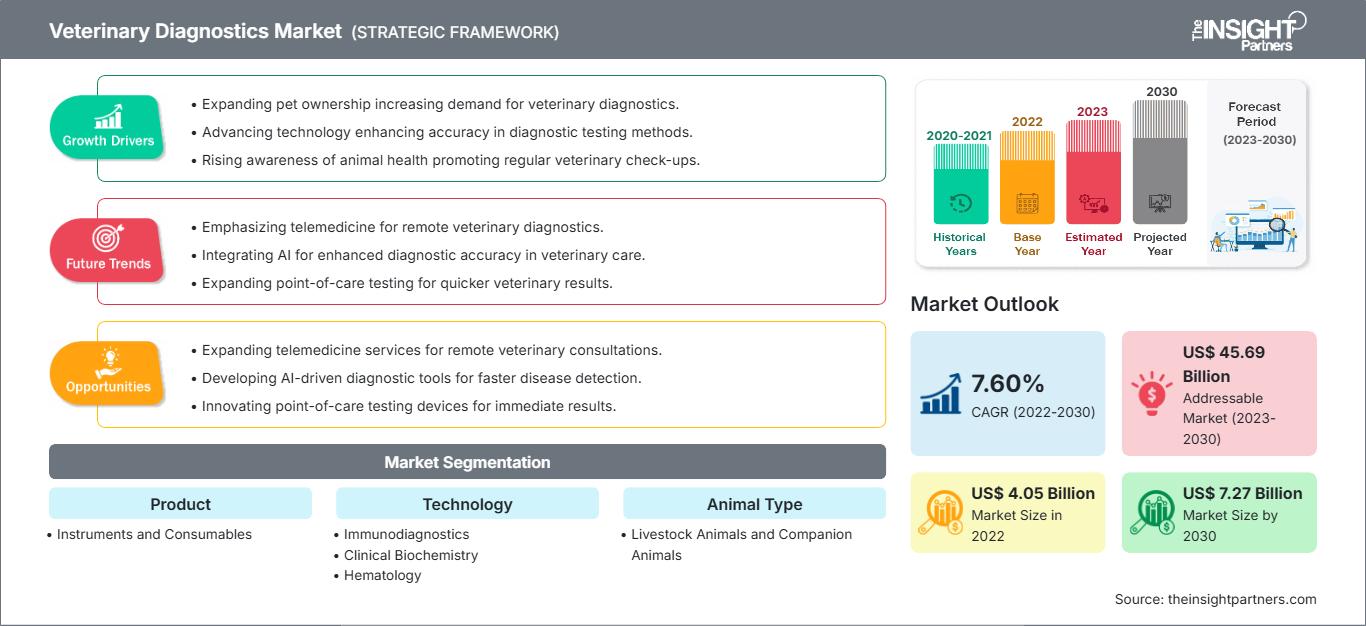

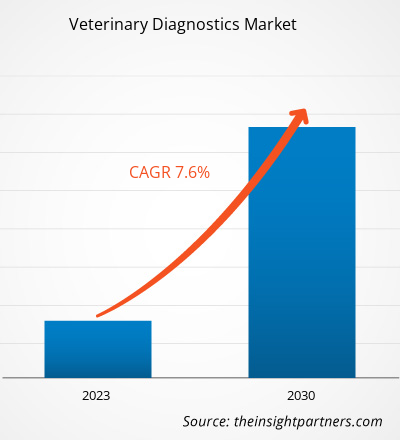

[Research Report] The veterinary diagnostics market size is expected to grow from US$ 4,045.50 million in 2022 to US$ 7,270.43 million by 2030; it is estimated to register a CAGR of 7.60% from 2022 to 2030.

Analyst’s ViewPoint

The veterinary diagnostics market analysis explains market drivers such as the rising prevalence of zoonotic disease and growing ownership of companion animals. Further, the advent of precision medicine in veterinary diagnostics are expected to introduce new trends in the market during 2022–2030. Based on product, the veterinary diagnostics market is segmented into instruments and consumables. The instrument segment accounted for a larger share in 2022. Based on disease type, the infectious disease segment dominated the market by accounting maximum share. By animal type segment, the companion animal segment is likely to account for a considerable share of the veterinary diagnostics market during the forecast period. Based on end user, the veterinary hospitals & clinics segment is expected to account for a maximum share of the veterinary diagnostics market during 2022–2030.

