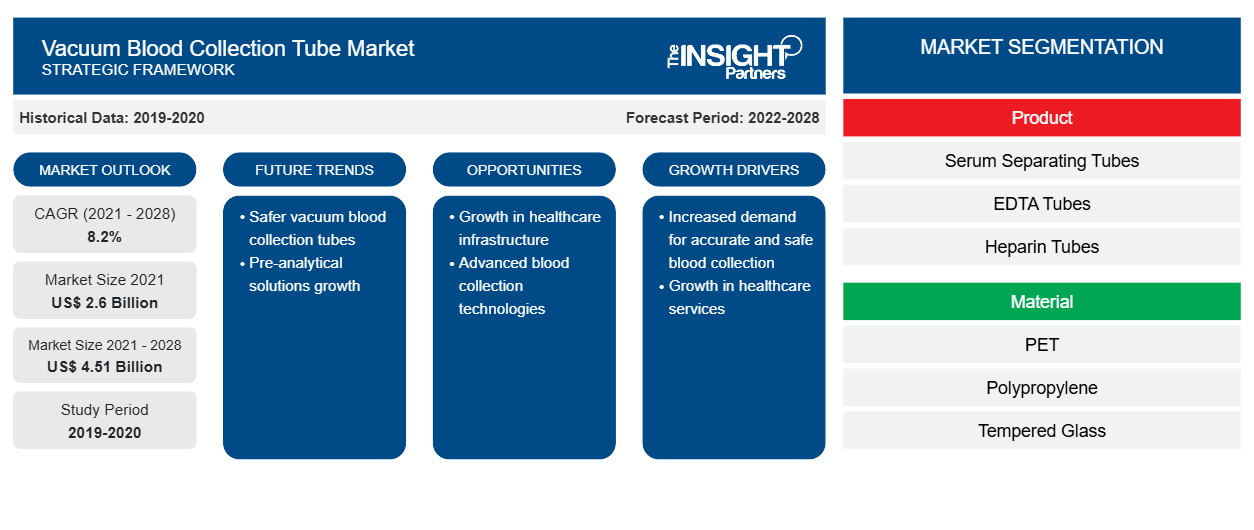

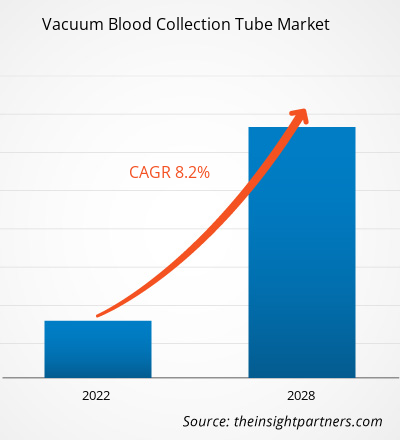

The vacuum blood collection tube market is expected to reach US$ 4,507.70 million by 2028 from US$ 2,598.78 million in 2021; it is estimated to grow at a CAGR of 8.2% from 2021 to 2028.

Vacuum blood collection tube is a sterile glass or plastic test tube with a stopper that creates vacuum inside the tube so that a preset volume of liquid can be depicted. The tube prevents needle stick damage by preventing needles from coming in human contact and thus, adulteration. A double-pointed needle is fitted to a plastic tubular adapter in the vacuum blood collecting tube. Double-pointed needles are available in numerous gauge sizes. The needle's length varies from 1 to 1 1/2 inches. Additional elements may be present in vacuum blood collection tubes, which are used to preserve blood for treatment in a medical laboratory. The increasing government subsidiaries and health services are likely to drive the market growth in the coming years. In addition, the rising awareness regarding the benefits of sterilization among the developed and developing economies is expected to offer significant growth opportunities in the market during the forecast period.

