality and aesthetics. Injection molding allows for the effective production of complex shapes and designs, enabling manufacturers to create innovative and sustainable packaging solutions that stand out in the market.

Strategic Initiatives by Key Market Players

Injection molded plastics manufacturers are engaging in mergers & acquisitions, collaborations, and other strategic developments to expand their clientele and enhance their market position. For instance, in April 2023, France-based Clayens acquired Parkway Products, expanding into North America with eight US locations. The expansion was aimed to cater to the growing demand for injection molded plastics from various end-use industries, including industrial, infrastructure, agriculture, aerospace, defense, transportation, and healthcare. Thus, strategic initiatives by key market players are expected to fuel the injection molded plastics market growth during the forecast period.

US Injection Molded Plastics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US injection molded plastics market analysis are type, and end use.

- Based on type, the US injection molded plastics market is segmented into acrylonitrile butadiene styrene, nylon, polyethylene, polypropylene, polystyrene, polycarbonate, thermoplastic polyurethane, and others. The polypropylene segment held the largest market share in 2023.

- Based on end use, the US injection molded plastics market is segmented into residential construction, non-residential construction, energy (oil and gas) and mining, retail stores and restaurants, petrochemical and chemical, transportation providers, vehicle aftermarket, HVAC, vehicle manufacturers, consumer, construction and agricultural equipment, military, aerospace, food and agriculture, healthcare, and others. The retail stores and restaurants segment held the largest market share in 2023.

US Injection Molded Plastics Market Share Analysis by Geography

The geographic scope of the US injection molded plastics market report focuses on market scenario, in terms of historical market revenues, and forecast.

The demand for injection molded plastics in the US is expected to surge owing to the expanding automotive and aerospace industries. The country is also a hub for significant aircraft, aircraft components, and defense equipment manufacturing companies such as Raytheon Technologies Corporation, Boeing, GE Aviation, and Lockheed Martin Corporation. Moreover, in March 2023, the Biden-Harris Administration proposed a Fiscal Year (FY) 2024 budget request of US$ 842 billion for the Department of Defense. The injection molded plastics demand in the US has been steadily increasing owing to the growing construction industry and surging infrastructure development. The construction industry strongly contributes to the US economy. Every year, US$ 1.4 trillion worth of structures are built nationwide.

US Injection Molded Plastics Market Regional Insights

The regional trends and factors influencing the US Injection Molded Plastics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Injection Molded Plastics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Injection Molded Plastics Market

US Injection Molded Plastics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 54.77 Billion |

| Market Size by 2031 | US$ 77.59 Billion |

| Global CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | US

|

| Market leaders and key company profiles |

US Injection Molded Plastics Market Players Density: Understanding Its Impact on Business Dynamics

The US Injection Molded Plastics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Injection Molded Plastics Market are:

- Wilbert Plastic Services Inc

- Rodon Ltd

- Texas Injection Molding LLC

- Nicolet Plastics

- Britech Industries

- Ironwood Plastics Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Injection Molded Plastics Market top key players overview

US Injection Molded Plastics Market News and Recent Developments

The US injection molded plastics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments and strategies undertaken by the market players operating in the injection molded plastics market:

- Aztec Plastic Company, a plastic injection molding company, partnered with IMEC to enhance workspace organization, eliminate waste, and foster continuous improvement by engaging Lean experts. (Source: Aztec Plastic Company/Company Website/ News Release/2022)

- Foster Corporation signed an agreement with SK Functional Polymer to serve the North America medical device market exclusively. (Source: Foster Corporation /Company Website/ News Release/2021)

US Injection Molded Plastics Market Report Coverage and Deliverables

The “US Injection Molded Plastics Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- US injection molded plastics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- US injection molded plastics market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- US injection molded plastics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US injection molded plastics market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US injection molded plastics market is estimated to reach US$ 77.59 billion by 2031.

Wilbert Plastic Services, The Rodon Group, Texas Injection Molding, Nicolet Plastics LLC, and Britech Industries are some of the leading players operating in the US injection molded plastics market.

Based on material, the polypropylene segment dominated the US injection molded plastics market in 2023.

The growing demand from automotive and transportation industry, and rising demand from packaging industry are some of the driving factors positively impacting the US injection molded plastics market.

The US injection molded plastics market is expected to register a CAGR of 4.5% during 2023-2031.

The increasing adoption of recycled plastics is one of the significant future trends of the US injection molded plastics market.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - US Injection Molded Market

- Rodon Ltd

- Texas Injection Molding LLC

- Ironwood Plastics Inc

- Jones Plastic & Engineering LLC

- Hi-Tech Mold and Tool Inc

- Valencia Plastics Inc

- Abtec Inc

- Mack Group Inc

- Revere Plastics Systems LLC

- Thomson Plastics Inc

Get Free Sample For

Get Free Sample For