Vascular Access Devices Market Growth and Recent Trends by 2030

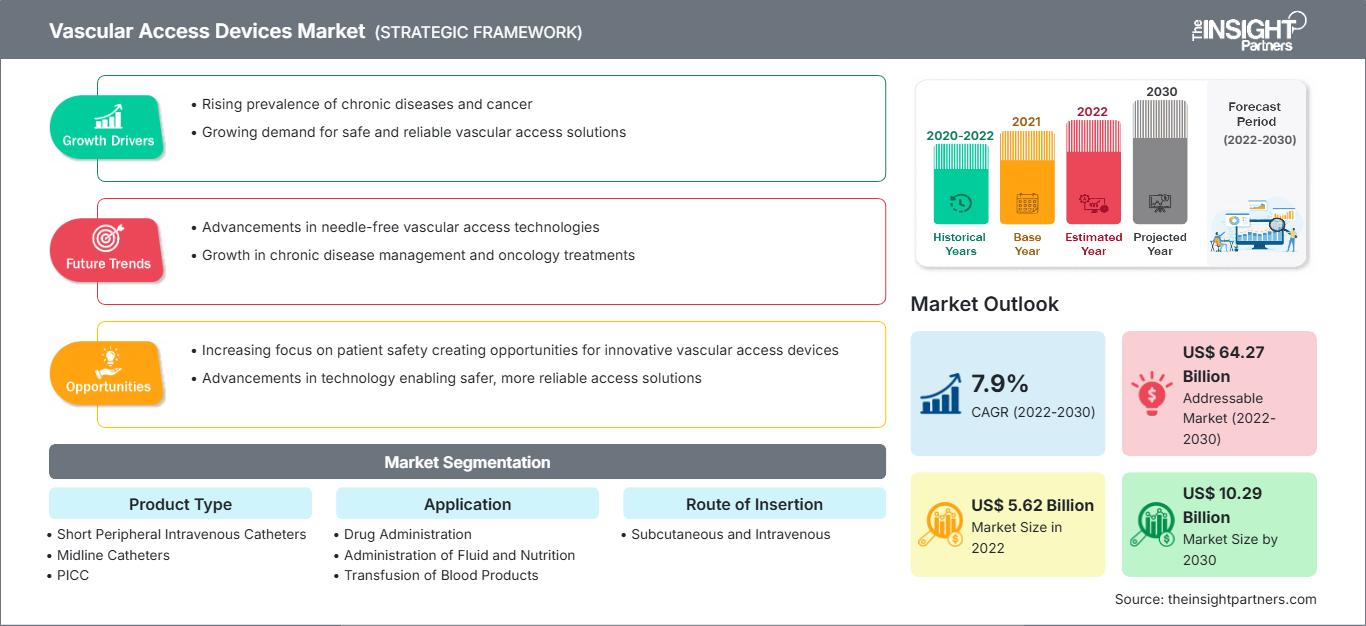

Historic Data: 2020-2022 | Base Year: 2022 | Forecast Period: 2022-2030Vascular Access Devices Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Short Peripheral Intravenous Catheters, Midline Catheters, PICC, Central Catheter, Implantable Ports, and Accessories), Application (Drug Administration, Administration of Fluid and Nutrition, Transfusion of Blood Products, and Others), Route of Insertion (Subcutaneous and Intravenous), End User (Hospitals and Clinics, Ambulatory Surgical Centers, and Others), and Geography

- Report Date : Feb 2026

- Report Code : TIPHE100000983

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

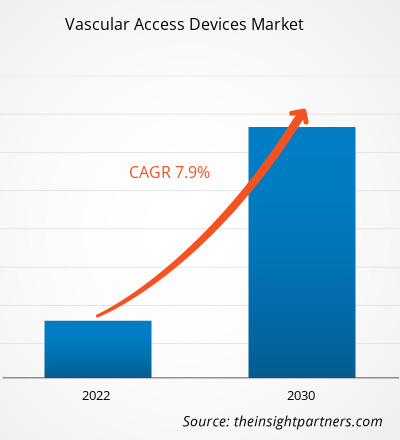

[Research Report] The vascular access devices market was valued at US$ 5.62 billion in 2022 and is projected to reach US$ 10.29 billion by 2030. It is expected to register a CAGR of 7.9% during 2022–2030.

Market Insights and Analyst View:

Vascular access devices are placed using a number of anatomic sites to access the superior or inferior vena cava—internal jugular vein, subclavian vein, external jugular vein, and femoral vein. The growing vascular access devices market size is driven by the rising prevalence of chronic diseases and the rising need for chemotherapy procedures. In addition, strategic initiatives by companies to stay competitive in the market fuel the market growth. A significant increase in the use of AI-enabled robotic venous access devices is likely to bring new vascular access device market trends during the forecast period.