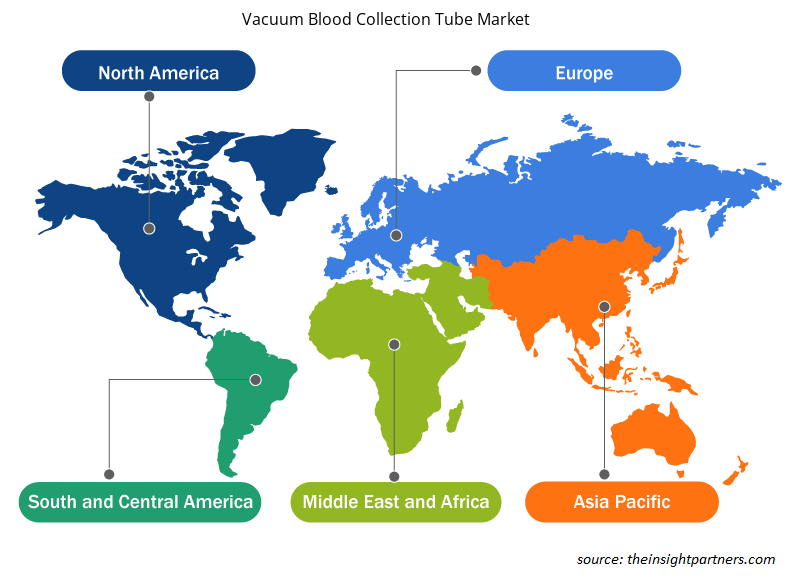

The vacuum blood collection tube market, by region, is segmented into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South and Central America (SAM). North America dominates the global market due to factors such as favorable government programs and initiatives for blood donation, improved public awareness, and rise in incidence of chronic diseases, upsurge in the research and development activities by the major key players, and advancements in vacuum blood collection tubes.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vacuum Blood Collection Tube Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vacuum Blood Collection Tube Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Number of Surgeries

With the rise in prevalence of heart, liver, kidney, lungs diseases, and other chronic diseases, the surgeries performed every year have also increased reasonably. As per the National Chronic Kidney Disease fact sheet, in 2017, approximately 30 million people had chronic kidney diseases in the US. Moreover, as per the National Institute of Diabetes and Digestive and Kidney Diseases, approximately 661,000 Americans suffer from kidney failure, out of which 468,000 patients are undergoing dialysis procedures, and 193,000 have undergone kidney transplantation. Similarly, according to the seventh annual report of the American Joint Replacement Registry (AJRR) on Knee and Hip Arthroplasty, approximately 2 million hip and knee procedures were performed, representing 1,347 institutions with data coming from hospitals, ambulatory surgery centers (ASCs), and private practice groups from all 50 states across the US and the District of Columbia in 2019–2020. Angioplasty and atherectomy are among the most common surgeries performed in the US. For instance, as per the latest interventional cardiology procedural analysis, more than 965,000 angioplasties are performed each year in the US. An angioplasty, also recognized as percutaneous coronary intervention (PCI), is a surgery that involves the insertion of a stent into a blocked or narrowed artery.

Another major reason for rising cases of surgeries is the growing number of accident and trauma cases. A rise in the number of road accidents, fires, and sports injuries has led to an increased incidence of trauma and injuries. According to Global Status Report on Road Safety—a report published by the World Health Organization (WHO) in 2018—road accidents are one of the leading causes of mortality worldwide. Approximately 1.3 billion people die in road accidents each year. Current trend analysis predicts that by 2030, road accidents will become the fifth-leading cause of mortality globally.

The rising number of accidents and injury cases will propel the demand for blood transfusion in the coming years. Accident casualties or trauma patients often face blood loss. Thus, transfusion of blood, particularly red blood cells, is required to restore the lost blood volume. Hence, the demand for blood transfusion in trauma patients, coupled with the rise in the incidence of injuries, will stimulate the growth of the blood collection devices market. With this alarming rise in the incidence of surgeries and blood transfusion procedures, the need for blood collection devices is rising, which is increasing the demand for vacuum blood collection tubes profoundly, giving a significant boost to the North America vacuum blood collection tube market.

Product-Based Insights

The global vacuum blood collection tube market, based on product, is segmented into heparin tubes, EDTA tubes, glucose tubes, serum separating tubes, and ERS tubes. In 2021, the serum separating tubes segment held the largest share of the market. Moreover, the market for the EDTA tubes segment is expected to grow at the fastest rate in the coming years.

Material-Based Insights

The global vacuum blood collection tube market, based on material, is segmented into PET, polypropylene, and tempered glass. In 2021, the PET segment held the largest share of the market. Moreover, the market for the same segment is expected to grow at the fastest rate in the coming years.

Application -Based Insights

The global vacuum blood collection tube market, based on application, is segmented into blood routine examination, biochemical test, and coagulation testing. In 2021, the blood routine examination segment held the largest share of the market. However, the market for the coagulation testing segment is expected to grow at the fastest rate in the coming years.

End-User -Based Insights

Based on end user, the vacuum blood collection tube market is segmented into hospitals and clinics, ambulatory surgical centers, pathology labs, and blood banks. The blood banks segment held the largest share of the market in 2021. Moreover, the same segment is estimated to register the highest CAGR of 8.8% in the market during the forecast period.

The vacuum blood collection tube market players adopt organic strategies, such as product launch and expansion, to expand their footprint and product portfolio worldwide and to meet the growing demand.

