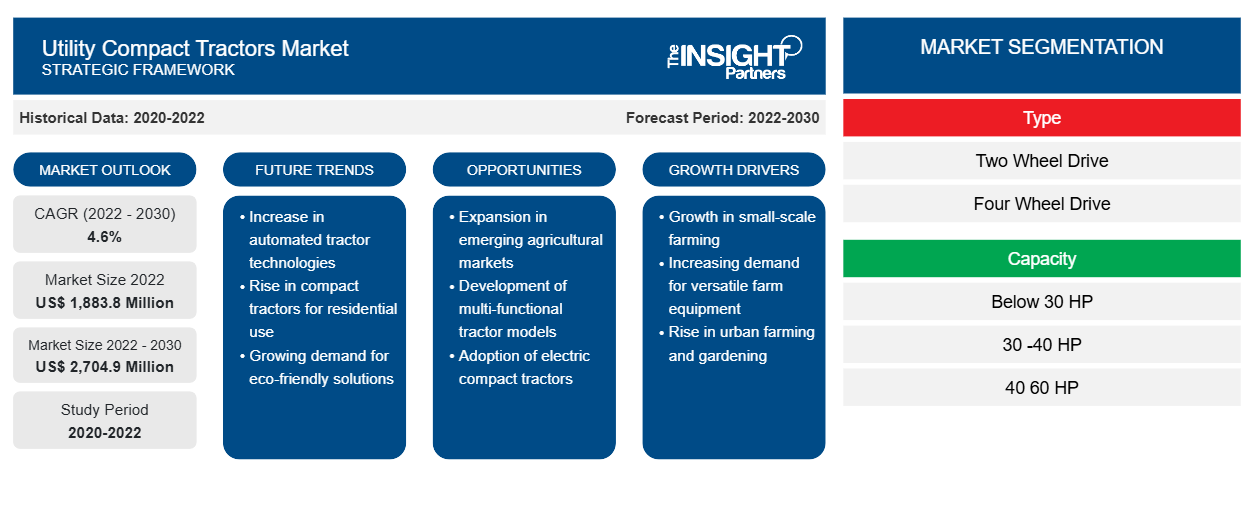

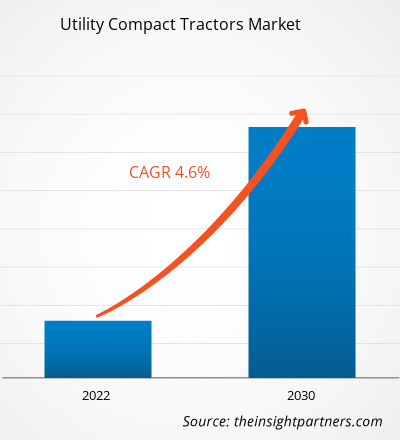

[Research Report] The utility compact tractors market size is projected to surge from US$ 1,883.8 million in 2022 to US$ 2,704.9 million by 2030; it is expected to register a CAGR of 4.6% from 2022 to 2030.

Analyst Perspective:

Increased use of compact tractors in construction, landscaping, animal management, and lawn management is an important factor contributing to the utility compact tractors market growth. These tractors are utilized in lifting, mowing, towing, hauling, and soil management activities. Increased investments in landscaping projects and a proliferating construction industry directly drive the adoption of utility compact tractors. As per data published by Oxford Economics in 2023, construction work is expected to increase in value from US$ 9.7 trillion in 2022 to US$ 13.9 trillion by 2037, led by giant markets such as China, the US, and India. India is emerging as one of the fastest-growing construction superpowers, while the UK is expected to be the fastest-expanding construction market in Western Europe. Further, snowfall is a common phenomenon in countries such as Germany, France, Russia, Norway, Switzerland, Spain, and Sweden, and compact utility tractors are commonly used in snow removal operations. In December 2023, Moscow witnessed heavy snowfall that disrupted transportation. As per the data provided by the Russian Government, approximately 20,000 pieces of equipment, including utility compact tractors, were used to clear the snowfall. Thus, snow removal needs and the increasing landscaping and construction projects drive the adoption of utility compact tractors in Europe, as well as in other parts of the world.

