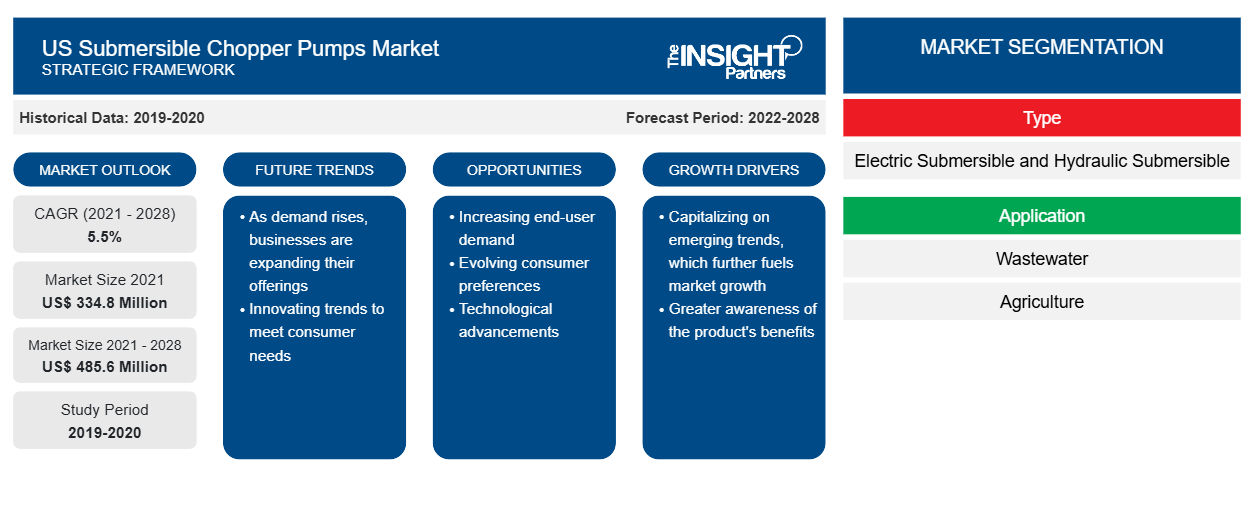

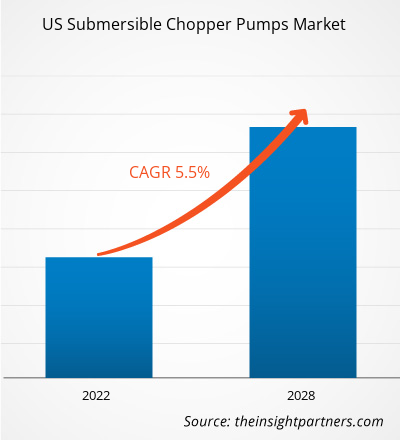

The US Submersible Chopper Pumps Market was valued at US$ 334.8 million in 2021 and is projected to reach US$ 485.6 million by 2028. It is expected to grow at a CAGR of 5.5% from 2021 to 2028.

Due to escalated usage of chopper pumps in wastewater applications, the demand for these pumps is increasing across the wastewater industry in the US Wastewater treatment facilities in the US process approximately 34 billion gallons of wastewater every day. Nearly one in four households in the US depends on an individual decentralized system to treat its wastewater. The nation's more than 16,000 centralized wastewater treatment plants are also functioning, at over 80% of their design capacities, while 15% have reached or exceeded it. Growing urban environments signal a trend that these facilities will increasingly accommodate a larger portion of the nation's wastewater demand. They find applications in various areas such as biological treatment and severe clogging, to break down solids especially in municipal water and wastewater treatment. The pumps can effectively pump heavily polluted wastewater having dry matter. Companies are developing broad variety of products and solutions that address customer needs in the wastewater industry. With rapid urbanization, the need for chopper pumps will increase significantly. The escalated usage of chopper pumps in wastewater applications is one of the major drivers for market growth in the US.

The US submersible chopper pumps market is analyzed on the basis of type, application, and discharge size. By type, the electric segment is expected to dominate the US market with high growth and greater revenue share. By application, wastewater holds a higher revenue share in the US market, followed by the agriculture application segment. By discharge size, medium discharge size, i.e., 6 inches to 12 inches, is estimated to hold a higher market value share. However, the high discharge size segment, i.e., above 12 inches, is expected to dominate the market growth during the forecast period.

Impact of COVID-19 Pandemic on Submersible Chopper Pumps Market

The downturn in the global economy due to the impact of COVID-19 has led to adverse effect on businesses and their operations. The COVID-19 pandemic came to effect in the US during the spring and affected the pump industry in varied ways. With severe industries halted, the pump industry also faced material adverse effects. Supply chain issues, shipping delays, border disputes and currency fluctuations were some of the effects of the pandemic. Volatility in the foreign currencies and raw material prices led to negative performance of the pump industry and other industries in general.