Veterinary diagnostic solution helps quickly identify health conditions for a variety of animals such as cattle, pigs, sheep, and goats. Veterinary diagnostics are critical for animal health, identifying health issues before they are able to be detected and support faster diagnosis and treatment planning. Traditional veterinary diagnostics analyzes blood, tissue, urine, or stool to detect proteins, antibodies, disease presence or general indicators of overall health. Lab-based testing ensures accurate quality results while point-of-care diagnostics enable real-time decisions that can ease concerned animal owners.

Market Insights

Rising Prevalence of Zoonotic Diseases

Zoonotic diseases cause illnesses not only in animals but also in humans. These infections can cause from mild to severe conditions. According to Centers for Disease Control and Prevention, in 2023, 6 out of every 10 infectious diseases in humans are spread by animals, and 3 of 4 new or emerging infectious diseases are transferred by animals.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Veterinary Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

As per the Council on Foreign Relations, zoonoses cause 2.5 billion illnesses and 2.7 million deaths each year globally, accounting for 60% of known infectious diseases and 75% of new or emerging infectious diseases. According to the European Centre for Disease Prevention and Control, campylobacteriosis was the most reported zoonotic disease, with 127,840 cases in 2021 compared to 120,946 cases in 2020. Salmonellosis was the second most common zoonotic disease, with 60,050 cases in 2021 compared to 52,702 cases in 2020. The other commonly reported zoonotic diseases are Yarniniosis with 6,789 cases, Shigatoxin-producing E. coli infections with 6,084 cases, and listeriosis with 2,183 cases.

According to the World Health Organization (WHO), rabies occurs in more than 150 countries and causes tens of thousands of deaths yearly, particularly in Asia and Africa. Of these, ~40% are children under 15 years of age. Cats, cattle, and dogs are the most reported rabid domestic animals in the US. Further, dogs contribute to 99% of all rabies transmissions to humans and are a major source of human rabies deaths. The economic burden due to dog-mediated rabies is estimated to be US$ 8.6 billion/year. The International Livestock Research Institute estimates that 13 zoonoses cause 2.4 billion cases of human disease and 2.2 million deaths annually in India. According to an article published in the National Library of Medicine (NLM), Ethiopia, Nigeria, Tanzania, and India have the highest burden of zoonotic diseases with widespread diseases. Further, ~20,000 deaths due to rabies are reported in India each year. Thus, the rising rabies globally increases the need for diagnoses of the illnesses, contributing to the growth of the veterinary diagnostics market.

As per the Global Action for Fungal Infections (GAFFI), ~40,000 cases of sporotrichosis are estimated to occur each year globally. As per an article published in the NLM, sporotrichosis is caused by a single dominant molecular species—i.e., 88% of sporotrichosis in southeastern South America is caused by S. brasiliensis, while 89% in western South, Central, and North America, 94% in Australia and South Africa, and 99.3% in Asia is caused by S. globosa. Thus, the rising prevalence of zoonotic diseases globally accelerates the demand for veterinary diagnostics.

Future Trend

Advent of Precision Medicine in Veterinary Diagnostics

Precision medicine is revolutionizing the landscape in veterinary care, offering tailored diagnostics and treatments that may benefit animal welfare and health. Precision medicine enables veterinarians to provide more accurate diagnoses, customized treatments, and improved outcomes using genomic sequencing, personalized diagnostics, and targeted therapies. The advancement of precision medicine in veterinary care will continue to be driven by rapid advancements in technologies such as genome sequencing, gene editing, and targeted therapies. Understanding animal genetics is expected to be enhanced by developing more sophisticated tools and techniques to diagnose and treat animals more precisely. As a result of precision medicine in veterinary care, animals at risk for certain diseases can be identified early, and targeted interventions can be implemented. As a result of this proactive approach, diseases can be prevented or detected at the initial stage when treatments are most effective.

Further, nutritional strategies can be developed based on an animal's genetic profile using precision medicine. Veterinary professionals can optimize diets to support animal health, prevent diseases, and improve performance based on an animal's unique nutritional needs and genetic variations. As a result of precision medicine, selective breeding practices can be obtained by identifying genes associated with desirable traits and disease risks. With this knowledge, breeders can make better breeding decisions, reduce the occurrence of inherited disorders, and increase the genetic diversity of animal populations. Thus, precision medicine in veterinary care could propel the future growth of the veterinary diagnostics market.

