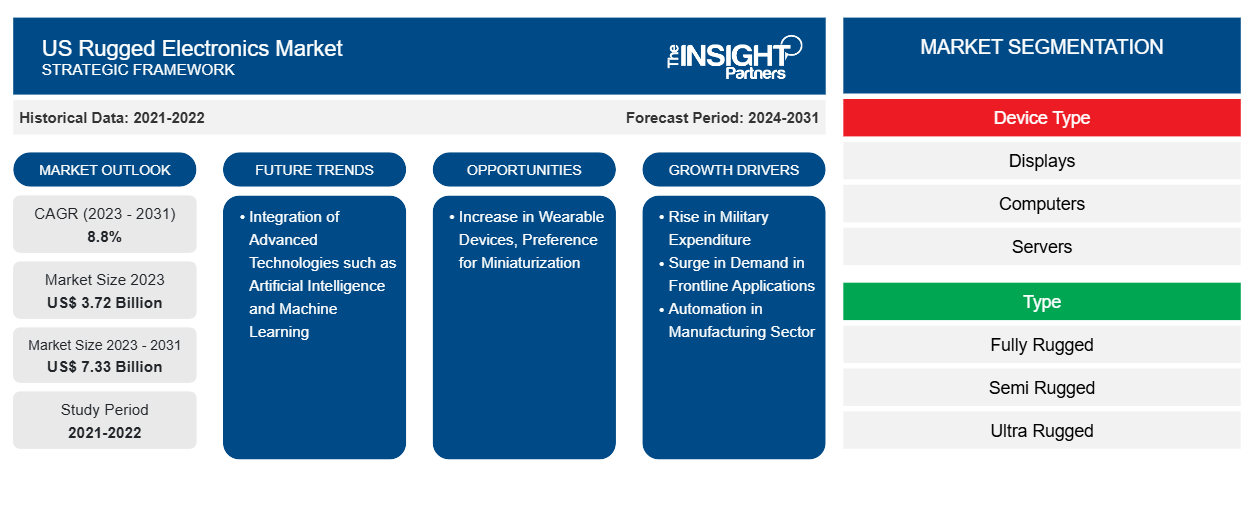

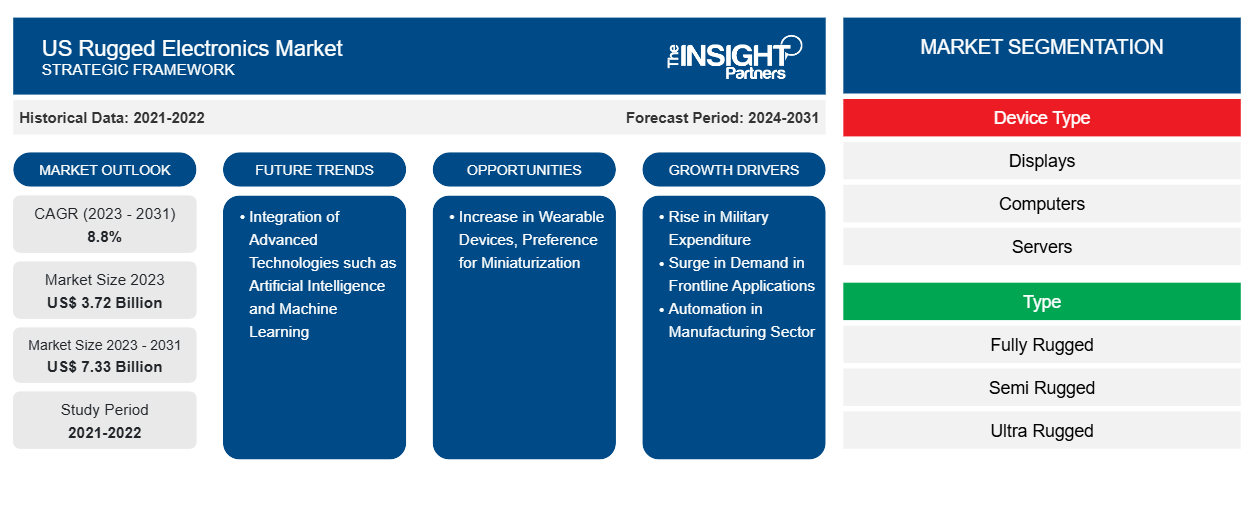

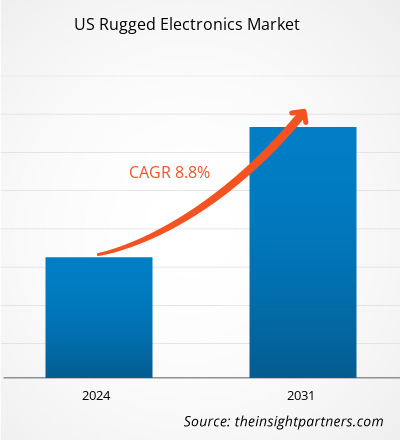

The US rugged electronics market size is projected to reach US$ 7.33 billion by 2031 from US$ 3.72 billion in 2023. The market is expected to register a CAGR of 8.8% in 2023–2031.

Integration of advanced technologies such as AI and ML is likely to emerge as a key trend in the US Rugged Electronics market in the coming years.

US Rugged Electronics Market Analysis

Frontline workers are the personnel who provide services directly to communities. According to Broadcom, frontline workers make up most of the global workforce, and they account for approximately 60% of the US workforce as of 2024. This category of employees operates in almost every industry, including hospitality, healthcare, military, and supply chain. Frontline workers require multiple devices to perform their jobs in time, which are strong enough to withstand unfavorable temperatures and mechanical shocks to enable communications and collaborations and accomplish tactical tasks. In the military and defense sector, military forces and authorities require rugged electronics for navigation, surveillance, communication, and battlefield management. In the public sector, rugged electronics are widely used by police departments, firefighters, and paramedics for critical communications and coordination. According to CONKERTAB, rugged PC devices are the optimal choice for frontline workers as it helps them to perform crucial tasks in demanding work conditions, requiring secure and unhindered access to pertinent information and data. Intel Core processors, USB ports, and computing hardware are fully rugged and they can work in extreme temperatures and endure vibration, shock, and water exposure.

US Rugged Electronics Market Overview

