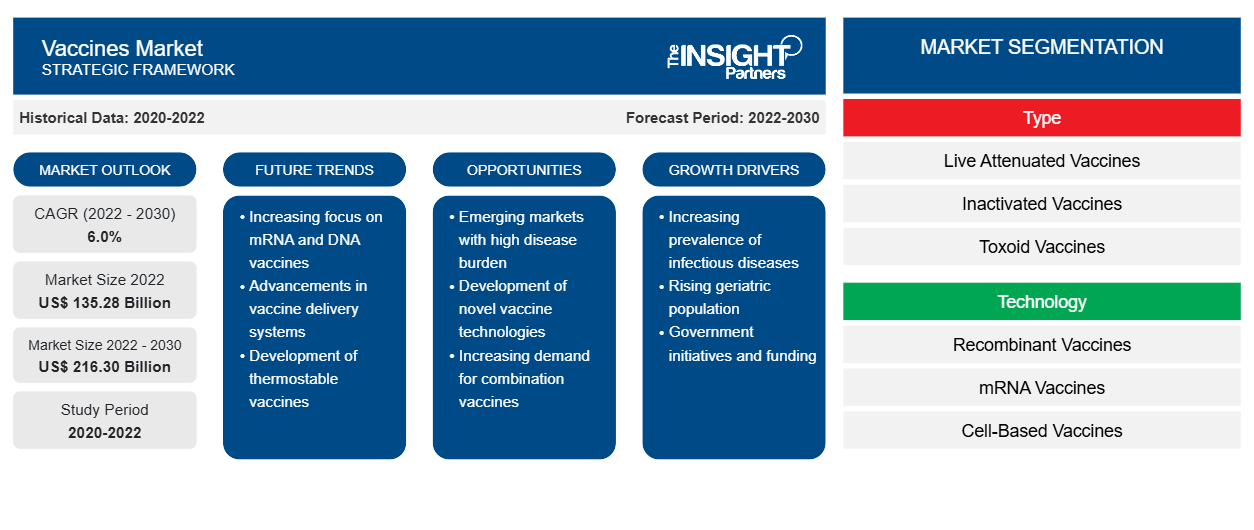

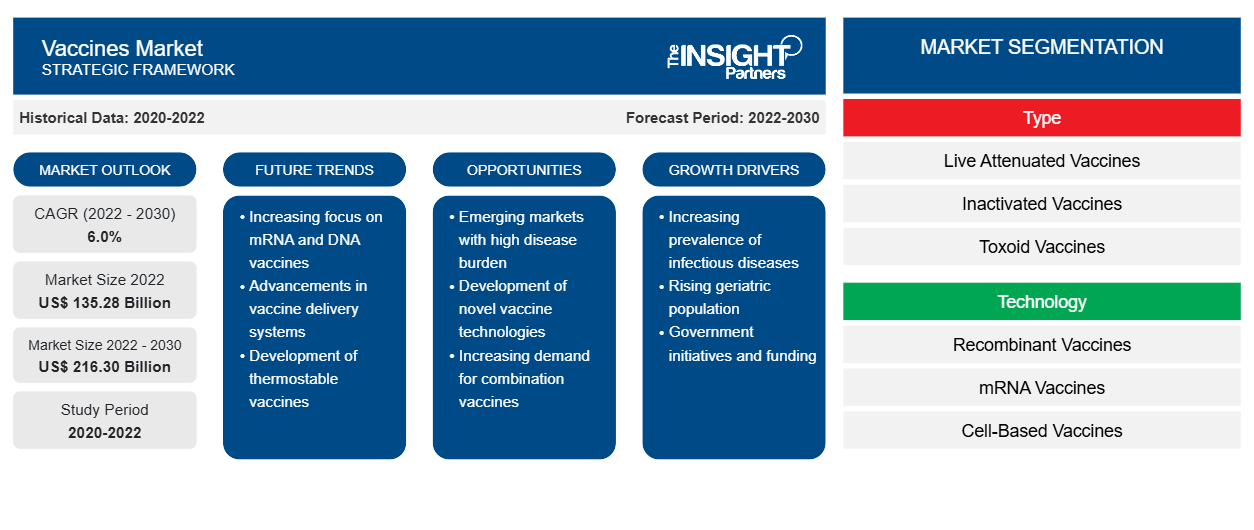

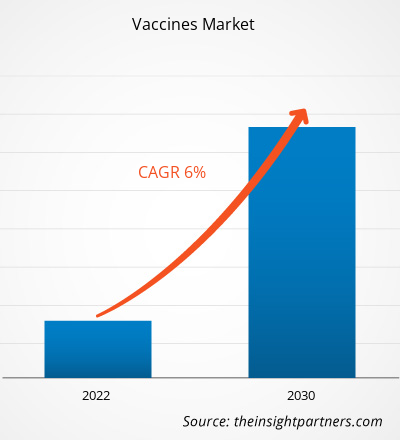

[Research Report] The vaccines market size is expected to grow from US$ 135.28 billion in 2022 to US$ 216.30 billion by 2030; the market is estimated to register a CAGR of 6.0% from 2022 to 2030.

