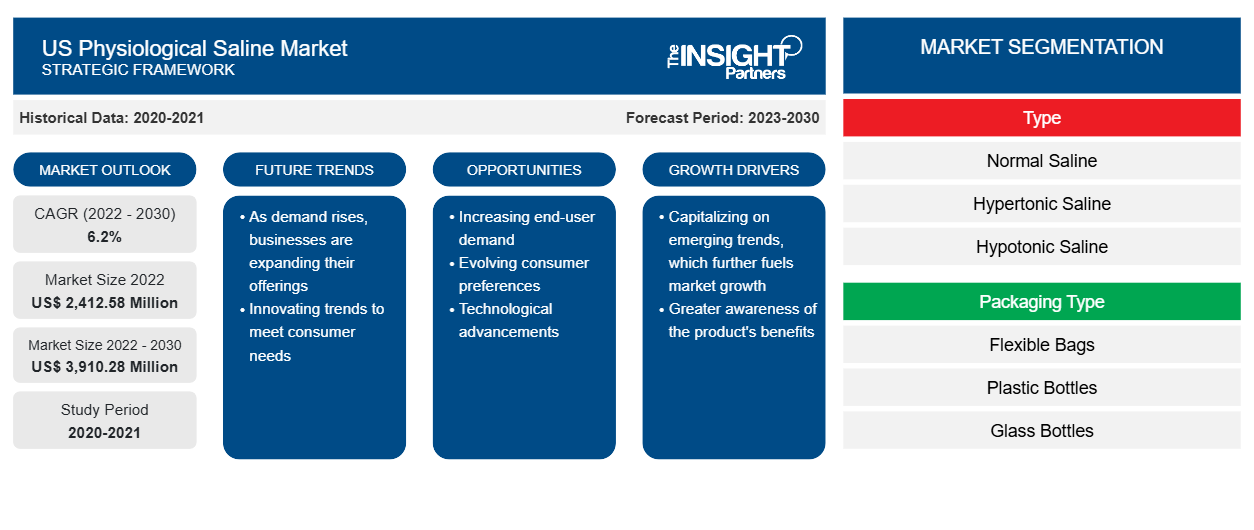

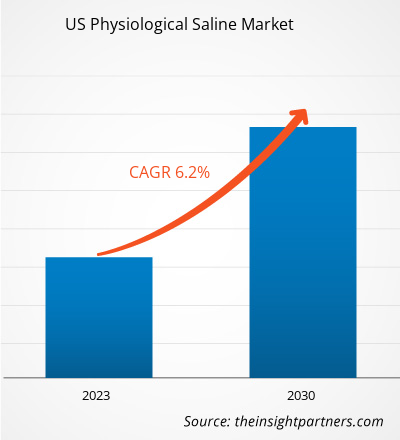

The US physiological saline market size is expected to grow from US$ 2,412.58 million in 2022 to US$ 3,910.28 million by 2030; it is estimated to register a CAGR of 6.2% from 2022 to 2030.

Analyst’s Viewpoint

The US physiological saline market analysis explains market drivers such as the rising prevalence of serious illnesses and fluid electrolyte disorders, and surging demand for fluid electrolytes in the elderly population. Further, large-scale saline solution requirements in hospital settings are expected to emerge as new trends in the market during 2022–2030. The US physiological saline market, by type, is segmented into normal saline, hypertonic saline, hypotonic saline, and balanced saline. The normal saline segment held the largest market share in 2022. However, the hypertonic saline segment is expected to register the highest CAGR during the forecast period. The US physiological saline market, by packaging type, is segmented into flexible bags, plastic bottles, and glass bottles. The plastic bottles segment held the largest market share in 2022. The flexible bag segment is anticipated to register the highest CAGR during 2022-2030. By application, the US physiological saline market is segmented as intravenous, ophthalmology, wound care, endoscopy, skin abrasion, and others. The intravenous segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022-2030. The US physiological saline market, by route of administration, is categorized into intravenous and topical. The intravenous segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR during 2022-2030. The US physiological saline market, by end-user, is segmented into hospitals, specialty clinics, ambulatory surgical centers, home care, and others. The hospitals segment held the largest market share in 2022. The specialty clinics segment is anticipated to register the highest CAGR during 2022-2030.

A physiological saline solution is composed of salt solutions that are isotonic and have the same pH. An example of a physiological saline solution is Ringer's solution, composed of a mixture of sodium chloride (NaCl), sodium bicarbonate, and potassium chloride solution. The physiological solution is recommended by the physician in case of dehydration, fluid imbalances, and many more clinical abnormalities among the patients.

Market Insights

Rising Prevalence of Serious Illnesses and Fluid Electrolyte Disorders Propels US Physiological Saline Market

According to a report by the Center to Advance Palliative Care, ~90 million Americans are living with serious illnesses, and the number is expected to rise to more than double over the next 25 years. Additionally, a report by the National Health Council reveals that incurable and ongoing chronic diseases affect nearly 133 million Americans, which represents more than 40% of the total population of the country. Among these, almost 50% of all adults and nearly 8% of children aged 5–17 have a chronic condition. The National Health Council’s report also mentions that the increasing cases of incurable chronic diseases among Americans result in ~75% of the healthcare costs.