Report Segmentation and Scope

Product-Based Insights

Based on product, the veterinary diagnostics market is bifurcated into instruments and consumables. The instruments segment held a larger market share in 2022. The consumables segment is expected to record a significant CAGR during 2022–2030. Veterinary consumables involve testing tubes, containers, petri dishes, deep well plates, and kits comprising syringes, needles, safety lancets, IV sets & tubes, and samplers. These consumables are intended to be used for companion animal diagnostics such as pet (canine, feline, and avian), bovine, goat, swine, equine, and poultry. The testing tubes involve citrate, ESR, glucose, and others. The cuvettes are used for biochemical tests of companion animals. Moreover, several manufacturers are involved in offering consumables for veterinary diagnostics animals. HWTAI is one such example. The consumables offered by HWTAI comprises specimen containers, petri dish, deep well plate, cuvette, swabs, VTM, and others. The rising diagnostics testing for veterinary and companion animals results in the high demand for consumables, thereby catalyzing the market for the consumables segment during 2022–2030.

Technology-Based Insights

Based on technology, the global veterinary diagnostics market is segmented as immunodiagnostics, clinical biochemistry, hematology, molecular diagnostics, and other veterinary diagnostic technologies. The immunodiagnostics segment is further segmented as lateral flow assays, ELISA tests, immunoassay analyzers, allergen-specific immunodiagnostic tests, and other immunodiagnostics. Clinical biochemistry segment is further segmented as clinical chemistry analysis, glucose monitoring, blood gas & electrolyte. The immunodiagnostics segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. The health of the animals is majorly associated with parasitic diseases. A parasite with a two host prey–predator lifecycle acts as an intermediate host, causing some of the most devastating and prevalent diseases in humans and animals. As per the World Health Organization (WHO) 2023 report, about 1 billion cases of illness and millions of deaths occur annually from zoonoses. Among these, about 60% of emerging infectious diseases are reported globally account for zoonoses. To overcome such a high prevalence of zoonotic infections, the demand for immunodiagnostic techniques is high among veterinarians. Cystic echinococcosis (CE) and Alveolar echinococcosis (AE) are severe zoonotic diseases caused by the larval stage (metacestode) of the Helminth Echinococcus multilocularis. Immunodiagnostics employs antigen–antibody binding with a variety of detection methods for the immune complexes formed. Also, immunodiagnostics technology is easier to perform than other techniques, such as PCR chromatography for drug quantification. Further, immunodiagnostics are useful in studying infectious disease serology among veterinary animals. The "WITNESS" immunodiagnostics is one such example offered by Pfizer Animal Health. The WITNESS test offers accurate and rapid results, requiring no snapping, feature room temperature storability, and is easy to interpret. The WITNESS HW heartworm test is intended for dogs and cats with accuracy, affordability, and minimal time to snap. Also, the WITNESS feline leukemia virus (FeLV) test is highly accurate, sensitive, and specific for testing cats or kittens at any age. With the rising prevalence of zoonotic diseases, the demand for immunodiagnostics is high among veterinarians, thereby accelerating the market for the immunodiagnostics segment.

Animal Type-Based Insights

Regarding animal type, the veterinary diagnostics market is bifurcated into livestock and companion animals. The livestock animals is further segmented as cattle, pigs, poultry, and other livestock animals. Companion animals is further segmented as dogs, cats, horses, and other companion animals. The companion animal segment held a larger market share in 2022 and is anticipated to register a higher CAGR during 2022–2030.

Companion animals include dogs, cats, horses, and others. Companion animals are a potential source of infectious disease for humans and food-producing animals. Newcastle disease epidemiology of neosporosis is a popular example of companion animals suffering from infectious diseases. Additionally, West Nile Virus (WNV) results in inflammation of the brain (encephalitis) and spinal cord lining (meningitis). Among horses bitten by a carrier mosquito, one-third will typically develop severe disease, resulting in the death of animals. Feline infectious peritonitis (FIP) is a viral disease of cats responsible for feline coronavirus. The incidence of the disease is 1 per 5,000 families of cats, as published in Thermo Fisher Scientific report. With such a high prevalence, the demand for companion animal diagnostic methods is high among veterinarians, ultimately driving the market for the companion animal segment.