Pump manufactures witnessed declined sales compared to previous financial years ranging from 5 to 7% decline. They also experienced reductions in the customer demand from various end-user markets. However, amidst the pandemic, the water and wastewater treatment industry seeks growth as developed and emerging regions increase their access to clean water and effective water treatment to supply their populations.

Market Insights– Submersible Chopper Pumps Market

Growing Wastewater Industry in US

In the US, opportunities remain concentrated in the agriculture and wastewater sectors. However, wastewater applications are expected to drive market growth in the US. This is because the category has had strong sales in recent years, manufacturers are continuing to focus on growing production of chopper pumps for water and wastewater treatment. In comparison to other pumps, chopper pumps have extremely high flow rates and cover a wide range of liquid pumping applications. As a result, chopper pumps continue to see increased innovation and investment. New trends have resulted in tectonic shifts in a variety of industries.

Wastewater treatment has become an essential aspect of the sustainable development goals as numerous groups bring attention to the problem of water scarcity. Pump manufacturers are focusing on and exploring the possibilities of their products in these applications, recognizing the growing importance of water and wastewater treatment around the world. Pump makers are also projected to benefit from increased government spending in water and wastewater treatment activities.

These factors are expected to create lucrative opportunities for players operating in the submersible chopper pumps market over the next few years.

Type-Based Submersible Chopper Pumps Market Insights

On the basis of type, the submersible chopper pumps market is divided into electric submersible and hydraulic submersible. The electric submersible segment accounts for the largest revenue share in the overall market. This is due to rapid adoption of electric pumps across various end use applications such as wastewater and agriculture. With ongoing trends such as multistage pumps, self-priming pumps and heavy duty pumps, demand for energy-efficient and high performance electric submersible pumps is fast gaining traction. Especially in the US, increasing energy costs and rising environmental awareness among end users is expected to drive demand for energy-efficient and cost-effective submersible chopper pumps over the forecast period.

Discharge-Size-Based Submersible Chopper Pumps Market Insights

On the basis of discharge, the submersible chopper pumps market is segmented into below 6 inch, 6 inch to 12 inch, and above 12 inch. Below 6 inch Submersible Chopper pumps are low discharge sizes which are considered in this segment. They are also referred as light duty chopper pumps. Submersible Chopper pumps with medium discharge sizes are considered in this segment. It includes all discharge sizes from 6 inch to 12 inch especially for pumping long fiber components. These pumps are used extensively in agriculture and wastewater applications. Above 12 inch discharge sized pumps are Submersible Chopper pumps with high discharge sizes which are considered in this segment. They are also referred as heavy duty chopper pumps and extensively pump thick materials like slurries.

Application-Based Submersible Chopper Pumps Market Insights

Based on application, the US submersible chopper pumps market is segmented into wastewater, agriculture, and others. The wastewater segment holds a significant amount of revenue share in the market. Today's wastewater industry professionals are facing varied challenges, but the challenge of handling unwanted sewage is made easier by chopper pumps. Similarly, submersible chopper pumps in agriculture are used in specific agricultural applications for pumping manure, dairy manure handling, and separating sand-laden manure through solid separators.

Chopper pumps are also exclusively used in livestock, slurry, and biogas in discharge heads, ranging from medium to high. Other applications of submersible chopper pumps include oil & gas, chemical, medical, and electronics. In the oil & gas industry, electric submersible pumps are an effective artificial lift method of pumping production fluids to the surface.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Submersible Chopper Pumps Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Submersible Chopper Pumps Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Players operating in the market mainly focus on developing advanced and efficient products.

- In May 2021, Hayward Gordon announced expanding its partnership with Weir Minerals. The partnership, which is a regional sales distribution agreement, aims at strengthening the knowledge and service expertise of both companies for each other.

- In Dec 2020, Pentair Plc announced the completion of the acquisition of Rocean, Be the Change Labs, Inc. The acquisition aims at broadening core water treatment products in the residential and commercial water markets.

US Submersible Chopper Pumps Market Regional Insights

The regional trends and factors influencing the US Submersible Chopper Pumps Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses US Submersible Chopper Pumps Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for US Submersible Chopper Pumps Market

US Submersible Chopper Pumps Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 334.8 Million |

| Market Size by 2028 | US$ 485.6 Million |

| Global CAGR (2021 - 2028) | 5.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

US Submersible Chopper Pumps Market Players Density: Understanding Its Impact on Business Dynamics

The US Submersible Chopper Pumps Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the US Submersible Chopper Pumps Market are:

- PentairAES

- Sulzer Ltd

- WAMGROUP S.p.A.

- Xylem Inc

- Zenit Italia Srl p.iva

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the US Submersible Chopper Pumps Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

- PentairAES

- Sulzer Ltd

- WAMGROUP S.p.A.

- Xylem Inc

- Zenit Italia Srl p.iva

- Vaughan Company

- Excel Fluid Group

- Hayward Gordon

- Landia A/S

- ValMetal Saint Francois

Get Free Sample For

Get Free Sample For