Serious illnesses result in an imbalance in body fluids, such as low levels of potassium, magnesium, calcium, and sodium in the body. Improper levels of body fluids negatively impact the body's function, muscle strength, and heart rhythm, which is associated with disorders of kidneys or endocrine glands. For example, edema occurs when the body retains excessive fluid levels, resulting in swelling and pain in the face, arms, legs, hands, and feet of the patient. Further, losing more body fluids than consumed quantities results in cases of dehydration, exhibiting a range of symptoms such as thirst, weakness, lightheadedness, fainting, and decreased urine output. Therefore, chronic illnesses may result in body fluid imbalance in the patient's body, which propels the demand for physiological saline that is administered as a part of their treatment. Thus, the rising prevalence of serious illnesses and fluid electrolyte disorders bolsters the US physiological saline market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Physiological Saline Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Physiological Saline Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Future Trend

Large-Scale Saline Solution Requirements in Hospital Settings

According to a report published by the Royal Society of Chemistry, using saline solution for washing red blood cells (RBCs) and treating critically ill patients is a common practice in hospital settings. Clinical research groups have reviewed the safety of using physiological saline (0.9% NaCl) in different clinical settings and suggested that the use of saline solution is one of the safest techniques in hospital settings. For example, in transfusion medicine, saline solution is used for washing cells and salvaging procedures in cases of apheresis and the resuscitation of patients with blood or fluid loss. Washing of RBCs requires 1–2 L of sterile saline solution. In the apheresis procedure, saline solution is used in therapeutic plasma exchange procedures and intra-operative cell salvaging to wash RBCs. Therefore, the multifaceted application of physiological saline on large scales in hospital settings is likely to emerge as a new trend in the US physiological saline market.

Report Segmentation and Scope

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Opportunity

Rapid Sample Transportation Using Low-Cost Saline Solutions

A less expensive and readily available saline solution can be used for the safe transportation of testing samples, enabling more effective, long-distance transportation of samples to diagnostic labs. A readily available saline solution such as "Phosphate Buffered Saline," a simple salt solution commonly available in hospitals and clinical laboratories, was in use as a transport medium for coronavirus-contaminated specimens; the saline could keep the samples stable for up to 18 hours. During the COVID-19 pandemic, a shortage of viral transport media posed a major challenge in the transportation of specimens obtained from COVID-19 patients to diagnostics and testing labs, which resulted in an upsurge in the demand for sterile saline solutions. As a result, researchers recommended using inexpensive and commonly available salt solutions, such as phosphate-buffered saline solutions, for transportation. Therefore, the rising awareness of less expensive and readily available saline solutions, and their use in the transportation of medical specimens is likely to provide opportunities to the US physiological saline market during 2022–2030.

Type-Based Insights

The US physiological saline market, by type, is segmented into normal saline, hypertonic saline, hypotonic saline, and balanced saline. The normal saline segment held the largest market share in 2022. Normal saline (NS) comprises a sterile salt solution used for short-term fluid replacement, as it helps restore electrolyte/salt levels in the body. It is a 0.9% sodium chloride solution intended to treat dehydration and electrolyte disturbances among people. NS is a cornerstone of intravenous solutions that are used commonly in clinical settings. It is suitable for both pediatric and adult patient populations. Primary indications for the use of NS solutions that are approved by the Food and Drug Administration (FDA) are as follows:

- Extracellular fluid replacement to treat dehydration, hypovolemia, hemorrhage, sepsis, etc.

- Treatment of metabolic alkalosis in the presence of fluid loss

- Mild sodium depletion

Further, NS can only be administered through intravenous access, and the management of normal saline requires evaluation of the patient's health status. Pharmacists need to monitor the implementation of IV fluids while installing and recommend to order based on the clinical situation of the patient with proper counselling to the nursing department in the hospital regarding dosage and administration.

Packaging Type-Based Insights

The US physiological saline market, by packaging type, is segmented into flexible bag, plastic bottles, and glass bottles. The plastic bottles segment held a larger market share in 2022 and flexible bag segment is anticipated to register a highest CAGR during the forecast period. Sodium chloride (NaCl) USP solutions for injections are sterile and nonpyrogenic. They are parenteral solutions that contain various concentrations of NaCl in water for injection (WFI) intended for intravenous (IV) administration. Further, the flexible container is fabricated from a specially formulated polyvinyl chloride. However, solutions coming in contact with plastic containers might leach out certain chemical components from the plastic in very small amounts. Further, biological testing proves effective in supporting the safety of plastic container materials. Therefore, the plastic bottles segment is expected to account for the smallest share of the physiological saline market during the forecast period.