Various initiatives have also been taken to enhance veterinarians' knowledge about the utility of antimicrobial drugs to companion animals. Veterinarians' awareness of antimicrobial drugs to treat diseases among companion animals reported in an AVMA survey revealed that 60.5% of the US veterinarian participants were aware of guidelines related to the utility of antimicrobial drugs. Such guidelines associated with rising awareness of antimicrobial drugs to treat infectious diseases among companion animals further promote the market for the segment.

Disease Type-Based Insights

By disease type, the market is categorized into infectious disease and non-infectious disease. The infectious disease segment held a larger market share in 2022 and is anticipated to register a higher CAGR in the veterinary diagnostics market during 2022–2030.

End User-Based Insights

End-user segments the market as veterinary hospitals & clinics, animal diagnostic laboratories, and veterinary research institutes & universities. The veterinary hospitals & clinics segment held the largest market share in 2022 and is anticipated to register the highest CAGR in the veterinary diagnostics market during 2022–2030.

Regional Analysis

The North America veterinary diagnostics market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the rising infectious animal diseases—a standalone factor positively influencing the growth of the market. Additionally, technological advancements in monitoring devices further enhances the overall market growth.

According to the Centers for Disease Control and Prevention (CDC) report, enteric diseases linked to animals are estimated to account for 450,000 illnesses, 5,000 hospitalizations, and 76 deaths in the US alone annually. Bacteria and parasites were the only types of etiologies reported. For example, "Cryptosporidium" was the most common cause of confirmed, single-etiology outbreaks, accounting for 21 outbreaks in the US, followed by Salmonella with 18 (35%) in 2020. In the US, certain veterinary diagnostics are regulated and dependent on the US Department of Agriculture-Center for Veterinary Biologics (USDA-CVB) for approval. These involve veterinary diagnostic kits intended to diagnose pathogens in the animal undergoing treatment. USDA-CVB are point-of-care diagnostics for testing feline leukemia virus (FeLV), canine parvovirus, canine heartworm, and other viruses.

Enteric Disease Outbreak Associated with Animal Contact in US

|

No. of Outbreaks |

No. of Illness |

|||||||

|

Etiology |

Confirmed Etiology (CE) |

Suspected Etiology (SE) |

Total |

Confirmed Etiology (CE) |

Suspected Etiology (SE) |

Total |

||

|

Bacterial |

||||||||

|

Salmonella |

18 |

2 |

20 |

1237 |

6 |

1243 |

||

|

E. Coli |

10 |

0 |

10 |

70 |

0 |

70 |

||

|

Campylobacters |

2 |

3 |

5 |

13 |

11 |

24 |

||

|

Sub-Total |

30 |

5 |

35 |

1320 |

17 |

1337 |

||

|

Parasitic |

||||||||

|

Cryptospordium |

21 |

3 |

24 |

158 |

23 |

181 |

||

|

Sub-Total |

21 |

3 |

24 |

158 |

23 |

181 |

||

|

Total |

51 |

8 |

59 |

1478 |

140 |

1518 |

||

|

No. of Hospitalizations |

No. of Deaths |

||||||

|

Etiology |

Confirmed Etiology (CE) |

Suspected Etiology (SE) |

Total |

Confirmed Etiology (CE) |

Suspected Etiology (SE) |

Total |

|

|

Bacterial |

|||||||

|

Salmonella |

286 |

0 |

286 |

2 |

0 |

2 |

|

|

E. Coli |

18 |

0 |

18 |

1 |

0 |

1 |

|

|

Campylobacters |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Sub-Total |

304 |

0 |

304 |

3 |

0 |

3 |

|

|

Parasitic |

|||||||

|

Cryptospordium |

6 |

2 |

8 |

0 |

0 |

0 |

|

|

Sub-Total |

6 |

2 |

8 |

0 |

0 |

0 |

|

|

Total |

310 |

2 |

312 |

3 |

0 |

3 |

|

Source: US Department of Health & Human Services

Therefore, diagnostic methods are primarily involved in overcoming a high prevalence of animal infections. According to the American Association of Veterinary Laboratory Diagnosticians (AAVLD), at least 500 state and federally funded pathologists and diagnosticians contribute to large animal herd health surveillance in the US and Canada. Also, food animal-focused diagnostic laboratories received over US$ 100 million to perform surveillance for studying a high-impact disease that may affect animal agriculture industries in 2020, as per the data retrieved from Centers for Disease Control and Prevention (CDC). Therefore, early recognition of emerging pathogens can benefit in controlling animal disease infection and identifying potential zoonoses. Thus, the aforementioned factors positively influence the veterinary diagnostics market in North America.

