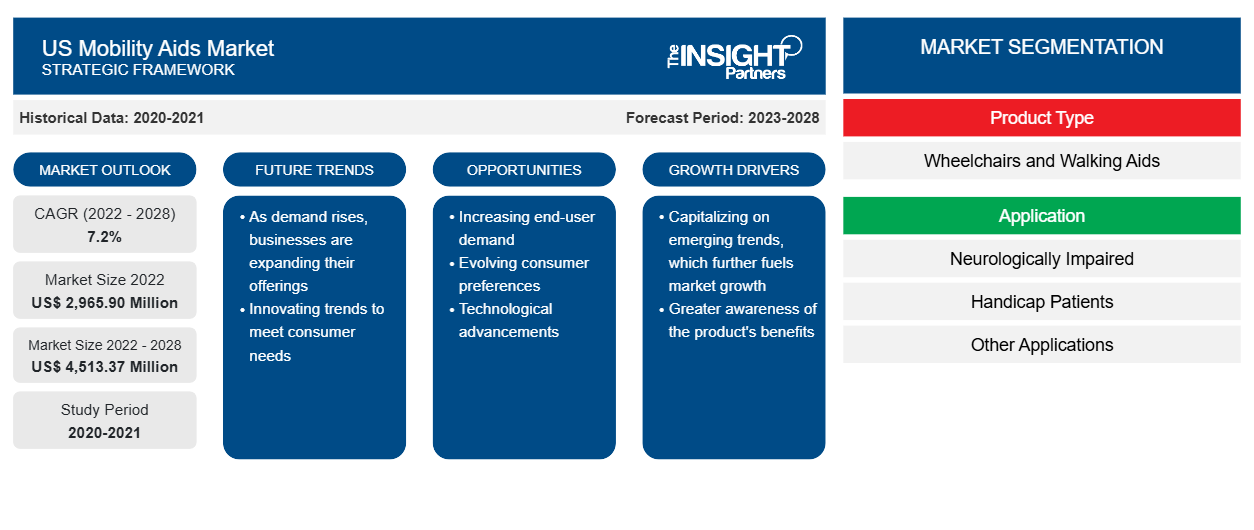

The mobility aids market size was valued at US$ 2,965.90 million in 2022 and is projected to reach US$ 4,513.37 million by 2028. It is estimated to register a CAGR of 7.2% during 2022-2028.

Market Insights and Analyst View:

A mobility assist is a tool that facilitates walking for those with mobility issues; these aids can also be used by people to enhance their mobility. Mobility aids are made to make moving around easier for the elderly and disabled. Additionally, patients who have trouble moving around in their in-home care environments can be transported using these goods. Braces, canes, crutches, and walkers are a few examples of mobility aids. Walking aids include crutches, walkers, and assistive canes, commonly referred to as walking sticks. According to the demands of individual users, these devices can provide improved stability, decreased lower-limb burden, and/or movement generation, which help maintain upright ambulation.

Growth Drivers and Challenges:

The US mobility aids market is continuously progressing at a substantial rate owing to rising mobility impairment disorder cases and increasing geriatric population. Common mobility impairment disorders include arthritis, multiple sclerosis, and Parkinson's disease. In the US, over 90,000 people are diagnosed with Parkinson's disease annually, according to a study funded by the Parkinson's Foundation published in late 2022. This indicates a 50% upsurge from the previously projected rate of 60,000 diagnoses annually. These conditions can cause significant mobility limitations, making it challenging for individuals to move around independently. Mobility aids such as mobility scooters, power wheelchairs, and stairlifts provide individuals with the necessary support and assistance to overcome these limitations. These devices enable individuals with mobility impairments to maintain independence and participate in daily activities. With a soaring number of individuals with mobility impairments, the demand for mobility aids is also on the rise. Sunrise Medical launched the QUICKIE QS5 X wheelchair in July 2023. The company redefines a folding wheelchair through this product, has the lowest weight in its class, along with conferring over 40% energy savings with every fold owing to the highly innovative FreeFold design. QS5 X requires 40% less force than other folding wheelchairs available on the market, and it sets the new standard for the ease and efficiency of folding. Different products offered by companies in the mobility aid market often feature advanced technologies and customizable options to meet the unique needs of each individual. Government initiatives and policies for individuals with mobility impairment disorders also contribute to the growth of the US mobility aids market. Many countries have implemented disability-friendly regulations and accessibility standards that mandate public spaces and transportation to be accessible to individuals with mobility impairments. Thus, the rising prevalence of mobility impairment disorders drives the growth of the US mobility aids market.

