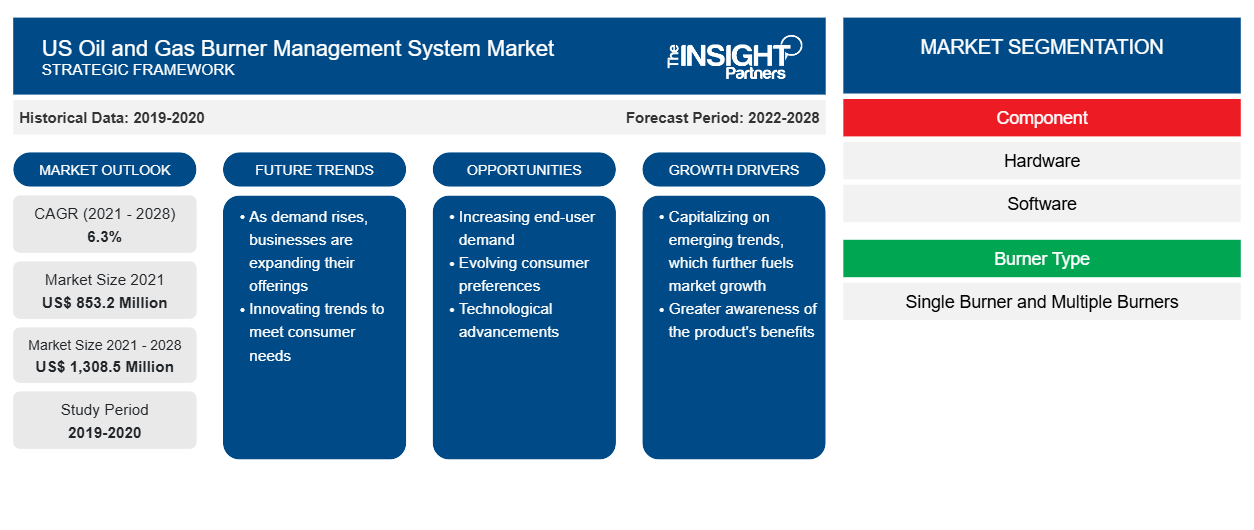

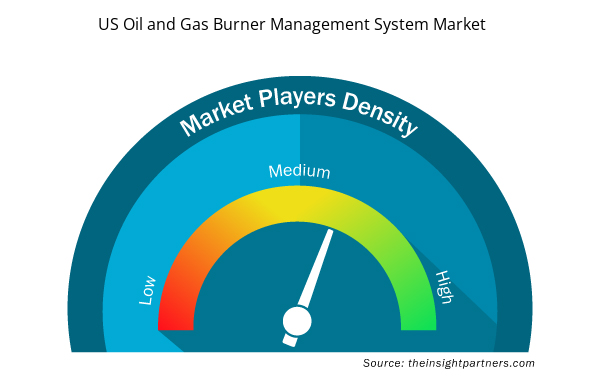

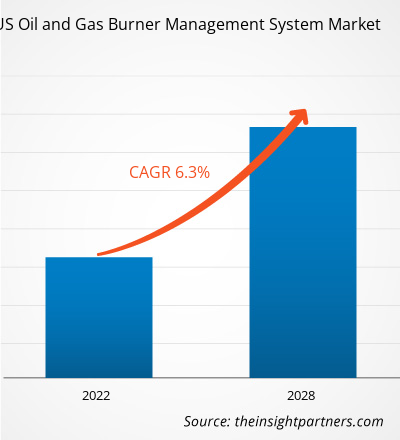

The US oil and gas burner management system market was valued at US$ 853.2 million in 2021 and is expected to reach US$ 1,308.5 million by 2028; it is estimated to grow at a CAGR of 6.3% from 2021 to 2028.

In oil and gas production, many types of direct and indirect fired heaters are used. Starting and operating a gas or oil-burning heater can pose a serious risk to any facility's operation. Installing a burner management system (BMS) on the process boiler is one approach to mitigate the risk. The BMS is an engineered hazard control used by oil and gas operators to ensure that a process heater is safely started, operated, and shut down. It also helps reduce fuel and maintenance costs, improve uptime, and create safe atmosphere for workers working near the heater. In an upset circumstance, a burner management system also prevents process heaters from exploding.

Burner management systems are widely used in various industries to improve plant operations by assuring reliable and safe burner operations, lowering maintenance costs, improving safety, and providing a safer work environment for all oil and gas plants operators. The BMS system must be correctly designed and work well throughout the equipment's lifecycle to protect people and the plant. Thus, the factors mentioned above are driving the US oil and gas burner management system market growth.

US Oil and Gas Burner Management System Market Insights

Increasing Safety Concerns in Industries

Workers in the oil & gas industry are at risk of fire and explosion if explosive Vapours or gases are ignited. Wells, trucks, production equipment, and surface equipment such as tanks and shale shakers can all produce flammable gases such as well gases, Vapours, and hydrogen sulphide. Static, electrical energy sources, open flames, lightning, cigarettes, cutting and welding instruments, hot surfaces, and frictional heat are all examples of ignition sources. Attention to personnel safety is paramount in industrial manufacturing facilities' design, construction, operation, and maintenance. Catastrophic equipment failure can result from years of seemingly innocuous negligence or inadequate operation and maintenance, resulting in serious and fatal damage. There is probably no more potentially dangerous equipment running in an industrial production facility than steam and power generating equipment due to possible catastrophic failure induced by inadequate operation and maintenance methods. If not managed and maintained properly, the boiler is often the largest, most expensive, and perhaps most dangerous piece of equipment.

