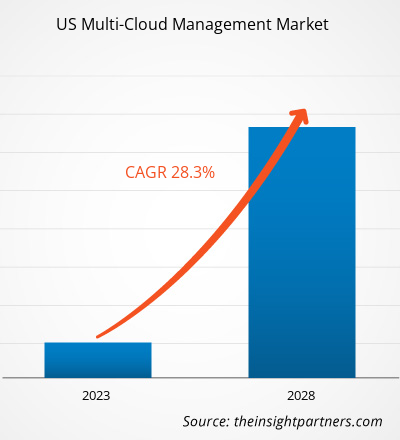

The US multi-cloud management market size is expected to grow from US$ 2,411.5 million in 2022 to US$ 10,741.1 million by 2028 at a CAGR of 28.3% during 2022–2028.

The US cloud solutions and services market is gradually shifting from standalone cloud solutions to platforms that integrate onsite, public, and private IaaS. The demand for innovative solutions and services based on the latest technologies has been fueled by the ongoing spread of wireless connectivity and the expanding usage of connected and IoT-enabled devices. As a result, market players are investing aggressively in cutting-edge technologies to gain a competitive advantage over their rivals.

Moreover, the rising demand for efficient computing frameworks encouraged the growth of the multi-cloud management market in the US. According to HashiCorp's State of Cloud Strategy Survey, 2022, 76% of companies have adopted multi-cloud into their digital infrastructure, as a multi-cloud strategy addresses the limitations of using a single cloud service provider.

Further, favorable government policies, leading cloud vendors, and robust internet infrastructure are the primary factors for the significant growth of the US multi-cloud management market. According to the US Federal Cloud Computing Strategy, the US government implemented the "CloudFirst policy" to accelerate the pace of cloud solutions and services adoption in the country. The policy promotes service management, innovation, and the uptake of emerging technologies.

In recent years, the rising internet penetration has propelled the demand for cloud solutions and services in the US. Many FDIs are investing heavily, propelling the country's multi-cloud management market growth. The US's promotion of the Cross Border Privacy Rules (CBPR), which has attracted many investors to invest in the IT sector of the country, has created lucrative opportunities for the market in the country. Therefore, US-based companies have maintained a strong presence in the international market to expand their business as the cloud service provider companies are partnering together, leading to a strong presence in the market.

The multi-cloud management market is segmented by component, deployment, application, verticals, and geography. US multi-cloud management market analysis by component, the multi-cloud management market is segmented into solution and service. In terms of deployment, the multi-cloud management market is bifurcated into public cloud and private cloud. US multi-cloud management market analysis by application, the multi-cloud management market is segmented into infrastructure and resource management, identity and policy management, compliance management, metering and billing, and provisioning and lifecycle management. Based on verticals, the multi-cloud management market is segmented into IT & Telecom, BFSI, government, retail & consumer goods, travel & hospitality, healthcare & life science, and others.

Impact of COVID-19 Pandemic on US Multi-Cloud Management Market

The US economic development was slowed by the spread of the SARS-CoV-2 virus, i.e., COVID-19, in 2020. Many ICT providers have had slower business operations as a result of the lockdowns imposed by the federal government. North America suffered considerable economic losses in the first two quarters of 2020 due to the sudden increase in COVID-19 cases in the region. However, in 2020, the region's IT industry flourished due to the changing business model of enterprises. Many businesses adopted new business models to protect their employees, such as the work-from-home model. This boosted the demand for multi-cloud-based solutions. According to the World Economic Forum, in the second quarter of 2020, cloud IT infrastructure investment increased by 35%. In addition, major players in the ICT industry, such as Microsoft, IBM, Amazon Web Services, and VMware, focused on digital technologies to lessen the effects of the COVID-19 crisis in 2020.

Furthermore, major players in the ICT industry witnessed exponential revenue growth in 2020. The onset of the COVID-19 pandemic boosted the growth of the cloud computing market due to the rising awareness and investment in cloud computing by several enterprises. For instance, in 2021, Microsoft's profit jumped 33% as the enterprises shifted to cloud infrastructure due to the pandemic.