Rugged electronics are hardware devices specifically designed to operate in challenging environmental conditions, including extreme temperatures, water exposure, vibrations, and dust. These electronics support daily business operations in the same way that non-rugged consumer electronics do. Devices that are commonly available in the form of rugged electronics include smartphones, tablets, barcode scanners, wearables, displays, and servers. These electronics allow frontline workers to access critical applications, interface with backend computing systems, and streamline data entry and reporting. These electronics are much more durable and reliable, making them ideal for frontline and deskless workers appointed to perform their duties in the field with unpredictable weather conditions and other operational hazards.

The rugged electronics market is gaining traction in the US owing to factors such as an upsurge in demand for durable and reliable electronic devices, and a continuous increase in investments in the military and defense sector. Moreover, the ability of rugged electronics to withstand harsh environments, extreme temperatures, shocks, water, and dust makes them an ideal choice for the military and defense, oil & gas, and public sectors, among others. The rise in military expenditures empowers military forces to procure advanced and robust electronic devices for mission-critical operations. Devices such as rugged smartphones and computers can facilitate efficient communications and coordination among military forces. In February 2024, Advantech launched the latest MIC-715-OX industrial computer, designed to withstand the most rugged conditions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Rugged Electronics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Rugged Electronics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Rugged Electronics Market Drivers and Opportunities

