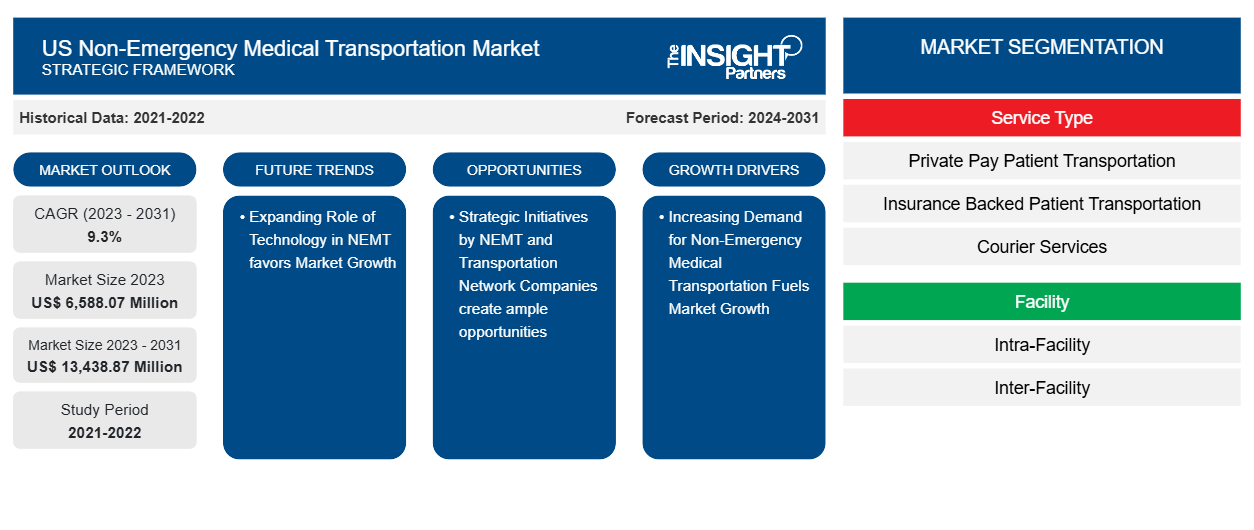

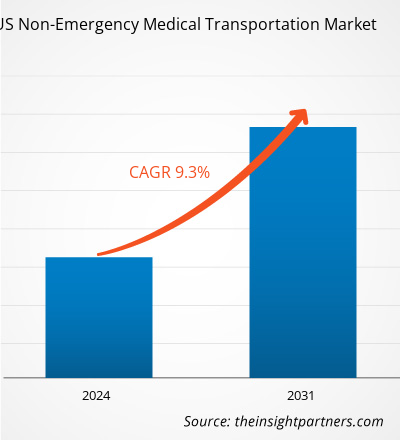

The US non-emergency medical transportation market size is projected to reach US$ 13,438.87 million by 2031 from US$ 6,588.07 million in 2023. The market is expected to register a CAGR of 9.3% during 2023–2031. The expanding role of technology in NEMT is likely to bring new trends in the market in the coming years.

US Non-Emergency Medical Transportation Market Analysis

Non-emergency medical transportation (NEMT) covers transport services that bring patients to and from healthcare destinations between sessions without any need for emergency medical intervention during transit. This service is intended for patients with limited mobility due to ill health or those living in areas without available transportation to access necessary health facilities. Most transportation services included under this NEMT umbrella tend to be routine doctor visits, physical therapy sessions, some minor surgeries, or appointments for dialysis treatments, as well as any other medically related events. The major factors driving the market are the increasing demand for non-emergency medical transportation, the rising aging population, and the increasing incidence of chronic conditions. Additionally, strategic initiatives by NEMT and transportation network companies are expected to create ample opportunities in the coming years.

US Non-Emergency Medical Transportation Market Overview

The District of Columbia, Alabama, Arkansas, Delaware, Louisiana, Maryland, Florida, Georgia, Kentucky, South Carolina, Tennessee, Mississippi, North Carolina, Oklahoma, Texas, Virginia, and West Virginia are the states covered under South US by the US federal government.

According to the Data from the 2021 American Community Survey (ACS), over 3.5 million Texans aged 65 and older had at least one disability, and about half (49%) of all Texans aged 75 and older had a disability.. With the growing cases of disability, the demand for NEMT for the disabled population is increasing, favoring market growth.

