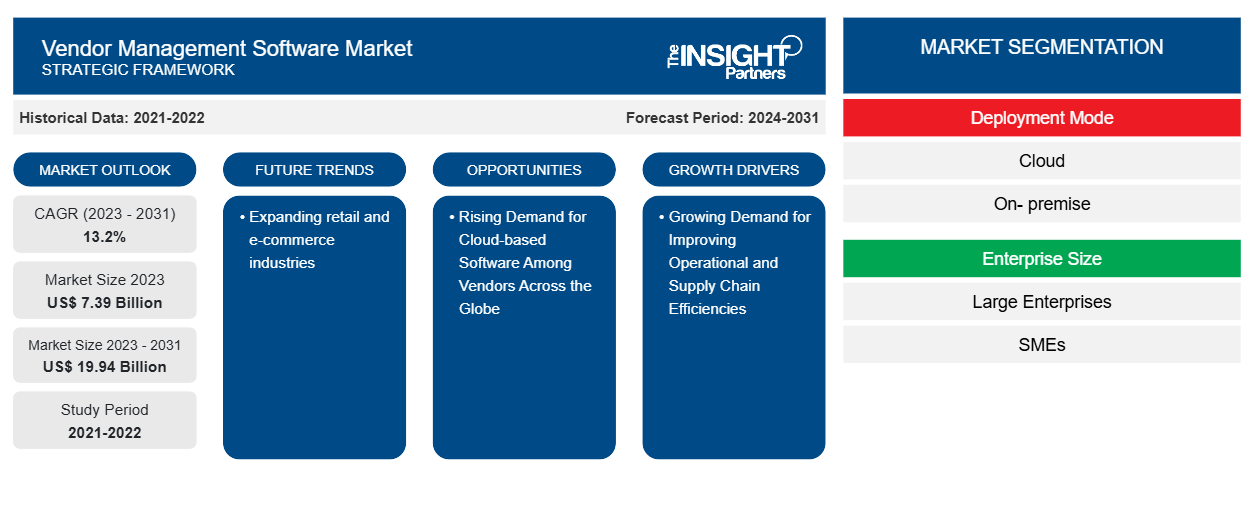

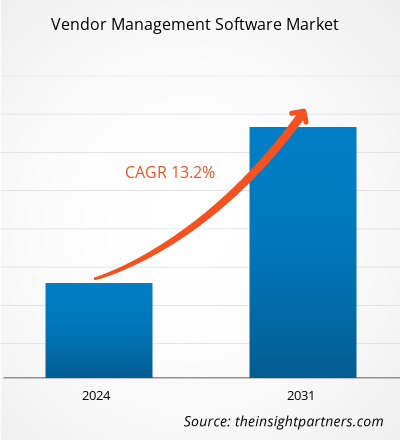

The vendor management software market size is projected to reach US$ 19.94 billion by 2031 from US$ 7.39 billion in 2023. The market is expected to register a CAGR of 13.2% in 2023–2031. Expanding retail and e-commerce industries are likely to remain a key vendor management software market trend.

Vendor Management Software Market Analysis

The vendor management software market is growing at a rapid pace due to the growing demand for improving operational and supply chain efficiencies and significant government initiatives to promote SME development with cloud adoption. The market is expanding steadily, driven by the rising demand for technologically advanced and cost-effective software among vendors. Moreover, rising demand for cloud-based software among vendors across the globe and increasing complexities in managing relationships with many vendors are providing lucrative opportunities for market growth.

Vendor Management Software Market Overview

Vendor management consists of developing and nurturing relationships with suppliers of goods and services required for day-to-day operations. Vendor management software is a software application used by vendors for appropriately managing their supply chain or distribution networks. The growing need to reduce risks and make faster decisions by businesses is creating growth opportunities for the vendor management software market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vendor Management Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vendor Management Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Vendor Management Software Market Drivers and Opportunities

Growing Demand for Improving Operational and Supply Chain Efficiencies is Driving the Market

The increased adoption of high-tech software across various companies to optimize business processes is driving the installation of vendor management systems. Organizations are increasingly focusing on automating their business processes in order to achieve higher efficiencies at lower costs, which increases the demand for vendor management software for optimizing business processes. Vendor management software is used for managing vendor-related information and organizational operations in order to achieve long-term growth effectively. The deployment of vendor management software allows organizations to take appropriate measures to reduce potential vendor risks, regulate costs, get value from vendors, and ensure outstanding service delivery in the long run, which is expected to drive the market during the forecast period.

Rising Demand for Cloud-based Software Among Vendors Across the Globe – An Opportunity in the Vendor Management Software Market

Rising demand for cloud-based vendor management software among vendors across the globe is creating opportunities in the market. Cloud-based vendor management software offers significant benefits to the user, such as scalability, affordability, and accessibility, providing vendors with more flexibility in integration with current systems, managing geographically distributed vendors, and rapidly scaling resources to meet fluctuating demand. Moreover, favorable government investment to promote the adoption of cloud-based software is creating opportunities in the market. For instance, the US Department of Defense invested around US$ 38.6 billion in unclassified IT in fiscal year 2022. Office of Management and Budget (OMB) mandated agencies to modernize, phase out, or merge their software program portfolios in order to promote cloud usage. This increases the demand for cloud-based solutions among customers. Thus, creating opportunities in the market during the forecast period.

Vendor Management Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the vendor management software market analysis are deployment mode, enterprise size, and industry vertical.

