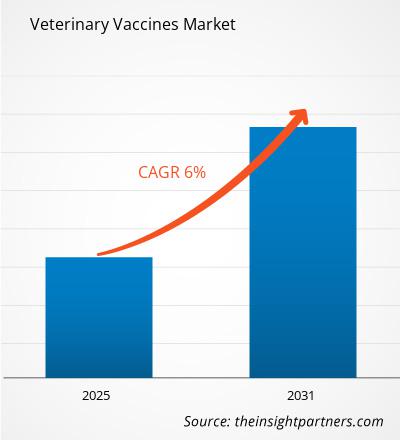

The veterinary vaccines market size is projected to reach US$ 13.67 billion by 2031 from US$ 9.13 billion in 2024. The market is estimated to register a CAGR of 6.0% during 2025–2031. The technological advancements in veterinary vaccine products are likely to bring new trends to the market in the coming years.

Veterinary Vaccines Market Analysis

The market growth is driven by increasing pet adoption, heightened awareness of animal health, and rising expenditure on veterinary care. The market is also influenced by the growing incidence of zoonotic diseases, which underscores the importance of vaccination in animal and public health. Additionally, regional manufacturing facilities ensure quicker distribution and lower import reliance, especially in developing regions such as India, Brazil, and Africa. Governments and institutions promote local manufacturing through incentives, such as in India's "Make in India" program, which has promoted local production of veterinary products. These investments provide opportunities for efficiency, innovation, and increased vaccine availability. Overall, the veterinary vaccines market is poised for continued expansion, driven by technological advancements and a growing focus on preventive healthcare for animals.

Veterinary Vaccines Market Overview

The increasing ownership of companion animals has heightened awareness regarding pet health and preventive care, ultimately raising the demand for vaccines that protect them from infectious diseases. According to the American Pet Products Association (APPA), the percentage of US households reported owning a pet increased from 67% in 2019 to 70% in 2022. This trend prevails among developed countries and emerging economies such as India and China. These economies have seen a rise in pet adoption due to urbanization and higher disposable income. In September 2022, the World Health Organization (WHO) established vaccination campaigns for zoonoses, such as rabies, that can pass from animals to humans. The WHO promotes elimination campaigns for rabies, which include the vaccination of dogs on a mass scale as a preventive measure. Such initiatives encourage vaccine acceptance in developed and developing regions. In conclusion, the rising pet ownership and companion animal population drive the growth of the veterinary vaccines market. This trend is fueled by changing societal attitudes toward pets, increasing disposable income, and global initiatives to control zoonotic diseases. As the pet healthcare industry continues to evolve, the demand for effective vaccines is expected to grow.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Veterinary Vaccines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Veterinary Vaccines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Veterinary Vaccines Market Drivers and Opportunities

Soaring Awareness Regarding Animal Health

Over the past decade, there has been a shift in people's perception of animal health as a means of ensuring animal welfare and as a critical factor in public health, food security, and economic stability. The Food and Agriculture Organization (FAO) emphasizes that healthy livestock are essential for sustainable food systems, driving the adoption of vaccines to prevent foot-and-mouth disease, brucellosis, and avian influenza. Pet owners are becoming educated about the importance of preventive healthcare, such as vaccinations, to ensure their companion animals live longer, healthier lives. According to a 2022 survey by the American Veterinary Medical Association (AVMA), over 80% of pet owners in the US expressed a willingness to invest in regular vaccinations and check-ups for their pets, highlighting the growing prioritization of proactive animal healthcare.

The increasing availability of animal health information through digital platforms, veterinary organizations, and public campaigns has empowered pet owners and farmers to learn about the risks of preventable diseases, including zoonotic ones such as rabies and leptospirosis, which can be transmitted from animals to humans. Organizations such as the WHO and the World Organization for Animal Health (WOAH) have launched global awareness campaigns emphasizing the role of vaccination in controlling zoonotic diseases. The WHO's Global Strategic Plan to End Human Deaths from Dog-Mediated Rabies by 2030 boosts initiatives to promote vaccine adoption on a large scale. The role of veterinarians as advocates for preventive care has contributed to this growing awareness. Veterinarians play a proactive role in educating pet owners and livestock farmers about vaccine schedules, the benefits of immunization, and the risks of neglecting preventive care. The advancements in veterinary medicine, such as the development of combination vaccines, which simplify vaccine administration and improve compliance among animal owners, further contribute to the awareness.

Expansion of Manufacturing Facilities to Create Growth Opportunities

The increase in manufacturing plants is a significant growth prospect for the veterinary vaccines market. It solves pressing issues, including production scalability, reducing costs, and making vaccines more accessible regionally. With the soaring demand for veterinary vaccines fueled by increasing pet ownership, livestock husbandry requirements, and international disease prevention programs, producers are spending on new plants and renovating old ones to boost production capacity. In March 2024, Zoetis revealed the acquisition of a 21-acre production facility in Melbourne to increase its existing operations and boost future capacity to produce and develop vaccines for sheep, cattle, dogs, cats, and horses. Boehringer Ingelheim invested more than US$ 209.01 million in 2021 to increase its veterinary vaccine manufacturing plant in Lyon, France, on cutting-edge vaccine technologies such as recombinant vaccines. These expansions add supply to address demand and reduce the cost of production through economies of scale.

Veterinary Vaccines Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Veterinary Vaccines Market analysis are technology, animal type, route of administration, end user, and geography.