Analyst’s Viewpoint

The vaccines market analysis explains market drivers such as the rising prevalence of infectious diseases and the increasing uptake of vaccines amid the COVID-19 pandemic. Further, innovation in vaccine development is expected to introduce new market trends during the forecast period. Based on type, the market is segmented into live attenuated vaccines, inactivated vaccines, toxoid vaccines, subunit & conjugate vaccines, and others. The live attenuated vaccines segment held the largest market share in 2022. Based on application, the vaccines market is segregated into human papillomavirus (HPV), cancer, MMR, DPT, and others. The HPV segment held the largest market share in 2022. By route of administration, the vaccines market is categorized into oral, nasal, and injectable. The injectable segment held the largest share of the market in 2022. By age, the pediatric segment will account for a larger share of the global vaccines market for the forecast period of 2022–2030. By end user, the vaccination centers & program segment will account for the largest share of the global vaccines market during 2022–2030.

A vaccine is a biological preparation that provides active acquired immunity to a particular infectious or malignant disease. A vaccine preparation typically contains an agent responsible for resembling a disease-causing microorganism is often made from a weakened or killed form of the microbe, toxin, or one of its surface proteins. Vaccines can be prophylactic or therapeutic.

Market Insights

Rising Infectious Diseases

According to the 2020 report of the Connecticut Department of Public Health, the number of cases of infectious diseases recorded in 2020 in Connecticut is given below.

Reported Cases of Connecticut Reportable Diseases in 2020 | |

Disease | Total |

Hepatitis A | 15 |

Influenza | 98 |

Malaria | 4 |

Tuberculosis | 54 |

SARS-CoV-2 | 200,379 |

Source: The Insight Partners Analysis

Additionally, the table below reveals notable infectious diseases as per the Center for Health Protection report in 2020:

Notable Infectious Disease | |

Disease | Total |

SARS-CoV-2 | 8,847 |

Chickenpox | 1,987 |

Community-associated methicillin-resistant Staphylococcus aureus infection | 813 |

Dengue Fever | 22 |

Tuberculosis | 3,656 |

Source: The Insight Partners Analysis

Among all the infectious diseases, SARS-CoV-2 was all-time high during the 2020 to 2022 period where other uptake of vaccines including Dengue, Chickenpox, Tuberculosis, and others were low. However, SARS-CoV-2 vaccine uptake was high due to the rising cases globally. According to the Public Health England report published in 2021, 12-month UK coverage for DTaP/IPV/Hib/HepB3 vaccination increased by 0.1% to 92.2% and Rotavirus by 0.3% to 90.6%. However, MenB2 decreased by 0.1%, accounting for 92.3% compared to the previous year. Also, the NHS England report revealed that, in December 2022, a total of 88.9% of all adult care home residents had been vaccinated with a COVID-19 booster dose. Therefore, due to the rising prevalence of infectious diseases, the demand for vaccination is high, resulting in overall market growth.

Market Trend

Innovation in Vaccine Development

The global vaccine development is subject to change due to the COVID-19 pandemic accelerating technological adoption. For example, mRNA vaccine innovation and new methods of administration, including intranasal, are the most innovative vaccine development methods. Additionally, manufacturers are trying different ways to improve these vaccines and deliver them in a way that makes them more productive and enhances the immunogenicity, durability, and overall efficacy.

Furthermore, more streamlined regulatory processes and standardization for clinical trial protocol played a crucial role in reducing the timeline for vaccine development from 10 years to 260 days for the COVID-19 vaccine, which is another example of vaccine development innovation. Such innovative vaccine delivery methods and favorable vaccine development innovation are responsible for the market growth for the forecast period of 2022–2030.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vaccines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vaccines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

Market Opportunity

Therapeutic Vaccine Development

Traditional vaccines stimulate the production of antibodies and immune proteins that target specific pathogens like viruses and bacteria. Likewise, therapeutic vaccines stimulate the immune system to target cancer cells and control the progression of chronic infections like HIV. Further, therapeutic vaccines typically stimulate the recipient's immune system to slow or stop chronic disease progression or target cancer cells. Further, therapeutic vaccines for the treatment of noninfectious diseases encompass a wide variety of possible formulations, antigens, and mechanism of action. Therefore, therapeutic vaccines development will provide lucrative market opportunity for the forecast period 2022-2030.

