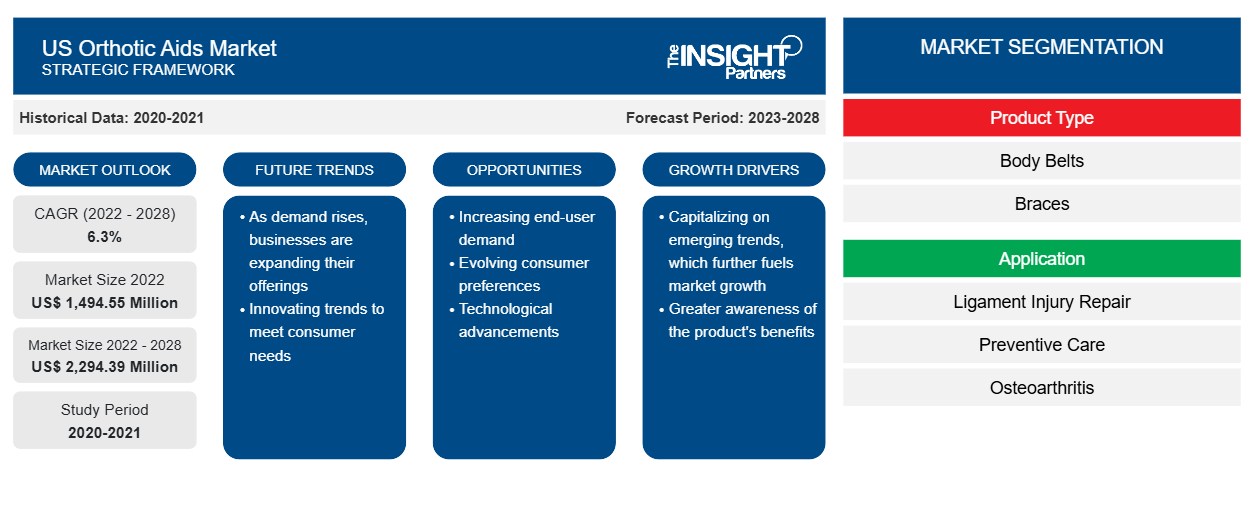

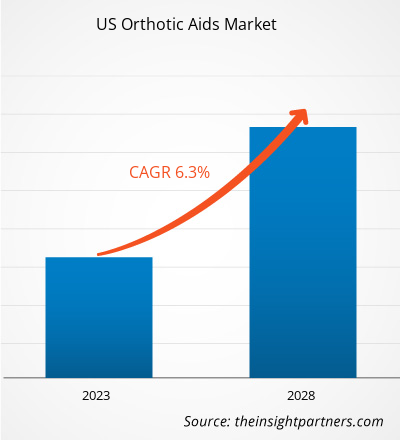

The orthotic aids market size was valued at US$ 1,494.55 million in 2022 and is projected to reach US$ 2,294.39 million by 2028. It is estimated to register a CAGR of 6.3% during 2022–2028.

Market Insights and Analyst View:

Orthotic aids are devices or supports intended to enhance the sustainability and functionality of the musculoskeletal system. These tools are frequently employed to address medical conditions such as pain, damage, or deformity. Common orthotic aids include orthotic insoles, ankle braces, knee braces, back braces, wrist braces, shoulder braces, neck braces, prosthetic limbs, spinal orthoses, etc. Orthotic devices have been shown to reduce pain and enhance the quality of life among users. Owing to these benefits, the demand for orthotic aids is increasing continuously in the populations affected by musculoskeletal diseases. Device manufacturers and healthcare providers consequently benefit significantly from this. Additionally, personalization to meet unmet needs, and innovations in materials and technologies are likely to open up sizable market opportunities in the coming years.

