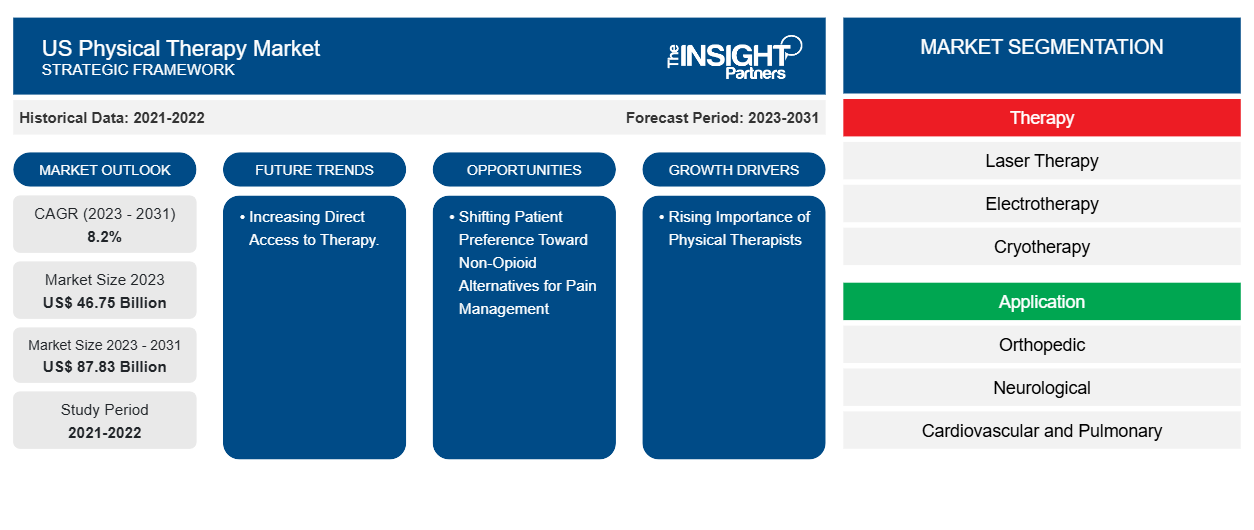

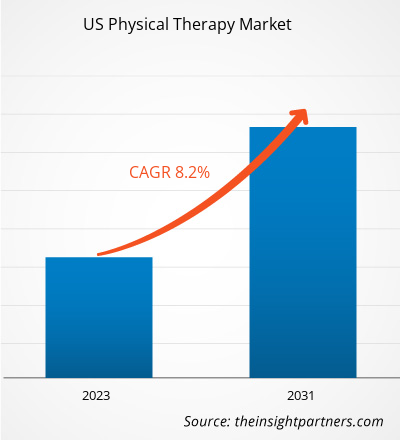

The US physical therapy market size is projected to reach US$ 87.83 billion by 2031 from US$ 46.75 billion in 2023. The market is expected to register a CAGR of 8.2% during 2023–2031. Growing emphasis on adopting novel drug delivery systems is likely to remain a key trend in the market.

US Physical Therapy Market Analysis

Physical therapy aids in treating spine, shoulder, knee, and neck injuries. Demand for physical therapy is expected to rise due to an aging population and an increase in chronic medical conditions across the US. According to the Parkinson's Foundation, symptoms of Parkinson's disease become evident at an average age of 60. For instance, ~90,000 Americans are diagnosed with Parkinson's Disease yearly. The organization also states that nearly 1 million people in the US have Parkinson's disease, and the number is expected to rise to 1.2 million by 2030. According to the National Spinal Cord Injury Data Sheet 2022, nearly 18,000 new Spinal Cord Injury cases are diagnosed yearly in the US. Physical therapy provided for neurological issues focuses on helping individuals restore functional mobility, strength, balance, and coordination.

US Physical Therapy Market Overview

InReach Physical Therapy opened its first outpatient physical therapy clinic in Hillsboro in August 2022. The clinic offers various integrated multispecialty services to patients of all ages, including pre-and post-operative care, nonsurgical pain management, and sports medicine. Burke Rehabilitation opened a new outpatient orthopedic and sports therapy center in Billings in January 2022 to expand its outpatient therapy services. The center serves patients with musculoskeletal and orthopedic diagnoses, including those needing post-operative care. It also offers one-on-one therapy sessions to facilitate effective recovery in critical cases. Such initiatives by healthcare providers to open therapy clinics and expand the range of services they provide are anticipated to propel the US physical therapy market growth in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Physical Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Physical Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Physical Therapy Market Drivers and Opportunities

Increasing Direct Access to Therapy Favors Market Growth

Referral and direct access are the two ways to gain access to physical therapy services in the US. Owing to the availability of this option, patients can decide whether they need physical therapy; if they experience an issue that can be addressed by physical therapy, they may approach physical therapists without a referral. Sometimes, direct access is called self-referral. Direct access allows patients to engage more actively in their healthcare decision-making; moreover, it allows them to save both time and money. Direct access further benefits them through faster access to care to ensure the improved continuity of care and a holistic approach to health and wellness. This approach grants patients a sense of independence, which can increase satisfaction and engagement in the treatment procedure, contributing to better outcomes.