Market Overview:

Although the application of compact tractors is more common in agricultural activities, they are also being used in construction, mining, landscaping, and lawn-mowing activities. These tractors are economical and easy to maintain compared to full-size tractors. Further, compact tractors can be easily managed in small spaces owing to their design and compact yet powerful engine. Compact utility tractors come in various drive types, such as conventional combustion engines and fully electric motors

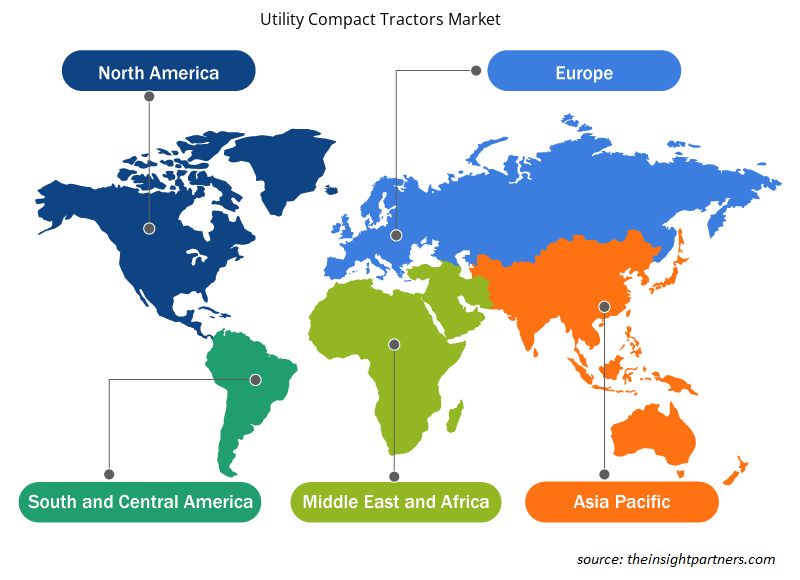

Asia Pacific is projected to generate lucrative opportunities for global and domestic compact utility tractor vendors, mainly due to the continuous growth of the construction and mining industries. As per the data published by Oxford Economics in 2023, Asia Pacific is expected to generate US$ 7.4 trillion for the global construction sector by 2030. In addition, owing to continuous industrial growth in the region, mining activities are projected to magnify rapidly in the coming years. Thus, the continuous growth of the industrial sector ultimately supports the utility compact tractors market growth. North America and Europe are expected to record strong growth rates in the global market in the coming years. Canada, Germany, Austria, Russia, and Sweden, among others, have the highest snowfall rates. Moreover, the demand for landscaping and lawn management is high compared to other countries in the US. Thus, the adoption of the utility compact tractor for snow removal and landscaping activities is higher in these countries.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Utility Compact Tractors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Utility Compact Tractors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Demand for Landscaping and Lawn Care Services

Lawn care services typically cover a wide range of activities associated with lawn and soil management, along with their upkeep. These include mowing, edging, pruning, fertilization, weed control, insect management, and watering. Some lawn care businesses may provide extra services such as aeration, overseeding, and sod installation. As per The Insight Partners analysis in 2022, the landscape and lawn care services reached approximately US$ 200 billion in 2022. The US is one of the main markets for landscape and lawn care services. US consumers spend approximately US$ 30 billion on professional landscaping and lawn care services. Further, government spending on landscape improvement is another factor benefitting the landscape industry and, ultimately, the utility compact tractors market. For instance, in December 2023, the US government announced US$ 161 million for landscape restoration activities. With the help of this funding, the government expects to complete the restoration of 21 landscapes. Increased spending on such services propels the demand for landscaping equipment such as utility compact tractors. Thus, increased demand for landscaping and lawn care services contributes significantly to the expansion of the utility compact tractors market size.