Growth Drivers and Challenges:

The US orthopedic aids market is continuously progressing at a substantial rate due to the burgeoning demand for orthotic aids from a large population, which also leads to an increase in new product developments and launches along with approvals. Orthotic aids market players invest in R&D activities to ensure the revolution and development of effective products. In February 2021, Breg Inc, a leading manufacturer of knee, hip, elbow, spine, foot, and ankle braces, announced the launch of Pinnacle and Ascend lines of spinal orthoses. With this product, Breg Inc. intended to elevate spinal care through more comfortable braces that encourage treatment adherence and promote healing. In May 2020, Össur, a developer and manufacturer of bracing, compression therapy, prosthetics, and other orthopedic products announced the launch of Unloader One X, the most recent model of its Unloader One knee braces.

Numerous illnesses impacting the musculoskeletal system of the body necessitate medical attention. Rheumatoid arthritis, osteoarthritis, and arthritis are a few examples of orthopedic diseases frequently affecting people. The government of the US is taking necessary steps to raise awareness of orthopedic diseases and to increase people’s access to orthopedic products. In response to the increasing burden of osteoarthritis, the Centers for Disease Control and Prevention funded the Osteoarthritis Action Alliance (OAAA). The OAAA promotes actions to prevent and control OA and its progression through tried-and-true interventions, public policies, communication strategies, and improved research initiatives for osteoarthritis. During National Arthritis Awareness Month, the Arthritis Foundation runs an awareness campaign to raise awareness of arthritis. The Arthritis Foundation has been hosting various awareness events as part of its 2023 campaign. With these activities, the Arthritis Foundation mainly focuses on raising money and awareness among the masses. Thus, the government’s initiatives to nurture the awareness of orthopedic diseases among people drive the adoption of orthopedic aids.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Orthotic Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Orthotic Aids Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Dynamic functional knee brace designs offer superior knee joint protection after injuries or surgeries compared to conventional static functional knee braces. Recently developed dynamic posterior cruciate ligament (PCL) knee braces counteract posterior translation of the tibia caused by an anterior force on the posterior proximal tibia. As a result, these braces help reduce the impact of any unfavorable force on the PCL and lessen the final posterior lag. Standard braces such as functional knee braces, unloader braces, and neoprene sleeves are being used more frequently in the treatment of chronic knee pain. They are also used to prevent injuries, accelerate recovery, and enhance physical and athletic performance. The widespread application of these braces is attributed to their consistent form for a long time. Although standard knee braces are widely used as a prevention and management aid against injuries and diseases, their primary purpose is to provide lateral stability or correct misaligned knee joint structures. These braces can go beyond structural support or alignment correction to increase leg muscular strength with technological advancements. Their application can improve knee joint function among healthy and injured people by employing modern technologies, making any movement—from basic daily tasks to weightlifting and cross-country skiing—easier. The knee extensor assist (KEA) design is one example of a new bracing technology. Recently, efforts have been made to address and improve the role of musculature in promoting healthy knee function through knee bracing with augmented assistive device technology. Improved muscle strength can help lessen wearer fatigue, which may improve performance in athletes, land-based arm forces, and manual laborers.

Inconsistent insurance coverage or limited product coverage results in an increased cost burden on patients. The high cost of orthotic treatments and aids, along with unfavorable reimbursement policies, impedes the growth of the orthotic aids market. Older adults suffering from chronic pain or injuries can benefit significantly from back braces. Durable arm, leg, neck, and back braces are covered by Medicare Part B, with some restrictions. The Medicare Braces Benefit covers knee orthoses. The orthosis must be a semi-rigid or rigid device that is used to support a weak or deformed body part or to limit or completely rule out motion in a diseased or injured part of the body to qualify for coverage under this benefit. The statutory definition of the Braces Benefit does not apply to items that are not sufficiently rigid to be able to immobilize or support the body part for which they are intended. Items that don't fit the description of a brace aren’t covered and don't qualify for benefits under this Medicare benefit.