Automation in Manufacturing Sector Favors Market Growth

Industry 4.0 is transforming how companies manufacture, process, and distribute their products. Practices based on Industry 4.0 have the potential to improve product quality by minimizing the risk of human error and creating a safe working environment. In January 2021, the US President announced the plan to strengthen the US manufacturing sector under the “Made in America” initiative, which focused on technological advancements and automation of the manufacturing sector. The president announced an investment of US$ 300 billion for the manufacturing sector to boost the country's production output. Moreover, to bring automation into the manufacturing processes, the government authorities are making significant investments that can fuel the adoption of robust electronics. For example, in November 2022, the US Department of Energy (DOE) announced US$ 2 million in funding to help manufacturers adopt smart manufacturing solutions and processes that would enhance productivity, save energy, and boost competitiveness across energy-intensive industries, including chemicals, food & beverages, and cement and concrete industries. The funding was announced in partnership with the Clean Energy Smart Manufacturing Innovation Institute (CESMII). Such investments foster research, development, and deployment of products to support advanced manufacturing practices. Thus, the government's focus on bringing automation into the manufacturing industries drives the demand for advanced electronics that can withstand harsh environments and extreme temperatures.

Increase in Wearable Devices to Provide Opportunity for US Rugged Electronics Market Growth

Wearable technology encompasses a wide range of devices, including smartwatches, glasses, and headphones. As the US is at the forefront of technological advancements, the development and introduction of advanced wearable technologies can create lucrative opportunities for the US rugged electronics market. In January 2024, RealWear, Inc., a pioneer in developing smart glasses for frontline workers, announced the launch of RealWear Navigator Z1 (play video), the world’s most advanced intrinsically safe (IS) head-mounted wearable, at the Consumer Electronics Show (CES). In addition, RealWear received its official ATEX/IECEx Intrinsically Safe (IS) certification for the RealWear Navigator Z1, with consultation with i.safe MOBILE, a technology expert in IS product development. The IS certification is granted after a product passes a plethora of tests, including thermal, electrical integrity, mechanical durability, safety compliance, and explosion-proof testing. The certification validates that a device, which serves the purpose of boosting productivity and enhancing safety for frontline workers, would not cause an explosion after it is exposed to flammable particulates present in the atmosphere. CONKERTAB provides a range of rugged wearable devices, including wearable barcode scanners and rugged smartwatches.

US Rugged Electronics Market Report Segmentation Analysis

The US rugged electronics market has been segmented on the basis of device type, type, and industry vertical.

- Based on device type, the US rugged electronics market is segmented into displays, computers, servers, scanners, and others the displays segment held a larger market share in 2023.

- By type, the market is segmented into fully rugged, semi-rugged, and ultra-rugged. The fully rugged segment held the largest share of the market in 2023.

- By industry vertical, the market is segmented into aerospace & defense, automotive, construction, energy and utilities, manufacturing, oil & gas, and others. The aerospace & defense segment held the largest share of the market in 2023.

US Rugged Electronics Market Share Analysis, by Geography

The adoption of rugged electronics in the US is increasing owing to factors such as rising military and defense investments, demand for more rugged options in IT infrastructure, and tech-enabled frontline workers operating across various sectors such as public safety, relief, and healthcare. With a massive defense budget announced every year, the US has one of the most technologically advanced defense sectors in the world. It continuously invests in technological advancements to develop products suitable for deployments in harsh conditions. In February 2024, Crystal Group launched rugged computers for warfighters; the new products feature various artificial intelligence (AI) capabilities, innovative ruggedization and thermal management attributes, and distributed architectures for tight packaging for edge deployment. Moreover, these computers are based on new and emerging open-system industry standards in efforts to "future-proof" the latest designs. In September 2023, DT Research, a California-based computer company, released a new robust laptop for military users. The newly launched LT355 is intended for complicated jobs in tough environments. It was introduced as a tactical option for the company’s LT300 range of rugged laptops. The laptop runs Windows 10 or 11 Enterprise and is powered by Intel i5 or i7 CPUs. It also includes two-factor authentication for security purposes. The LT355 hardware includes a full-size, backlit keyboard, a 15.6-inch high-brightness touchscreen display with night vision capability, digital pen compatibility, modular batteries, a built-in network adaptor, and an antimicrobial casing.