According to the Department of Agriculture, Fisheries and Forestry report, the Japanese Encephalitis (JE) virus—spread by mosquitoes—negatively affects the reproductive performance of pigs; it also causes viral encephalitis in humans. In 2022, Australia experienced an outbreak of JEV in domestic pigs, accounting for detections in over 80 piggeries in Queensland, New South Wales (NSW), Victoria, and South Australia. In March 2022, the first JEV outbreak in Australia resulted in the declaration of a Communicable Disease Incident of National Significance (CDINS). Australia is well placed to continue to manage the risk of JEV. For instance, in June 2023, the CDINS declared JEV as an outbreak, and the nation is well prepared to handle future outbreaks with a dedicated response.

The Public Library of Science (PLoS) reports that the incidence of infectious diseases has increased in Asia Pacific since 2020. For example, increased encroachment of farms on wildlife habitats has resulted in the reach of livestock and wild animals with severe consequences of accelerating emerging infectious/zoonotic diseases from wild animals. Therefore, the Asia Pacific strategy for emerging diseases has benefitted from controlling the prevalence of infectious diseases in animals. Regionally and globally, zoonotic diseases are recognized closely by the Food and Agriculture Organization of the United Nations (FAO), the World Organisation for Animal Health (OIE), and WHO working in Asia Pacific. As per the Accelerating One Health in Asia and the Pacific report, the concept and importance of One Health approach is gaining significant attention due to eosystem degradation, biodiversity loss, and climate change putting public health challenges at the human-animal-environment interface in Asia Pacific. Therefore, the adoption of One Health approaches can assist Asia Pacific countries to progress through multiple sectors and stakeholders engagement. These engagements are conducted in terms of human health, terrestrial and aquatic animal health, and food production to ultimately improve outcomes essential to achieve the Sustainable Development Goals (SDGs).

Veterinary Diagnostics Market Regional InsightsThe regional trends and factors influencing the Veterinary Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Veterinary Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Veterinary Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.05 Billion |

| Market Size by 2030 | US$ 7.27 Billion |

| Global CAGR (2022 - 2030) | 7.60% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Veterinary Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Veterinary Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Veterinary Diagnostics Market top key players overview

The report profiles leading players operating in the global veterinary diagnostics market. These include Thermo Fisher Scientific Inc, Idexx Laboratories Inc, Zoetis Inc, Heska Corp, Neogen Corp, Randox Laboratories Ltd, Virbac SA, INDICAL BIOSCIENCE GmbH, FUJIFILM Holdings Corp, and Merck Animal Health.

- In April 2023, Mars completed acquisition of Heska, global provider of advanced veterinary diagnostic and specialty solutions. Heska is now part of Mars Petcare’s Science & Diagnostics division, enabling broader coverage across diagnostics and technology while accelerating R&D and expanding access globally to pet healthcare solutions.

- In August 2023, Zoetis launched first on-farm mastitis diagnostics. Zoetis has launched Vetscan Mastigram+, a rapid on-farm mastitis diagnostic, in several markets across Europe. It uses a simple flow dipstick test to detect Gram-positive mastitis in eight hours, enabling results before the next milking. Because often only Gram-positive cases will benefit from treatment with antimicrobials, a farmer or vet can use this information to deliver more targeted therapy and ensure antimicrobial usage is focused only on cows that need it.

Company Profiles

- Thermo Fisher Scientific Inc

- Idexx Laboratories Inc

- Zoetis Inc

- Heska Corp

- Neogen Corp

- Randox Laboratories Ltd

- Virbac SA

- INDICAL BIOSCIENCE GmbH

- FUJIFILM Holdings Corp

- Merck Animal Health

Frequently Asked Questions

Who are the key players in the veterinary diagnostics market?

Which are the top companies that hold the market share in veterinary diagnostics market?

Which region is expected to witness significant demand for veterinary diagnostics market in the coming years?

What are the driving factors for the veterinary diagnostics market across the globe?

Which end user held the largest share in the veterinary diagnostics market?

What is the market CAGR value of veterinary diagnostics market during forecast period?

Which disease type segment leads the veterinary diagnostics market?

What is veterinary diagnostics?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For