Each state in the US regulates physical therapy services through a "state-practice" act. Under this act, each state lists professionals who can recommend patients to physical therapy, including dentists and nurse practitioners. The American Physical Therapy Association (APTA) has helped change the law in many states, further enabling patients’ direct access to physical therapy. Patients can see a physical therapist through direct access without a prior prescription requirement. Direct access is available in all 50 states, along with the District of Columbia and the US Virgin Islands; most states also have policies about direct access. The level of access depends on a person’s health insurance plan and the state where they live. Thus, the increasing direct access to physical therapy is bolsters the market growth.

Shifting Patient Preference Toward Non-Opioid Alternatives for Pain Management Creates Significant Opportunities

As per the World Health Organization statistics on opioid overdose, the US recorded 70,630 deaths due to drug overdose in 2019. The CDC estimated that ~280,000 people in the country died from the overdose of prescription opioids during 1999–2021. In 2021, nearly 21% of all opioid overdose deaths in the country involved a prescription opioid. As per “Physical Therapy and Opioid Use for Musculoskeletal Pain Management,” published in September 2020, opioids accounted for 18.8% of prescriptions for chronic lower back pain, and 76.9% of the opioid prescriptions were for long-term use in the country. Due to the increasing number of opioid overdose cases and associated mortality rate, the CDC labeled the situation as a nationwide Public Health Emergency in 2017. For decades, the healthcare system in the US has focused on pain management by masking the pain pharmacologically rather than treating its root cause. This strategy has increased opioid prescriptions, causing widespread misuse and addiction. As a result, there has been a shift in pain management strategies from opioid-based medication to non-opioid options such as physical therapy, which are deemed safer, more effective, and long-lasting.

Side effects associated with medications are also causing patients to shift from medications to physical therapy services. According to a survey published by the Palmer College of Chiropractic in September 2022, 78% of those surveyed stated that they favored drug-free approaches compared to pain medication. 68% described physical therapy as very safe or far safer (in their opinion) compared to pain-relief drugs (23%). Therefore, the rapidly growing preference for physical therapies owing to side effects associated with medication offers lucrative growth opportunities to the US physical therapy market.

US Physical Therapy Market Report Segmentation Analysis

Key segments that contributed to the derivation of the US physical therapy market analysis are therapy, application, age group, and end user.

- Based on therapy, the US physical therapy market is divided into laser therapy, electrotherapy, cryotherapy, ultrasound, heat therapy, and other therapies. The ultrasound segment held a larger market share in 2023.

- By application, the market is segmented into orthopedic, neurological, cardiovascular and pulmonary, and other. The orthopedic segment held the largest share of the US physical therapy market in 2023.

- By age group, the market is segmented into pediatrics, adult, and geriatric. The adult segment held the largest share of the market in 2023.

- Based on end user, the US physical therapy market is divided into hospitals and clinics, rehabilitation centers, sports and fitness facilities, and other end users. The rehabilitation centers segment held the largest market share in 2023.

US Physical Therapy Market Regional Insights

The regional trends and factors influencing the US Physical Therapy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Physical Therapy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Physical Therapy Market

US Physical Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 46.75 Billion |

| Market Size by 2031 | US$ 87.83 Billion |

| Global CAGR (2023 - 2031) | 8.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Therapy

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

US Physical Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The US Physical Therapy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Physical Therapy Market are:

- ATI Physical Therapy, Inc.

- Physical Therapy Now

- The Jackson Clinics

- Select Physical Therapy

- Onward Physical Therapy

- PT SOLUTIONS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Physical Therapy Market top key players overview

US Physical Therapy Market News and Recent Developments

The US physical therapy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the US physical therapy market are listed below:

- Athletico Physical Therapy commenced operations at a new location in Grand Blanc, Michigan. This location allows working in convenient hours, including early morning, late evening, and Saturday appointments. It does not require a referral or prescription to start treatment. Athletico Grand Blanc provides physical therapy, free assessments, vestibular rehabilitation, hip rehabilitation, and dry-needling services. (Source: Athletico Physical Therapy, Press Release, March 2024)

- ATI Physical Therapy relocated its Kirkland, Washington, clinic to a new state-of-the-art facility on 97th Lane in Kirkland. This move signifies ATI's commitment to deliver remarkable physical therapy services while catering to the needs of the Greater Kirkland and neighboring areas. (Source: ATI Physical Therapy, Press Release, February 2024)

US Physical Therapy Market Report Coverage and Deliverables

The “US Physical Therapy Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- US physical therapy market size and forecast at country levels for all the key market segments covered under the scope

- US physical therapy market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- US physical therapy market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the US physical therapy market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Key factors driving the market include the rising importance of physical therapists and increasing direct access to therapy.

Patient engagement with the adoption of advanced technologies is likely to emerge as a key trend in the market.

ATI Physical Therapy, Inc; Physical Therapy Now; The Jackson Clinics; Select Physical Therapy; Onward Physical Therapy; PT SOLUTIONS; Athletico Physical Therapy; Confluent Therapy Solutions; Peak Performance Physical Therapy; and Upstream Rehabilitation Inc are among the leading players in the US physical therapy market.

The market is expected to register a CAGR of 8.2% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Physical Therapy Market

- ATI Physical Therapy, Inc.

- Physical Therapy Now

- The Jackson Clinics

- Select Physical Therapy

- Onward Physical Therapy

- PT SOLUTIONS

- Athletico Physical Therapy

- Confluent Therapy Solutions

- Peak Performance Physical Therapy

- Upstream Rehabilitation Inc.

Get Free Sample For

Get Free Sample For