The increasing geriatric population benefits the US mobility aids market growth. With age, people become more susceptible to medical conditions limiting their mobility, as a result of which they require medical assistance or aid to avoid dependence on other individuals. The global population is aging rapidly, and the number of older adults is expected to increase significantly in the coming years. According to the 2020 Census, during 1920–2020, the population aged 65 and above in the US surged at a rate nearly five times faster than the overall population growth rate. In 2020, 55.8 million Americans, i.e., 16.8% of the total population, were aged 65 and above.

Older adults often face challenges such as reduced muscle strength, balance issues, and joint problems, making it challenging for them to move around independently. Mobility aids such as walkers, canes, and wheelchairs are designed to provide support and assistance to them. These devices can help prevent falls, reduce the risk of injuries, and enable older adults to remain active and engaged in daily activities. Manufacturers are developing products for older adults, with a greater focus on stability, ease of use, and comfort. Thus, the increasing geriatric population is a significant driver for the growth of the US mobility aids market.

According to Forbes Health, the Pride Go Chair, a basic, portable power wheelchair, costs US$ 2,000 as of August 2023, while the Quickie Q500 M Power Wheelchair, a fully adjustable and highly maneuverable variant, costs nearly US$ 6,000. This research also estimates that the price of fully tailored electric wheelchairs can range from US$ 12,000 to US$ 50,000. Moreover, this type of wheelchair is uncommon for any funding source, including Medicare or private health insurance, to come close to paying the entire retail cost. Several factors contributing to the elevated prices of mobility aids include extensive R&D involved, sophisticated electronics incorporated, and stringent safety and quality standards compliance needs. Creating advanced mobility aids with cutting-edge features and technologies can be expensive due to the involvement of elaborate R&D operations. These devices often incorporate sophisticated electronics, durable materials, and specialized manufacturing processes. Additionally, the stringent safety and quality standards imposed on medical and mobility devices, and limited competition among manufacturers in some market segments can heighten the costs. Thus, the high cost of mobility aid devices, hindering accessibility and affordability for many individuals in need, limits the US mobility aids market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Mobility Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Mobility Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

By product type, US mobility devices market is segmented into wheelchairs and walking aids. On the basis of application, the US mobility aids market is classified into neurologically impaired, handicap patients, and other applications. The US mobility aids market, by type of supplier, is segmented into branded and unbranded. On the basis of end user, the market is segmented into homecare, hospitals and clinics, rehabilitation centers, and ambulatory surgical centers. In 2022, the homecare segment held the largest share of the market. Based on distribution channel, the US mobility aids market is bifurcated into online and offline.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

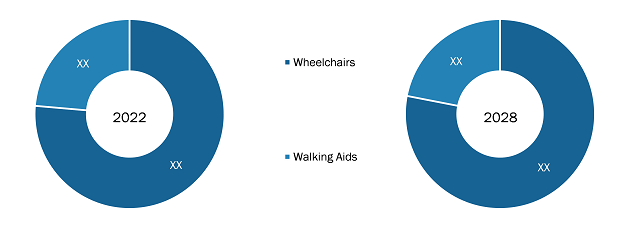

Based on product type, the US mobility aids market is segmented into wheelchairs and walking aids. The wheelchairs segment is further segregated into powered, unpowered, and smart. The walking aids segment is also further classified into walkers, crutches, rollators, walking sticks, and canes. Growth of the US mobility aids market for the wheelchair segment is ascribed to a rise in accidental and innate mobility deformities, a growing geriatric population, patients’ preference for independent mobility in indoor and outdoor settings, and a high prevalence of Alzheimer's disease and Parkinson's disease. Additionally, the growing availability and accessibility of wheelchairs in middle and low-income countries, and advanced features such as lockable wheels, oxygen tank holders, hemiplegic handles, friction brakes, light frame, larger wheel diameter, and expanded weight-bearing capacity benefit the market for this segment.