Application-Based Insights

The US physiological saline market, by application, is segmented as intravenous, ophthalmology, wound care, endoscopy, skin abrasion, and others. The intravenous segment held a larger market share in 2022 and the same segment is anticipated to register a highest CAGR during the forecast period. Intravenous (IV) saline solutions are the formulated for the prevention or treatment of dehydration. IV saline is prescribed by physicians of all ages for people who are injured, sick, dehydrated, or undergoing surgery. Saline IV bags provide a rapid and targeted solution to replenish fluids and relieve symptoms. Furthermore, a combination of sterile water and sodium chloride, or salt and normal saline IVs, helps restore fluid balance and hydrate tissues among patients. IV saline is commonly administered to patient’s bloodstreams when they require hydration. It is considered a suitable option for people with allergies or sensitivities to specific medications.

Various companies are producing innovative products related to IV saline; for example, Fresenius Kabi USA offers "freeflex" and "freeflex+ IV bags." These products also provide leak prevention, sterility protection, and needle-stick prevention.

Route of Administration-Based Insights

The US physiological saline market, by route of administration, is bifurcated into intravenous and topical. The intravenous segment held a larger market share in 2022 and the same segment is anticipated to register a highest CAGR during the forecast period. IV saline solutions are specially formulated liquids that are injected into a vein to prevent and treat dehydration. Also, these IV fluids are utilized among people of all ages suffering from sickness, injury, dehydration, etc. The IV saline solution is a simple, safe, and common procedure with a low risk of complications. Also, fluid resuscitation is a vital component for the management of acutely ill patients, and normal saline is considered to be the most widely used IV fluid for seriously ill or injured patients. Being a common, simple, and safe procedure, patients administered via the IV route may feel relief in a short span.

US Physiological Saline Market, by Type – 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Country Analysis

The US physiological saline market is expected to reach US$ 3,910.28 million by 2030 from US$ 2,412.58 million in 2022. The US FDA is actively working with manufacturers such as Fresenius Kabi and Grifols to address the critical shortage of intravenous (IV) administration fluids by supporting them through the enlargement of their production capabilities. The FDA also focuses on saline imports to address critical shortages. Further, according to a National Center for Biotechnology Information report, nearly 200 million liters of saline is sold annually in the US. Over 1 million liters of 0.9% NaCl is administered to patients across the country daily as per the same report. Further, according to a report by JAMA Network, there has been an upsurge in the number of surgical procedures in the US, which is evident from 3,156,240 procedures performed in 2020. Therefore, with the rising count of surgical procedures, the demand for physiological saline solutions also increases in the US.

Hospital settings in the US recorded a high demand for physiological saline during the COVID-19 pandemic. To address critical shortages, hospitals searched for alternative solutions such as 5% dextrose in water, 5% dextrose with a lower concentration of NaCl, and 5% dextrose in lactated Ringer injection to address critical demands. Such saline solution alternatives helped them overcome the challenges posed by the demand–supply gap during the COVID-19 pandemic.

The report profiles leading players operating in the US physiological saline market. These include Fresenius Kabi AG, Merck KGaA, AdipoGen Life Sciences Inc, Enzo Life Sciences Inc, ICU Medical Inc, Grifols SA, Geno Technology Inc, B Braun Medical Inc, Pfizer Inc, and Ward's Science.

US Physiological Saline Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,412.58 Million |

| Market Size by 2030 | US$ 3,910.28 Million |

| Global CAGR (2022 - 2030) | 6.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Packaging Type, Application, Route of Administration, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

A physiological saline solution is composed of salt solutions that are isotonic and have the same pH. An example of physiological saline solution is Ringer's solution, composed of a mixture of sodium chloride (NaCl), sodium bicarbonate, and potassium chloride solution. The physiological solution is recommended by the physician in case of dehydration, fluid imbalances, and many more clinical abnormalities among the patients.

The CAGR value of the US Physiological Saline during the forecasted period of 2022-2030 is 6.2%.

The normal saline segment held the largest market share in 2022 segment in the US physiological saline.

The plastic bottle segment dominated the US physiological saline and held the largest market share in 2022.

Fresenius Kabi AG and ICU Medical Inc are the top two companies that hold huge market shares in the US physiological saline market.

The US physiological saline majorly consists of the players such Fresenius Kabi AG, Merck KGaA, AdipoGen Life Sciences Inc, Enzo Life Sciences Inc, ICU Medical Inc, Grifols SA, Geno Technology Inc, B Braun Medical Inc, Pfizer Inc, and Ward's Science, and among others. .

Key factors that are driving the growth of this market are rising prevalence of serious illnesses and fluid electrolyte disorders to boost the market growth for the US physiological saline over the years.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - US Physiological Saline Market

- Fresenius Kabi AG

- Merck KGaA

- AdipoGen Life Sciences Inc

- Enzo Life Sciences Inc

- ICU Medical Inc

- Grifols SA

- Geno Technology Inc

- B Braun Medical Inc

- Pfizer Inc

- Ward's Science

Get Free Sample For

Get Free Sample For