Examples of Therapeutic Vaccines in Development | |

Indication | Development Phase |

Ovarian Cancer | Phase 1 |

Multiple Myeloma | Phase 1 |

Type 1 Diabetes | Preclinical |

Acute Myelogenous Leukemia | 3 |

Mesothelioma | 2 |

Source: The Insight Partners Analysis

Type-Based Insights

Based on type, the vaccines market is segmented into live attenuated vaccines, inactivated vaccines, toxoid vaccines, subunit & conjugate vaccines, and others. The live attenuated vaccines segment held the largest market share in 2022. Live attenuated vaccines are very effective vaccines used in the prevention of a variety of diseases, including influenza, chickenpox, measles, polio, and tuberculosis. As per the World Health Organization (WHO) report, there are nearly a billion cases of seasonal influenza, including 5 million cases of severe illness. Also, it causes ~290,000 to 650,000 respiratory deaths annually. Live-attenuated influenza vaccine (LAIV) proves advantageous in combating the infection among the population. For example, LAIV can provide up to 90% protection to adults under 65 years of age and up to 40% to adults over 65. The aforementioned factors are responsible for the market growth for the segment for the forecast period of 2022–2030.

Application-Based Insights

Based on application, the vaccines market is categorized into human papillomavirus (HPV), cancer, MMR, DPT, and others. The HPV segment held the largest market share in 2022. According to the WHO report, HPV is highly prevalent among women in Sub-Saharan Africa (24%), followed by Latin America and the Caribbean (16%), Eastern Europe (14%), and Southeast Asia (14%). Also, 625,600 women and 694,000 men have HPV-related cancer annually globally. Also, in 2020, cervical cancer accounted for 93% of HPV-related cancers among women. Therefore, there is a high demand for HPV vaccines among the population due to rising cases, as these vaccines protect against genital warts and most cases of cervical cancer. Also, HPV vaccines are highly approved by the US Food and Drug Administration (USFDA). "GARDASIL 9" is one such example of an HPV vaccine approved by the USFDA. The aforementioned factors are responsible for the market growth for the segment during the forecast period of 2022–2030.

Route of Administration-Based Insights

In terms of route of administration, the vaccines market is categorized into oral, nasal, and injectable. The injectable segment held the largest share of the market in 2022. The most common route of vaccine administration is through injectables, as administering a vaccine through a subcutaneous or intradermal route may cause local irritation, skin discoloration, inflammation, and many more.

Further, the CDC report reveals that DTaP, DT, HepA, HepB, Hib, HPV, IIV4, RIV4, ccIIV4, IPV*†, MenACWY, MenB, MMR‡ , PCV13, PPSV23*†, RZV, Td, Tdap, TT, VAR† are common vaccines administered through the injectable route of administration. Varied vaccines administered through injectable routes act as a standalone factor responsible for the market growth for the segment during the forecast period of 2022–2030.

Vaccines Market Regional Insights

Vaccines Market Regional Insights

The regional trends and factors influencing the Vaccines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Vaccines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Vaccines Market

Vaccines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 135.28 Billion |

| Market Size by 2030 | US$ 216.30 Billion |

| Global CAGR (2022 - 2030) | 6.0% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

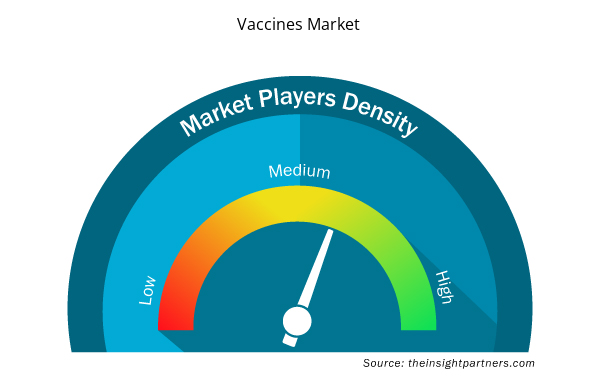

Vaccines Market Players Density: Understanding Its Impact on Business Dynamics

The Vaccines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Vaccines Market are:

- GSK

- Pfizer

- Sanofi

- Merck

- Serum Institute of India (SII)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Vaccines Market top key players overview

Regional Analysis

North America accounted for the largest share of the vaccines market. The market in North America is subsegmented into the US, Canada, and Mexico. The US holds the largest share of the vaccines market in this region.