Report Segmentation and Scope:

The orthotic aids market is divided on the basis of product type, application, type of supplier, and distribution channel. Based on product type, the orthotic aids market is segmented into body belts, braces, and others. The braces segment is further segmented into neck & cervical braces, knee braces, foot support & braces, elbow support & braces, and others. The others segment includes pouch arm slings, cast covers, and cast shoes. Based on application, the orthotic aids market is segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. Based on the type of supplier, the orthotic aids market is classified into branded and unbranded. Based on distribution channel, the orthotic aids market is bifurcated into online and offline.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on product type, the orthotic aids market is segmented into body belts, braces, and others. The braces segment is further bifurcated into neck & cervical braces, knee braces, foot support & braces, elbow support & braces, and others. The others segment is further classified into pouch arm slings, cast covers, and cast shoes. Body belts such as back traction belts, elastic back braces, copper belts, back pain belts, and back braces are commonly used to treat joint sprain, muscle strain, and injuries. Most people are likely to experience back pain at some point in their lives. According to Cross River Therapy, 8 out of 10 Americans report having back issues at least once or more frequently in a year. While injuries and illnesses are among several causes of back pain, a vast percentage of cases result from improper lifting of heavy objects and poor posture. Wearing a back brace is a standard method of preventing back pain and improving posture.

US Orthotic Aids Market by Product Type – 2022 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on application, the orthotic aids market is segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. The medial collateral ligament (MCL), posterior cruciate ligament (PCL), anterior cruciate ligament (ACL), and lateral collateral ligament (LCL) are the four major ligaments in the knee. Ligaments are instrumental to keeping a person's knee moving, and moderately minor injuries can also cause much discomfort to persons. Knee braces can decrease the load on the knee. If a person has a partial tear, a doctor may recommend repairing the ACL tear non-surgically by using an ACL brace and physical therapy for muscle strengthening. However, for patients undergoing surgery, doctors recommend wearing post-operative knee braces and crutches until they are adequately healed. The rehab procedure for an ACL tear is relatively lengthy, as it can take 6 months to 1 year for completion. After recovery, the patient may be advised to wear an ACL knee brace while playing sports. PCL tears are classified as Grade 1 tear, Grade 2 tear, Grade 3 tear, and Healthy PCL. If the tear is severe enough, the patient may have to have PCL surgery. After surgery, they are recommended to wear a PCL knee brace for post-surgical recovery. Brace Ability offers many braces and supports for preventing and treating PCL tears. The majority of MCL injuries can be treated at home with ice application, anti-inflammatory medication, and rest. A doctor may suggest a brace that helps protect the patient's knee and enables some movement. If the tear is significantly severe, patients may need surgery.

Based on distribution channels, the orthotic aids market is divided into online and offline. The offline segment is further segregated into hospitals, pharmacies, and retail. A retail pharmacy typically offers community guidance to encourage the product's safe and efficient use. The care and services provided by medical centers include a particular area of pharmacy practice known as hospital pharmacy. The availability of advanced technologies and facilities at hospitals increases the preference for managing orthopedic diseases at hospitals. This, in turn, increases the distribution of orthopedic aid products, such as braces, belts, and arm slings through hospital pharmacies.

Competitive Landscape and Key Companies:

Ossur hf, Ottobock SE & Co KGaA, Thuasne SAS, Fillauer LLC, Lohmann & Rauscher GmbH & Co KG, DeRoyal Industries Inc, Hanger Inc, Steeper Group Holdings Ltd, Breg Inc and DJO LLC are a few prominent players operating in the orthotic aids market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their widescale presence allows them to serve a large base of customers, subsequently allowing them to expand their market share.

US Orthotic Aids Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,494.55 Million |

| Market Size by 2028 | US$ 2,294.39 Million |

| Global CAGR (2022 - 2028) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, Type of Supplier, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Orthotic Aids Market

- Ossur hf

- Ottobock SE & Co KGaA

- Thuasne SAS

- Fillauer LLC

- Lohmann & Rauscher GmbH & Co KG

- DeRoyal Industries Inc

- Hanger Inc

- Steeper Group Holdings Ltd

- Breg Inc

- DJO LLC

Get Free Sample For

Get Free Sample For