- Based on technology, the veterinary vaccines market is segmented into live attenuated vaccines, inactivated vaccines, recombinant vaccines, toxoid vaccines, and others. The live attenuated vaccines held the largest share of the veterinary vaccines market in 2024, and it is expected to register a significant CAGR during 2025–2031.

- By animal type, the market is categorized into companion, livestock, and poultry. The livestock and poultry segment held the largest share of the veterinary vaccines market in 2024. The companion animal segment is further divided into dogs, cats, horses, and others. The livestock and poultry segment is categorized into chicken, cattle, and others. The livestock and poultry segment held the largest share in the Veterinary Vaccines Market in 2024.

- As per route of administration, the veterinary vaccines market is divided into intramuscular, subcutaneous, and others. The intramuscular segment held a larger share of the veterinary vaccines market in 2024, and it is expected to register a significant CAGR during 2025–2031.

- In terms of end user, the veterinary vaccines market is segmented into veterinary hospitals, veterinary clinics, and others. The veterinary hospitals segment held the largest share of the veterinary vaccines market in 2024, and it is expected to register a significant CAGR during 2025–2031.

Veterinary Vaccines Market Share Analysis by Geography

The geographic scope of the Veterinary Vaccines Market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. The North America is expected to dominate the market in 2024. Factors such as the growing launch of veterinary vaccines from market players, the increasing government support to provide cost-effective healthcare services, the rising strategic developments by the veterinary vaccine players to enhance services, and a growing healthcare industry that demands frameworks and guidelines based on real-world data for their business models contribute to the market growth. Livestock groups provide consumers with different products and services, including meat, milk, eggs, fiber, and draught power. Viral infection among livestock, companion animals, and others is a critical aspect of animal health in the US. The viruses infecting the animals spread at a faster rate. Thus, immunizations of the animal from such viruses are of prime importance in animal healthcare in the country. Foot-and-mouth disease is a highly contagious viral disease that affects cloven-hoofed animals, such as cattle, pigs, sheep, and goats. While the US has been free of FMD for decades, outbreaks in other parts of the world, particularly in regions with close international trade and animal transport, present an ongoing risk. The US government and agriculture industry are ready to respond quickly if an outbreak occurs, with vaccines being essential for managing and controlling the disease. According to the US Department of Agriculture, Animal and Plant Health Inspection Service (APHIS) invested ~US$ 42 million in foot-and-mouth disease vaccine antigen concentrate from private companies in 2022, with an additional US$ 30 million in 2023.

The increasing pet ownership is driving the demand for vaccinations for companion animals in the country. According to the 2023–2024 American Pet Products Association Survey, 66% of US households, which equates to 86.9 million households, own a pet. Moreover, the rise in research and development activities is expected to further boost the growth of the veterinary vaccines market.

Veterinary Vaccines Market Regional Insights

Veterinary Vaccines Market Regional Insights

The regional trends and factors influencing the Veterinary Vaccines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Veterinary Vaccines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Veterinary Vaccines Market

Veterinary Vaccines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 9.13 Billion |

| Market Size by 2031 | US$ 13.67 Billion |

| Global CAGR (2025 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Veterinary Vaccines Market Players Density: Understanding Its Impact on Business Dynamics

The Veterinary Vaccines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Veterinary Vaccines Market are:

- Boehringer Ingelheim International GmbH

- Zoetis Inc

- Merck & Co Inc

- Virbac SA

- Biovac LTD

- Neogen Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Veterinary Vaccines Market top key players overview

Veterinary Vaccines Market News and Recent Developments

The veterinary vaccines market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- Zoetis announced that the U.S. Department of Agriculture (USDA) Center for Veterinary Biologics (CVB) has issued the company a conditional license for its Avian Influenza Vaccine, the H5N2 Subtype Killed Virus. The vaccine is labeled for use in chickens. The conditional license was granted on the demonstration of safety, purity, and reasonable expectation of efficacy based on serology data. (Source: Zoetis, Company Website, February 2025)

- Ceva Animal Health (Ceva) – the #5th largest animal health global player, present in 110 countries, unveiled its latest investment in European vaccine manufacturing, with the construction of a new facility in Hungary, expanding the capacity of Ceva Phylaxia. (Source: Ceva, Company Website, November 2024).

Veterinary Vaccines Market Report Coverage and Deliverables

The "Veterinary Vaccines Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Veterinary Vaccines Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Veterinary Vaccines Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Veterinary Vaccines Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the veterinary vaccines Market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vaccine Type and Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market value is expected to reach US$ 13.67.00 billion by 2031.

North America dominated the market in 2024.

Rising pet ownership and companion animal population and growing awareness of animal health are significant factors fueling the market growth.

Technological advancements in veterinary vaccine products are expected to emerge as a prime trend in the market in the coming years.

Boehringer Ingelheim International GmbH, Zoetis Inc, Merck & Co Inc, Virbac SA, Biovac LTD, Neogen Corp, Elanco Animal Health Inc, HIPRA SA, Ceva Santé Animale, and Hester Biosciences Ltd are among the key players in the market.

The market is expected to register a CAGR of 6.0% during 2025–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Veterinary Vaccines Market

- Boehringer Ingelheim International GmbH

- Zoetis Inc

- Merck & Co Inc

- Virbac SA

- Biovac LTD

- Neogen Corp

- Elanco Animal Health Inc

- HIPRA SA

- Ceva Santé Animale

- Hester Biosciences Ltd

Get Free Sample For

Get Free Sample For