- Based on deployment mode, the vendor management software market is divided into cloud and on- premise. The cloud segment held a larger market share in 2023.

- On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. The large enterprise segment held a larger market share in 2023.

- In terms of industry vertical, the vendor management software market is categorized as retail, manufacturing, BFSI, IT and telecom, and others. The retail segment held a larger market share in 2023.

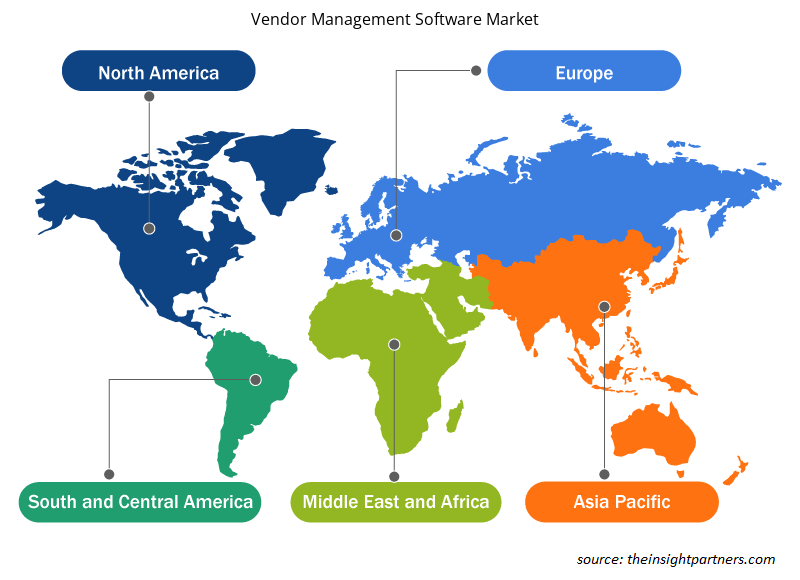

Vendor Management Software Market Share Analysis by Geography

The geographic scope of the vendor management software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, the North America market accounted for the largest vendor management software market share, due to the growing need for effective and efficient management of the entire distribution channel. Significant government initiatives and investments for developing SMEs are driving the market during the forecast period. For instance, in August 2022, the U.S. Department of Treasury permitted an additional batch of four state bids by investing US$ 750 million through the State Small Business Credit Initiative. The Treasury announced funding approvals totaling more than US$ 2.25 billion to boost small business growth. However, government initiatives for promoting SMEs towards the adoption of advanced software and solutions for improving their distribution network are boosting the market.

Vendor Management Software Market Regional Insights

The regional trends and factors influencing the Vendor Management Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Vendor Management Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Vendor Management Software Market

Vendor Management Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.39 Billion |

| Market Size by 2031 | US$ 19.94 Billion |

| Global CAGR (2023 - 2031) | 13.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Deployment Mode

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

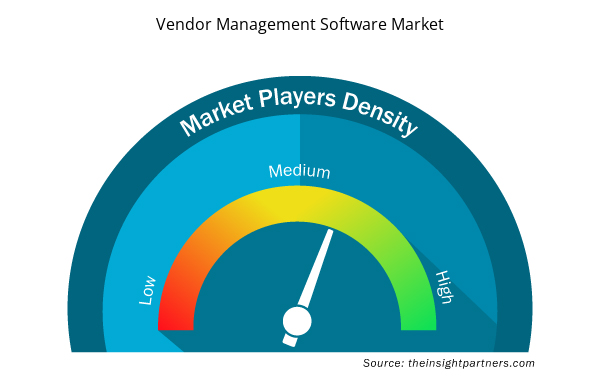

Vendor Management Software Market Players Density: Understanding Its Impact on Business Dynamics

The Vendor Management Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Vendor Management Software Market are:

- Coupa Software Inc.

- Gatekeeper (Cinergy Technology Limited)

- HICX Solutions Ltd.

- IBM Corporation

- Intelex Technologies Inc.

- LogicManager, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Vendor Management Software Market top key players overview

Vendor Management Software Market News and Recent Developments

The vendor management software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for vendor management software and strategies:

- In November 2022, Cloud5 Communications, Inc launched a new Project Management solution to manage the full lifecycle of project relationships – from contract negotiations and day-to-day management to issue escalation and resolution. Cloud5’s PMO serves as a single resource for all vendor interactions – building strong relationships with vendors that can lead to better rates, cost savings, and a dramatic reduction of the burden on hotel staff. (Source: Cloud5 Communications, Inc, Press Release, 2022)

Vendor Management Software Market Report Coverage and Deliverables

The “Vendor Management Software Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment Mode ; Enterprise Size ; Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The incremental growth expected to be recorded for the global vendor management software market during the forecast period is US$ 12.55 billion.

The global vendor management software market is expected to reach US$ 19.94 billion by 2031.

The key players holding majority shares in the global vendor management software market are Coupa Software Inc., HICX Solutions Ltd., IBM Corporation, Intelex Technologies Inc., and LogicManager, Inc.

Expanding retail and e-commerce industries to play a significant role in the global vendor management software market in the coming years.

The growing demand for improving operational and supply chain efficiencies and significant government initiatives to promote SME development with cloud adoption are the major factors that propel the global vendor management software market.

The global vendor management software market was estimated to be US$ 7.39 billion in 2023 and is expected to grow at a CAGR of 13.2% during the forecast period 2023 - 2031.

Get Free Sample For

Get Free Sample For