Market players in the US are implementing inorganic growth strategies, such as partnerships and collaborations, for market expansion and growth. In June 2022, AdventHealth Gordon & AdventHealth Murray collaborated with Amtran Medical Transport to provide transportation services to patients requiring medical care in non-emergency conditions. In addition, Uber Health expanded NEMT to Texas Medicaid recipients in August 2021. Texas' nearly 4.4 million Medicaid enrollees have access to NEMT services through Uber Health.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Non-Emergency Medical Transportation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Non-Emergency Medical Transportation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Non-Emergency Medical Transportation Market Drivers and Opportunities

Increasing Demand for Non-Emergency Medical Transportation

According to the American Hospital Association, each year, ~3.6 million individuals in the US do not obtain medical care due to transportation issues (lack of vehicle access, long distances to healthcare facilities, inadequate public transportation infrastructure, and the cost of transportation). A study by UC Davis Health revealed that ~5.8 million Americans experience missed or delayed medical care each year due to transportation barriers. Transportation is a significant factor contributing to missed medical appointments. A 2019 survey by Kaiser Permanente found that one-third of Americans frequently or occasionally undergo stress due to transportation.

Since 1965, Medicaid has had a non-emergency medical transportation (NEMT) benefit, and people covered by Medicaid are provided with transportation services as an essential benefit. As per Medicaid Enrollment and Unwinding Tracker, ~94 million individuals in total were enrolled in Medicaid till April 2023. The KFF Medicaid Budget Survey anticipated an 8.2% increase in healthcare membership in 2021 in the US, primarily driven by the COVID-19 crisis and elevated unemployment rate. As more people gain access to Medicaid, there is a direct increase in demand for NEMT services. The need and demand for NEMT services increase with the increase in healthcare enrollment and eligibility.

Most of the states in the US have transitioned to deliver NEMT through NEMT brokers or managed care organizations (MCOs). In many states, the brokers or MCOs receive a per capita payment to oversee the NEMT services, while other states, including Nevada, Arizona, and Vermont, deliver NEMT on a fee-for-service basis through local service providers. The Children's Health Insurance Program (CHIP) offers health coverage to eligible children via Medicaid and separate CHIP programs. CHIP is administered by states in accordance with federal requirements and jointly funded by state and federal governments. Therefore, with an increase in such initiatives by governments, the demand for NEMT is increasing in the US, thereby driving market growth.

Strategic Initiatives by NEMT and Transportation Network Companies

NEMT companies and transportation network companies (TNCs) are eager to undertake strategic actions to improve access to care. TNCs, such as Uber and Lyft, are known for their on-demand ride-hailing capabilities and user-friendly mobile apps. These features can effectively address the availability and scheduling issues related to NEMT services. Various TNCs are currently developing new platforms or are engaged in collaborations with NEMT and individual healthcare service providers across the US. Several state agencies are allowing the use of TNCs to provide NEMT services. A few examples are given below.

- In June 2024, Uber officially introduced Uber Health, a platform aimed at helping patients reach their medical appointments, which could reduce no-shows and enhance punctuality. This initiative is HIPAA-compliant and offers a cost-effective alternative to traditional taxi services, particularly benefiting smaller healthcare organizations lacking dedicated transportation resources. With coverage in over 250 US cities, Uber's healthcare-focused platform significantly broadens access to NEMT.

- In January 2024, MediDrive, a CTG partner company, formally entered the NEMT market. The company is dedicated to addressing the complexities of transporting patients to and from their healthcare appointments and procedures.

- In June 2022, MTM launched the Elevate program to provide proactive trip management. MTM takes a proactive approach to managing trips for members in its Elevate Program, providing concierge-level service for complex journeys and addressing the unique transportation needs of its members.

- In February 2022, Modivcare Inc. launched Modivcare Academy. This innovative initiative aims to assist transportation providers in NEMT by delivering educational resources, networking opportunities, and training. The program uniquely equips transportation providers with essential business tools, best practices, and training to effectively support the care of the nation's most vulnerable populations.

Such strategic initiatives focus on enhancing service efficiency, increasing patient accessibility, reducing operational costs, and ensuring better integration with healthcare services. As the NEMT sector continues to grow, these initiatives will be crucial in expanding services and improving the quality of patient care across the US.

US Non-Emergency Medical Transportation Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US non-emergency medical transportation market analysis are service type, facility, application, and end user.

- In terms of service type, the US non-emergency medical transportation market is segmented into private pay patient transportation, insurance backed patient transportation, courier services, and others. The private pay patient transportation segment held the largest share of the market in 2023.

- Based on facility, the market is bifurcated into intra-facility and inter-facility. The inter-facility segment dominated the market in 2023.

- Based on application, the market is segmented into dialysis, routine doctor visits, mental health related appointments, rehabilitation, and others. The mental health related appointments segment held the largest share of the market in 2023.

- By end user, the market is categorized into hospitals and clinics, nursing homes, homecare settings, MCO and state agencies, healthcare payers, and others. The hospitals and clinics segment dominated the market in 2023.