The performance of the burner management system and the performance of the plant are linked. Although a poorly designed system that is prone to erroneous trips, light-off issues, and difficult troubleshooting may still protect plant equipment and employees. Further, these trips' process interruptions can significantly impact plant operability and performance. A BMS is a vital component of combustion safety. The BMS monitors the process for harmful situations while regulating the combustion unit's safe light-off, start up, and shutdown. The system must be correctly designed and work well throughout the equipment's lifecycle to protect people and the plant. The system should incorporate best practices in selecting and maintaining field equipment, utilizing safety-rated equipment, collecting and analysing essential BMS data, and employing a sequenced approach to logic design to reduce lost production as operations and maintenance troubleshoot BMS problems. Best practices in BMS guarantee that safety conditions are identified and accounted for, allowing operators to identify upset sources rapidly and reliably. As a result of increased investment in safety, the oil and gas burner management system market is growing.

Burner Type-Based Market Insights

Based on burner type, the US oil and gas burner management system market is segmented into single burner and multiple burners. The burner management system are engineered to provide igniter (pilot) and main flame detection. They also control and monitor burner start-up and shutdown sequences, including master fuel trip and purge, for both multiple and single burners, which can burn single or multiple liquid and gaseous fuels. In the oil & gas industry, the BMS is critical to use on heated vessels where precise temperature control is needed.

Application-Based Market Insights

Based on application, the US oil and gas burner management system market is segmented into combustors, flares, separators, dehydrators, vertical treaters, horizontal treaters, tanks, and others. BMS systems help improve overall plant performance, reduce possession charges, and ensure plant control adherence. They stop the equipment from starting and firing up until the combustion chamber purge is completed, control the sequencing of components during start-up and shut-down of the system, protect against the admission of inappropriate quantities of fuel to the heater, and provide status and feedback on component condition to the operator. Whether the application may be an industrial furnace, dryer, fluid bed incinerator, steam boiler, or other combustion equipment, companies are providing burner management systems to various applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Oil and Gas Burner Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Oil and Gas Burner Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The players operating in the US oil and gas burner management system market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key US oil and gas burner management system market players are listed below:

- In 2021, Profire Energy, Inc. announced the strategic distribution agreement and partnership with Spartan Controls Ltd. The Spartan partnership is designed to strengthen existing and new customer and industry relationships by leveraging a significantly increased footprint in Western Canada.

- In 2021, ClearSign Technologies Corporation announced collaboration agreement with Zeeco, Inc. Pursuant to the agreement, the parties expect to jointly develop, sell, and supply a product line of best in class ultra-low NOx burners for the global oil processing and petrochemical industries by combining the Company's ClearSign Core technology with the engineering, global manufacturing, and sales footprint of Zeeco.

The global US oil and gas burner management system market is segmented on the basis of component, burner type, and application. Based on component, the market is segmented into software and hardware. In terms of burner type, the US oil and gas burner management system market is segmented into single burner and multiple burner. By application, the market is segmented into combustors, flares, separators, dehydrators, vertical treaters, horizontal treaters, tanks, and others.

ACL Manufacturing Inc., Cimarron Energy, Combustex Corp., Kimark Control Solutions, Platinum Control Technologies, and profire Energy Inc are among the key US oil and gas burner management system market players considered for the research study. In addition, several other significant market players have been studied and analyzed in the research report to get a holistic view of the market and its ecosystem.

Report ScopeUS Oil and Gas Burner Management System Market Regional Insights

The regional trends and factors influencing the US Oil and Gas Burner Management System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Oil and Gas Burner Management System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Oil and Gas Burner Management System Market

US Oil and Gas Burner Management System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 853.2 Million |

| Market Size by 2028 | US$ 1,308.5 Million |

| Global CAGR (2021 - 2028) | 6.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

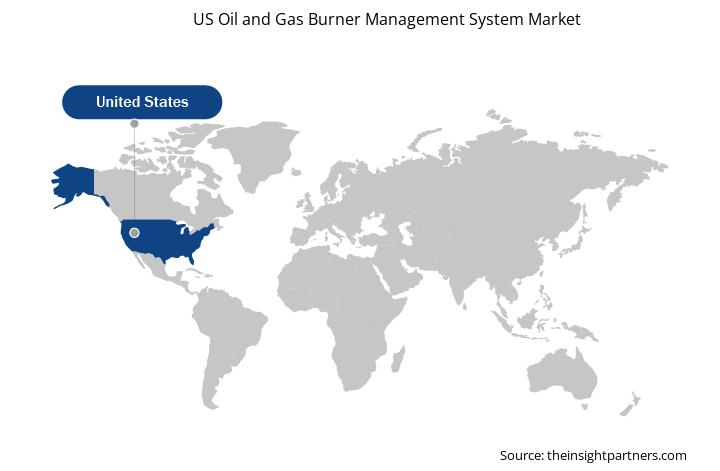

US Oil and Gas Burner Management System Market Players Density: Understanding Its Impact on Business Dynamics

The US Oil and Gas Burner Management System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Oil and Gas Burner Management System Market are:

- ACL Manufacturing Inc

- Cimarron Energy

- Combustex Corp

- Kimark Control Solutions

- Platinum Control Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Oil and Gas Burner Management System Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- ACL Manufacturing Inc

- Cimarron Energy

- Combustex Corp

- Kimark Control Solutions

- Platinum Control Technologies

- Profire Energy Inc

- Zeeco Inc

- Surefire Burner Management Systems

Get Free Sample For

Get Free Sample For