COVID Impacts

The North American economy is severely affected due to the exponential growth of COVID-19 cases in the region. The COVID-19 pandemic is expected to have an imperceptibly negative impact on the market. The COVID-19 pandemic and the subsequent economic downturn have had a detrimental effect on people's mental wellness and built new barriers for those who already have a mental illness or behavioral disorders. About 4 in 10 adults in the US have reported anxiety or depressive disorder signs during the pandemic, a number that has remained mostly steady, up from one in ten adults who had related symptoms from January to June 2019. Many adults are reporting specific adverse effects on their mental health and well-being as a result of worry and stress about the coronavirus, such as difficulty sleeping (36%), eating (32%), increasing alcohol consumption or substance use (12%), and worsening chronic conditions (12%), according to the KFF Health Tracking Poll from July 2020. As the epidemic progresses, continuing and required public health actions expose many people to scenarios connected to poor mental health outcomes, such as isolation and job loss.

Vacuum Blood Collection Tube Market Regional Insights

Vacuum Blood Collection Tube Market Regional Insights

The regional trends and factors influencing the Vacuum Blood Collection Tube Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Vacuum Blood Collection Tube Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Vacuum Blood Collection Tube Market

Vacuum Blood Collection Tube Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.6 Billion |

| Market Size by 2028 | US$ 4.51 Billion |

| Global CAGR (2021 - 2028) | 8.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

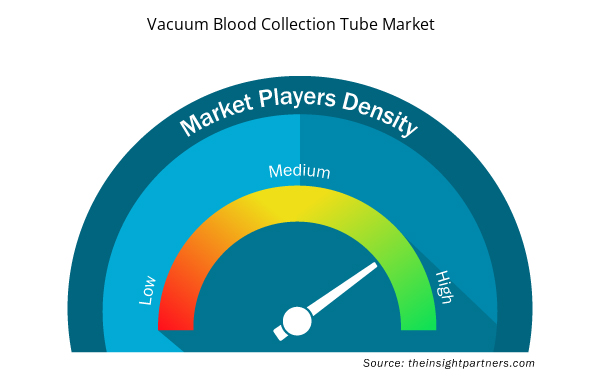

Vacuum Blood Collection Tube Market Players Density: Understanding Its Impact on Business Dynamics

The Vacuum Blood Collection Tube Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Vacuum Blood Collection Tube Market are:

- BD

- Narang Medical Limited.

- Terumo Corporation

- Greiner AG

- FL MEDICAL s.r.l.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Vacuum Blood Collection Tube Market top key players overview

By Product

- Gel and Clot Activator Tubes

- Heparin Tubes

- EDTA Tubes

- Glucose Tubes

- Serum Separating Tubes

- ERS Tubes

By Material

- PET

- Polypropylene

- Tempered Glass

By Application

- Blood Routine Examination

- Biochemical Test

- Coagulation Testing

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Pathology Labs

- Blood Banks

By

Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- South and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- BD

- Narang Medical Limited

- Terumo Corporation

- GPC Medical Ltd.

- Vitrex Medical A/S

- Medtronic

- KALSTEIN FRANCE

- ELITech Group

- F.L. Medical

- STRECK, INC.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Material, Application, and End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Algeria, Argentina, Australia, Brazil, Canada, China, Egypt, France, Germany, India, Italy, Japan, Libya, Mexico, Morocco, Qatar, RoAPAC, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, Sudan, Tunisia, Turkey, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The Vacuum Blood Collection Tube market is anticipated to grow around 8.2% CAGR amid the forecast period 2021-2028.

North America held highest market share in 2021.

BD. and Terumo Corporation are the key players in the Vacuum Blood Collection Tube market.

Serum separating tubes segment market provides the most opportunity for growth.

The increasing government subsidiaries and health services are likely to drive the market. In addition, the rising awareness regarding benefits of sterilization among the developed and developing economies is expected to offer significant growth opportunities in the market during the forecast period.

A vacuum blood collection tube is a sterile glass or plastic test tube with a stopper that creates a vacuum inside the tube so that a preset volume of liquid can be depicted. The vacuum blood collection tube prevents needle stick damage by preventing needles from coming in human contact and thus, adulteration. A double-pointed needle is fitted to a plastic tubular adapter in the vacuum blood collecting tube. Double pointed needles are available in numerous gauge sizes. The needle's length varies from 1 to 1 1/2 inches. Additional elements may be present in vacuum blood collection tubes, which are used to preserve blood for treatment in a medical laboratory.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Vacuum Blood Collection Tube Market

- BD

- Narang Medical Limited.

- Terumo Corporation

- Greiner AG

- FL MEDICAL s.r.l.

- GPC Medical LTD

- Vitrex Medical A/S

- ELITechGroup

- SEKISUI CHEMICAL CO. LTD

- SARSTEDT AG and Co. KG

Get Free Sample For

Get Free Sample For