US Non-Emergency Medical Transportation Market Share Analysis by Country

The US non-emergency medical transportation market is a dynamic and rapidly evolving sector, primarily driven by the increasing prevalence of various diseases, expanding insurance coverage for non-emergency medical transportation (NEMT), and high state-wise reimbursement rates for these services as administrative or medical expenses. In addition, a shift toward patient-centered care, heightened awareness of NEMT, and technological advancements are a few factors supporting the market growth. Chronic illnesses, old age, disabilities, injuries, and obesity are just a few of the many reasons Americans rely on non-emergency medical transportation services. Also, the COVID-19 pandemic generated an enormous need for reliable car transportation for appointments, essential doctor visits, and daily treatments. In addition, the increase in the number of senior citizens is contributing to the growth of the non-emergency medical transportation market in the country.

US Non-Emergency Medical Transportation Market Regional Insights

The regional trends and factors influencing the US Non-Emergency Medical Transportation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Non-Emergency Medical Transportation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Non-Emergency Medical Transportation Market

US Non-Emergency Medical Transportation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6,588.07 Million |

| Market Size by 2031 | US$ 13,438.87 Million |

| Global CAGR (2023 - 2031) | 9.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | US

|

| Market leaders and key company profiles |

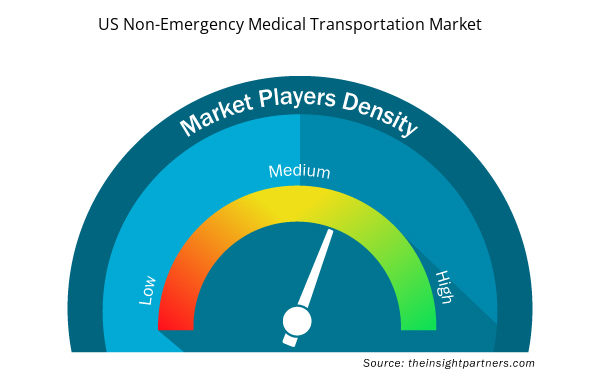

US Non-Emergency Medical Transportation Market Players Density: Understanding Its Impact on Business Dynamics

The US Non-Emergency Medical Transportation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Non-Emergency Medical Transportation Market are:

- MTM, Inc

- AMR

- Xpress Transportation

- CJ Medical Transportation

- VERIDA

- ModivCare

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Non-Emergency Medical Transportation Market top key players overview

US Non-Emergency Medical Transportation Market News and Recent Developments

The US non-emergency medical transportation market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the US non-emergency medical transportation market are listed below:

- MTM, the nation's largest privately held non-emergency medical transportation (NEMT) broker, signed an agreement with Global Medical Response to acquire Access2Care, LLC. This strategic acquisition significantly enhanced MTM's market presence and increased total annual revenue, marking a milestone in the company's growth trajectory. The acquisition of Access2Care's NEMT business comes after careful consideration and aligns with MTM's strategic expansion initiatives. (Source: MTM, Company Website, August 2024)

- Transdev and First Transit are part of the same company and operate under the Transdev brand. This transaction made Transdev the leading operator of safe, cost-effective, and environmentally friendly public transportation services in the US and Canada. The combined company provides a wide range of transit solutions, including fixed-route bus systems, paratransit, shuttle services, rail, light rail, and fleet maintenance. (Source: Transdev, Press Release, March 2023)

US Non-Emergency Medical Transportation Market Report Coverage and Deliverables

The "US Non-Emergency Medical Transportation Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- US non-emergency medical transportation market size and forecast at country levels for all the key market segments covered under the scope

- US non-emergency medical transportation market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- US non-emergency medical transportation market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US non-emergency medical transportation market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service Type, and Application, and End user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Midwest, Northeast, South Korea, West

Frequently Asked Questions

The market segmentation by service type is led by private pay patient transportation segment that is growing significantly due to custom NEMT rate of reimbursements with higher margins compared to other, low-cost, and flexibility pay and less complicated billing process compared to Medicare and Medicaid services.

The market is estimated to grow with a CAGR of 9.3% from 2023 to 2031.

Key factors that are driving growth of the market are increasing demand for non-emergency medical transportation and aging population and increasing incidence of chronic conditions fuel the growth of the market.

Non-Emergency Medical Transportation (NEMT) covers transportation services offered to the patients who are not in an emergency or in need assistance getting to and from medical appointments avoiding travel which are costly. These services are most widely used by the eligible Medicaid and Medicare members.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Non-Emergency Medical Transportation Market

- VERIDA

- Elite Medical Transport

- Transdev

- Ride Health

- Roundtrip

- Medical Answering Services, LLC

- One Call

- Stellar Transport

- Abba Medical Transportation, LLC

- Able Medical Transportation, Inc.

- Life Ride

- Mobility Transportation Services, Inc.

- ABC Non-Emergency Medical Transportation, LLC

- MTM, Inc.

- AMR

- Xpress Transportation

- CJ Medical Transportation

- Southeastrans

- ModivCare

- Crothall Healthcare

- Elite Medical Transport

- Acadian Ambulance Service.

Get Free Sample For

Get Free Sample For