The US has one of North America's most advanced logistics and supply chain networks. The logistics industry supports the country's GDP growth; thus, the US government frequently invests in IT sectors. For instance, in July 2022, Microsoft launched an effort to encourage broader multi-cloud adoption among US government agencies to increase its share (i.e., 21%) in US government spending on cloud services.

Moreover, the relaxation of lockdown measures led to the recovery of e-commerce, logistics, and supply chain industries and the rise in the adoption of cloud-based solutions. For example, under the Infrastructure Investment and Jobs Act in 2021, the federal government will spend US$ 1.2 trillion to revamp the nation's critical transportation and power systems in the coming years. Under this act, the federal government would spend US$ 75 billion on technology upgrades nationwide, with US$ 65 billion earmarked for broadband expansion to underserved populations and US$ 7.5 billion to encourage the adoption of electric vehicles. This will offer lucrative opportunities for key players operating in the multi-cloud management market in the US.

US Multi-Cloud Management Market Insights

Growing Popularity of Hybrid Cloud

Dedicated private clouds, various public clouds for applications and data, and on-premises resources can all be included in hybrid cloud technology models. Over the years, it has been estimated that the adoption rates of hybrid cloud methods will increase further. More businesses will adopt multi-cloud environments to disperse their burden as they continue their cloud migration and digital transformation. For instance, 82% of major businesses have chosen a hybrid cloud architecture, and 92% of organizations either have a multi-cloud strategy or are currently developing one.

According to Faction, a leading multi-cloud data services provider company, organizations use 2.6 public clouds and 2.7 private clouds on average. The cloud infrastructure offers advantages such as failover capabilities for greater redundancy and disaster recovery, avoiding vendor lock-in, and pay-as-you-go models. Organizations now have more control over where and how their data is stored. While utilizing the scalable computing capability of the cloud, businesses may choose to preserve sensitive information on on-premises servers for security or compliance reasons. Thus, enterprises' high uptake of hybrid cloud will create more opportunities for the multi-cloud management solution provider in the near future.

US Multi-Cloud Management Market Revenue and Forecast to 2028 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Component-Based US Multi-Cloud Management Market Insights

Based on component, the market can be bifurcated into solution and service. The solution segment led the market with a larger multi-cloud management market share in 2021.

Deployment-Based US Multi-Cloud Management Market Insights

Based on deployment, the market can be bifurcated into public cloud and private cloud. The public cloud segment led the market with a larger multi-cloud management market share in 2021.

Application-Based US Multi-Cloud Management Market Insights

Based on application, the US multi-cloud management market is segmented into infrastructure and resource management, identity and policy management, compliance management, metering and billing, and provisioning and lifecycle management. The infrastructure and resource management segment led the market with a larger market share in 2021.

Vertical-Based US Multi-Cloud Management Market Insights

Based on verticals, the multi-cloud management market is segmented into IT and Telecom, BFSI, government, retail and consumer goods, travel and hospitality, healthcare and life science, and others. In 2021, the BFSI led the US market.

Company Profiles

- BMC Software, Inc.

- Cisco Systems, Inc.

- Flexera

- International Business Machines Corporation

- Micro Focus International plc

- Zerto Ltd.

- VMware, Inc.

- Snow Software, Inc.

- UnityOneCloud

- Dynatrace, Inc.

US Multi-Cloud Management Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,411.5 Million |

| Market Size by 2028 | US$ 10,741.1 Million |

| Global CAGR (2022 - 2028) | 28.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

- BMC Software, Inc.

- Cisco Systems, Inc.

- Flexera

- International Business Machines Corporation

- Micro Focus International plc

- Zerto Ltd.

- VMware, Inc.

- Snow Software, Inc.

- UnityOneCloud

- Dynatrace, Inc.

Get Free Sample For

Get Free Sample For