Frontline workers are employees who provide vital services to the public that keep society running and contribute to economic progress in their communities. According to a 2023 study by Broadleaf, 82% of all workers in the US work in frontline roles. Frontline workers, such as public safety officials and first responders, require mobile computing solutions that can help them meet the demands of their jobs. Rugged laptops, industrial PCs, rugged embedded computers, etc., are specifically designed to serve these roles. Moreover, police, fire, and medical professionals rely on rugged electronics for communications and data collection in inconducive conditions. With ongoing infrastructure projects such as highways, railways, and utilities, there is a need for rugged electronics to monitoring and control in these circumstances, which further contributes to the US rugged electronics market growth.

US Rugged Electronics Market News and Recent Developments

The US rugged electronics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for US rugged electronics and strategies:

- As per Digital Systems Engineering press release in 2022, the company unveiled the Typhon rugged display, an advanced multiscreen system tailored specifically for the modern military fleet. With a robust design engineered to endure the harshest environments, Typhon ensures unparalleled high-definition performance and unwavering reliability in combat situations.

- As per NCS Technologies, Inc., press release in 2022, NCS Technologies, Inc. inaugurated its advanced 108,000-square-foot headquarters facility, situated on a spacious 8.4-acre site at 9601 Discovery Boulevard, Innovation Park. This significant corporate expansion represents a pivotal step for NCS, which has been rooted in Prince William County since 2002. The decision to establish the new facility in Innovation Park was driven by strategic considerations such as enhanced accessibility, heightened security measures, and proximity to key clientele.

US Rugged Electronics Market Report Coverage and Deliverables

The “US Rugged Electronics Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

US Rugged Electronics Market Regional Insights

The regional trends and factors influencing the US Rugged Electronics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Rugged Electronics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Rugged Electronics Market

US Rugged Electronics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.72 Billion |

| Market Size by 2031 | US$ 7.33 Billion |

| Global CAGR (2023 - 2031) | 8.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Device Type

|

| Regions and Countries Covered | US

|

| Market leaders and key company profiles |

US Rugged Electronics Market Players Density: Understanding Its Impact on Business Dynamics

The US Rugged Electronics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Rugged Electronics Market are:

- Core Systems Inc

- Crystal Group Inc

- Mercury Systems Inc

- Systel Inc

- Trenton Systems Inc

- DELL INC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Rugged Electronics Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- 3D Audio Market

- Playout Solutions Market

- Formwork System Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Space Situational Awareness (SSA) Market

- Lyophilization Services for Biopharmaceuticals Market

- Bathroom Vanities Market

- Artificial Turf Market

- Human Microbiome Market

- Embolization Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Fully rugged segment led the US rugged electronics market with a significant share in 2023 and is expected to grow with the highest CAGR.

Growing number of infrastructural development activities, increasing need for drones or UAVs in mapping and surveying, and rising demand for land survey equipment are driving factors of US rugged electronics market.

Rising deployment of cloud-based software and services is expected to set the future trend for the US rugged electronics market in the coming years.

The US rugged electronics market was estimated to be valued at US$ 3.72 billion in 2023 and is projected to reach US$ 7.33 billion by 2031; it is expected to grow at a CAGR of 8.8% during the forecast period.

The US rugged electronics market is expected to reach US$ 7.33 billion by 2031.

The key players holding majority shares in the US rugged electronics market include Dell Inc., Mercury Systems, Inc., Crystal Group Inc., Sparton, and Core Systems

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - US Rugged Electronics Market

- Digital Systems Engineering Inc.

- Core Systems

- Crystal Group Inc.

- Mercury Systems, Inc.

- Systel

- Trenton Systems, Inc.

- Dell Inc.

- Sparton

- ZMicro

- NCS Technologies, Inc.

Get Free Sample For

Get Free Sample For