Growth Drivers and Challenges:

Chemotherapy is a primary treatment or adjuvant treatment used to shrink or eliminate tumors through the administration of powerful drugs. Thus, increasing cases of cancer fuel the demand for chemotherapy procedures. As per the estimates by the International Agency for Research on Cancer (IARC), 19.3 million new cancer cases were reported globally in 2020, and ~10 million deaths occurred due to the disease. According to the National Cancer Registry (NCR), in South Africa, about 110,000 new cancer cases were diagnosed, with over 56,000 cancer-related deaths in 2020. Moreover, the disease burden is projected to increase in the coming decades, with new cancer cases estimated to rise to 138,000 and 175,000 by 2030 and 2040, respectively, while cancer-related mortality will rise to 73,000 and 94,000 in the said years. Thus, the rising prevalence of cancer drives the vascular access devices market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vascular Access Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The vascular access devices market analysis has been carried out by considering the following segments: product type, application, route of insertion, end user, and geography. The market, by product type, is segmented into short peripheral intravenous catheters, midline catheters, PICC (peripherally inserted central catheters), central catheters, implantable ports, and accessories. The market for the central catheter segment is further segmented into CICC (centrally inserted central catheter), FICC (femorally inserted central catheter), and others. Based on application, the vascular access devices market is segmented into drug administration, administration of fluid and nutrition, transfusion of blood products, and others. Based on the route of insertion, the market is bifurcated into subcutaneous and intravenous. Based on end users, the market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The scope of the vascular access devices market report entails North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, Japan, India, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The vascular access devices market, by product type is segmented into short peripheral intravenous catheters, midline catheters, PICC (peripherally inserted central catheters), central catheters, implantable ports, and accessories. The market for the central catheter segment is sub segmented into CICC (centrally inserted central catheter), FICC (femorally inserted central catheter), and others. In 2022, the short peripheral intravenous catheter segment accounted for the largest vascular access devices market share, and the same segment is expected to record the highest CAGR during 2022–2030.

Based on application, the vascular access devices market is segmented into drug administration, administration of fluid and nutrition, transfusion of blood products, and others. In 2022, the drug administration segment held the largest share and is projected to register the highest CAGR during 2022–2030.

Based on the route of insertion, the vascular access devices market is bifurcated into subcutaneous and intravenous. The intravenous segment held a larger market share in 2022 and is anticipated to record a higher CAGR during 2022–2030.

By end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The vascular access devices market for the hospitals and clinics segment is likely to grow during 2022–2030.

Regional Analysis:

North America is the biggest contributor to the global vascular access devices market growth. Asia Pacific is predicted to register the highest CAGR in the market during 2022–2030. North America held the largest share of the global market in 2022 owing to the growing prevalence of chronic disorders, increasing geriatric population, presence of key market players involved in new and existing product developments, and rising technological advancements. In North America, the US held the largest market share in 2022.

Vascular Access Devices Market Regional InsightsThe regional trends and factors influencing the Vascular Access Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Vascular Access Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Vascular Access Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.62 Billion |

| Market Size by 2030 | US$ 10.29 Billion |

| Global CAGR (2022 - 2030) | 7.9% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Vascular Access Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Vascular Access Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Vascular Access Devices Market top key players overview

Industry Developments and Future Opportunities:

The vascular access devices market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. According to the press releases published by the key market players, a few strategies are listed below:

- In November 2023, BD (Becton, Dickinson, and Company) launched new needle-free blood draw technology, which is compatible with integrated catheters, helping to enable the company's vision of a "One-Stick Hospital Stay." The PIVO Pro Needle-free Blood Collection Device features design improvements to achieve compatibility with integrated and long peripheral IV catheters, which include the new Nexiva Closed IV Catheter System with NearPort IV Access.

- In May 2023, Teleflex Inc. launched two new devices—Arrow VPS Rhythm DLX Device and NaviCurve Stylet—designed to enhance the PICC insertion procedures and reduce the chance of complications. The VPS Rhythm DLX Device provides real-time catheter tip location information by using the patient’s cardiac electrical activity. The NaviCurve Stylet features an anatomical curve and flexible tip that are designed to self-orient to patient anatomy for enhanced PICC advancement into the superior vena cava (SVC) for successful insertion.

Competitive Landscape and Key Companies:

Teleflex Inc, BD, B. Braun SE, Terumo Medical Corporation, Medtronic, Fresenius Kabi, Baxter, Vygon SAS, Kimal, and Access Vascular Inc are among the prominent players profiled in the vascular access devices market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and new product launches to fulfill the growing demand from consumers across the world and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.

Frequently Asked Questions

Which region is dominating the vascular access devices market?

Who are the major players in market the vascular access devices market?

Which segment is dominating the vascular access devices market?

Based on application, the market is segmented into drug administration, administration of fluid & nutrition, transfusion of blood products, and others. In 2022, the drug administration segment held the largest vascular access devices market share and is projected to record the highest CAGR during 2022–2030.

Based on route of insertion, the market is bifurcated into subcutaneous and intravenous. The intravenous segment held a larger share of the vascular access devices market in 2022 and is anticipated to record a higher CAGR during 2022–2030.

Based on end user, the market is divided into hospitals and clinics, ambulatory surgical center, and others. The vascular access devices market size for the hospitals and clinics segment is likely to surge during 2022–2030.

What is vascular access devices?

What are the driving and restraining factors for the vascular access devices market?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For