Segmental Analysis:

The utility compact tractors market analysis has been carried out by considering the following segments: type, capacity, and drive type. On the basis of capacity, the market is segmented into below 30 HP, 30-40 HP, and 40-60 HP. The 40-60 HP segment accounted for more than 60% of the utility compact tractors market share in 2022

Utility compact tractors from the 40-60 HP category are used significantly by landscaping and lawn care service providers in plowing, load-carrying, and hauling activities, among others. Product development activities by compact tractor manufacturers further propel the market progress. For instance, in February 2023, Kubota launched its LX4020 compact tractor with 40HP power. The model features a wider axle, which increases overall maneuverability, adding to their suitability for landscape and lawn care operations.Regional Analysis:

The geographic scope of the utility compact tractors market report includes North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). The North American utility compact tractors market is segmented into the US, Canada, and Mexico. The landscape and lawn care maintenance industry in countries such as the US, Canada, and Mexico majorly drives the demand for utility compact tractors.

North America is expected to continue to dominate the utility compact tractors market share in the coming years due to the steady expansion of landscape and construction industry growth. The construction industry is a significant contributor to the US economy. There were about 919,000 construction establishments in the country in the first quarter of 2023, which completes approximately US$ 2.1 trillion worth of building projects each year. In Canada, the construction sector was the sixth-largest contributor to GDP in 2022. The Canadian construction industry produced around US$ 250 billion in annual revenue in 2022. In addition to the demand from this industry, heavy snowfall received by Canadian states is a notable factor driving the adoption of utility compact tractors. In the US, increased preference for carbon emissions and rising adoption of electric vehicles are expected to bring new utility compact tractors market trends in the coming year.

Utility Compact Tractors Market Regional Insights

Utility Compact Tractors Market Regional Insights

The regional trends and factors influencing the Utility Compact Tractors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Utility Compact Tractors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Utility Compact Tractors Market

Utility Compact Tractors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,883.8 Million |

| Market Size by 2030 | US$ 2,704.9 Million |

| Global CAGR (2022 - 2030) | 4.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Utility Compact Tractors Market Players Density: Understanding Its Impact on Business Dynamics

The Utility Compact Tractors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Utility Compact Tractors Market are:

- YANMAR Tractor

- Mahindra

- TYM CORPORATION

- Solectrac

- John Deere

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Utility Compact Tractors Market top key players overview

Key Player Analysis:

Bobcat Company, Mahindra Tractors, Kubota, John Deere, Massey Ferguson, TYM, Yanmar, and New Holland are among the prominent players profiled in the utility compact tractors market report. In addition, several other important companies were studied and analyzed during this market research study to get a holistic overview of the market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the utility compact tractors market. A few recent developments by key market players are listed below:

|

|

|

March 2023 | TYM launched the new series of 4 tractors with a telematics system (T76 only) and hydraulic top links. | APAC |

May 2023 | John Deere introduced the 2024 model-year enhancements to its 3R- and 4-Series compact utility tractors. These tractors are equipped with accessories that are useful for commercial snow removal. | North America |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Capacity, and Drive Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Regions such as Europe, North America and Asia-Pacific will boost the growth of the utility compact tractors market during the forecast period. The demand for the utility compact tractors in Europe and North America is mainly attributed increased investments for the snow removal equipment.

AGCO GmbH, Yamaha Tractors, Solis, Bobcat Company, Mahindra Tractors, Kubota, John Deere, Massey Ferguson, and New Holland are the key market players operating in the global utility compact tractors market.

Increased adoption in the construction industry is one of the primary factors behind the market growth. Global construction activity is expected to expand by 1.2% in 2024, reaching a value of US$ 9.6 trillion. Total construction activity is expected to reach a value of US$ 9.9 trillion by 2025, with a growth rate of 3.6%; Further, it is estimated to reach US$ 10.1 trillion by 2028, growing at a CAGR of 2.2%.

Continuous adoption of electric vehicles owing to increased focus on sustainability is one of the trends that is expected to drive the demand of the electric utility compact tractors market.

Many compact tractor manufacturers are focusing on developing fully automated compact tractors. Such development is projected to generate lucrative opportunities for the utility compact tractors market during the forecast period.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Utility Compact Tractors Market

- YANMAR Tractor

- Mahindra

- TYM CORPORATION

- Solectrac

- John Deere

- AGCO GmbH

- Bobcat Company

- New Hollland

- Massey Ferguson

- LS Tractors

- Iseki & Co., Ltd.

- Deutz-Fahr

Get Free Sample For

Get Free Sample For