The rising government support for vaccine development enhances vaccine production in the US alone. For example, in March 2023, the US Government announced an investment of US$ 31.9 billion in mRNA vaccine research and procurement. The study of vaccines is based on extensive analysis of US government research grants and procurement contracts related to mRNA vaccines and technologies. After the pandemic, US$ 29.2 billion (92%) of the US public funds announced vaccine procurement, with US$ 2.2 billion (7%) supporting clinical trials and US$ 108 million supporting manufacturing and science. Further, companies in the US get approval for vaccines favorably. For instance, in September 2023, Pfizer and BioNTech announced receiving USFDA approvals of "supplemental Biologics License Application (COMIRNATY 2023-2024 Formulation)" for individuals 12 years and older with emergency use authorization (EUA) for six months individuals. The newly approved vaccine is available in pharmacies, hospitals, and clinics across the US. Fast approvals and a rise in government support for vaccine development and manufacturing are responsible for the major market share of the US in the regional market.

Asia Pacific is expected to register the highest CAGR in the global vaccine market. Asia Pacific accounts for the largest share of R&D spending, with large publications and patents on vaccine research & development (R&D). Also, the region is home to state-owned and private pharmaceutical firms and contract research organizations (CROs) to conduct vaccine R&D. Further, countries in Asia Pacific utilize several supply-side and demand-side approaches to incentivize investment in vaccine R&D. For example, high-income countries in Asia Pacific are major contributors to product development partnerships launching vaccine development programs to boost innovative vaccine manufacturing and research.

During the COVID-19 pandemic, many high and middle-income countries in Asia Pacific established vaccine development manufacturing setups. Regional institutions and intergovernmental organizations in Asia Pacific helped promote and coordinate regional cooperation in vaccine R&D. Therefore, Asia Pacific favorable policies for conducting vaccine development programs to boost innovative vaccine manufacturing and research activities is a standalone factor responsible for accounting for the highest CAGR for the vaccine market during 2022-2030.

The report profiles leading players operating in the global vaccines market. These include GSK, Pfizer, Sanofi, Merck, Serum Institute of India (SII), AstraZeneca, BioNTech, Biological E, Sinovac, Sinopharm, and Bharat Biotech. In August 2022, GSK announced the acquisition of Affinivax, Inc., aiming to build a strong portfolio of specialty medicines and vaccines. The acquisition includes a next-generation 24 valent pneumococcal vaccine that is currently in Phase 2 development and is based on highly innovative Multiple Antigen Presenting System (MAPS) platform technology. The MAPS technology supports higher valency than conventional conjugational technologies and less broad coverage against prevalent pneumococcal serotypes. It generates higher antibody responses for many individual serotypes than current pneumococcal vaccines.

In January 2022, Pfizer Inc. announced a collaboration with BioNTech for new research, development, and commercialization to develop a potential first mRNA-based vaccine for the prevention of shingles. Also, the collaboration builds on the company's success in developing the first approved and most widely used mRNA vaccine to help prevent COVID-19.

Company Profiles

- GSK

- Pfizer

- Sanofi

- Merck

- Serum Institute of India (SII)

- AstraZeneca

- BioNTech

- Biological E

- Sinovac

- Sinopharm

- Bharat Biotech

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Identity Verification Market

- Workwear Market

- Personality Assessment Solution Market

- Tortilla Market

- Clinical Trial Supplies Market

- USB Device Market

- Print Management Software Market

- Integrated Platform Management System Market

- Trade Promotion Management Software Market

- Airline Ancillary Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, Application, Route of Administration, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

A vaccine is a biological preparation that provides active acquired immunity against a particular disease. A vaccine consists of an agent that resembles or is a part of the disease-causing microorganism and is often made from weakened or killed forms of the microorganism, its toxins, or one of its surface proteins. The agent triggers the body's immune system to recognize the agent as a threat, destroy it, and to further recognize and destroy any of the microorganisms associated with that agent that it may encounter in the future.

Pfizer Inc., GlaxoSmithKline plc, Merck & Co. Inc, Sanofi, Johnson & Johnson Services, Inc., Panacea Biotec Limited, Astellas Pharma Inc., NOVAVAX, INC., VBI Vaccines Inc., and Bavarian Nordic are some of the major players in the vaccines market.

The growth of the market is attributed to the rising prevalence of infectious diseases, growing focus on implementation of immunization programs, and increasing support for vaccine development.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Vaccines Market

- GSK

- Pfizer

- Sanofi

- Merck

- Serum Institute of India (SII)

- AstraZeneca

- BioNTech

- Biological E

- Sinovac

- Sinopharm

- Bharat Biotech

Get Free Sample For

Get Free Sample For