US Mobility Aids Market by Product Type – 2022 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The US mobility aids market, by application, is segmented into neurologically impaired, handicap patients, and other applications. In 2022, the neurologically impaired segment held the largest share of the market, and it is further expected to record the highest CAGR during 2022–2030. Neurologically impaired individuals include people suffering from Parkinson's disease, multiple sclerosis, etc., who may experience difficulties moving around. Neurological impairment is a consistent process hampering intellectual function, mobility, communications, and multiple other specific medical issues. It can be mild with reduced muscle tone and coordination, or severe enough to disrupt a person's ability to stand or walk. Mobility aids help these individuals maintain their independence and improve their quality of life. In addition to overcoming physical limitations, these aids can help them enhance their safety while making movements. Mobility aids used by neurologically impaired patients include wheelchairs, walkers, canes, and scooters.

The US mobility aids market, by type of supplier, is segmented into branded and unbranded. In 2022, the branded segment held a larger share of the market, and it is further estimated record a higher CAGR during the 2022-2028. The branded segment includes products offered by leading players who have global presence. It also includes products offered by companies that are exported to other countries. The branded segment focuses on products manufactured and sold under specific brand names by recognized suppliers. These suppliers offer products of established brands (manufacturers) that have been operating in the market for a significant period of time; they build a reputation for providing reliable, and high-quality products and services. Creating such goodwill helps these companies generate more significant sales opportunities and profitable relationships.

The US mobility aids market, by end user, is segmented into homecare, hospitals and clinics, rehabilitation centers, and ambulatory surgical centers. In 2022, the homecare segment held the largest share of the market. Hospitals provide healthcare facilities with specialized scientific equipment. Teams of trained and highly skilled staff members are assigned to resolve the problems associated with modern medical sciences in hospitals. Hospitals offer advanced treatment choices for patients to treat chronic and hard-to-heal wounds. Most surgeries are performed in hospitals due to their continuous patient care and monitoring services. The hospitals and clinics segment plays a crucial role in the mobility aid market. Hospitals are the sources of patients requiring mobility aids for post-surgery recovery, injury rehabilitation, and managing chronic health conditions. With their advanced infrastructure and specialized departments, hospitals are well-equipped to provide comprehensive care, including the provision of mobility aids. Additionally, the availability of advanced equipment in hospitals, such as remote-controlled wheelchairs and innovative gadgets, having the ability to increase the quality of patient care is another reason for patients’ preference to take treatments at hospitals.

Based on distribution channel, the US mobility aids market is divided into online and offline. The offline segment is further segregated into hospitals, pharmacies, and retail. In recent years, there has been an extensive surge in e-commerce and online platforms. Online stores offer better pricing than offline stores, along with better access, lower transaction and product costs, greater convenience, and consumer anonymity. They offer individuals with limited mobility and people in remote areas with better access to mobility aid products. The mobility aids market for the online segment is anticipated to experience significant growth during the forecast period. Leading e-commerce platforms such as Amazon offer a diverse range of mobility aids. Mobility aids manufacturers also have their own online sales sites or e-commerce channels, via which they sell their goods. Invacare and Sunrise Medicals are among other businesses offering a variety of options for assistive medical aid devices online, including manual & motorized wheelchairs and mobility scooters.

Competitive Landscape and Key Companies:

Invacare Corporation, Stryker Corporation, Medline Industries, Inc, NOVA Medical Product, Sunrise Medical LLC, Otto Bock HealthCare, Karman Healthcare, Carex Health Brands Inc., Pride Mobility Products Corporation, and ETAC AB are a few of the prominent players operating in the mobility aids market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their widescale presence allows them to serve a large base of customers, subsequently allowing them to expand their market share.

US Mobility Aids Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,965.90 Million |

| Market Size by 2028 | US$ 4,513.37 Million |

| CAGR (2022 - 2028) | 7.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Who are the major players in the US mobility aids market worldwide?

What are the driving factors for the US mobility aids market worldwide?

What are mobility aids?

Which segment is dominating the US mobility aids market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For